Abstract:

The Islamic finance human capital demand is accelerating with a rapidly growing Islamic banking and finance (IBF) industry. In Pakistan, the IBF industry moves forward to be more competitive and sophisticated. Therefore, there is a need to explore the employability skills, which the IBF employers mainly require from the new Islamic finance graduates. This study examines the viability of employability skills for the employment of Islamic bank graduates in Pakistan. A quantitative method was adopted to collect data from 120 respondents using a self-administered questionnaire. The findings of the factor analysis suggested five variables deemed to be relevant in IBF graduates' employability skills for Islamic banks which are communication, interpersonal, technical, social, and subject knowledge skills. This study attempts to obtain the employer's perspective that will be used to refine and strengthen the existing skills, knowledge, and course structure in academia.

Key Words:

Employability Skills, Islamic Banks, Pakistan

Introduction

The Islamic banking and finance (IBF) industry has made significant progress across the globe in the present-day competitive financial environment (Khan, Alheety & Bardai, 2020). It can be perceptible with the introduction and development of new Shariah-compliant products, improved structure, the inclusion of more Islamic banks branches, and new Islamic financial markets such as Sukuk, Islamic capital markets, etc. (State Bank of Pakistan [SBP], 2020). Despite the better IBF industry growth over the years, the IBF industry is still tackling numerous challenges, including a lack of product creativity (Narayan & Phan, 2019), lack of awareness (Iqbal, 2007), shortages of skilled human resources (Ab Manan et al., 2018), and the lack of ability to manage operations as per Shariah standards (Hassan & Mollah, 2018).

The rapid growth of the IBF industry undoubtedly creates and calls for a considerable demand for new expertise (Ab Manan et al., 2018). The IBF industry needs highly skilled human resources (HR) to compete successfully with the comparative traditional financial markets worldwide (Kunhibava, Ling & Ruslan, 2018). However, locally and globally, there is a misalliance between academia and industry that is crucial to providing the best-skilled HR to match the IBF industry's needs (Khan et al., 2018). Presently, more than 40 higher educational institutions (HEIs) are offering programs in IBF, either graduate or post-graduate, across the world producing about 5,000 professionals annually, although the demand is ten times high (Pakistan Gulf Economist [PGE], 2020).

Due to the Shariah-compliant procedures and financial regulations, the IBF industry operates in a complex environment, which presents challenges for HR in terms of placing the right people in the right positions (Ali et al., 2018). Human capital hurdles the growth of the IBF industry, particularly Islamic banking (Haneef, 2009). There is a lack of vital training and educational programs, support, standard recruitment guidelines, employee retention policies, and unrealistic expectations. In order to make the economy an international centre for Islamic finance education, the effect of making the employability of IBF graduates a crucial agenda item within Islamic nations (Kayadibi, 2010). The Islamic finance industry currently employs roughly 25,000 professionals (PGE, 2020).

Pakistan has made massive progress in establishing academic institutions to provide the best education and knowledge to the apprentices (Ahmad & Humayoun, 2011). In Pakistan, 22 institutions currently offer master's or bachelor's degrees in IBF specialized domain (Khan et al., 2020). Being acquainted with the significance of skilled HR for the IFIs, the Pakistan central bank, SBP, has also established the Centre for Excellence in Islamic Finance (CEIFs) in three renowned HEIs: LUMS in Lahore, IBA Karachi, and IM Sciences in Peshawar (PPI, 2021). As per the SBP vision to retain 20 per cent of Islamic banking share by 2020, and based on an expected 30 per cent IBF industry assets growth, the demand for qualified IBF professionals in the next 5 years is estimated to be around 3,000-4,000 (PGE, 2020).

The term ‘employability’ refers to a person’s ability to secure and sustain employment within an organization (Belt, Drake & Chapman, 2010). It includes individual personality traits and capacity, organizational skills, academic aptitude, skills, knowledge, and formally acquired competencies and capabilities (Atfield & Purcell, 2012). According to Mason, Williams, and Cranmer (2009), the demand for employability skills increases as the number of graduates from HEIs increases in the labour market. Thus, there must be growing interest in developing employability skills. Even though few empirical studies conducted to explore the skills that are most sought-after by employers and the most useful for graduates and thereby offer the importance of employability skills as an alternative mode for graduate development (Dhir, 2019; Vyas & Chauhan, 2013; Passow, 2012; Stewart & Knowles, 2000).

Additionally, few studies also investigate the nexus between employability skills and organizational performance (say Khan et al., 2020). To the researcher's best knowledge, no comprehensive research has been conducted to explore employability skills for IBF graduates based on the employer's perspective, particularly in Pakistan. Therefore, this research paper examines the viability of employability skills as a possible IBF graduate's employment in the Islamic banking sector in Pakistan.

Significance of the Study

Pakistan is considered one of the most prominent Islamic finance education providers globally and is ranked among the top ten countries to provide professional education, courses, and training in Islamic finance (Khan et al., 2018). Concurrently, Pakistan also focuses on capacity building, including HR development and quality education, to provide Islamic finance talents locally and abroad. However, the demand and supply information of Islamic finance education programs and graduates available on the websites of respective HEIs and relevant agencies are inconclusive. It poses constraints to policymakers in planning, designing, and implementing decisions to place Pakistan as a leading Islamic finance education hub globally (Ahmad, Fiaz & Shoaib, 2015).

According to the IBA CEIF and Thomson Reuters report, entry-level trained professionals are insufficient as per the opinion of 76 per cent of executives of the Islamic finance industry in the present-day dynamic marketplace. It emphasized the gap that the current education/academic system throughout the country offers information mainly about the traditional financial system and consequently still lags behind in conveying the appropriate employability skills set and academic context about the IBF system. Thus, the IBF industry has a tremendous growing demand for well-qualified and skilled HR. However, academia lacks the expertise and resources to cater to this fast-emerging sector's needs (PGE, 2020). Therefore, this study explores the viability of employment skills for Islamic bank graduates in Pakistan.

This paper divides into six sections. Section 1 gives an introduction and rationale for conducting the study. Section 2 provides previous studies on the under-studied employability variables. Section 3 entails information about the research methods and methodology. Section 4 discusses the key findings and research results. Section 5 has a discussion of the findings, and finally, the conclusion and recommendations are provided in section 6 of the paper.

Literature Review

As per the job matching theory, graduates must possess the qualification or competency levels required by employers. Otherwise, it negatively influences the wages and productivity of getting a job (Abdullah et al., 2015). The job match theory states that new graduates must utilize their capabilities, skills, attitude, and knowledge correctly at the workplace. Besides, the theory further proposes if the competencies and skills of the graduates are mismatched with the employer's requirements, unemployment will emerge (Ismail et al., 2011). In recent years, where many jobs are inter-reliant, graduates need to multitask and blend hard and soft skills. From the perspective of the IBF industry, Husna et al. (2012) ascertain that banks require an HR that can assist customers in daily banking operations and making wise decisions for products.

Skill in an individual's ability to apply such know-how to complete tasks and solve problems (Kulkarni & Chachadi, 2014). It can be intuitive, logical, practical, or creative thinking, requiring an individual's use of instruments, methods, kits, and resources (Hoffmann & Post, 2014). Many previous studies explored the employability skills required for a particular position or sector (such as Ngoo, Tiong & Pok, 2015; Collet, Hine & Du Plessis, 2015; Klibi & Oussii, 2013; Sodhi & Son, 2008). Earlier studies in the context of the banking sector generally either focused on the knowledge needs or has had used the banking sector among several other factors, however, not many studies examine the specific required employability skills for graduating participants in the banking sector (Khan et al., 2020; Cicekli, 2016; Adebakin, Ajadi & Subair, 2015; Rassuli et al., 2012; Sullivan, 2012).

The concept of employability has links with HEIs and has been known for decades (Leitch, 2006). Employability defines the quality and skills that an individual possesses, is offered, and is required by the organization (Madar & Buntat, 2011; Bowers-Brown & Harvey, 2005). Employability skills transfer from one job to another, which the individual can use in any firm and across all sectors (Branine, 2008) and are possible enough to get a candidate employed (Madar & Buntat, 2011). A graduating participant with employability skills is considered to be appealing to employers compared to a graduate with low employability skills (Oria, 2012). These skills, in short, can be said to be job readiness skills (Shafie & Nayan, 2010). Kulkarni and Chachadi (2014) ascertain that employability skills are significant for graduates to develop and secure their first job after graduation.

Despite the increasing attention that employability skills have received over the years (Yorke, 2006; Hillage & Pollard, 1998; Mcquaid & Lindsay, 2005; Weinert, 2001). According to Pillai et al. (2012), employability skills refer to an individual's attributes, knowledge, and skills to succeed and benefit the community, workforce, economy, and themselves. Besides, Huda et al. (2016) said that these are the characteristics an individual possesses, such as personal attributes, skills, and subject-related concepts understanding to gain employment and be successful in their career, thus contributing positively to economic development and society. HEIs are a powerful platform to grasp the knowledge and employability skills of the graduates related to the specifications of their domain (Madar & Buntat, 2011). Therefore, the graduates should possess skills up to an appropriate level to meet the industry requirements for subject-related knowledge (Thota, 2014).

The graduates should develop self-equipped skills to perform professionally in business areas, according to Alpay and Jones' (2012) study. The graduates must possess the business acumen, communication skills, and professional skills necessary to be effective employees (Vyas & Chauhan, 2013). Skilled and knowledgeable employees are required to adopt rapid economic and technological changes over the period (Griffin & Annulis, 2013). Skilled, knowledgeable and experienced human personnel are a great asset for a company to handle hard challenges and situations (Madar & Buntat, 2011). Therefore, employers have always looked to recruit and select the best-skilled workforce (Miller, Biggart & Newton, 2013).

Collect, Hine, and Du Plessis (2015) conducted a study using a sample of 207 managers from the research industry in Australia. They found a gap between the skills organizations need and graduates' skills. Adebakin et al. (2015) found that the vital skills were decision-making, problem-solving, analytical, teamwork, and information and communication (ICT) skills in Nigeria. A similar study by Ngoo et al. (2015) also explored that the vital skills employers sought in accounting graduates were problem-solving, critical thinking, and communication skills. Zeti (2006) further illustrates the need for human capital development to sustain the performance and competitiveness of Islamic financing and the Islamic services industry.

Today, most corporate values derive from combining many assets like equipment, finance, property, and expertise (Dess & Picken, 2000). Besides, intangible assets such as brands, images, and human capital skills are significant assets of any organization. Human capital is a form of workforce that is increasingly severe to business operations (Rastogi, 2000). According to previous studies (say Belonio, 2012; Leblebici, 2012; Athar & Shah, 2015), bank employees cannot perform well and do not complete their tasks due to less experience and lack of training. Proper training, identification, and budget allocation is a significant successes towards human capital development as it is a basic need for contributing to the IBF industry.

In order to meet the employer’s needs and requirements, the development of employability skills has significantly reinforced pressures to gain support from HEIs (Kulkarni & Chachadi, 2014). It is because one of the critical aspects of education is to generate and develop employable human power (Pavlin & Svetlik, 2014; Pillai et al., 2012; Oria, 2012). According to Grant and Dickson (2006), higher education authorities worldwide are now more concerned about the knowledge, skills, and characteristics they expect their graduates to have. Graduate employability also is one of the measurements of university performance (Tymon, 2011). In simple words, university education is the main contributor to employability skills development and to tackle the unemployment crisis, the literature suggests that the graduating participants should possess the required employability skills (Jensen et al., 2013).

Since organizations always try to figure out skills in the graduates in the early stage of employment interviews, and lack of such employability skills might contribute to rejection in a job interview, thus resulting in a higher unemployment rate (Dania, Bakar & Mohamed, 2014). The flow of ideas, problem-solving attitude, and collaborative acts among skilled HR provide the base for building a solid and productive team. Top leadership values teamwork for innovation (Hoegl & Parboteeah, 2007). On the other hand, a lack of communication and collaboration impedes the capability of innovation in the organization as group members are more sceptical and have less shared understanding (Banaeianjahromi & Smolander, 2019). The social skills impact the innovation process in the IFIs, given the level of communication and interactions required for a financial service or product to be developed, and approved by the Shariah committee members. Thus such social skills help build a shared cognition among the team members (Dunn, Gerad & Grabski, 2017).

Research Gap

Since the calibre of staff that is available to an organization at any given time by the recruitment and selection of any organization, thereby these are difficult tasks that demand HR managers' full attention. As a result, they must make sure that accurate job analyses are performed consistently at each employee's desk to meet the organization's goals (Stankeviien, Korsakien, & Liuvaitien, 2009). As the performance of an organization is greatly influenced by its HR, HEIs are expected to produce highly mobile skill-oriented graduates who can work or respond to the continuously varying needs of organizations as well as the marketplace. Although it is debatable whether the qualifications of these recent graduates meet the needs of the organization (Hesketh, 2000). To meet the needs of the employer, educators and students in HEIs must be aware of these needs and skills. Therefore, research is required to determine what employers want from the graduating workforce. Very few researches have addressed this issue related to the banking sector and the Islamic banking sector, particularly in the context of Pakistan (Sewell, 2009). The purpose of the proposed study model is to guide and assist the academicians in embedding employability provisions into the current curriculum to enhance graduate employability in the IBF industry.

Research Methodology

The study population consisted of employees from seven full-fledged Islamic banks and traditional banks with Islamic windows/branches who were directly or indirectly involved in the IBF graduates recruitment and selection process within Lahore, Pakistan. The study sample was 120 employees of full-fledged Islamic banks – namely, Meezan Bank Limited, Al-Baraka Bank Limited, Dubai Islamic Bank, Bank Islamic Limited, MCB Islamic Banking, Bank AlFalah Islamic, and Askari Bank Limited. The data was gathered using convenience sampling from the targeted respondents. Consequently, exploratory factor analysis (EFA) was performed to analyze the Islamic banker's perspectives on all the variables in employability skills to determine its viability as an alternative organizational performance mode for Islamic banks. SPSS v24 was used to analyze the data.

The study has employed a literature survey as presented above in section 2, and five variables/constructs with regard to the viability of employability skills for IBF graduates have been identified. These include 1) Communication skills, 2) Interpersonal skills, 3) Technical skills, 4) Social skills, and 5) Subject knowledge. To understand the viability of the Employability skills of IBF graduates for Islamic banks, views on these variables/constructs were gathered from the employer's perspectives. A survey instrument was used because it is the most suitable way to manage and collect the primary data (Kerlinger, Lee & Bhanthumnavin, 2000). Demographic data (part 1) and Islamic bankers' opinions on IBF graduates' employability skills (part 2) made up the two sections of the questionnaire. Part 2 comprises 31 questions to examine the Islamic bank's views on IBF graduates' employability skills. A 7-point Likert scale was used for the study to indicate the participant's degree of disagreement or agreement (where 1 represents Strongly Disagree and 7 represents Strongly Agree) regarding the respondent's views on the particular series of statements/items on employability skills. Linan and Chen (2009) also suggested that it would be much more rigorous to determine the intention level of respondents by applying Likert scales with seven items as the intention is a complex cognitive trait. The researchers have used quantitative data as it is helpful for producing objective data which can be clearly communicated through numbers and statistics.

Results

This section of the paper discusses the data

analysis results and is categorized into three sub-sections: (a) respondents' demographic profile, (b) reliability analysis, and (c) exploratory factor analysis.

Respondents Profile

Table 1 shows that 90.8% were males, and 9.2% were females out of the 120 respondents. About 39.1% of the respondent's age were between 37-42 years, 24.7% were between 31-36 years, 13.4% were between 43-48 years, and 12.4% were between 25-30 years old. The majority of the respondents (47.0%) have 4 to 7 years of experience in the banking sector. 31.5% of respondents have an MS/Ph.D. degree followed by 29.6% of respondents with a Master's and 21.8% of respondents with a Bachelor's degree.

Table 1

|

|

Frequency |

Per cent |

|

Gender |

||

|

Male |

109 |

90.8 |

|

Female |

11 |

9.2 |

|

Age |

||

|

Less than 25 years |

5 |

4.3 |

|

25-30 years |

15 |

12.4 |

|

31-36 years |

30 |

24.7 |

|

37-42 years |

47 |

39.1 |

|

43-48 years |

16 |

13.4 |

|

Above 48 years |

7 |

6.1 |

|

Designation |

||

|

Branch/Operation Manager |

26 |

21.6 |

|

HR Manager |

64 |

53.5 |

|

Higher Management/Leadership |

20 |

16.9 |

|

Others ________ |

10 |

8.0 |

|

Experience |

||

|

1-3 years |

30 |

25.0 |

|

4-7 years |

56 |

47.0 |

|

8-10 years |

20 |

16.4 |

|

More than 10 years |

14 |

11.6 |

|

Education |

||

|

Bachelors |

26 |

21.8 |

|

Masters |

35 |

29.6 |

|

MS / PhD. |

38 |

31.5 |

|

Diploma / Certification |

17 |

14.2 |

|

Professional Qualification |

3 |

2.2 |

|

Others ________ |

1 |

0.7 |

Reliability Analysis

Reliability analysis is an essential statistical component of any quantitative research. It is the extent to which an instrument is free from errors (Sekaran & Bougie, 2010). Using SPSS, reliability analysis was conducted to confirm all measurement items' reliability of the five variables in employability skills. In reliability analysis, Cronbach's alpha value of equal to or above 0.7 is generally said to be acceptable (Brink, 1991). It shows that the survey tool is reliable for further conducting the study (Kline, 1986). The findings of the reliability analysis show that measurement items were found to be reliable as they achieved the minimum value of alpha 0.7, thereby concluding that constructs/variables are reliable measures. Table 2 presents reliability values for all variables.

Table 2

|

S. No |

Scale Name |

Cronbach's Alpha |

Number of Items |

|

1 |

Communication

Skills |

.916 |

5 |

|

2 |

Interpersonal

Skills |

.881 |

7 |

|

3 |

Technical Skills |

.911 |

5 |

|

4 |

Social Skills |

.928 |

7 |

|

5 |

Subject Knowledge |

.906 |

7 |

Factor Analysis

Factor analysis is performed to understand how different underlying factors affect the variance among the constructs. It is a "statistical method to describe the variability within correlated, observed variables in terms of the potentially lower number of unobserved variables" (Yong & Pearce, 2013). To analyze the Islamic banker's views on the variables, this study used EFA because this technique can show which items indicate the same thing (Zainudin, 2012). Moreover, this method also allows the researcher in determining factors that contribute to the viability of employability skills as a viable factor for performance for Islamic banks.

Using SPSS, we have employed EFA to examine the contribution of each item to form a factor/component by utilizing the principal component analysis as the extraction method and the varimax method as the rotation method. The factor analysis depicts a Kaiser-Meyer-Olkin Measure (KMO) value of 0.938. According to Trujillo-Ortiz et al. (2006), the KMO value above the 0.5 threshold shows that the dataset is suitable for factor analysis and has strong partial correlations. Furthermore, the significance value of Bartlett's Test of Sphericity is below 0.05, suggesting that there is a significant association between variables (Tabachnick, Fidell & Ullman, 2007).

Table 3

|

KMO Measure of Sampling Adequacy. |

.938 |

|

|

Bartlett's Test of Sphericity |

Approx. Chi-Square |

3379.953 |

|

df |

406 |

|

|

Sig. |

.000 |

|

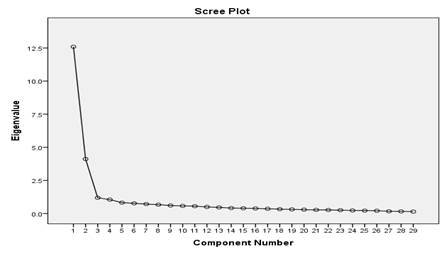

Additionally, as shown in Table 4, all 29 items were grouped into five factors when analyzed simultaneously, consistent with the five variables which were identified earlier in Section 2. The top five components show the initial eigenvalues greater than one, thereby forming a strong argument for representing the factors. Likewise, the cumulative percentage of variance for the top five components was 77.91%, which indicated that these variances could be explained by employability skills for IBF graduates. In other words, it means that these five generated components can explain more than 77.91% of the variances in employability skills. Furthermore, from the scree plots, the analysis depicts that the first five components have Eigenvalues over 1. Thus these five factors are considered to be the strong factors.

Table 4

|

Component |

Initial Eigenvalues |

Extraction Sums of

Squared Loadings |

Rotation Sums of

Squared Loadings |

||||||

|

Total |

% of Variance |

Cumulative % |

Total |

% of Variance |

Cumulative % |

Total |

% of Variance |

Cumulative % |

|

|

1 |

18.931 |

52.586 |

52.586 |

18.931 |

52.586 |

52.586 |

8.594 |

23.871 |

23.871 |

|

2 |

4.677 |

12.991 |

65.577 |

4.677 |

12.991 |

65.577 |

7.528 |

20.911 |

44.782 |

|

3 |

2.615 |

7.263 |

72.840 |

2.615 |

7.263 |

72.840 |

4.474 |

12.428 |

57.210 |

|

4 |

1.841 |

5.113 |

77.953 |

1.841 |

5.113 |

77.953 |

4.336 |

12.046 |

69.256 |

|

5 |

1.308 |

3.633 |

81.586 |

1.308 |

3.633 |

81.586 |

3.116 |

8.654 |

77.910 |

Varimax rotation matrix was performed to aid the interpretation of the five components, and the results are shown below in Table 5. Rotated factor matrix indicates that items CS1, CS3 CS4 and CS5 form one factor (or construct), items IS1, IS2, IS3, IS4, IS5, IS6, and IS7 form the second construct, items TS1, TS2, TS3, TS4 and TS5 form the third construct, items SS1, SS2, SS3, SS4, SS5, SS6 and SS7 form the fourth construct, while items SK1, SK2, SK3, SK4, SK5, and SK6 form the fifth construct. It shows that out of all these 31 items, 29 items contribute to five underlying factors/constructs.

Table 5

|

Construct |

Item

Code* |

Component |

||||

|

1 |

2 |

3 |

4 |

5 |

||

|

Communication Skills |

CS1 |

.568 |

|

|

|

|

|

CS3 |

.750 |

|

|

|

|

|

|

CS4 |

.870 |

|

|

|

|

|

|

CS5 |

.820 |

|

|

|

|

|

|

Interpersonal Skills |

IS1 |

|

.696 |

|

|

|

|

IS2 |

|

.836 |

|

|

|

|

|

IS3 |

|

.740 |

|

|

|

|

|

IS4 |

|

.687 |

|

|

|

|

|

IS5 |

|

.681 |

|

|

|

|

|

IS6 |

|

.567 |

|

|

|

|

|

IS7 |

|

.534 |

|

|

|

|

|

Technical Skills |

TS1 |

|

|

.792 |

|

|

|

TS2 |

|

|

.767 |

|

|

|

|

TS3 |

|

|

.686 |

|

|

|

|

TS4 |

|

|

.639 |

|

|

|

|

TS5 |

|

|

.735 |

|

|

|

|

Social Skills |

SS1 |

|

|

|

.712 |

|

|

SS2 |

|

|

|

.748 |

|

|

|

SS3 |

|

|

|

.832 |

|

|

|

SS4 |

|

|

|

.852 |

|

|

|

SS5 |

|

|

|

.567 |

|

|

|

SS6 |

|

|

|

.885 |

|

|

|

SS7 |

|

|

|

.673 |

|

|

|

Subject Knowledge |

SK1 |

|

|

|

|

.704 |

|

SK2 |

|

|

|

|

.638 |

|

|

SK3 |

|

|

|

|

.594 |

|

|

SK4 |

|

|

|

|

.859 |

|

|

SK5 |

|

|

|

|

.739 |

|

|

SK6 |

|

|

|

|

.867 |

|

|

*

The description of the item code is presented in Annexure A. |

||||||

Discussion

Human capacity must be given top priority for any organisation to meet the expectations of its stakeholders (Kesti & Syvajarvi, 2010). Keeping this into consideration, the HR department of an organization generally and ideally looks to source qualified and outstanding candidates capable of delivering high-quality results for their organization (Ericksen & Dyer, 2005). Since one of the main tasks of HR managers is to recruit and select suitable candidates for the right job at the right time, thus it represents the staff quality at an organization's disposal par time (Chen & Huang, 2009). Hence, HR managers should ensure that proper job analysis is done before hiring a candidate so that the goals and objectives of an organization are consistently met at each employee's desk. It is only possible when the HR department harmonizes its work with other department managers to ensure that the organization is not leaving any stone unturned in employing the best human capital (Shahnaei & Long, 2015).

The results of exploratory factor analysis have concluded that five variables deemed to be relevant in IBF graduates' employability skills for Islamic Banks are (i) communication, (ii) interpersonal, (iii) technical, (iv) social, and (v) subject knowledge skills. Thus, the research shows that these employability skills-related variables, as identified in the earlier empirical literature surveys, are deemed to be valid to measure the viability of Islamic Finance graduates as employability skills for Islamic banks. Moreover, social skills and subject knowledge are the most crucial factor perceived by Islamic Banks. The flow of ideas, problem-solving attitude, and collaborative acts among the skilled HR provide the base for building a solid team, and teamwork is valued by top leadership for innovation. Social skills impact the innovation process in the IFIs, given the level of communication and interactions required for a financial service or product to be conceived and approved by the Shariah committee members. Thus such social skills help to build a shared cognition among the team members. Therefore, findings supported the relevance of employability skills for Islamic banks, as suggested by this study.

Another factor, subject knowledge, is also a vital factor from an employability perspective for Islamic banks. The HR conceptual understandings of Shariah-compliant products are a valuable asset for Islamic financial institutions. Subject knowledge is the degree to which an individual understands the products of IBF, the comparative banking system, and the Islamic way of trading and business (Sabirzyanov & Hashim, 2015). Gray and Hamilton (2004) argued that the existing studies have recognized there should be more research on the communicational and subject knowledge aspects. O'Cass (2004) found that understanding IBF products is a significant factor as it affects the organizational commitment towards long-term goals. With these findings, it can be concluded that employing these skills among IBF graduates can be a viable source of employment in Islamic banks.

Employers look for these skills irrespective of what industry they operate in. While prospective candidates need to be tested on these employability skills, the organization needs to continuously improve business performance (Philippaers, Cuyper & Forrier, 2019). Corporate organizations should implement robust learning, research, and development model to invest in their human resources. Within organizations, changes in job roles and responsibilities are inevitable; however, a sufficient budget will ensure that these changes only enhance business performance (De Cuyper et al., 2014). Hence, sufficient attention should be given to continuous learning. Employability skills can be developed in the graduate degree program. Thus, staff must be regularly trained because that is the only way to guarantee their continued relevance to the organization and, ultimately, improve business performance. (Camps & Rodriguez, 2011).

Conclusion

A key strategic concern for Islamic banking in Pakistan is now human resources. Human capital is the key component in the sector's continued growth despite the rapid development of Islamic banking. As the Shariah-compliant financial system expands into newer markets globally to support the industry's growth in these developing jurisdictions, resulting in significant aid from the effectiveness of human capital, the need for Islamic banking professionals will become even more evident (Ali et al., 2018). As a result, Islamic banks need to have excellent human capital with specialized knowledge, skills, and expertise in relation to Islamic matters. A weak HR department may have a negative impact on an Islamic bank's performance, causing them to become ill. Therefore, this study proposed employability skills as a viable employment source for IBF graduates in Pakistan's Islamic banking sector.

References

- Abdullah, A., Kamarudin, M. K., Ahmad, N. A., Yusoh, S. S., Muhamad, S. F., & Ismail, M. (2015). The exploration study on employability of Islamic banking and finance graduates from practitioners' perspective. Intercontinental Journal of Finance Research Review, 3(11), 10-21.

- Adebakin, A. B., Ajadi, T. O., & Subair, S. T. (2015). Required and Possessed University Graduate Employability Skills: Perceptions of the Nigerian Employers. World Journal of Education, 5(2), 115–121.

- Ahmad, A., Rehman, K.-U. -, & Humayoun, A. (2011). Islamic banking and prohibition of Riba/interest. African Journal of Business Management, 5(5), 1763–1767.

- Ahmed, S., Fiaz, M., & Shoaib, M. (2015). Impact of knowledge management practices on organizational performance: an empirical study of the banking sector in Pakistan. FWU Journal of Social Sciences, 9(2), 147-167.

- Ali, S. A., Hassan, A., Juhdi, N., & Razali, S. S. (2018). Employees’ attitude towards Islamic banking: measurement development and validation. International Journal of Ethics and Systems, 34(1), 78–100.

- Alpay, E., & Jones, M. E. (2012). Engineering education in research-intensive universities. European Journal of Engineering Education, 37(6), 609–626.

- Andrews, J., & Higson, H. (2008). Graduate Employability, “Soft Skills†Versus “Hard†Business Knowledge: A European Study. Higher Education in Europe, 33(4), 411–422.

- Atfield, G., & Purcell, K. (2012). The fit between graduate labour market supply and demand: 3rd year UK undergraduate degree final year students' perceptions of the skills they have to offer and the skills employers seek. Institute for Employment Research, University of Warwick, Working Paper, 4

- Athar, R., & Shah, F. M. (2015). Impact of training on employee performance (banking sector Karachi). IOSR Journal of Business and Management, 17(11), 58-67.

- Banaeianjahromi, N., & Smolander, K. (2017). Lack of Communication and Collaboration in Enterprise Architecture Development. Information Systems Frontiers, 21(4), 877–908.

- Bashah, N. H. S. N., Japar, N. H. M., Bakar, A. A., & Abdullah, S. B. (2012). Manpower competency in Bank Islam Malaysia Berhad. Journal of Human Development and Communication, 1: 23–37

- Belonio, R. J. (2014). The Effect of Leadership Style on Employee Satisfaction and Performance of Bank Employees in Bangkok. AU-GSB E-JOURNAL, 5(2).

- Belt, V., Drake, P., & Chapman, K. (2010). Employability skills: A research and policy briefing. UK Commission for Employment and Skills (UKCES). London.

- Bowers-Brown, T., & Harvey, L. (2004). Are there too many graduates in the UK? A literature review and an analysis of graduate employability. Industry and Higher Education, 18(4), 243–254.

- Branine, M. (2008). Graduate recruitment and selection in the UK. Career Development International, 13(6), 497–513.

- Brink, P. J. (1991). Issues of reliability and validity. Qualitative nursing research: A contemporary dialogue, 164-186

- Camps, J., & RodrÃguez, H. (2011). Transformational leadership, learning, and employability. Personnel Review, 40(4), 423–442.

- Chen, C.-J. . (2009). Strategic human resource practices and innovation performance: the mediating role of knowledge management capacity. Strategic Direction, 25(6).

- Cicekli, E. (2016). Graduate skills requirements for effective performance in the banking sector. Verslas: Teorija Ir Praktika, 17(4), 317–324.

- Collet, C., Hine, D., & du Plessis, K. (2015). Employability skills: perspectives from a knowledge-intensive industry. Education + Training, 57(5), 532–559.

- Danial, J., Bakar, A. R., & Mohamed, S. (2014). Factors Influencing the Acquisition of Employability Skills by Students of Selected Technical Secondary School in Malaysia. International Education Studies, 7(2), 117–124.

- De Cuyper, N., Sulea, C., Philippaers, K., Fischmann, G., Iliescu, D., & De Witte, H. (2014). Perceived employability and performance: moderation by felt job insecurity. Personnel Review, 43(4), 536– 552.

- Dess, G. G., & Picken, J. C. (2000). Changing roles: Leadership in the 21st century. Organizational Dynamics, 28(3), 18–34.

- Dhir, S. (2019). The changing nature of work, leadership, and organizational culture in future ready organizations. CMC Senior Theses.

- Dunn, C. L., Gerard, G. J., & Grabski, S. V. (2017). The combined effects of user schemas and degree of cognitive fit on data retrieval performance. International Journal of Accounting Information Systems, 26, 46–67.

- Ericksen, J., & Dyer, L. (2005). Toward a strategic human resource management model of high reliability organization performance. The International Journal of Human Resource Management, 16(6), 907–928.

- Gray, F. E., & Hamilton, L. (2013). Communication in Accounting Education. Accounting Education, 23(2), 115–118.

- Griffin, M., & Annulis, H. (2013). Employability skills in practice: the case of manufacturing education in Mississippi. International Journal of Training and Development, 17(3), 221– 232.

- Haneef, M. A. (2009). Islamic Banking and Finance in the 21st Century: Selected Issues in Human Capital Development. ICR Journal, 1(2), 292– 302.

- Hassan, A., & Mollah, S. (2018). Gaining Strength: Prudential Regulations in Islamic Banking. In Islamic Finance (pp. 217-222). Palgrave Macmillan, Cham.

- Hesketh, A. J. (2000). Recruiting an Elite? Employers’ perceptions of graduate education and training. Journal of Education and Work, 13(3), 245–271.

- Hillage, J., & Pollard, E. (1998). Employability: developing a framework for policy analysis. Dept. For Education and Employment.

- Hoegl, M., & Parboteeah, K. P. (2007). Creativity in innovative projects: How teamwork matters. Journal of Engineering and Technology Management, 24(1-2), 148–166.

- Hoffmann, A. O. I., & Post, T. (2014). Self- attribution bias in consumer financial decision-making: How investment returns affect individuals’ belief in skill. Journal of Behavioral and Experimental Economics, 52, 23–28.

- Huda, N., Rini, N., Anggraini, D., Hudori, K., & Mardoni, Y. (2016). The Development of Human Resources in Islamic Financial Industries from Economic and Islamic Financial Graduates. Al-Iqtishad: Journal of Islamic Economics, 8(1).

- Iqbal, Z. (2007). Challenges facing the Islamic financial industry. Journal of Islamic Economics, Banking and Finance, 3(1), 1- 14.

- Ismail, R., Yussof, I., & Sieng, L. W. (2011). Employers’ Perceptions on Graduates in Malaysian Services Sector. International Business Management, 5(3), 184–193.

- Jensen, S. M., Luthans, K. W., Lebsack, S. A., & Lebsack, R. R. (2007). Optimism and employee performance in the banking industry. Journal of Applied Management and Entrepreneurship, 12(3), 57.

- Kayadibi, S. (2010). Employability and marketability of the graduates of Islamic studies in Islamic banking and finance: Malaysian experience. Journal of Islamic Law Studies (IHAD), 16(16), 503–516.

- Kerlinger, F. N., Lee, H. B., & Bhanthumnavin, D. (2000). Foundations of behavioural research. The most sustainable popular textbook by Kerlinger & Lee.

- Kesti, M., & Syväjärvi, A. (2010). Human tacit signals at organization performance development. Industrial Management & Data Systems, 110(2), 211–229.

- Khadijah, S., Manan, A., Saidon, R., Ishak, A., & Sahari, N. (2018). COMPETENCY SKILLS OF GRADUATING ISLAMIC FINANCE STUDENTS. The Turkish Online Journal of Design, Art and Communication, Special Edition, 1420– 1426. https://doi.org/10.7456/1080SSE/190

- Khan, M. M. S., Alheety, S. N. Y., & Bardai, B. (2020). Impact of Human Capital Skills on Corporate Performance: A Case of Islamic Banks in Pakistan. Journal of Islamic Finance, 9(1), 076–088.

- Khan, R. H., Subramaniam, G., Ali, E., & Parvin, S. (2018). Islamic banking opportunities in a non-Islamic economy: Customer perspectives of New Zealand. Journal of Emerging Economies and Islamic Research, 6(3), 59–68.

- Klibi, M. F., & Oussii, A. A. (2013). Skills and Attributes Needed for Success in Accounting Career: Do Employers’ Expectations Fit with Students’ Perceptions? Evidence from Tunisia. International Journal of Business and Management, 8(8).

- Kulkarni, N., & Chachadi, A. H. (2014). Skills for employability: Employers' perspective. SCMS Journal of Indian Management, 11(3), 64.

- Kunhibava, S., Ling, S. T. Y., & Ruslan, M. K. (2018). Sustainable Financing and Enhancing the Role of Islamic Banks in Malaysia. Arab Law Quarterly, 32(2), 129–157.

- Leblebici, D. (2012). Impact of Workplace Quality on Employee’s Productivity:Case Study of a Bank in Turkey . Journal of Business Economics and Finance , 1 (1) , 38-49 .

- Leitch, S. (2006). Prosperity for all in the global economy-world class skills. The Stationery Office.

- Li, H., & Sun, Z. (2019). Study on the definition of college students' employability. In ITM Web of Conferences (Vol. 25, p. 04001). EDP Sciences.

- Madar, A. R., & Buntat, Y. (2011). Elements of employability skills among students from Community Colleges Malaysia. Journal of Technical, Vocational & Engineering Education, 4, 1-11.

- Mason, G., Williams, G., & Cranmer, S. (2009). Employability skills initiatives in higher education: what effects do they have on graduate labour market outcomes? Education Economics, 17(1), 1–30.

- McMurray, S., Dutton, M., McQuaid, R., & Richard, A. (2016). Employer demands from business graduates. Education + Training, 58(1), 112–132.

- McQuaid, R. W., & Lindsay, C. (2005). The Concept of Employability. Urban Studies, 42(2), 197–219.

- Miller, C. S., & Dettori, L. (2008, October). Employers' perspectives on its learning outcomes. In Proceedings of the 9th ACM SIGITE conference on Information Technology education (pp. 213-218).

- Miller, L., Biggart, A., & Newton, B. (2018). Basic and employability skills. International Journal of Training and Development, 17(3), 173–175.

- Narayan, P. K., & Phan, D. H. B. (2019). A survey of Islamic banking and finance literature: Issues, challenges and future directions. Pacific-Basin Finance Journal, 53, 484–496.

- Ngoo, Y. T., Tiong, K. M., & Pok, W. F. (2015). Bridging the gap of perceived skills between employers and accounting graduates in Malaysia. American Journal of Economics, 5(2), 98-104.

- Oria, B. (2012). Enhancing higher education students’ employability: A Spanish case study. International Journal of Technology Management & Sustainable Development, 11(3), 217–230.

- Passow, H. J. (2012). Which ABET Competencies Do Engineering Graduates Find Most Important in their Work? Journal of Engineering Education, 101(1), 95–118.

- Pavlin, S., & Svetlik, I. (2014). Employability of higher education graduates in Europe. International Journal of Manpower, 35(4), 418–424.

- Philippaers, K., De Cuyper, N., & Forrier, A. (2019). Employability and performance: The role of perceived control and affective organizational commitment. Personnel Review, 48(5), 1299–1317.

- PPI. (2021, March 24). SBP posts highest growth in Islamic banking assets, deposits. Brecorder.

- Rassuli, A., Bingi, P., Karim, A., & Chang, O. (2012). A survey of critical knowledge and skills of business school graduates: Employer perspectives. The Journal of International Management Studies, 7(2), 1-6.

- Rastogi, P. N. (2000). Knowledge management and intellectual capital – the new virtuous reality of competitiveness. Human Systems Management, 19(1), 39–48.

- Raza, M. (2019, March 31). Addressing the challenges in Islamic Finance education in Pakistan. Pakistan & Gulf Economist.

- Sabirzyanov, R., & Haidir Hashim, M. (2015). Islamic Banking and Finance: Concept and Reality. Journal of Islamic Banking and Finance. 32. 88, 102.

- Sekaran, U. & Bougie, R. (2010). Research methods for business: A skill building approach (5th ed.). Chichester: John Willey & Sons Ltd

- Shafie, L. A., & Nayan, S. (2010). Employability Awareness among Malaysian Undergraduates. International Journal of Business and Management, 5(8), 119. https://doi.org/10.5539/ijbm.v5n8p119

- Shahnaei, S., & Long, C. S. (2015). The Review of Improving Innovation Performance through Human Resource Practices in Organization Performance. Asian Social Science, 11(9), 52.

- Sodhi, M. S., & Son, B.-G. (2008). ASP, The Art and Science of Practice: Skills Employers Want from Operations Research Graduates. Interfaces, 38(2), 140–146.

- StankeviÄienÄ—, A., KorsakienÄ—, R., & LiuÄvaitienÄ—, A. (2009). ŽmogiÅ¡kųjų iÅ¡teklių valdymo strategijos rengimo teoriniai ir praktiniai aspektai: Lietuvos telekomunikacijų sektoriaus atvejis. Verslas: Teorija Ir Praktika, 10(4), 276–284.

- State Bank of Pakistan (2020). Islamic Banking Bulletin. https://dnb.sbp.org.pk/ibd/Bulletin/2020/ Dec.pdf

- Stewart, J., & Knowles, V. (2000). Graduate recruitment and selection: implications for HE, graduates and small business recruiters. Career Development International, 5(2), 65–80.

- Sullivan, D. W. (2012). Manufacturing Hiring Trends: Employers Seeking More Diverse Skills. International Journal of Management & Information Systems (IJMIS), 16(3), 247–254.

- Tabachnick, B. G., Fidell, L. S., & Ullman, J. B. (2007). Using multivariate statistics (Vol. 5, pp. 481-498). Boston, MA: Pearson

- Thota, N. (2014, April). Programming course design: phenomenography approach to learning and teaching. In 2014 International Conference on Teaching and Learning in Computing and Engineering (pp. 125-132). IEEE.

- Trujillo-Ortiz, A., Hernandez-Walls, R., Castro- Perez, A., Barba-Rojo, K., & Otero-Limon, A. (2006). kmo: Kaiser-Meyer-Olkin Measure of Sampling Adequacy. A MATLAB file.

- Tymon, A. (2013). The student perspective on employability. Studies in Higher Education, 38(6), 841–856.

- Vyas, P. R. I. T. I., & Chauhan, G. S. (2013). The preeminence of soft skills: need for sustainable employability. International Journal of Social Science & Interdisciplinary Research SSN, 2(5), 2277.

- Yong, A. G., & Pearce, S. (2013). A Beginner’s Guide to Factor Analysis: Focusing on Exploratory Factor Analysis. Tutorials in Quantitative Methods for Psychology, 9(2), 79–94.

- Yorke, M. (2006). Employability in higher education: what it is-what it is not (Vol. 1). York: Higher Education Academy.

- Zainudin, A. (2010). Research Methodology for Business and Social Science. Shah Alam: Universiti Teknologi Mara Publication Centre (UPENA).In Press

- Zeti, A. A. (2006). Extending the Boundaries in the New Financial Landscape. Governor's Speech at the 10th Malaysian Banking, Finance and Insurance Summit: 'Liberalisation and Consolidation of Malaysian Banking and Finance Sector: Enhancing Competitiveness and Resilience of Our Economy'. Kuala Lumpur: Bank Negara Malaysia (09 June).

Cite this article

-

APA : Mushtaq, A., Hussain, T., & khan, M. M. S. (2023). Viability of Employability Skills for Islamic Banking and Finance Graduates Employment; Case of Islamic Banks of Pakistan. Global Economics Review, VIII(II), 32-48. https://doi.org/10.31703/ger.2023(VIII-II).04

-

CHICAGO : Mushtaq, Afia, Talat Hussain, and Muhammad Mahmood Shah khan. 2023. "Viability of Employability Skills for Islamic Banking and Finance Graduates Employment; Case of Islamic Banks of Pakistan." Global Economics Review, VIII (II): 32-48 doi: 10.31703/ger.2023(VIII-II).04

-

HARVARD : MUSHTAQ, A., HUSSAIN, T. & KHAN, M. M. S. 2023. Viability of Employability Skills for Islamic Banking and Finance Graduates Employment; Case of Islamic Banks of Pakistan. Global Economics Review, VIII, 32-48.

-

MHRA : Mushtaq, Afia, Talat Hussain, and Muhammad Mahmood Shah khan. 2023. "Viability of Employability Skills for Islamic Banking and Finance Graduates Employment; Case of Islamic Banks of Pakistan." Global Economics Review, VIII: 32-48

-

MLA : Mushtaq, Afia, Talat Hussain, and Muhammad Mahmood Shah khan. "Viability of Employability Skills for Islamic Banking and Finance Graduates Employment; Case of Islamic Banks of Pakistan." Global Economics Review, VIII.II (2023): 32-48 Print.

-

OXFORD : Mushtaq, Afia, Hussain, Talat, and khan, Muhammad Mahmood Shah (2023), "Viability of Employability Skills for Islamic Banking and Finance Graduates Employment; Case of Islamic Banks of Pakistan", Global Economics Review, VIII (II), 32-48

-

TURABIAN : Mushtaq, Afia, Talat Hussain, and Muhammad Mahmood Shah khan. "Viability of Employability Skills for Islamic Banking and Finance Graduates Employment; Case of Islamic Banks of Pakistan." Global Economics Review VIII, no. II (2023): 32-48. https://doi.org/10.31703/ger.2023(VIII-II).04