Abstract:

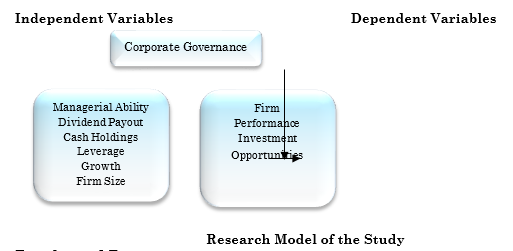

The current study focused on investigating the influence of management ability on the investment opportunity and firm performance. The managerial ability has a strategic impact on firm performance and value. Secondary data was employed. The study takes 369 non-financial firms as a population of the study and 196 firms as sample size selected randomly. The data was collected from 2008 to 2017. The managerial ability, cash holdings and dividend payout have a significant effect on the firm performance (ROA). Corporate governance has significant effects on the independent variables and ROA. The findings suggested that managerial ability, cash holdings and dividend payout have significant effects on firm investment opportunities (total Q). Corporate governance has positive and significant effects among independent variables and total Q (TTQ). It has been recommended that managers with superior abilities correlate themselves with a better investment opportunity

Key Words:

Managerial Ability, Investment Opportunity, Firm Performance, Non- Financial, OLS, Fixed Effect.

Introduction

The indication and effect of management ability have been a hot topic for the academic researcher and scholars for the reason to find out the significant role of top-notch management that is CEO and CFO in making a decision and other corporate activities. The research conducted by (Lazear, 1986) highlighting management capabilities in business activities found that the probability of maximum output will be high when the management skills and capabilities match with the organizational needs. On the basis of the above theory, the social scientists in the field of finance, accounting and management discover how managers show their capabilities to the general public.

The influence of managerial capabilities on the firm performance and policies has been ignored for a long period of time in financial research due to the fact of management homogeneity. For a long time, the management was considered as homogeneous individuals which suggest a limited role of management on the economic output of organizations. Although it is quite clear that the association between management capability and corporate policy is straight forward, still previous studies prove the opposite. A couple of research findings argued that the able managers who are working for the betterment of organizations and shareholders keep their reputation at risk, reject the opportunistic rent-seeking actions that are destructive for firm value.

The quality of management ability may have an effect on the efficiency of routine operations of the organizations. Specifically, in uncertain and crisis time, the role of management ability becomes more crucial and important. The investment needs suitable and proper funding. In uncertain and an emergency period where funding is restricted and shrink the higher management ability draw the positive value of the organization to the outsiders and fix the information asymmetry, therefore, making the firm able to elevate more funds in the form of debt for the purpose of investment.

The decision of investments in optimal ventures are very crucial, and these investments have the same goal as other important corporate activities for value maximization of the firm. The through and extensive budgeting process show the significance of regulatory investment activities (Holmstrom and Costa 1986). The suboptimal and inferior investments are harmful to shareholders’ welfare and wealth, as it not only wastes the crucial funds but also has a negative effect in the long run. The superior investment decisions also lead to unforeseen results.

The theory forwarded by (Tobin and Brainard 1977) called the neoclassical theory of corporate investment forecast that the organization’s best investment policy is to invest till the time, the marginal cost becomes equal to marginal benefit considering that the management is working in the best interest of shareholders welfare. In continuation to their theory, the firm should take the project with positive net present value (NPV) for the purpose to maximize the value of the organization to park the excessive cash or using other funding channels. The project or venture with negative NPV must not be considered, and the excess cash must be paid to the shareholders (Jenson 1986, Tobin and Brainart 1977: Biddle et al.2009).

A study conducted by Preston (2008) stated that the management abilities provided a yardstick for the comparison of actual and desired results. The findings of Preston were also backed by Fatoki (2014) and Krajcovicova (2012) and also stated that managerial ability play a crucial role in achieving the goals, mission and objectives of the organization. The performance of the firm is centered upon various success factors that are management and firm characteristics (Gorgievski et al., 2014). This research will focus on managerial competencies that are necessary for firm growth enabling management capacity to adopt, adapt, and exploit new technology and business practices that improve firm performance within the economic context of Pakistan.

Problem Statement

Majority of the previous studies regarding the managerial abilities were measured by questionnaire method or interview schedule (Andreou et al., 2013 and Saeid, 2016). The study conducted by Lee et al., (2018) who highlighted the gap that the managerial ability should be evaluated by quantitative variable so that the measurement can evaluate the financial position of the firm. Another point which is forwarded by the study that maximum studies estimated the investment of the firm. This current research study argued that the managerial ability, which is the asset of the firm, can be related to the investment opportunities of the firm. Another study conducted by Gan (2015) who argued that majority of the studies for the managerial ability were conducted in US and Europe markets, but this factor should be evaluated in the developing economies of less efficient markets. The study also takes the gap from the papers about the moderating role of corporate governance which was not used by any study among the managerial ability, investment opportunity and firm performance. The idea of corporate governance as a moderator has been taken from the study of Guizani (2018). By taking the gap from these studies, the present study will evaluate the managerial ability, investment opportunity with the firm performance among the non-financial firms listed at the Pakistan Stock Exchange. The efficiency of the management is measured by the newly adopted technique called the data envelopment analysis (DEA) firstly used by Demerjian, Lev and McVay (2012). This newly adopted technique measures managerial efficiency in terms of generating higher revenues. The prior research showed that DEA (data envelopment analysis) is a better measure of managerial efficiency. The investment opportunities have been measured through the newly adopted technique called the Total Q. The important thing about the Total q is the inclusion of both non-tangible and tangible assets which is very popular and getting significance in the current development and high-tech industries.

Objectives

• To understand the role of managerial ability in firm investment opportunities.

• To find out the effect of managerial ability on firm performance.

• To analyze the moderating role of corporate governance between the managerial ability, firm investment opportunity and firm performance.

Hypotheses

Hypothesis 1. Managerial ability is significantly related to a firm's performance.

Hypothesis 2 Cash holding is significantly related to a firm's performance.

Hypothesis 3 Dividend payout is significantly related to a firm's performance.

Hypothesis 4 Managerial ability is significantly related to a firm's investment opportunities.

Hypothesis 5 Cash holding is significantly related to a firm's investment opportunities

Hypothesis 6 Dividend payout is significantly related to a firm's investment opportunities.

Literature Review

The study conducted by Lee et al., (2018), using the data of US industrial firms from 1988-2015 to find out whether the firms operated by highly capable managers may get more promising investment opportunities. The finding of the study revealed that there is a positive relationship between managerial ability and firm investment opportunity. Generally, the overall findings of the various studies support the fact that managers with extraordinary abilities could get high monetary profits by exploiting better investment opportunities in the market. Through our research, the managerial ability will get more attention from investors and policymakers.

According to Gan, (2015), the management capabilities of top-level management, i.e., the CEO has a great influence on the quality of investment, efficiency of investment and cash value. Their research focused on how the higher management capability is associated with the quality of merger and acquisition, efficient investment in capital and higher cash value. According to (Stein 2003), the shareholder judges the management capability of the firm’s CEO by the investment decision he made and implementation of those decisions. The study concludes that the firm will have a high cash value which is operated by the able CEO. This study uses the methodology firstly adopted by Demerjian et al., (2012) to evaluate the management ability and the study also investigated that after the acquisition, the merger and acquisition conducted by capable CEOs have low chances of goodwill impairment and divestitures.

In a few previous research studies conducted by Demerjian et al. (2012) attempted to quantify the managerial ability based on their performance in generating revenues from the given set of available resources. They showed that their measurements have a significant relationship with stability on the managers’ side, and the stock price reacts to financial management in firms.

Many investors confront the losses in the capital market, which attracted the attention of many scholars and university professors to the issue of the stock price crash. By stock price crash risk, we mean the probability of a sudden decrease in stock prices on a large scale. Despite the existence of negative skewness in the output of stock market and sudden drop in stock prices is generally accepted by pundits, but the economic mechanisms that lead to the outbreak of this phenomenon are still not clear. In accounting literature, many theories and opinions are present that try to explain the phenomenon of the stock price crash.

Managerial ability also plays a significant part in corporate investment because they require a long-time horizon and large cash flow amount. The study conducted by Chemmanur, Imants & Karen, (2009) proves that able managers have the capacity to identify high NPV projects and in a term, increase the investment volume. Peters & Taylor (2017) used a new method called Total q, the proxy for investment opportunities. The important thing about the Total q is that it includes the non-tangible and tangible assets, which is very popular and getting significance in the current development and high-tech industries.

Previous studies on corporate governance show that managerial and institutional shareholdings are important indicators of corporate governance that significantly improves the performance and value of the firm. In particular, prior studies by Al-Malkawi & Pillai, (2013); Gugler, Mueller & Yurtoglu (2008); Chung & Pruitt (1996); all documented significant relationship between managerial shareholding and firm performance. In addition to Previous research studies by Al-Malkawi & Pillai, (2013); Erkens, Hung, & Matos (2012); Lee & Chen, (2011) have reported a significant relationship between institutional shareholding and firm performance. They use the formula for measurement of institutional shareholding by the number of shares held by institutions divided by the total number of shares with the company.

Methodology

The study is conducted in the non-financial sector of Pakistan. The study is quantitative in nature, and all the data of the variables are collected from the reports published by the State Bank of Pakistan. There are 559 total enlisted firms in Pakistan Stock Exchange, but the reports of State Bank of Pakistan published a financial data of 369 non-financial firms. The current study takes these 369 non-financial firms as the population of the study. Based on the calculation from the table of Krejcie & Morgan (1970), the current study is limited to 196 non-financial firms which is the sample size and are selected randomly.

Data Collection & Analysis

The data of the variables are collected from the annual reports published by the sample non-financial firms or from the Balance Sheet Analysis (BSA) published by State Bank of Pakistan. The data in the current study are collected from 2008 to 2017. The data of the current study is the panel in nature. The panel data is a combination of both time-series and cross-sectional data. Initially, the data of the variable for the said time period are collected and then entered in MS Excel. The current study uses Gretl, research software for the data analysis. The data from Excel are imported to this research software.

Variables Description

Dependent Variables

Firm Performance (Return on Assets)

The current study will use return on assets (ROA) as a proxy for the firm performance. According to the pecking order theory, the first priority of a firm to finance itself should be the retained earnings. Furthermore, if the source of funding is not available, the company should go to finance itself through debt. If both the options are not available, the company should issue new equity as a last choice of financing. This pecking order shows the performance of the company to the general public. If the company is using the first option, it shows the strength of the company. If the company is using the second option for financing, i.e., financing through debt it indicates that the management is confident about the fact that the firm can overcome through its monthly obligation. However, if the company opted the third choice, i.e., issuance of new equity, it signals a negative image of the firm to the general public. It suggested that those firms which are profitable will take less amount of leverage (Myers & Majluf 1984) and thus expecting negative association between managerial ability and profitability.

ROA = (Net Income )/(Total Assets)

Investment Opportunities (Total’s Q)

Total q is measured in this research by measuring firm value by adding of physical capital and intangible capital and is represented by the following equation:

q_it^tot=V_it/(K_it^phy+K_it^int )

Where;

V_itis the market value of outstanding equity plus the book value of debt minus the firm's current assets which include cash, inventory, and marketable securities. K_it^phydenotes the book value of property, plant, and equipment. K_it^intdenotes the replacement cost of intangible capital.

Independent Variables

Managerial Ability

Management ability plays a significant role in tax reduction, quality of earning, goodwill impairment and many other business strategies (Shroff, 2013). The managerial ability will be measured by Data Envelopment Analysis (DEA). Most of the studies use the DEA technique for measurement of management capabilities or talent for firms from the same industry. In a study conducted by Murthi et al. (1996) evaluated consumer goods at the maturity stage of the product life cycle by using the DEA technique for measuring management skills.

Cash Holdings

The cash holding is composed of the cash amount and securities that can be converted into cash easily (Daher, 2010). In a study conducted by Myers & Majluf (1984) finds that amount of cash and other securities give the firm more an extra amount or slack finances which enables the firm to operate it without a costly external source of funding. This argument is basically the extension of Pecking order theory, which postulates that firm should prefer the internal sources as compared to costly external sources. In the case of high agency cost because of large asymmetry of information between lenders and borrowers, firms have to keep more liquid assets in reserve instead of using costly external source of funding. The cash holding of the company is used as an independent variable in the study. The cash holding of the firm will be calculated as cash plus cash equivalents divided by total assets minus cash plus cash equivalents represented by the following equation.

CH = (Cash+cash equivalents)/(Total assets-Cash+cash equivalents)

Dividend Payout Ratio

The dividend payout is used as a dependent variable in the study. The dividend policy is considered as one of the significant financial judgment that management come across with (Baker and Powell, 1999). The agency cost theory states that dividend policy of a firm in dependent on agency cost, which arises from the deviation between the managers and owners. A study conducted by Zhou & Ruland, (2006) states that firms paying high dividend payout has the tendency of high future earnings and having low previous earning growth, but the market observers have a controversial view about the phenomenon. The dividend is defined as the distribution of the earning among the shareholders of the company at the rate mentioned by the financial manager of the firm (Khan & Jain, 2007). The dividend payout ratio can be calculated as below:

DPR = TotalDividend/(net income)

Control Variables

Leverage

The past literature proposes that the proportion of leverage is based on the leverage definition. Various studies used book value and market value measures for the calculation of leverage. In the current study, the book value measure of leverage is used. According to (Shah, 2011), there are different factors for holding more cash, and leverage is one amongst them. The leverage is defined as the volume of the debt compared to the equity of the firm (Daher, 2010). The research carried out by (Adami et al., 2010) identified a significant and negative relationship of leverage on stock return. The equation for the calculation of leverage is given as under.

LEV = (Total Debts)/(Total Equity)

Growth

The relationship between growth and leverage is very debatable. The Pecking order theory states that the firm will use the retained earnings as a first option which may not be enough for the newly growing firm. As a second option, they will go for debt financing, which clearly indicates that the growing firm will have high leverage portion (Drobetz & Fix, 2003).

The positive relationship among corporate governance and opportunities for growth are forecasted because the financial cost of the firms is high for those organizations which have more and more chances of and opportunities for growth (Shah, 2011).

The sales growth is used as a control variable in the current study. The sales growth will be calculated by the formula given below:

Sales Growth = ln((Current Sale )/(Previous Sale))

Firm Size

Firm size has been treated as control variables to enhance the effect of independent variables on the dependent variables. The firm size reflects the total assets having by the firm in a single financial year. Every firm has its assets in millions and billions, so this huge variation might cause a negative effect on the results (Shah, 2011). By solving the issue of variations among the observations of total assets, the present study takes the log of total assets of the firm. The firm size will be measure by:

Firm Size = log (total assets)

Moderating Variable

Corporate Governance

Corporate governance is a system or set of rules, processes and practices through which the operations of the corporations are monitored and controlled. The implementation of corporate governance practices in corporations safeguards the interest of all the stakeholders. These stakeholders encompass the shareholders (owners of the company), managers, financiers (investors), customers, suppliers, government and community as well. Furthermore, corporate governance provides structure to organizations for the achievement of its goals and objectives. In short, the corporate governance encompasses every aspect of management, including internal control of an organization, corporate disclosure and action plans.

Corporate governance will be taken as the moderating variable of the study. The corporate governance has used different parameters, but in the current study, Institutional shareholdings and managerial shareholdings will be used as the proxies of corporate governance.

Institutional Shareholdings

The institutional shareholdings will be taken as the predictor variable in the current research. The institutional shareholdings will be measured by the number of shares held with institutions divided by total share equity (Bansal, 2005). The combination of ownership structure shows the significance of governance structure, which act as an additional monitoring tool to keep a check on the operations of the firm consequently affecting the firm performance Arora and Sharma (2006).

The previous literature revealed that the institutional shareholders invest in the companies which have better managerial performance (Parrino, Sias, & Starks 2003). Another study shows that the institutional investors attracted to invest in the companies which have better disclosure and transparency of information Bushee & Noe, (2000). In another study conducted by Grinstein & Michaely, (2005), the institutional investor prefers to invest in those firms which pay a cash dividend or repurchase the shares.

In a study conducted by Ferreira & Matosm, (2008) found that the institutional investors invest in those firms partially whose ownership structure are closely-held.

IS = (Number of shares held with institutions)/(Total shares equity)

Managerial Shareholdings

The management shareholding will find out by the fraction of shares held by the management of the same organization (Bansal, 2005). The study conducted by Jensen & Meckling's, (1976) revealed that the ownership of management in firm capital structure tends to align the interest of management with the shareholder and therefore the top management may opt the risky investment and take decisions in the best interest of the owners.

The study conducted by Chow, (1997) any kind of managerial incentive system implemented by the government, the study stated that there is a positive association between the financial and economic benefits and firm profitability.

Results and Discussions Ordinary Least Square

|

ROA

|

(Model 1) |

(Model 4) |

|

Const |

0.7071

(0.1033) |

0.7289

(0.21) |

|

Managerial Ability |

0.411(3.40)

** |

0.391(3.48)

** |

|

Cash Holdings |

0.02507(5.3849)

** |

0.99237

(4.40) ** |

|

Dividend Payout |

1.42282(38.4383)

** |

0.42084

(9.41) ** |

|

Leverage |

-0.00429(-3.7945)

** |

-0.00435

(-0.70) |

|

Firm Size |

0.6839

(0.6245) |

0.6901

(1.31) |

|

Growth |

0.00068(1.2807) |

0.00066

(0.164) |

|

CG |

|

0.87210

(3.68) ** |

|

R-Square |

0.651046 |

0.661102 |

|

F-value |

28.10680 |

24.63605 |

|

P-value |

0.00000 |

0.00000 |

The

findings argued that the managerial ability, cash holdings, dividend payout and

leverage are showing significant while firm size and growth are having

insignificant effects on the firm performance.

The findings suggested that there are some other factors which have a major

contribution to the ROA as compared to managerial ability, but the positive

relationship argued that the contribution is minimal but have positive effects.

The management ability, particularly human capital, is considered as intangible

assets. The high quality of management ability is directly related to well

organized, smooth and routine operations which takes place on a daily basis. Efficient

management becomes more significant in the crisis period where the management

decision has a greater influence on the performance of the firm.

In addition,

Carmeli and Tishler (2004) conducted research and relate the management ability

with the performance of the industrial organizations and show direct relation

with capabilities, resources and performance of the industrial organizations.

They are of the opinion that top-level management has a prominent role in

generating profits and value maximization of the firm. They also found in their

study that those firm which is having all these core characteristics superior to

other firms have an edge on other industrial organizations.

The study conducted by Switzer & Huang in (2007) found that the human capital

characteristics and the mid-cup and small mutual fund performance are directly

correlated with each other Additionally, negative effect on firm value

was predicted in case of deviations from optimal cash level. Developing firms

hold more cash when external funding is more expensive because entrepreneurs

want to get benefit from the potential venture (Shah, 2011). Similarly, Afza

& Adnan (2007) suggests that for the purpose of reinvestment, firms must

keep a certain level of cash, or to pay as dividend payments to the

shareholders. The findings of the moderating model suggested that managerial

ability, cash holdings and dividend payout is having significant effects on

firm performance in the existence of corporate governance. According to Babar

et al., (2017), When the Corporate Governance practices are implemented in the true

spirit, it helps in maintaining sustainable economic development. The

implementation of Corporate Governance Practices also helps to solve internal

disputes and deliver outside capital access. In the developing and emerging

economies like Pakistan, the role of corporate governance becomes very crucial

and play a significant part in public policy. Recently a research study has

been conducted to investigate the effect of Failure of Corporate Governance on

financial reporting on Malaysian Firms. A number of various organizations have been

investigated, for example, Technology resource industries, Malaysian Airlines

system, Perwaja steel, World Com, Megan and many other organizations are

observed. The examination of those multinational organizations which did not

implement the corporate governance in true spirit exposed that low enforcement

and poor monitoring are treated as primary issues in the implementation of

corporate governance practices. The research recommended that implementation of

transparency measures in financial reporting to initiate the good practices of

corporate governance.

Fixed Effect Model

|

INV (TTQ) |

(Model

1) |

(Model

2) |

|

Const |

-0.4704

(4.7) |

-0.2232

(-1.3) |

|

Managerial Ability |

0.0114

(4.2) |

0.0122

(0.61) |

|

Cash Holdings |

0.45189

(2.0) |

0.4889

(2.94) |

|

Dividend Payout |

0.78382

(6.41) |

0.8063

(0.75) |

|

Leverage |

0.00129

(7.60) |

0.0019

(0.02) |

|

Firm Size |

0.6993

(2.9) |

0.7690

(1.53) |

|

Growth |

0.00300

(1.9) |

0.0032

(0.05) |

|

CG |

- |

0.51918

(3.62) |

|

R-Square |

0.734608 |

0.814678 |

|

F-value |

33.870301 |

39.660682 |

|

P-value |

0.0000 |

0.0000 |

The

findings of the above-fixed effect model argued that the managerial ability,

cash holdings, dividend payout, leverage and firm size have significant while

firm growth has insignificant effects on the firm performance. The findings suggested that managerial

ability is the major contributor to investment opportunities in the Pakistani

market. The findings are consistent with

Lee et al., (2018), the previous studies prove that the management ability is a

key and significant determinant in goodwill impairment, tax evasion, earning

quality and many such corporate strategies. Due to the data restriction and

issues in measurements, the relationship between management ability and

investment opportunity remain ambiguous for a long time

Firstly,

the managerial ability has a significant and fundamental role in the

performance of the firm by enhancing the income and profitability of the firm,

measuring the efficiency of the managers. The efficiency of the management is

measured by the newly adopted technique called the data envelopment analysis

(DEA) firstly used by Demerjian, Lev & McVay, (2012). This newly technique measures

managerial efficiency in terms of generating higher revenues. The prior

research showed that DEA is a better measure of managerial efficiency.

Secondly,

the managerial capability has a significant fundamental role in corporate

finance which consequently have an impact on an investment opportunity, future

growth, dividend policy and firm’s capital structure (Kallapur & Trombley,

1999; Smith & Watts, 1992). The investment opportunity is unnoticeable by

the other stockholders who are outside the firms. It will be more beneficial if

we could connect managerial ability with opportunity for investment and other

characteristics of the firm. The investment opportunities have been measured

through the newly adopted technique called the Total Q firstly used by Peter

and Taylor, (2017). The important thing about the Total q is that it includes

the non-tangible and tangible assets, which is very popular and getting

significance in the current development and high-tech industries.

The

findings suggested that managerial ability, dividend payout and firm size is

having significant effects on corporate governance, and corporate governance is

having significant effects on firm performance. Managerial ability also plays a

significant part in corporate investment because they require a long-time

horizon and large cash flow amount. The study conducted by Chemmanur, Imants,

and Karen (2009) proves that able managers have the capacity to identify high

NPV projects which in term increase the investment volume.

The findings of the moderating variable show that corporate governance is having positive and significant effects between independent variables and dependent variables. The researchers Pinkowita, Opler, Williamson and Stulz (199) conducted research studies and found out the repercussions and determinants of the share of assets allocated to cash in 3600 listed non-financial firms from 1952 to 1994. These studies find out smaller firms assign greater ratio of assets to cash. They also state that those firms which invest more in research and development also assign a greater portion of the asset to cash inconsistency with research and development intensive sector which needs a higher ratio of cash for the purpose of acquisition. They also find that firms with unstable cash flow assign a greater portion of assets to cash as defensive demand for liquid assets.

Conclusion

Managers have a very key and significant role in the corporate decisions of an organization and firm performance. In modern times, the astute managers with strong technical and interpersonal skills can be helpful in achieving higher income, profit, value-creating investments and organizational success. The outcomes of the research contended that the managerial ability is having momentous effects on firm performance and investment opportunities.

Managers with superior abilities are able to recognize the ongoing trend of industry, foresee the demand of the product precisely and invest in such a venture that creates high value, therefore correlate themselves with a better investment opportunity. This study considered managerial ability as the major and fundamental tool to get a higher level of performance. The managerial abilities involve the accurate and timely corporate decisions which are important for the profitability, and it can be helpful in getting higher firm value when the managers are working for the best interest of shareholders.

The outcomes of the research study argued that the superior managers have the abilities to manage and control the divined payment decisions, investment decisions, capital structure and other important corporate decisions. This statement supports a significant role in enhancing firm performance and firm value. The current study shows the positive and significant relationship between managerial ability and firm performance. The findings of the study contended that the educational background, personality traits, working experiences of the managers are the significant characteristics which are helpful in taking correct and timely decisions for value maximization of the firm while such characteristics determine the superior managerial skills.

Cash holdings with the firm are the important decision that is taken by the managers or board of directors. The retaining of cash with the firm is an important task which can be helpful in completing the short-term liabilities and also the important factors for making decisions for future investment projects. The outcomes of the research revealed that cash holdings are having substantial effects on the firm performance and firm value in the non-financial sector of Pakistan. The excess amount of cash and other securities give the firm more and extra amount or slack finances, which enables the firm to operate without a costly external source of funding. This argument is basically the extension of Pecking order theory, which postulates that firm should prefer the internal sources as compared to costly external sources.

The findings of the current study pertaining to cash holdings argued that the non-financial sector of Pakistan is in favour of higher level of cash holdings due to the fact to meet their short-term obligations and also can be useful in getting profit for the firm as well.

As the dividend payout is the indicator of a firm’s earnings, therefore it holds greater importance as this decision is having an impact on the firm’s performance both in short-run and long run. The shareholders are directly affected by such decisions. The investors are always interested in getting dividend and discourage the retain cash holdings, while the firm is always interested in getting a higher ratio of cash to take future investment decisions. The theoretical argument for the significant effects of cash holdings is an important tool which can be helpful in suggesting the supportive theory. The agency cost theory states that dividend policy of a firm is dependent on agency cost, which arises from the deviation between the managers and owners. Firms paying high dividend payouts have the tendency of high future earnings and having low previous earning growth, but the market observers have a controversial view about the phenomenon. The dividend is defined as the distribution of the earning among the shareholders of the company at the rate mentioned by the financial manager of the firm. The findings of the study also revealed that corporate governance is having a significant moderating role with the managerial ability, cash holdings and dividend payout in the firm performance and investment opportunities. Corporate governance is an important factor that is adopted by managers to control the overall firm. Majority of the studies have evaluated the direct impact of corporate governance, but fewer studies have been undertaken to test the moderating role of corporate governance. Lastly, the findings of the study argued that corporate governance could be found as a better source of information disclosure by taking the appropriate decisions by managers of the firm.

The study argued that managerial ability has a positive and significant role in investment opportunities. The capable management has the capacity to grab the opportunities of the market and convert it into a positive investment opportunity. The suboptimal and inferior investments are harmful to shareholders’ welfare and wealth as it wastes the crucial funds but also have a negative effect in the long run. The superior investment decisions also lead to unforeseen results.

Practical Implications

Past literature on managerial ability suggests that lack of sound managerial

competencies is the primary cause of the lower performance in most of the firms in developing countries (Andreou, ?2013). The Managerial capabilities serve as a yardstick for associating actual and desired performance. Managerial efficiency contributes significantly for achieving the organizational mission, objectives and goals. The firm performance is linked with various management characteristics and other success indicators. This research focused on managerial competencies that are necessary for firm growth enabling management capacity to adopt, adapt, and exploit new technology and business practices that improve firm performance within the economic context of Pakistan. Majority of the previous studies regarding the managerial abilities were measured by questionnaire method or interview schedule (Andreou et al., 2013 and Saeid, 2016). The study conducted by Lee et al., (2018), highlighted the gap that the managerial ability should be evaluated by quantitative variable so that the measurement can evaluate the financial position of the firm. Another point which is forwarded by the study that maximum studies estimated the investment of the firm but this study argued that the managerial ability which is the asset of the firm could be related with the investment opportunities of the firm. The findings of the current study determined how managerial ability can contribute to superior firm performance. The earlier research studies show the indication of direct association within the quality of management and initial public offerings (IPO) performance (Chemanur and Paeglis, 2005).

The study provides a significant contribution to developing a conceptual description of managerial ability from a quantitative aspect in the developing market.

The study is significant for the academicians due to the fact as it will measure the managerial ability by quantitative variables, the findings of which added a suitable portion of literature in the field of corporate finance. Particularly the study adopted quantitative methodology for the investment opportunity, which is a reasonable addition in the methodological literature. The results of the study evaluated through the perspective of Agency theory, which states that a firm performance has significantly improved when the goals and objectives of principal and agents are aligned. The study contributes towards the measurement of managerial ability and investment opportunity for Pakistani firms on a newly adopted measure that is the data envelopment analysis (DEA) measuring the efficiency of the manager and investment opportunities by Total Q proposed by Peter and Taylor (2017) considering managerial skills as intangible assets of the firm. The findings of the study are helpful for the management of secondary market and also for the regulatory authorities.

The findings of the study are significant for the investors due to the fact that the real picture of the market is given in terms of different recommendations in the present scenario. The study is significant for the Security and Exchange Commission of Pakistan as the study provides the justification of the findings and relationship of the variables from the different parts of both developed and developing markets.

References

- Almeida, H., Campello, M., & Weisbach, M. S. (2004). The cash flow sensitivity of cash. The Journal of Finance, 59(4), 1777-1804.

- Altman, E. I. (1968). Financial ratios, discriminant analysis and the prediction of corporate bankruptcy. The journal of finance, 23(4), 589-609.

- Bamber, L. S., Jiang, J., & Wang, I. Y. (2010). What's my style? The influence of top managers on voluntary corporate financial disclosure. The accounting review, 85(4), 1131-1162.

- Bens, D. A., Goodman, T. H., &Neamtiu, M. (2012). Does investment-related pressure lead to misreporting? An analysis of reporting following M&A transactions. The Accounting Review, 87(3), 839-865

- Brennan, M. J. 2003. Corporate investment policy. Handbook of the Economics of Finance 1: 167-214.

- Cartwright, S., & Schoenberg, R. (2006). Thirty years of mergers and acquisitions research: Recent advances and future opportunities. British journal of management, 17(S1), S1-S5

- Chang, Y. Y., Dasgupta, S., & Hilary, G. (2010). CEO ability, pay, and firm performance. Management Science, 56(10), 1633-1652.

- Chaplinsky S., M. Schill, and P. Doherty. 2006. Methods of valuation for mergers and acquisitions, Darden Graduate School of Business Note #UVA-F-1274, University of Virginia.

- Datta, S., M. Iskandar-Datta, and K. Raman. 2001. Executive Compensation and Corporate Acquisition Decisions. Journal of Finance 56 (6): 2299-2336.

- Demerjian, P., B. Lev, M. F. Lewis, and S. McVay. 2013. Managerial Ability and Earnings Quality. The Accounting Review 88 (2): 463-498.

- Denis, D. J., &Sibilkov, V. (2009). Financial constraints, investment, and the value of cash holdings. The Review of Financial Studies, 23(1), 247-269.

- Dittmar, A., &Mahrt-Smith, J. (2007). Corporate governance and the value of cash holdings. Journal of financial economics, 83(3), 599-634.

- Dong, M., Hirshleifer, D., Richardson, S., &Teoh, S. H. (2006). Does investor misvaluation drive the takeover market? The Journal of Finance, 61(2), 725- 762.

- Fama, E. F., & French, K. R. (1993). Common risk factors in the returns on stocks and bonds. Journal of financial economics, 33(1), 3-56.

- Fazzari, S. M., Hubbard, R. G., Petersen, B. C., Blinder, A. S., & James, M. (1988). Financing Corporate Constraints Investment. Brookings Papers on Economic Activity, 1(1), 141-206.

- Francis, J., Huang, A. H., Rajgopal, S., &Zang, A. Y. (2008). CEO reputation and earnings quality. Contemporary Accounting Research, 25(1), 109-147.

- Fuller, K., Netter, J., &Stegemoller, M. (2002). What do returns to acquiring firms tell us? Evidence from firms that make many acquisitions. The Journal of Finance, 57(4), 1763-1793.

- Ghosh, A. 2001. Does Operating Performance Really Improve Following Corporate Acquisitions? Journal of Corporate Finance 7: 151-178.

- Goodman, T. H., Neamtiu, M., Shroff, N., & White, H. D. (2013). Management forecast quality and capital investment decisions. The Accounting Review, 89(1), 331- 365.

- Grinstein, Y., & Michaely, R. (2005). Institutional holdings and payout policy. The Journal of Finance, 60(3), 1389-1426.

- Harford, J., & Li, K. (2007). Decoupling CEO wealth and firm performance: The case of acquiring CEOs. The Journal of Finance, 62(2), 917-949.

- Hayes, R. M., & Schaefer, S. (1999). How much are differences in managerial ability worth? Journal of Accounting and Economics, 27(2), 125-148.

- Healy, P. M., Palepu, K. G., &Ruback, R. S. (1992). Does corporate performance improve after mergers? Journal of financial economics, 31(2), 135-175.

- Holmstrom, B., & Costa, J. R. I. (1986). Managerial incentives and capital management. The Quarterly Journal of Economics, 101(4), 835-860

- Jensen, M. C., & Meckling, W. H. (1976). Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of financial economics, 3(4), 305- 360.

- Jensen, M. C., &Ruback, R. S. (1983). The market for corporate control: The scientific evidence. Journal of Financial economics, 11(1-4), 5-50.

- Kaplan, S. N., &Weisbach, M. S. (1992). The success of acquisitions: Evidence from divestitures. The Journal of Finance, 47(1), 107-138.

- Lang, L. H., Stulz, R., &Walkling, R. A. (1991). A test of the free cash flow hypothesis: The case of bidder returns. Journal of Financial Economics, 29(2), 315-335.

- Lee, S., Matsunaga, S. R., & Park, C. W. (2012). Management forecast accuracy and CEO turnover. The Accounting Review, 87(6), 2095-2122.

- Lehn, K. M., & Zhao, M. (2006). CEO turnover after acquisitions: are bad bidders fired? The Journal of Finance, 61(4), 1759-1811.

- Liu, Y., & Mauer, D. C. (2011). Corporate cash holdings and CEO compensation incentives. Journal of financial economics, 102(1), 183-198.

- Malmendier, U., & Tate, G. (2005). CEO overconfidence and corporate investment. The journal of finance, 60(6), 2661-2700.

- Malmendier, U., & Tate, G. (2008). Who makes acquisitions? CEO overconfidence and the market's reaction. Journal of financial Economics, 89(1), 20-43.

- Pinkowitz, L. F. and R. Williamson. 2004. What is a Dollar Worth? The Market Value of Cash Holdings. Working Paper. Georgetown University

- Richardson, S. (2006). Over-investment of free cash flow. Review of accounting studies, 11(2-3), 159-189.

- Rosen, R. J. (2006). Merger momentum and investor sentiment: The stock market reaction to merger announcements. The Journal of Business, 79(2), 987-1017.

- Shleifer, A., &Vishny, R. W. (1989). Management entrenchment: The case of managerspecific investments. Journal of financial economics, 25(1), 123-139.

- Shroff, N., 2013. Corporate Investment and Changes in GAAP. MIT Sloan Research Paper No. 4972-12.

- Stein, J. C. (2003). Agency, information and corporate investment. In Handbook of the Economics of Finance (Vol. 1, pp. 111-165). Elsevier.

- Tobin, J. (1978). Monetary policies and the economy: the transmission mechanism. Southern economic journal, 421-431.

- Travlos, N. G. 1987. Corporate takeover bids, method of payment, and bidding firms' stock returns. Journal of Finance 42 (4): 943-963.

- Trueman, B. (1986). Why do managers voluntarily release earnings forecasts? Journal of accounting and economics, 8(1), 53-71.

- Wessels, R., & Titman, S. (1988). The determinants of capital structure choice. Journal of Finance, 43(1), 1-19.

- Weston, J. F. and S. G. Weaver. 2001. Mergers and Acquisitions. McGraw-Hill. New York.

Cite this article

-

APA : Nawaz, K., Jan, F. A., & Shah, S. K. (2020). The Role of Managerial Ability in Firm Investment Opportunities and Performance of Non-Financial Firms: A Moderating Role of Corporate Governance. Global Economics Review, V(I), 309-324. https://doi.org/10.31703/ger.2020(V-I).26

-

CHICAGO : Nawaz, Kamran, Farzand Ali Jan, and Syed Kashif Shah. 2020. "The Role of Managerial Ability in Firm Investment Opportunities and Performance of Non-Financial Firms: A Moderating Role of Corporate Governance." Global Economics Review, V (I): 309-324 doi: 10.31703/ger.2020(V-I).26

-

HARVARD : NAWAZ, K., JAN, F. A. & SHAH, S. K. 2020. The Role of Managerial Ability in Firm Investment Opportunities and Performance of Non-Financial Firms: A Moderating Role of Corporate Governance. Global Economics Review, V, 309-324.

-

MHRA : Nawaz, Kamran, Farzand Ali Jan, and Syed Kashif Shah. 2020. "The Role of Managerial Ability in Firm Investment Opportunities and Performance of Non-Financial Firms: A Moderating Role of Corporate Governance." Global Economics Review, V: 309-324

-

MLA : Nawaz, Kamran, Farzand Ali Jan, and Syed Kashif Shah. "The Role of Managerial Ability in Firm Investment Opportunities and Performance of Non-Financial Firms: A Moderating Role of Corporate Governance." Global Economics Review, V.I (2020): 309-324 Print.

-

OXFORD : Nawaz, Kamran, Jan, Farzand Ali, and Shah, Syed Kashif (2020), "The Role of Managerial Ability in Firm Investment Opportunities and Performance of Non-Financial Firms: A Moderating Role of Corporate Governance", Global Economics Review, V (I), 309-324

-

TURABIAN : Nawaz, Kamran, Farzand Ali Jan, and Syed Kashif Shah. "The Role of Managerial Ability in Firm Investment Opportunities and Performance of Non-Financial Firms: A Moderating Role of Corporate Governance." Global Economics Review V, no. I (2020): 309-324. https://doi.org/10.31703/ger.2020(V-I).26