Abstract:

The foreign exchange rate fluctuations do create an impact on stock returns, which has been investigated for non-financial listed Pakistani firms. The real effective exchange rate has been used as the true measure of foreign exchange exposure. The modelled econometric equation includes; firm size, firm liquidity, money supply and inflation as predictors of stock returns. Twenty-five non-financial listed firms have been evaluated for the study period 2004 to 2013, which signifies the military regime era proceeded by peoples party rule in Pakistan. Financial data analysis, including; ADF unit root and Johansen Co-integration tests, have been applied to evaluate financial data, which further led to correlation, descriptive stats and panel data regression analysis. The results have suggested a very weak relationship between stock returns and foreign exchange exposure. Therefore, sample non-financial listed firms have not been foreign exchange exposed; however, firm size, liquidity, money supply and inflation rates have definitely created an impact on stock returns

Key Words:

REER, Stock Returns, Firm Size, Liquidity, Money Supply, Inflation Rate

Introduction

Factually, according to the literature on the subject, that explain movements of exchange rates creating higher volatility that lead to economic uncertainty because these fluctuations not properly analyzed and managed have a noteworthy impact on the firm value and cash flow stability. These fluctuations do alter competition for multinational firms that are engaged in international business ventures and remit earnings back to their home country in case of changes in hone currency value with respect of host countries over short intervals of time. These fluctuations normally lead to higher conversion costs associated with exchange rate movements which in turn affect stock returns. Ultimately expected cash inflows to the firm in the home country gets squeezed and resultantly depletes earnings. Therefore, the Exchange rate is a crucial variable that influences the performance of firms in the age of international competitiveness.

It is well understood that the foreign exchange exposure discussed by Adler and Dumas (1984) highlighting the relationship between the excess returns and exchange rate fluctuations and identified the risk management of large exposures as expensive measures that need to be taken in situations where funds could be allocated internationally to cover hedging or risk management costs. In this study, we are concerned with the transactional foreign exchange exposure representing real risk faced by the listed sample firms during cash flow transactions across borders. The transaction exposure is more related to the exchange rate exposure, which arises when firms focus on their foreign risk management as according to Belk and Edelshain (1997). Consequently, according to the literature, exchange rate fluctuations have a significant impact on cash flows through economic or transaction exposures. Transaction exposure has been defined as “the impact of exchange rate on the cash flow of identifiable and specific transactions dominated by foreign currencies”. Since its time and dimensions are short, so exchange rates fluctuations can have an impact only at the time when the transaction is contracted and settled. In most cases, the exposure can be hedged because certainty does not exist in transactions. This scenario could be elaborated as such that a firm contracted to sell its products abroad, and the payment will be in the foreign currency. The firm will try to hedge the exchange rate risk which arises due to fluctuations in home and foreign currency. In such a situation, the firm could be engaged in a contract which can be a forward contract to hedge the exchange rate risk. Forward rate and spot rates are normally used in these situations to secure the trade. The overall argument supports the idea that transaction exposure can be effectively hedged through derivative instruments.

Contrary, Hagelin and Prambourg (2004) had defined transaction exposure as “the unexpected fluctuations in the exchange rates because the value of the future cash flows to change”. In this regard, reduction in the cash flows variability, cost related to financial distress, under-investment issues and taxes the firm value can be increased, and this only happens by hedging transaction exposure because it affects the firm value variability and the risk associated with poorly diversified manager’s shareholdings. Reasonably, connecting these facts, the foreign exchange exposures deal with the changes in the foreign exchange rates of corporations. Accordingly, Adler and Dumas (1984) supported the argument that the sensitivity of firm value in home currency with respect to foreign exchange rates changes represents the economic foreign exchange rate exposure.

Subsequently, in this study, we have investigated the impact of real effective exchange rates on the stock returns of randomly selected non-financial listed firms operating in Pakistan. And further investigated the impact of effective exchange rates along with other literature suggested variables including; firm liquidity, firm size, money supply and inflation rate. Therefore, the research question answered in this research study is; what is the impact of real effective exchange rates, firm liquidity, firm size, money supply and inflation on stock returns as an econometric model representing non-financial listed firms operating in Pakistan?

The major findings of the study revealed that there is very weak or no relation between the sample firm’s return and foreign exchange. Hence, these firms are least exposed to foreign exchange movements. Similarly, empirical evidence has endorsed that money supply and inflation rate do not affect stock returns. This research study is beneficial and valuable for the policymakers and stock investors to take necessary information relating to the real effective exchange rate (REER), money supply and inflation rate before selecting and targeting stocks for inclusion in the portfolio of investments. This paper is arranged in a sequence where the introduction is proceeded by the literature review of essential and recommended variables of the Study; further hypotheses of the Study have been formulated for empirical analysis. The methodology utilized in the study has been explained and further deployed to test the econometric modelled equation in order to generate study results which have been discussed and concluded at the end.

Literature Review

Literature review encompasses review of studies relating to real effective exchange rates, firm liquidity, firm size, money supply, inflation rate and stock returns.

The foreign exchange market of Pakistan is smalls than the other foreign exchange market in emerging economies. Since 1949, foreign exchange policy as part of monitory policy went through several changes in Pakistan, which was pegged to pound till September 1971 and to U.S dollar. Later from January 1982, the regime of exchange rate followed managed float system, and the exchange rate was pegged with a basket of currencies. In 1991, financial reforms were initiated, and a free float system is introduced, which was further implemented during 2000-2001 and currently, the dollar is used as a reserve currency in Pakistan. Furthermore, the nominal value of the Pakistani rupee went through several changes where in September 1949, the current account deficit reached 2.5 per cent of GDP; still, the rupee was not devalued by the Government while other 48 currencies were devalued in the sterling area. However, after the Korean War Pakistani rupee was first time devalued in July 1955. In 1956 and1957, the Governor of the State Bank of Pakistan declared inflation and balance of payments as variables of concern for the economy. A similar pattern had been in these variables were experienced later, and in 1955 the exchange rate was fixed at Pak Rupees 4.76 per US dollar, but due to export bonus schemes and other factors, the rupee was further depreciated to 7.76 for export in 1971 and Pak Rupees 11 per dollar in 1972.

However, the issue of the overvaluation of the real effective exchange rates emerged but later in the year 1973 rupee was further devalued to 56.73% and made exports more competitive in the international market. In this situation, Pakistan got aid from the donor agencies, which adjusted the current account deficit and held back the economy. Consequently, the support funds from International Monetary Fund was used only to support the current account deficit, and this was not translated into the foreign exchange market activities. Conversely, the inflows in Pakistan’s foreign exchange markets were due to FDI, remittances and export proceeds. This trend continues until, in 1991, financial reforms had started, and foreign account holders were allowed to send money abroad without any restrictions. On behalf of investors, special convertible accounts were maintained by the banks to send amounts in or out as capital market investments. The transition of power from a military regime to general elections in the year 2008 was the volatile period for the foreign exchange market as it experienced foreign assets reduced to PKR 375 billion and parallel to its depletion of bank deposits were reported. Thus further, Pak Rupee has depreciated 18 per cent, which was again supported by the IMF aid. These arrangements were for the short term to support the economy until the time recession in over and prices were stabilized. In June 2008, the foreign exchange market had improved, and consequently, the USD reserves increased. Subsequently, the State Bank of Pakistan had implemented a foreign exchange exposure limit as another corrective measure that made the market’s range of paid-up capital of banks relaxed from 10 to 20 per cent and made the foreign exchange market arrange it in a widespread.

The constraints involved in Pakistan’s foreign exchange market can be managed with the initiatives taken by the State Bank of Pakistan in coordination with market players in the aftermath of the 40 per cent devaluation of the Pakistan rupee in the year 2019. However, devaluation and rising current account deficit is not the solution for Pakistan. Therefore, in order to address this problem, long-term policies need to be implemented that encourage cash flow generation within the (CPEC) This is the solution to all these problems faced so far by Pakistan, and considerable sincere efforts are required in this direction.

Review of Studies relating Foreign Exchange Exposure and Firm Related Foreign Exchange Exposures

Flood and Lessard (1986) explained the differences between contractual and operating foreign exchange exposure and recommended that multinational enterprises should form a competitive standing to respond to exchange rate fluctuations that could be hedged through forwards and contractual positions in debt capital which might be imperfect. But, Choi and Elyasiani (1997) employed exchange rate risk betas of fifty-nine U.S. commercial banks and interest rates during 1975-92 and reported that the sensitivity of interest rates and exchange rate risks affecting the U.S bank stock returns were significant for all stocks of the bank. However, interest rate risk was negative and significant for exchange rate risk. The Study of Choi, Hiraki and Takezawa (1998) had investigated Japanese stock market pricing of exchange rate risk and found that risk associated with the exchange rates were priced in both weak and strong Yen. Similarly, Kodongo and Ojah (2011) investigated the combined occurrence of equity market segmentation and unconditional currency risk in major stock markets of Africa by employing multifactor asset pricing theory and reported that stock markets of Africa are partially segmented. Likewise, Al-Shboul (2014) confirmed that in the Canadian stock market, exchange rate risk was priced and its pricing was time-varying, and the long-run relationship between term structure, herd behaviour, interest rates as well as exchange rate risk was present.

Precisely, the firm’s foreign exchange exposure is defined as “the sensitivity of its economic value to exchange rate changes” (Hekman, 1983). Measurement of exchange rate exposure has been under continuous debate for more than four decades. However, after 1973, the exchange rates movements and their direct effect on firms’ value was the prominent debatable issue of great concern for economists and managers performing around the globe. At the same time, the empirical investigation related to a firm’s exchange rate exposure has been initiated recently. Particularly, Adler and Dumas (1984) had investigated the interest of stakeholders and suggested that exposure as statistical quantity is the exposure measurement in terms of “the elasticity between exchange rate and firm value fluctuations”. The beta which was generated after running the regression on rates of return was called the elasticity of stock price. Accordingly, Bodnar (2000) regressed stock returns on exchange rate fluctuations and reported the results relating to exposure elasticities showing the significant impact of the structure of the empirical model representing estimates of strong exchange rate exposure on stock returns. Multiple other studies, including; Shapiro (1975); Heckman (1985); Miller and Reuer (1998); Marston (2001); Hagelin (2004); Parlapiano, Alexeev and Dungey (2015); Zivkov, Kuzman and Andrejevic-Panic (2020) had emphasized on all companies directly or indirectly concerning foreign exchange exposures because of their cash flows and explained the risk that had arisen due to transaction exposure resulting short term implications that could be hedged by futures or forward contracts. Alternatively, studies by Jorion (1991), Bodnar and Gentry (1993) and Amihud (1994) recommended that companies do not have exchange rate exposure. Moreover, studies of Bartov and Bodnar (1994), El-Masry (2006), Hutson and Stevenson (2010) had reported marginal exchange rate exposures effect on the company's stock returns. However, Bartram and Bodnar (2012) investigated non-financial firms and suggested that stock returns relation with the exchange rate exposure was conditional; however, the return impact was significantly linked with the sign and size of change in exchange rates, the source of time variation in currency return due to fluctuations. Licandro and Mello (2019) further endorsed that the association between stock returns and exchange rate exposure was although validated by the cash flow effect. In these cases, exchange rate fluctuation affected cash flows of the companies in international business and the stock returns of the U.S., Japan and Germany varied by fluctuations in exchange rates due to macroeconomic factors and fluctuations in real terms of trade. They were further supported by Nandha (2013), who investigated the risk-return characteristics of Chinese shares and explained that the foreign investors got benefit from changes in exchange rates but benefited when the appreciation of Yuan is offset by the extra volatility of returns

Stock Returns as Dependent Variable of the Study

Real Effective Exchange Rate (REER), Firm Liquidity, Firm Size, Money supply and Inflation Rate as Independent Variables of the Study

The exchange rates and stock prices relationship had been explained by Abdalla and Murinde (1997) by employing monthly real effective exchange rates and international IFC stock price index and reported that the exchange rates had directional causality running into stock prices for the sample countries. Whereas Muhammad, Rasheed, and Husain (2002) investigated the long-run as well as the short-run association between the exchange rates and the stock prices and suggested that neither long run nor short-run relation for Pakistan and India existed for the exchange rates and stock prices. However, Liang (2013) revisited the relationship between the stock market and exchange rate market in ASEAN and reported that the exchange rate affected stock prices negatively through capital mobility. The Real effective exchange rate had been supported by Andreou, Matsi and Savvides (2013), who had reported bi-directional spillover between the stock and exchange markets. The Study of Ghosh and Reitz (2013) had investigated the relationship between exchange rates in India (i.e., real effective exchange rates) and capital flows and found a positive relationship between real effective exchange rates and net outstanding equity investment in India, further supported by (Lee, 2017; Khomo and Aziakpono, 2020). Further, results relating to co-integration analysis suggested that the real effective exchange rates had a long-run relationship with outstanding net equity investment, and in the short-run rupees, real exchange rates relating to the capital inflow had been increased considerably.

Firm Liquidity

The Study of Amihud and Mendelson (1986) and Pastor and Stambaug (2003) suggested a positive relationship between liquidity and stock returns across companies. They had investigated the effect of bid and ask spread of stocks on their returns and found a 50 per cent increase in assets value was found due to an increase in the liquidity of assets. However, it was suggested that liquidity could explain the cross-sectional difference of the stock returns in the United States stock markets. It was also suggested that the supply response of firms could better be considered by modelling the return spread relationship more comprehensively. Consequently, Neumann (2003) and; Roll, Schwartz, and Subrahmanyam (2010) had investigated the liquidity effect on the price spreads between dual-class of shares and found that different cross-sectional models that measured the corporate control had not contributed any explanation relating to price premium.

Firm Size

Earlier studies of Chue and Cook (2008); Choi and Jiang (2009); Hutson and Stevenson (2010); Aggarwal and Harper (2010) had initially reported that the firms’ exposure to foreign exchange movements were largely due to the firm-specific characteristics, including; size, value, growth prospects available in the market and the expected financial distress. However, Williamson et al. (2002) had reinvestigated the value of a firm with respect to the economic importance and nature of exchange rates and reported that firm size determines the exposure and its proxies the level of a firm’s foreign activity. Additionally, Bodnar and Wong (2000) had conducted a survey about the firm and industry-specific characteristics and found that the firms that had hedged their exposure regularly were generally hedging just a small portion of the firm’s total foreign exchange exposures. In this regard,

Money Supply

The role of the money supply was elaborated by Rogalski and Vinso (1977), further by Urich and Wachtel (1981) as well as Mukherjee and Naka (1995) had suggested a positive relationship of the stock returns with the money supply. In view of Chaudhuri and Smile (2006), who had explained three ways by which money supply affects share prices. First, the money supply is negatively related to sharing prices, as future inflation uncertainty and unexpected increase in the inflation rate affects the money supply. Second, as money supply affect economic activity, it had affected the share prices positively. Finally, the portfolio shift from non-interest-bearing money to equities, including financial assets, supported the portfolio theory, which suggested a positive relationship between money supply and share prices. However, the Study of Andreas and Peter (2009) supported the idea of the money supply as its positive relation with US stock prices and found a significant positive relationship between them. Furthermore, the Study by Gupta and Modise (2011) was focused on investigating the prediction power of stock returns by applying monthly data and dividing it into two sub-periods and suggested that for out of sample forecast, money supply and interest rates expressed short-run prediction, for, in sample forecast world oil production growth, money supply and interest rates had short-run prediction power while for out of sample only inflation rate shows a strong power of prediction.

Inflation Rate

The inflation rate is another macroeconomic variable that evidently affects stock returns was the change in the consumer price index. This stock return and inflation rate relationship was controversial. However, previous studies have explained that the inflation rate may have a positive or a negative association with the stock returns in a financial market. Therefore, the Study of Barrows and Naka (1994) suggested that fewer fluctuations of stock returns were reported in connection to the inflation rate. But, earlier, Chen-Chia et al. (2013) reported that the inflation rate had a negative impact on the stock returns. This argument had been explained by; “if expected price level increases then the central bank interventions will negatively affect the stock returns be a phenomenon termed as interest rate effect”.

The Study of Albaity and Ahmad (2011) had investigated the impact of monetary variables, including the interest rate and the stock market index, an inflation hedge and reported negative relation between stock returns and inflation rate. Consequently, earlier studies used a single proxy for exchange rate fluctuations, such as; Booth and Rotenberg (1990) examined the movements or changes in the Canadian dollar with respect to the U.S dollar and did not consider the other foreign currencies while these currencies could affect the returns of Canadian company stocks. Jorion (1991); Bodnar (1993); And Amihud and Levich (1994) employed real exchange rates. Furthermore, previous empirical researches in economic exposure and exchange rate movements focused on industry or portfolios instead of a firm. Therefore, in this study firms, 25 non-financial listed firms have been evaluated for the study period 2004 to 2013.

Research Hypothesis

H_(1.0)^?: Real effective exchange rate and stock returns are negatively associated.

H_(1.1): Real effective exchange rate and stock returns are positively associated.

H_(2.0)^?: Firm liquidity and stock returns are negatively associated.

H_(2.1): Firm liquidity and stock returns are positively associated.

H_(3.0)^?: Firm size and stock returns are negatively associated.

H_(3.1): Firm size and stock returns are positively associated.

H_(4.0)^?: Money supply and stock returns are negatively associated.

H_(4.1): Money supply and stock returns are positively associated.

H_(5.0)^?: Inflation rate and stock returns are negatively associated.

H_(5.1): Inflation rate and stock returns are positively associated.

Methodology

The daily data of stocks has been extracted from the business recorder and converted into monthly data by taking monthly averages. Therefore, the data employed in this study involves 108 values of each stock (9years = 108 months). The foreign exchange data is also taken monthly. The population of this study is comprised of all non-financial firms listed at the Pakistan stock exchange (PSX), Pakistan. Only securities of those non-financial listed firms have been selected, which have traded frequently. Therefore, 25 non-financial listed firms have been selected for the study period 2004 to 2013, which represented the military regime and further led by the democratic era of government formed by the Peoples Party in Pakistan. Moreover, the stock trading period starting from 2004 to 2013 has been selected based on the availability of the financial data. E-views software has been used to apply stats relating to the stationary test (ADF unit-root), descriptive statistics, correlation, Johansen co-integration and panel data analysis.

The daily data of stocks has been extracted from the business recorder and converted into monthly data by taking monthly averages. Therefore, the data employed in this study involves 108 values of eac

Stock Returns is the dependent variable of the Study. The formula used to measure stock returns is as follows:

(?Return?_i=logp_t-p_(t-1)).

Independent Variables

Foreign exchange measured as Real Effective Exchange Rate (REER), Firm Liquidity which has been estimated by using the measures, i.e., trading activity, price impact and transaction cost measures. The liquidity formula used in this study is as follows:

?LIQ?_imy=1/D_imy ?_(d=1)^(D_imy) ?LIQ?_idmy

Firm Size has been estimated through the market capitalization of the firms. Money Supply (M2) has been extracted from the monetary aggregates available at the State Bank of Pakistan. The Inflation Rate is the historical rate that has been extracted from the official website of the State Bank of Pakistan.

Mathematical Equation/Model of the Study

The estimation of currency risk exposures

which have been explained by Dumas (1978), further by Adler and Dumas (1984) as well as by Hodder (1982) in a statement that is, “the effect of unanticipated exchange rate fluctuations on firm value”, the work of Jorion (1990) has been benchmarked in this Study represented as the equation (1) which is a two-factor model (used as a base model) where stock returns have been taken as the dependent variable, and percentage changes in the exchange rate as the explanatory variable, as shown below:

R_it= ?_i0+?_im R_mt+?_ix R_xt+?_it Eq (1)

The extensive literature review has revealed multiple variables from a vast array of models, which are equally important as the exchange rates whenever stock returns are estimated for variability. Therefore, under the assumption of model fit, the following research models have been formulated and tested;

Econometric Model of the Study

R_it= ?_0+?_1 REER+?_2 ?FL?_i+ ?_3 ?FSIZE?_i+?_4 ?MS?_i+?_5 ?INF?_i+ ?_(it ) Eq (2)

The Symbols represented in the above equation (4) have the following meaning;

?_0 = It is the model’s constant.

R_it = It is the return of stock I of the firm at time t.

REER =It is a Nominal Effective Exchange Rate.

?FSIZE?_it = It is the firm’s market capitalization of stock I at time t.

MS = It represents money supply further measured by M2.

INF = It represents the inflation rate.

?FL?_it = It is the liquidity of stock i.

Results and Discussion

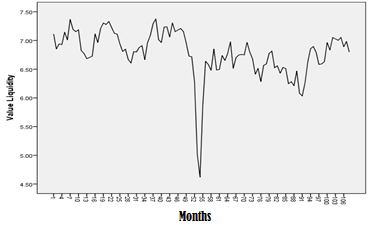

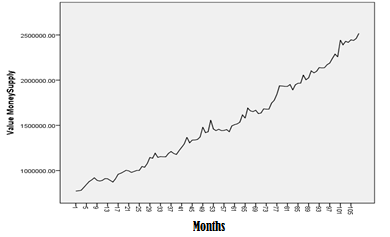

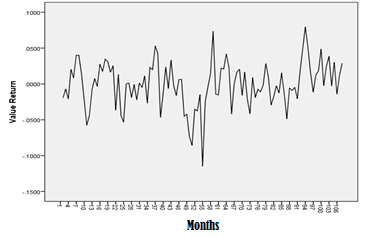

The graphical depiction of the financial

data relating to the variables of the Study has been shown below for a closer look to understand the pattern and trend relating fluctuations and movement of variables over 180 months study interval.

Unit Root Test Table 1. Results of Econometric Modeled Equation 2

|

Null

Hypothesis = REER, Firm Liquidity, Firm Size, Money Supply, Inflation Rate

And, Stock Returns has a unit root Exogenous

= Constant Lag Length

= 0 (Automatic and based on the SIC, max lag value = 12) |

|||||

|

|

t-Statistic |

Prob.* |

|||

|

Augmented Dickey-Fuller test statistic (REER) |

-8.596514 |

0.0000 |

|||

|

Test critical values |

1% level |

-3.493129 |

|

||

|

5% level |

-2.888932 |

||||

|

10% level |

-2.581453 |

||||

|

ADF (Firm Liquidity) |

-8.500774 |

0.0000 |

|||

|

Values |

At 1% |

-3.493747 |

|

||

|

At 5% |

-2.889200 |

||||

|

At 10% |

-2.581596 |

||||

|

ADF (Firm Size) |

-7.849982 |

0.0000 |

|||

|

|

At 1% |

-3.493129 |

|

||

|

At 5% |

-2.888932 |

||||

|

At 10% |

-2.581453 |

||||

|

ADF (Money Supply) |

-13.17534 |

0.0000 |

|||

|

Values |

At 1% |

-3.493129 |

|

||

|

At 5% |

-2.888932 |

||||

|

At 10% |

-2.581453 |

||||

|

ADF (Inflation Rate) |

-8.890153 |

0.0000 |

|||

|

Values |

At 1% |

-3.493129 |

|

||

|

At 5% |

-2.888932 |

|

|||

|

At 10% |

-2.581453 |

|

|||

|

ADF (Stock Returns) |

-6.528051 |

0.0000 |

|||

|

Values |

At 1% |

-3.493129 |

|

||

|

At 5% |

-2.888932 |

||||

|

At 10% |

-2.581453 |

||||

*According

to MacKinnon (1996),

calculations of one-sided p-values

Table 1 shows the result of the ADF unit root for all the variables of the

Study. In the case of Real Effective Exchange Rate, computed ADF test

t-statistic value -8.56 is smaller than the critical values (i.e. -3.49, -2.88,

and -2.58 at 1%, 2% and 10% significance levels). Therefore, the null

hypothesis relating to REER is rejected, and the financial data of REER is

stationary. In the case of firm liquidity, the computed ADF test t-statistic

value -8.50 is smaller than the critical values (i.e. -3.49, -2.88, and -2.58

at 1%, 2% and 10% significance levels). Therefore, the null hypothesis relating

to firm liquidity is rejected, and the financial data of firm liquidity is

stationary. ADF unit root test for firm size resulted test t-statistic value of

-7.849 which is smaller than the critical values (i.e. -3.49, -2.88, and -2.58

at 1%, 2% and 10% significance levels). Therefore, financial data of firm size

is stationary. Similarly, ADF unit root for money supply has a t-statistic

value of -13.175, which is smaller than the critical values (i.e. -3.49, -2.88,

and -2.58 at 1%, 2% and 10% significance levels). Therefore, money supply

financial data is stationary. Additionally, ADF unit root test for inflation

rate has t-statistic value of -8.89 which is smaller than the critical values

(i.e. -3.49, -2.88, and -2.58 at 1%, 2% and 10% significance levels).

Therefore, the financial data of the inflation rate is stationary. Lastly, in

the case of ADF unit root for stock market returns with ADF test t-statistic

value of -8.56 is smaller than the critical values (i.e. -3.49, -2.88, and

-2.58 at 1%, 2% and 10% significance levels). Therefore, the financial data of

stock returns is also stationary.

Johansen Co-integration Test Results Table 2.

|

Series:

Stock Returns, REER, Liquidity, Money Supply, Firm Size, Inflation rate |

||||

|

First

differences relating to lags intervals are representing as 1 to 1 |

||||

|

Application

of Co-integration Rank Test - Unrestricted (Trace Stats) |

||||

|

Eigenvalue |

Trace Statistics |

Critical Value |

Prob.** |

|

|

None * |

0.633474 |

320.8650 |

95.7536 |

0.0000 |

|

At most 1 * |

0.521956 |

216.4816 |

69.8189 |

0.0000 |

|

At most 2 * |

0.476079 |

139.7240 |

47.8561 |

0.0000 |

|

At most 3 * |

0.325859 |

72.49699 |

29.7971 |

0.0000 |

|

At most 4 * |

0.251208 |

31.48808 |

15.4947 |

0.0001 |

|

At most 5 |

0.013385 |

1.401451 |

3.84147 |

0.2365 |

There

are 5 co-integration equations according to trace test at 5 per cent level.

* It shows the hypothesis has been rejected over a

5 per cent confidence level.

** It is the p values as per the MacKinnon-Haug-Michelis (1999).

Table 2 expresses the results of Johansen

Co-integration representing long term relationship between the variables (i.e.

Stock Returns, REER, Firm liquidity, firm size, money supply and inflation

rate). It is evident that at most 1 to 4 at the prob values less than 5 per

cent and the values of trace statistics are greater than the critical values,

i.e. at most 1 (216.4816 > 69.81889 ), at most 2

(139.7240 > 47.85613), at most 3 ( 72.49699 > 29.79707), at most 4

(31.48808 > 15.49471). These results suggest a long term relationship

between the variables of the econometric modelled equation 2 of the Study.

Johansen Co-integration Test Results Table 2.

|

Series:

Stock Returns, REER, Liquidity, Money Supply, Firm Size, Inflation rate |

||||

|

First

differences relating to lags intervals are representing as 1 to 1 |

||||

|

Application

of Co-integration Rank Test - Unrestricted (Trace Stats) |

||||

|

Eigenvalue |

Trace Statistics |

Critical Value |

Prob.** |

|

|

None * |

0.633474 |

320.8650 |

95.7536 |

0.0000 |

|

At most 1 * |

0.521956 |

216.4816 |

69.8189 |

0.0000 |

|

At most 2 * |

0.476079 |

139.7240 |

47.8561 |

0.0000 |

|

At most 3 * |

0.325859 |

72.49699 |

29.7971 |

0.0000 |

|

At most 4 * |

0.251208 |

31.48808 |

15.4947 |

0.0001 |

|

At most 5 |

0.013385 |

1.401451 |

3.84147 |

0.2365 |

There

are 5 co-integration equations according to trace test at 5 per cent level.

* It shows the hypothesis has been rejected over a

5 per cent confidence level.

** It is the p values as per the MacKinnon-Haug-Michelis (1999).

Table 2 expresses the results of Johansen

Co-integration representing long term relationship between the variables (i.e.

Stock Returns, REER, Firm liquidity, firm size, money supply and inflation

rate). It is evident that at most 1 to 4 at the prob values less than 5 per

cent and the values of trace statistics are greater than the critical values,

i.e. at most 1 (216.4816 > 69.81889 ), at most 2

(139.7240 > 47.85613), at most 3 ( 72.49699 > 29.79707), at most 4

(31.48808 > 15.49471). These results suggest a long term relationship

between the variables of the econometric modelled equation 2 of the Study.

Descriptive Statistics Table 3.

|

|

N |

Mean |

Std. Deviation |

Skewness |

Kurtosis |

|

Stock Returns |

2675 |

-0.000466 |

0.0592841 |

-0.418 |

10.194 |

|

REER |

2700 |

2.007689 |

0.0160168 |

-0.371 |

-0.547 |

|

Liquidity |

2700 |

0.822122 |

0.0896044 |

-0.556 |

0.690 |

|

Firm Size |

2700 |

1.328356 |

0.0541484 |

-0.274 |

-0.076 |

|

Inflation Rate |

2700 |

1.025219 |

0.1540052 |

0.688 |

0.017 |

|

Money Supply |

2700 |

6.155300 |

0.1448000 |

-0.076 |

-1.138 |

|

Valid N (list-wise) |

2675 |

|

|

|

|

Table 3 reports the descriptive statistic of the

Study overall results have confirmed the normality of the financial data. The

mean values of independent variables (REER, firm liquidity, firm size, money

supply and inflation rate) are positive, while the dependent variable (stock

returns) is negative. The skewness and kurtosis show that the data is almost in

the normal range because skewness lies between -1 to +1 and kurtosis is less

than 3.

Correlation Table 4.

|

|

REER |

Liquidity |

Firm Size |

Inflation |

Money Supply |

Return |

|

REER |

1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Firm Liquidity |

-.107 |

1 |

|

|

|

|

|

.000 |

|

|

|

|

|

|

|

Firm Size |

.084 |

.143 |

1 |

|

|

|

|

.000 |

.000 |

|

|

|

|

|

|

Inflation Rate |

-.062 |

-.024 |

-.071 |

1 |

|

|

|

.001 |

.220 |

.000 |

|

|

|

|

|

Money Supply |

.438 |

-.046 |

.135 |

-.405 |

1 |

|

|

.000 |

.016 |

.000 |

.000 |

|

|

|

|

Stock Returns |

.033 |

.164 |

.630 |

-.050 |

.000 |

1 |

|

.091 |

.000 |

.000 |

.009 |

.983 |

|

Table 4 explain the correlation between the stock

return and five independent variables of the Study. Stock returns have

significant relation with all the independent variables except Real Effective

Exchange Rate and money supply. Firm size and money supply are positively

related to a dependent variable, that is, stock returns which show that if the

real effective exchange rate increases, then stock returns will also increase,

while negative relation exists between firm liquidity, inflation rates and stock

returns. Furthermore, the issue of multicollinearity has been declined because

all the correlation values are less than 0.9 (90 per cent).

Panel Regression for Research Model 3 Coefficients of Research Model 3 Table 5.

|

Model |

Unstandardized Coefficients |

Standardized Coefficients |

t |

Sig. |

|

|

B |

Std. Error |

Beta |

|||

|

REER |

-0.037 |

0.143 |

-0.004 |

-0.261 |

0.794 |

|

Firm Liquidity |

0.110 |

0.021 |

0.073 |

5.261 |

0.000 |

|

Firm Size |

0.483 |

0.218 |

0.508 |

34.396 |

0.000 |

|

Money Supply |

0.009 |

0.065 |

0.002 |

0.133 |

0.894 |

|

Inflation Rate |

0.001 |

0.018 |

0.001 |

0.048 |

0.961 |

|

R |

0.703 |

|

|

|

|

|

R Square |

0.495 |

|

|

|

|

|

Standard Error |

0.042 |

|

|

|

|

|

Durbin-Watson |

2.017 |

|

|

|

|

Dependent

Variable: Stock Returns

Table 5 represent the significance values of REER,

money supply, and inflation rate are 0.794, 0.894, and 0.961,

respectively, which are greater than the 0.05 level. Therefore, the

relationship is insignificant, whereas; firm liquidity and firm size have

significance values of (0.00) which are less than significance 0.05, which show

a significant relationship with stock returns. R square explains that about 50

per cent variance independent variable has been explained by the set of

independent variables. Moreover, model variables have a strong association,

which accounted for 70 per cent of correlation representation in the model.

Additionally, the Durbin-Watson value of 2.017 rejects the issue of

autocorrelation in the model.

The results of this Study show weak relation

between foreign exchange exposure and stock returns. This result is consistent

with Rasheed (2002), who found neither long run nor short-run association

between foreign exchange and stock prices both for Pakistan and India.

Similarly, our results are also consistent with Frank and Young (1972) and Abdalla and Murinde (1997) as they had found no relationship between these two variables.

Moreover, a very weak relationship between the foreign exchange measured by

REER and stock returns has been supported by the idea presented by Ong and Izan (1999) relating to the weak relationship between foreign exchange rates and

the U.S stock market. Moreover, firm-specific factors like firm size and

liquidity have very little or no impact on foreign exchange exposure. This

result is also consistent with the Study of Sam, Khelifa and Shuxing (2012).

However, these firm-specific factors and market returns have a significant

relationship with stock returns. Furthermore, the negative relationship of the

inflation rate with stock returns is also consistent with the Study of Fama (1981). Therefore,

the results of regression suggest that the inflation, money supply and stock

returns relationship is insignificant but positive.

In an expert’s opinion and according to Zaidi (2006), the purpose of the monetary policy of the State Bank of Pakistan was to fulfil the national objectives of export competitiveness and economic diversification, but high priority had also been given to attain a low inflation rate. SBP authorities had tried to avoid loss in external competitiveness by keeping the real effective exchange rates stable. However, inflation also plays a role in the exchange rates process. Therefore, Iqbal added that real and nominal effective exchange rates sometimes did not move in the cycle due to the difference in the inflation rate from the major trading partners. The real exchange rates had appeared to be appropriate in the past, as real effective exchange rates had appreciated whereas the domestic inflation rate was higher than the partner countries inflation rate. However, the continuous criteria for successful inflation targeting by SBP authorities must ensure that there will be no return to fiscal dominance monetary policy in Pakistan.

Conclusion

In this research study, an investigation by considering 25 non-financial listed firms during the study period 2004 to 2013 has been conducted to report foreign exchange exposure experienced by non-financial listed firms relating stock returns and market capitalization (firm size), firm liquidity, money supply and inflation rate during the military regime transition into a democratic form of government in the country. The real effective exchange rate has been included to tap non-financial firms’ exposure to currency movements by using panel data financial analysis. The daily stock prices have been converted to monthly prices by applying price-weighted indexes such as Dow Jones Industrial Average (DIJA). The results of this study suggest that there is very weak or no relation between the sample firm’s return and foreign exchange. Hence, these firms are least exposed to foreign exchange movements. Similarly, empirical evidence has endorsed that money supply and inflation rate do not affect stock returns. This study is a valuable addition for the exporters as well as investors to understand and determine how changes in stock returns against the fluctuations in exchange rates in terms of real effective exchange rate have been during the study period. Thus, a better understanding relating to the role of real exchange rates affecting stock returns could set grounds for informed future investment decisions.

References

- Abdalla, I. S. A. & Murinde, V. (1997). Exchange rate and stock price interactions in emerging financial markets: evidence on India, Korea, Pakistan and the Philippines. Applied Financial Economics, 7(1), 25-35.

- Adler, M., & Dumas, B. (1984). Exposure to currency risk: Definition and measurement. Financial Management, 13(2), 41-50.

- Aggarwal, R., & Harper, J. T. (2010). Foreign exchange exposure of

- Agyei-Ampomah, S., Mazouz, K., & Yin, S. (2012). The Foreign exchange Exposure of UK Non-Financial Firms: A Comparison of MarketBased Methodologies. International Review of Financial Analysis, 29, 251- 260.

- Albaity, M., & Ahmad, R. (2011). Return performance, leverage effect, and volatility spillover in Islamic stock indices evidence from DJIMI, FTSEGII and KLSI. Investment Management and Financial Innovations, 8(3), 161-171

- Al-Shboul, M., & Anwar, S. (2014). TimeVarying Exchange Rate Exposure and Exchange Rate Risk Pricing in the Canadian Equity Market. Economic Modelling, 37, 451-463. 3.11.034

- Amihud, Y. & Levich, R.M. (1994). Exchange Rates and Corporate Performance. Irwin, New York, NY

- Amihud, Y., & Mendelson, H. (1986). Asset pricing and the bid-ask spread. Journal of Financial Econmics, 17(2), 223-249.

- Andreas, H., & Macmillan P. (2009). Can macroeconomic variables explain long term stock market movements? A comparison of the US and Japan. Applied Financial Economics, 19(2), 111-119. 48956

- Barrows, C. W., & Naka, A. (1994). Use of macroeconomic variables to evaluate selected hospitality stock returns in the U.S. International Journal of Hospitality Management, 13(2), 119- 128.

- Bartov, E., & Bodnar, G. M. (1994). Firm valuation, earning expectations and the Exchange rate exposure effect. Journal of Finance, 49(5), 1755-1785.

- Bartram, S. M., & Bodnar, G. M. (2012). Crossing the Lines: The Conditional Relation Between Exchange Rate Exposure and Stock Returns in Emerging and Developed Markets. Journal of International Money and Finance, 31(4), 766-792.

- Belk, P. A., & Edelshain, D. J. (1997). Foreign Exchange Risk Management - The Paradox. Managerial Finance, 23(7), 5-24.

- Bodnar, G.M. & Gentry, W.M. (1993). Exchange rate exposure and industry characteristics: evidence from Canada, Japan, and the USA. Journal of International Money and Finance, 12 (1), 29-45.

- Bodnar, G. M., & Wong, M. H. F. (2000). Estimating Exchange Rate Exposure: Issues in Model Structure. Financial Management, 32(1), 35-67.

- Booth, L., & Rotenberg, W. (1990). Assessing Foreign Exchange Exposure: Theory and Applications using Canadian Firms. Journal of International Financial Management and Accounting, 2, 1-22.

- Chaudhuri, K., & Smile, S. (2006). Stock market and aggregate economic activity: evidence from Australia. Applied Financial Economics, 14(2), 121-129.

- Chkili, W., & Nguyen, D. K. (2014). Exchange rate movements and stock market returns in a regime-switching environment: Evidence for BRICS countries. Research in International Buiness and Finance, 31, 46-56.

- Chin-Chia L., Jeng-Bau Lin, J-B., & HaoCheng Hsu, H-C. (2013). Reexamining the relationships between stock prices and exchange rates in ASEAN-5 using panel Granger causality approach. Economic Modelling, 32, 560-563.

- Choi, J. J., & Jiang, C. (2009). Does multinationality matter? Implications of operational hedging for the exchange risk exposure. Journal of Banking & Finance, 33(11), 1973-1982.

- Choi, J. J., Hiraki, T., & Takezawa, N. (1998). Is Foreign Exchange Risk Priced in the Japanese Stock Market?. The Journal of Financial and Quantitative Analysis, 33(3), 361-382.

- Choi, J. J., & Elyasiani, E. (1997). Derivative exposure and the interest rate and exchange rate risks of US banks. Journal of Financial Services Research, 12, 267-286.

- Chue, T.K., & D. Cook, D. (2008). Emerging market exchange rate exposure. Journal of Banking & Finance 32(7), 1349-1362.

- Dominguez, K. M. E., & Tesar, L. L. (2001). A Reexamination of Exchange Rate. American Economic Review, 91(2), 396-399.

- Dumas, B. (1978). The theory of the trading firm revisited. Journal of Finance, XXXIII(3), 1019-1029.

- El-Masry, A. A. (2006). The exchange rate exposure of UK non-financial companies: industry level analysis. Managerial Finance, 32(2), 115-36.

- Fama, E. F. (1981). Stock Returns, Real Activity, Inflation and Money. American Economic Review, 545-565.

- Flood, E. Jr. & Lessard, D. R. (1986). On the Measurement of Operating Exposure to Exchange Rates: A Conceptual Approach. Financial Management, 12, 25-36.

- Frank, P., & Young, A. (1972). Stock Price Reaction of Multinational Firms to Exchange Realignments, Financial Management, Principles of Economics, New York, McGraw Hill/Irwin winter, 66-73.

- Ghosh, S. & Reitz, S. (2013). Capital Flows, Financial Asset Prices and Real Financial Market Exchange Rate: A Case Study for an Emerging Market, India. Journal of Reviews on Global Economics, Lifescience Global, 2, 158-171

- Griffin, J. M. and Stulz, R. M. (2001). International competition and exchange rate shocks: A cross-country industry analysis of stock returns. Review of Financial Studies 14(1), 215-41.

- Gupta, R., & Modise, M. P. (2011). Macroeconomic Variables and South African Stock Return Predictability. Economic Modeling, 30, 612-622.

- Hagelin, N. & Prambourg, B. (2004). Hedging Foreign exchange Exposure: Risk Reduction from Transaction and Translation Exposure. Journal of International Financial Management and Accounting, 15(1), 1-20.

- Heckman, C. R. (1985). A Financial Model of Foreign Exchange Exposure. International Business Studies, 16(2), 83-99.

- Hekman, C. R. (1983). Measuring Foreign Exchange Exposure: A Practical Theory and Its Application. Financial Analysts Journal, 39 (5), 59-65.

- Hodder, J . E. (1982). Exposuret o Exchange Rate Movements. Journal of International Economics, 13(3-4), 75-86.

- Hutson, E. R., & Stevenson, S. (2010). Openness, hedging incentives and foreign exchange exposure: A firmlevel multi-country study, Journal of International Business Studies, 41(1), 105-122.

- Inci, A. C., & Lee B. S. (2014). Dynamic Relations between Stock Returns and Exchange Rate Changes. European Financial Management, 20(1), 71- 106.

- Jacob, G., Loretan, M., Subhanij, T., & Chan, E. (2014). Exchange rate fluctuations and international portfolio rebalancing. Emerging Markets Review 18, 34-44.

- Jorion, P. (1990). The Exchange-Rate Exposure of U.S. Multinationals. The Journal of Business, 63(3) 331-345.

- Jorion, P. (1991). The Pricing of Exchange Rate Risk in the Stock Market. Journal of Financial and Quantitative Analysis, 26(3), 363-376.

- Khomo, M. M., & Aziakpono, M. J. (2020). The behaviour of the real effective exchange rate of South Africa: Is there a misalignment?, Cogent Economics & Finance, 8(1), 1760710.

- Kodongo, O., & Ojah, K. (2011). Foreign exchange risk pricing and equity market segmentation in Africa. Journal of Banking & Finance, 35(9), 2295-2310.

- Liang, C-C., Lin, J-B., & Hsu, H-C. (2013). Reexamining the relationships between stock prices and exchange rates in ASEAN-5 using panel Granger causality approach. Economic Modelling, 32, 560-563.

- Licandro, G., & Mello, M. (2019). Foreign currency invoicing of domestic transactions as a hedging strategy: evidence for Uruguay, Journal of Applied Economics, 22(1), 622-634.

- Lee, M. (2017). The Impact of Exchange Rate on Firm Performance: Evidence from Korean Firms. Emerging Markets Finance and Trade, 53(11), 2440-2449.

- Ma, C. K., & Kao, G. (1990). On Exchange rate changes and stock price reactions. Journal of Business Finance and Accounting, 17 (3), 441- 449.

- MacKinnon, J.G. (1996) Numerical Distribution Functions for Unit Root and Cointegration Tests. Journal of Applied Econometrics, 11, 601-618.

- MacKinnon, J.G., Haug, A.A. and Michelis, L. (1999) Numerical Distribution Functions of Likelihood Ratio Tests for Cointegration. Journal of Applied Econometrics, 14, 563-577.

- Marston, R. C. (2001). The effect of industry structure on economic exposure. Journal of International Money and Finance, 20(2), 149-164.

- Miller, K. D., & Reuer, J. (1998). Firm Strategy and Economic Exposure to Foreign exchange Rate Movements. Journal of International Business Studies, 29(3), 493-513.

- Moore, T., & Wang, P. (2014). Dynamic linkage between real exchange rates and stock prices: Evidence from developed and emerging Asian markets. International Review of Economics & Finance, 29, 1-11.

- Muhammad, N., Rasheed, A., & Husain, F. (2002). Stock Prices and Exchange Rates: Are they Related? Evidence from South Asian Countries. The Pakistan Development Review, 41(4), 535-550.

- Mukherjee, T., & Naka, A. (1995). Dynamic Relation Between Macroeconomic Variables and the Japanese Stock Market: An Application of a Vector Error Correction Model. The Journal of Financial Research, 461-471.

- Nandha, M. (2013). A Risk-Return Analysis of the Chinese Stock Market. Available at SSRN:

- Neumann, R. (2003). Price Differentials betwen Dual-Class Stocks: Voting Premium or Liquidity Discount?. European Financial Management, 9(3), 315- 332.

- Ong, L. L., & Izan, H. Y. (1999). Stocks and currencies: are they related?. Applied Financial Economics, 9(5), 523-532.

- Parlapiano, F., Alexeev, V., & Dungey, M. (2015). Exchange rate risk exposure and the value of European firms, The European Journal of Finance, 23(2), 111-129.

- Roll, R., Schwartz, E., & Subrahmanyam, A. (2010). The relative trading activity in options and stock. Journal of Financial Economics, 96(1), 1-17.

- Rogalski, J. R., & Vinso, J. D. (1977). Stock Returns, Money Supply and the Direction of Causality. Journal of Finance, 32(4), 1017-1030.

- Shapiro. A. C. (1975). Exchange Rate Changes, Inflation, and the Value of the Multinational Corporation. Journal of Finance, 30(2), 485-502.

- Sinha, P., & Kohli, D. (2013). Modeling exchange rate dynamics in India using stock market indices and macroeconomic variables. MPRA Paper 45816 University Library of Munich, Germany, Available at:

- Tiryaki, A., Ceylan, R., & Erdogan, L. (2019). Asymmetric effects of industrial production, money supply and exchange rate changes on stock returns in Turkey, Applied Economics, 51(20), 2143-2154.

- Urich, T., & Wachtel, P. (1981). Market response to the weekly money supply announcements in the 1970s. Journal of Finance, 36, 1063-1072.

- Williamson, R., Griffin, J M., & Doidge, C. (2002). Does Exchange Rate Exposure Matter? Available at SSRN: , 2002

- Yucel, T., & Kurt, G. (2007). Foreign exchange Rate Sensitivity and Stock Price: Estimating Economic Exposure of Turkish Companies. Available at:

- Zaidi, M. I. (2006). Exchange Rate Flexibility and the Monetary Policy Framework in Pakistan.

- Zivkov, D., Kuzman, B., & AndrejevicPanic, A. (2020). Nonlinear bidirectional multiscale volatility transmission effect between stocks and exchange rate markets in the selected African countries, Economic Research,

Cite this article

-

APA : Tirmizi, S. M. A., Haider, M. J., & Din, S. U. (2021). The Risk of Foreign Exchange Exposure of Stock Returns Concerning Non-Financial Listed Firms. Global Economics Review, VI(I), 105-125. https://doi.org/10.31703/ger.2021(VI-I).09

-

CHICAGO : Tirmizi, Syed Muhammad Ali, Muhammad Jawad Haider, and Shahab Ud Din. 2021. "The Risk of Foreign Exchange Exposure of Stock Returns Concerning Non-Financial Listed Firms." Global Economics Review, VI (I): 105-125 doi: 10.31703/ger.2021(VI-I).09

-

HARVARD : TIRMIZI, S. M. A., HAIDER, M. J. & DIN, S. U. 2021. The Risk of Foreign Exchange Exposure of Stock Returns Concerning Non-Financial Listed Firms. Global Economics Review, VI, 105-125.

-

MHRA : Tirmizi, Syed Muhammad Ali, Muhammad Jawad Haider, and Shahab Ud Din. 2021. "The Risk of Foreign Exchange Exposure of Stock Returns Concerning Non-Financial Listed Firms." Global Economics Review, VI: 105-125

-

MLA : Tirmizi, Syed Muhammad Ali, Muhammad Jawad Haider, and Shahab Ud Din. "The Risk of Foreign Exchange Exposure of Stock Returns Concerning Non-Financial Listed Firms." Global Economics Review, VI.I (2021): 105-125 Print.

-

OXFORD : Tirmizi, Syed Muhammad Ali, Haider, Muhammad Jawad, and Din, Shahab Ud (2021), "The Risk of Foreign Exchange Exposure of Stock Returns Concerning Non-Financial Listed Firms", Global Economics Review, VI (I), 105-125

-

TURABIAN : Tirmizi, Syed Muhammad Ali, Muhammad Jawad Haider, and Shahab Ud Din. "The Risk of Foreign Exchange Exposure of Stock Returns Concerning Non-Financial Listed Firms." Global Economics Review VI, no. I (2021): 105-125. https://doi.org/10.31703/ger.2021(VI-I).09