01 Pages : 1-7

Abstract:

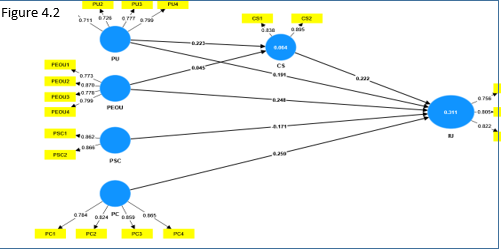

The goal of this study is to look at the effect of "perceived ease of use" (PEOU), "perceived usefulness" (PU), "perceived service cost" (PSC), "perceived credibility" (PC) and "customers' satisfaction" (CS) on consumers' intention to adopt mobile wallet payment services. "Customer satisfaction" (CS) was the mediator between PEOU, PU and IU. The study model is based on the model of "technology acceptance model" (TAM). The study involves 300 respondents and the data was obtained via an online questionnaire. - Convenient sampling method. Smart PLS (partial least squares) regression using the "structural equation" technique has been applied to review and analyze the data. The data analysis findings are supported with several previously published hypotheses. All independent variables influence the dependent variable IU, indirect effect of PU is positive and significant to IU, further it was found from analysis that the PEOU has not significant effect to the mediator CS and the IU indirectly.

Key Words:

Mobile Wallet, Digital Payments, Technology Acceptance Model (TAM), Adoption of Technology, Consumer Intention

Introduction

In the modern era, the world has moved towards digitalization, and digital payments via mobile wallet accounts are becoming more popular in many countries. The mobile wallet payment method has changed people's lifestyle and saved their plenty of time. Mobile wallet payment is different from traditional banking transactions and services by features such as fastest transactions, no time constraints because it can be operated 24/7 throughout the year and at any location. In COVID-19 pandemic situation throughout the world, it became impossible to go to banks or physical locations for transactions, but in that situation, mobile wallet payment services played a significant role for users and proved to be the most convenient tool.

Digital payments trace its origin to 1997, when “Coca-Cola” presented machine based vending in Helsinki city that allowed the customers to buy a can of drink through text messages. This is the origin, even though it is extremely different from current digital

transactions (Wiki payments).

Nowadays, M-wallets are used to carry out a variety of financial transactions. M-wallets provide a gateway to target a large population in emerging economies. Because of their numerous benefits, mobile wallet services are gaining popularity. On the other hand, consumers' likes, dislikes, and interests change over time (Sharma & kulshreshtha, 2019). Mobile wallet has replaced usual physical wallets due to the convergence of mobile technology and payment mechanism (Sharma et al., 2018).

A mobile wallet payment services varies from internet banking applications in different dimensions, even though it is funded by a user's bank account. Mobile banking apps may be used for different payments as usual transactions, however they are just an extension to an existing account of bank. Therefore most banks have their own mobile wallets (George & Sunny, 2020).

Mobile money services, which provide financial services (Branchless banking) uses extensive distribution and cellular network of mobile operators, has been done as tool for expansion of financial inclusion (Ibtasam et al., 2017).

As per Global Findex Databsse (2017) Digital technology cannot enhance financial inclusion on its own. To ensure that customers gain from digital financial services, it is necessary to have a proper developed payment platform, a solid physical infrastructure, appropriate laws, and strong consumer protection. Financial services must be customized and disadvantaged groups' needs should be met including women, the poor, and first-time customers who may not have appropriate reading and numeracy skills, whether they are digital or analogue. Around 1.1 billion people worldwide are unbanked, accounting for around two-thirds of all adults.

All technologies made available to the user and actions taken by payment service providers in order to conduct payment transactions are included in a mobile payment service (Dahlberg et al., 2006). Digital payments speed up and lower the cost of payments between businesses and their suppliers, workers, consumers, and governments. In addition to making it easier to satisfy legal and tax obligations, digital financial systems encourage formal entrepreneurship by making it easier for entrepreneurs to get credit products to start and grow their businesses (Klapper, 2017).

Background of the Study

The mobile wallet payment is a very new topic of research, having received far less attention than comparable areas such as electronic commerce, mobile commerce, or phone banking, all of which have received substantial attention (Oliveira et al., 2016). As mobile phones are becoming more popular, more consumers may use them for online purchasing as well as in-person payment choices. Consumers now have a new, easy payment option open to them, as long as merchants are also ready to accept it (Taggart, 2022). A mobile wallet can allow a variety of transactions, such as “consumer to consumer” (C2C), “consumer to business” (C2B), “consumer to machine” (C2M) (payment for small payments at a machine such as a “parking meter”), and consumer-to-online. Furthermore, with mobile phone payments, users have more options for paying purchases at the moment of sale. The use of a mobile wallet speeds up transaction processing from sale point of view and increases the opportunities for impulse buys. (Shin, 2009).

SARS COVID-19 has advanced the transition to payments without any contact. Credit cards are not just swiped at the payment hubs, but cellphones with a mobile wallet applications are also doing the same thing. Customers are paying in-store using their cellphones and even smartwatches. These proximity payments are easy, quick, and are increasingly being used throughout the epidemic (global payments, 2021).

Due to varying adoption and acceptance levels, as well as differing business models tailored to a country's economic and sociological context, the global deployment of digital payments has not been consistent (Goparaju, 2017).

The World Bank is optimistic about paperless economy of Pakistan’s future, evaluating it at $36 billion and expecting a 7% increase in GDP with an actual retail payments channel, however it mainly relies on broad adoption of digital financial transactions, according to the World Bank (Saeedi, 2019). Due to a number of issues, such as low banking penetration, a lack of knowledge and confidence in digital payment systems, a lack of interoperability, accessibility issues, and high transaction costs, there are few electronic transactions in Pakistan. Digital payments currently accounted for only “0.2” percent of Pakistan's “100 billion” payments (Ahmed, 2020). This can be referred primarily to issues inside the payment ecosystem (State Bank of Pakistan, 2020)

Profiles of Renowned Mobile Payment Service Providers in Pakistan Easypaisa by Telenor

Easypaisa is a Pakistani company that offers branchless banking, mobile wallets, and mobile payments. In 2009, Telenor Pakistan started it in collaboration with Tameer Bank, which Telenor Microfinance Bank later purchased.

Jazzcash by Mobilink

JazzCash, originally MobiCash, is a Pakistani provider of mobile wallet and services of branchless banking. In 2012, Mobilink (now Jazz) and its affiliate bank, Mobilink Microfinance Bank, together developed MobiCash. In terms of mobile money transactions, it holds a 64% market share.

Upaisa

UPaisa simplifies payments, cash transfers, and cell balance recharge with a single tap. In October 2013, UPaisa, a joint venture between U Microfinance Bank and Ufone, introduced unique branchless banking solutions for Pakistan. UPaisa promotes financial inclusion by making financial services available at the final mile.

Paymax

The State Bank of Pakistan (SBP) granted CMPAK Electronic Commerce Company Limited (CMPAK ECCL), a 100% owned subsidiary of CMPAK (which also owns and runs ZONG4G), a Commercial License to operate as an Electronic Money Institution (EMI) in Pakistan in March 2022. CMPAK ECCL will begin commercial services under the brand name "PayMax" with the approval of this license, aiming to further CMPAK's objective of digital and financial inclusion.

Sadapay

SadaPay is in registration with the “Securities and Exchange Commission of Pakistan” as Sadapay Private Limited (No. 0136598), and regulated by the State Bank of Pakistan, and subsidiary wholly owned by SadaPay Technologies Ltd., which is registered under commercial fintech license #3263 at Dubai International Financial Center

Literature Review Background

Research Method & Material

This study’s base relies on primary and quantitative research. Research model / framework is based on “technology acceptance model”, which is mostly adopted and proved valid till now in many research for analyzing behavior or intension to adopt technology. Questionnaire for this research is close-ended and 5 point “Likert-scale” based. The data have been assessed using "Smart PLS-SEM."

Methodology Construct Measurement and Sampling

Following the literature study, the tool for the survey of the study was developed using indicators chosen from prior research. A 5-points “Likert scale” differs from 1 – “strongly disagree” to 5- “strongly agree” was employed for each construct. The opinion poll (questionnaire) was designed on google forms and link created was sent online to students, employees, businessmen and general public via social media and in-personal text message. Participants ware categorized by age from 18 to 60 who are residents of Pakistan and received responses of 300 participants.

Data Collection Technique

A questionnaire was adopted from a previous research which was also based on “technology acceptance model” (TAM) and 2 more variables were added which are included in this study, the questionnaire was created online and sent to individuals through link generated, respondents incudes different cities, ages, occupation and income, total of 300 responses were received.

Data Analysis Approach

In 2012 Surendran reviewed “technology acceptance model” and different studies based on it and he found that TAM is a globally used model to understand and explain user intention to adopt technology, many researches are conducted to test “technology acceptance model” (TAM) and he also reviewed researches where researchers have made different changes in model and results were founded reliable (Surendran, 2012). After reviewing previous studies “technology acceptance mod el” TAM has been applied for this study and analyzed through Smart PLS-SEM 4.

Research Framework

Framework given, shows the study model. It is an extended TAM measuring “perceived usefulness” (PU), “perceived ease of use” (PEOU), “perceived service costs” and “perceived credibility” adopted form (Rodrigues et al., 2021), and the variable

“consumers’ satisfaction” is taken from (PHUONG et al., 2020). Because the focused objective of this study is to “investigate the factors and intention of users to adopt Mobile wallet payment services”.

Peceived Usefulness

“Perceived usefulness” is an essential cause in

the user’s adoption of a technology. The "perceived usefulness" of the technological system is concerned to its efficacy and productivity, and its overall gains for improving performance of user (Davis's, 1986).

Perceived Ease of Use

The “perceived ease of use” directs to the simplicity with which a technological system and its display may be accessed. “TAM” model is one of the most crucial variables in consumer adoption of a technology is “perceived ease of use” (Davis's, 1986).

Perceived Service Costs

The “perceived service cost” is the cost that a customer have to pay in return of the services he is receiving from the service provider (Neuburger, 1971).

Perceived Credibility

Consumers are concerned about the security of their private data since digital wallets convey sensitive and private data via a cellular network shared with other firms (Al-Natour et al., 2020). “Perceived credibility” of service provider refers to how users perceive the operation and administration of costumer’s personal data which is stored in online system. Users' perceptions of a system's security can

impact their willingness to utilize it. Users are

more likely to reject a system if they think it carries the risk, particularly in terms of security (Loewenstein et al., 2001)

Customers’ Satisfaction

"Customer satisfaction" assesses how well a provider of products or services meets the needs and expectations of their customers. This most likely applies to all interactions before, after, and during the usage of the service. (act.com).

Intention to Use

The behavior of the individual to continue usage of something in the future is known as “intention to use”. Individual has formed conscious plans to involve or not to involve in a specific future behavior is described as “intention to use” (Brezavš?ek et al., 2016)

Hypotheses to be Tested

H1, PU, PEOU, PC, PSC and CS have positive effect on (IU) intention to use mobile wallet payment services.

H2, CS has positive relationship as mediator between “PU” and (IU) intension to use.

H3, CS has positive relationship as mediator between “PEOU” and (IU) intension to use.

Analysis, Result and Discussion Demographic Analysis of Respondents

Descriptive analysis of 300 respondents are shown in below tables by age, gender and income.

Table 1.

|

|

Ages |

Frequency |

Percent |

Cumulative Percent |

|

Valid |

18 to 25 |

111 |

37.0 |

37.0 |

|

26 to 35 |

120 |

40.0 |

77.0 |

|

|

36 to 45 |

46 |

15.3 |

92.3 |

|

|

46 to 55 |

13 |

4.3 |

96.7 |

|

|

56 and 60 |

3 |

1.0 |

97.7 |

|

|

56 to 60 |

4 |

1.3 |

99.0 |

|

|

above 60 |

3 |

1.0 |

100.0 |

Respondents are categorized by age groups ranges between 18 to 60 years, number of respondents and percentages are given in table by age groups.

Table 2. Gender

Responses are shown gender wise by number and percentage of respondents.

Table 3. Income

|

|

Frequency |

Percent |

Cumulative Percent |

|

|

Valid |

25K-50K |

79 |

26.3 |

26.3 |

|

51K-75K |

70 |

23.3 |

49.7 |

|

|

76K-100K |

39 |

13.0 |

62.7 |

|

|

Above

100K |

36 |

12.0 |

74.7 |

|

|

Not

applicable |

76 |

25.3 |

100.0 |

|

|

Total |

300 |

100.0 |

|

|

In

above table the respondents are categorized by their income, in which 4 income

groups are classified from Rs. 25,000 to above Rs. 100,000,

Measurement Model Validity and Reliability of Constructs Table 4. Construct Reliability and Validity

|

Constructs |

CA |

CR (rho_a) |

CR (rho_c) |

AVE |

|

CS |

0.710 |

0.712 |

0.858 |

0.752 |

|

IU |

0.709 |

0.715 |

0.837 |

0.632 |

|

PC |

0.854 |

0.863 |

0.901 |

0.695 |

|

PEOU |

0.821 |

0.844 |

0.881 |

0.649 |

|

PSC |

0.708 |

0.714 |

0.855 |

0.746 |

|

PU |

0.753 |

0.777 |

0.840 |

0.569 |

Note: CA= “Cronbach’s

Alpha”, CR= “Composite reliability”, AV= “Average variance extracted”

“Cronbach's alpha”, “rho_A”, and “Composite reliability” are

tools to assess internal consistency or reliability between items. “Cronbach's

alpha”, “rho A”, and “Composite Reliability” is greater than 0.7, which is

considered strong internal reliability (Hair et

al., 1994). Table 4.4 demonstrates

that the value of “Cronbach's alpha” for all variables are more than 0.7,

indicating that they are reliable. Moreover, “rho A” and “composite

reliability” are both more than 0.7, hence all the constructs are reliable.

Furthermore, a construct's “Average Variance Extracted” (AVE) must be more than

0.50 (Fornell & Larcker, 1981). Which also exceed than 0.5 which are reliable and

valid.

Variance Inflation Factor

The "variance inflation factor" determines how the behavior (variance) of an independent variable is exaggerated by assessing its correlation and interaction with the other variables (independent). “Variance inflation factors” provide a rapid assessment of a variable's contribution to the regression standard error. According to Jou et al (2014) VIF is the widely used diagnostic tool, which reveals that how the difference of the associated co-efficient is inflated according to collinearity of data.

Table 5. Collinearity Statistics (VIF) of Items

|

S. No |

items |

VIF |

Sr. |

items |

VIF |

|

1. |

CS1 |

1.346 |

11. |

PEOU2 |

2.049 |

|

2. |

CS2 |

1.346 |

12. |

PEOU3 |

1.663 |

|

3. |

IU1 |

1.425 |

13. |

PEOU4 |

1.764 |

|

4. |

IU2 |

1.428 |

14. |

PSC1 |

1.320 |

|

5. |

IU3 |

1.324 |

15. |

PSC2 |

1.320 |

|

6. |

PC1 |

1.749 |

16. |

PU1 |

1.627 |

|

7. |

PC2 |

1.874 |

17. |

PU2 |

1.616 |

|

8. |

PC3 |

2.102 |

18. |

PU3 |

1.509 |

|

9. |

PC4 |

2.207 |

19. |

PU4 |

1.430 |

|

10. |

PEOU1 |

1.749 |

|

|

|

Note: VIF,

Variance inflation Factor

Assessment of Outer-loadings

In reflective measurement models, the expected connections are referred to as "outer loadings", arrows connecting the latent variable to its indicators indicate the total influence of an item on the related construct.

Table 6. Outer-Loadings of Items

|

Constructs |

Item |

O.L |

|

Perceived ease of

use |

“Using

the Mobile Wallet Payment service is easy for me.” |

0.773 |

|

“My interaction

while using the Mobile wallet payment services clear and understandable.” |

0.870 |

|

|

“It is easy to become

skillful at the use of the mobile wallet payment services.” |

0.778 |

|

|

“Overall, I find

the use of the mobile wallet payment services easy.” |

0.799 |

|

|

Perceived

usefulness |

“Using

the Mobile Wallet Payment services make me able to complete my tasks more

quickly.” |

0.711 |

|

“Using the Mobile

Wallet Payment services make it easier for me to carry out my tasks.” |

0.726 |

|

|

“I find the Mobile Wallet Payment

useful.” |

0.777 |

|

|

“Overall, I find

using the Mobile Wallet Payment services as beneficial.” |

0.799 |

|

|

Perceived

service cost |

“Service

charges for transactions using mobile wallet are affordable.” |

0.862 |

|

“Using mobile

wallet the operating charges/Service charges are affordable as compared to

other methods of banking and transactions.” |

0.866 |

|

|

Perceived Credibility |

“I feel secure

providing sensitive information across the Mobile Wallet Payment service.” |

0.784 |

|

“The Mobile Wallet

Payment service is a secure means through which to send sensitive

information.” |

0.824 |

|

|

“I feel totally

safe providing sensitive information about myself over the Mobile Wallet

Payment service.” |

0.859 |

|

|

“Overall, the

Mobile Wallet Payment service is a secure place to transmit sensitive

information.” |

0.865 |

|

|

Customers’ satisfaction |

“I am satisfied with the method of

doing transactions using Mobile Wallet Payment services.” |

0.838 |

|

“I am satisfied with the overall services provided by

Mobile Wallet Payment services providers.” |

0.895 |

|

|

Intention to use |

“I

would use the Mobile Wallet Payment services for my banking needs.” |

0.822 |

|

“Using the Mobile

Wallet Payment services for handling my transactions is something I would

do.” |

0.805 |

|

|

“I

would see myself using the Mobile Wallet Payment services for handling my

transactions.” |

0.756 |

Note: OL=

Outer loadings

Outer loading for all constructs are more than 0.6,

demonstrating satisfactory convergent validity of all items of constructs

(Chin, 1998).

In above table our study’s outer-loadings of items are shown and all are above

0.7 which are acceptable.

Heterotrait - Monotrait Ratio (HTMT)

According to Henseler et al., (2014)

Understanding how to interpret the HTMT is simple: If the HTMT value of the indicators of the two constructs A and B is obviously less than 01, the exact connection between two constructions are most likely distinct from one another, and the indicators of the two constructs should differ.

Table 7. HTMT

|

|

HTMT |

|

IU ->

CS |

0.605 |

|

PC ->

CS |

0.680 |

|

PC ->

IU |

0.546 |

|

PEOU

-> CS |

0.233 |

|

PEOU

-> IU |

0.387 |

|

PEOU

-> PC |

0.201 |

|

PSC ->

CS |

0.207 |

|

PSC ->

IU |

0.332 |

|

PSC ->

PC |

0.276 |

|

PSC ->

PEOU |

1.165 |

|

PU ->

CS |

0.318 |

|

PU ->

IU |

0.489 |

|

PU ->

PC |

0.296 |

|

PU ->

PEOU |

0.773 |

|

PU ->

PSC |

0.752 |

Note: HTMT= “Heterotrait –

Monotrait”

A

lack of discriminant validity is shown by “HTMT” values close to 1. The “HTMT”

is employed as a parameter by relating it to a predefined range. If the “HTMT”

value exceeds this level, one might assume that discriminant validity is

lacking (Ab Hamid et al., 2017). In our study all the values of variables relationships

are lower than 0.9 except relationship of “perceived

service cost” to “perceived ease of

use” which is slightly greater than 0.9.

Structural Model Assessment of R2

A numerical fit indicator known as R-Squared,

which measures the percentage of a dependent variable's variation that a regression model's one or more independent variables can account for

Figure 2 Figure 3

Some disciplines of study have an advanced level of unexplained variance. Your R2 values will very certainly be lesser in these places. For example, R2 levels for research attempting to explain human behavior, are often less than 50%. Individuals are more difficult to forecast than physical processes. Furthermore, even if the R-squared assessment is low but all of the independent constructs are significant, you may still have crucial findings about the variables' relationship (Frost, 2022). Using smart PLS as variance based technique the study has assessed the value of R2, all the independent variables cause 31% variation in dependent variable, which is “intention to use” mobile wallet payments.

Effect Size f 2

If an exogenous variable is removed from the model, than the R2 changes, which is called the f 2. The magnitude of the effect is assessed by the f 2 as greater than or equal to “0.02” small; medium: “0.15” or greater, large: “0.35” or greater (Cohen, 2013).

Table 8. Effect of f2

|

Variables |

“Customers’ satisfaction” |

“Intention to use” |

|

CS |

|

0.051 |

|

PC |

|

0.069 |

|

PEOU |

0.001 |

0.022 |

|

PSC |

|

0.012 |

|

PU |

0.035 |

0.033 |

Hypothesis Testing Table 9. Hypothesis Testing

|

|

Sample Mean (M) |

Standard Deviation |

T Statistics |

P Values |

Result |

|

CS

-> IU |

0.222 |

0.087 |

2.561 |

0.010 |

Accepted |

|

PC

-> IU |

0.265 |

0.072 |

3.621 |

0.000 |

Accepted |

|

PEOU->

CS |

0.044 |

0.068 |

0.658 |

0.511 |

Rejected |

|

PEOU->

IU |

0.243 |

0.091 |

2.731 |

0.006 |

Accepted |

|

PSC->

IU |

-0.162 |

0.078 |

2.190 |

0.029 |

Accepted |

|

PU

-> CS |

0.230 |

0.065 |

3.426 |

0.001 |

Accepted |

|

PU

-> IU |

0.190 |

0.067 |

2.860 |

0.004 |

Accepted |

The P-value is regarded as a crucial factor in evaluating our results. The

result is regarded significant if the P-value is “0.05” or lower; the effect is

considered non-significant if the P-value is more than “0.05” (Pripp, 2015). Likewise, the T-statistic calculates the

coefficient's distance from 0. Any T-value more than 2 and below than minus 2

is typically considered suitable. The greater value of the T-value, the

increased our confidence in the coefficient's ability to forecast. (Dun &

Bradstreet, n.d). In our study values of all hypotheses are matching with

criteria of P-values and T statistics values as required except one hypothesis “perceived ease of use” to mediator “customer satisfaction”. However,

negative relationship has been found in variable “perceived service cost” to variable “intention to use” except that all the relationships between

variables are positive

Table 10. Indirect Effect on Dependent Variable

|

|

Sample Mean (M) |

Standard Deviation |

T-Statistics |

P Values |

Result |

|

PEOU -> CS -> IU |

0.021 |

0.028 |

0.564 |

0.573 |

Rejected |

|

PU -> CS -> IU |

0.11 |

0.032 |

3.259 |

0.001 |

Accepted |

Indirect effect of variable “perceived ease of use” on variable “intention to use” with mediating effect of variable “customer satisfaction” is also not

significant.

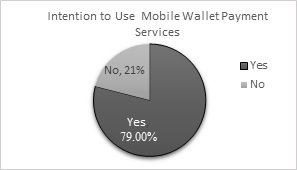

Intention to Use Table 11. Intention to Use

|

|

Frequency |

Percent |

|

|

Valid |

No |

63 |

21.0 |

|

Yes |

237 |

79.0 |

|

|

Total |

300 |

100.0 |

|

The consumers’ “intention to use” mobile wallet payment services is highly positive with rate of 79% acceptance.

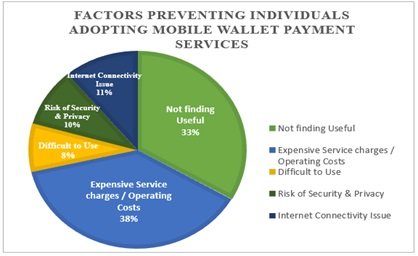

In figure 4.3. The individuals from 21% of the sample size who do not intend to use mobile wallet payment services provided the factors that are preventing them from adopting mobile wallet payments are as displayed in table 4.4 above 5. Conclusion, recommendations, future studies and limitations

Discussion

Many studies have been done on mobile wallet payments globally, in Pakistan few research have been done in this area, there is still need of conducting research in this area in Pakistan. We have conducted this research by adopting the research model mixed of two researches which have been conducted in foreign. In this research we are investigating the factors which influence the adoption of mobile wallet payments in Pakistan, we have adopted 6 variables for this study, which are “perceived ease of use”, “perceived usefulness”, “perceived credibility”, “perceived service cost”, “customers; satisfaction” and “intention to use”. The mediation of “customers’ satisfaction” between “perceived ease of use” and “perceived usefulness” is novelty of this research. We have found that all the variables have relationship with “intention to use”.

Conclusion

Mobile wallet payments are preferably used in many countries around the globe and it is widely acceptable by retailors and online stores. In Pakistan the usage of mobile wallet payments services is also increasing but still there is less usage of mobile wallet payments services as compared to other physical methods of transaction. State Bank of Pakistan mentioned in their report of 2020, Pakistan has only 0.2 percent of online transaction out of 100 billion transactions which is comparatively very low. State Bank of Pakistan and also World Bank are optimistic about usage of online transactions, usage of mobile wallet payment services can replace formal cash based transactions which will provide information to the data base of State Bank of Pakistan and every single transaction would be recorded, ultimately it will be proved as boost in economy of Pakistan.

Usage of mobile wallet payment services is easy and different from internet banking, very less efforts are required to open the mobile wallet account as there are no any extreme conditions. Mobile wallet payment services providers should run campaign about their services and benefits they are providing as still after a lot time of launching mobile wallet payment services still people are unaware of usage of services.

In our study we have collected data from 300 respondents through convenient sampling method, online questionnaire was designed and responses were saved in Microsoft excel sheets SPSS and then imported in Smart PLS software and analyzed by creating research model with graphical user interface. We performed several tests on Smart PLS to validate the data including:

The study attempts to analyze the consumers’ intention towards mobile wallet payments services in Pakistan by integrating theories of “technology acceptance model” (TAM) which are adopted from two studies Rodrigues et al., (2021) & PHUONG et al., (2020) the results show that “perceived ease of use”, “perceived usefulness”, “perceived credibility” and “customers’ satisfaction” has significant and positive relationship with dependent variable “intention to use”. Majority of the respondents are 18 to 35 year age group and mobile wallet payment services are easy for them and they find it useful too, as compared to bank account the mobile wallet account has less requirements to open an account and payments through mobile wallet are widely acceptable and all the operations can be done through mobile wallet which are done by using banking services because of that mobile wallet payment services are preferred. Consumers feel secure and understand mobile wallet service providers credible. However, according to users operating and service costs which are charged by mobile wallet service providers are little bit expensive but instead of that they find it useful and satisfied. The relationship of “perceived usefulness” with mediator “customers’ satisfaction” has been found positive and significant meanwhile the “perceived ease of use” to “customers’ satisfaction” relationship has been found non-significant.

The indirect relationship of “perceived ease of use” with mediation of “customers’ satisfaction” on “intention to use” is also non-significant however the indirect relationship of “perceived usefulness” with mediation of “customer satisfaction” has significant and positive relationship with “intention to use” that means the relationship of “customer satisfaction” between “perceived usefulness and intention to use” exist.

Limitations of the Study

Data for this research has been collected through close-ended questionnaire, from which complete data can’t be gathered. In this modern era several different data gathering methods are available which can be employed. Sampling technique for this research is convenient due to limited resources which can be changed also for more accuracy of data.

Recommendations

Data has been collected from Sindh province and sample size is 300 which is acceptable to know the intention of individuals of country but in future sample size can be increased and data can be collected from other provinces to improve the generalization of the study as well. Further questionnaire can be changed or modified and other variables can be added too in future studies.

References

- Ab Hamid, M. R., Sami, W., & Mohmad Sidek, M. H. (2017). Discriminant validity assessment: Use of Fornell & Larcker criterion versus HTMT criterion. Journal of Physics: Conference Series, 890, 012163. https://doi.org/10.1088/1742-6596/890/1/012163

- Abrahão, R. De, Moriguchi, S. N., & Andrade, D. F. (2016). Intention of adoption of mobile payment: An analysis in the light of the “unified theory of acceptance and use of technology†(utaut). RAI Revista De Administração e Inovação, 13(3), 221– 230. https://doi.org/10.1016/j.rai.2016.06.003

- Ahmed, A. (2020, July 6). Despite covid-19, Pakistanis still hesitant to adopt digital payments: Survey. Brecorder. https://www.brecorder.com/news/40003157

- Al-Natour, S., Cavusoglu, H., Benbasat, I., & Aleem, U. (2020). An empirical investigation of the antecedents and consequences of privacy uncertainty in the context of mobile apps. Information Systems Research, 31(4), 1037–1063. . https://doi.org/10.1287/isre.2020.0931

- Alaeddin, O., Altounjy, R., Zainudin, Z., & Kamarudin, F. (2018). From physical to digital: Investigating consumer behaviour of switching to Mobile Wallet. Polish Journal of Management Studies, 17(2), 18–30. https://doi.org/10.17512/pjms.2018.17.2.02

- Amoroso, D. L., & Magnier-Watanabe, R. (2012). Building a research model for mobile wallet consumer adoption: The case of Mobile Suica in Japan. Journal of Theoretical and Applied Electronic Commerce Research, 7(1), 13–14. . https://doi.org/10.4067/s0718-18762012000100008

- Aslam, W., Ham, M., & Arif, I. (2017, December 18). Consumer behavioral intentions towards Mobile Payment Services: An empirical analysis in Pakistan. Market-Tržište. https://hrcak.srce.hr/190850

- Bahadur, W., Ali, M., Khan, N. A., & KHAN, A. L. I. (2021). Mobile payment adoption: A multi-theory model, multi-method approach and multi-country study. International Journal of Mobile Communications, 19(1), https://doi.org/10.1504/ijmc.2021.10032082

- BrezavÅ¡Äek, A., Å parl, P., & ŽnidarÅ¡iÄ, A. (2016). Factors influencing the behavioral “intention to use†statistical software: The perspective of the Slovenian students of Social Sciences. EURASIA Journal of Mathematics, Science and Technology Education, 13(3). ). https://doi.org/10.12973/eurasia.2017.00652a

- Chawla, D., & Joshi, H. (2019). Consumer attitude and intention to adopt Mobile Wallet in India – an empirical study. International Journal of Bank Marketing, 37(7), 1590–1618.

- Chin, W. W. (1998). The partial least squares approach for structural equation modeling. In G. A. Marcoulides (Ed.), Modern methods for business research. Lawrence Erlbaum Associates Publishers. 295–336.

- Cohen, J. (2013). Statistical Power Analysis for the behavioral sciences.

- Dahlberg, T., Zmijewska, A., Ondrus, J., & Mallat, N. (2006). Mobile Payment Market and Research - Opus at UTS: Home.

- Dijkstra, T. K., & Henseler, J. (2015). Consistent and asymptotically normal PLS estimators for linear structural equations. Computational Statistics & Data Analysis, 81, 10–23.

- Fornell, C., & Larcker, D. F. (1981). Evaluating structural equation models with unobservable variables and measurement error. Journal of Marketing Research, 18(1), 39.

- Frost, J. (2022, July 22). How to interpret R- squared in regression analysis. Statistics by Jim.

- Davis, F. D. (1986). A “technology acceptance model†for empirically testing new end- user information systems: Theory and results. Doctoral dissertation, Cambridge, MA: Massachusetts Institute of Technology.

- George, A., & Sunny, P. (2020). Developing a research model for mobile wallet adoption and usage. IIM Kozhikode Society & Management Review, 10(1), 82–98.

- Global Payments. (n.d.). Top 5 2022 payment & commerce trends.

- Goparaju, H. (2017). Digital Payment Sector: The Sunrise Industry in India: A Review. The IUP Journal of Business Strategy, XIV(2), 7–19.

- Hair, J. F., Anderson, R. E., Tatham, R. L., & Black, W. C. (1995). Multivariate data analysis. Englewood Cliffs, NJ: Prentice- Hall.

- Hayashi, K., Bentler, P. M., & Yuan, K.-H. (2011). Structural equation modeling. Essential Statistical Methods for Medical Statistics, 202–234.

- Henseler, J., Dijkstra, T. K., Sarstedt, M., Ringle, C. M., Diamantopoulos, A., Straub, D. W., Ketchen, D. J., Hair, J. F., Hult, G. T., & Calantone, R. J. (2014). Common beliefs and reality about PLS. Organizational Research Methods, 17(2), 182–209.

- Henseler, J., Ringle, C. M., & Sarstedt, M. (2014). A new criterion for assessing discriminant validity in variance-based structural equation modeling. Journal of the Academy of Marketing Science, 43(1), 115–135.

- Hong, S. J., Thong, J. Y. L., & Tam, K. Y. (2006). Understanding continued information technology usage behavior: A comparison of three models in the context of Mobile internet. DecisionSupport Systems, 42(3), 1819–1834.

- Hu, L.-tze, & Bentler, P. M. (1998). Fit indices in covariance structure modeling: Sensitivity to under parameterized model misspecification. Psychological Methods, 3(4), 424–453.

- Ibtasam, S., Mehmood, H., Razaq, L., Webster, J., Yu, S., & Anderson, R. (2017). An exploration of smartphone based mobile money applications in Pakistan. Proceedings of the Ninth International Conference on Information and Communication Technologies and Development.

- Jou, Y.-J., Huang, C.-C. L., & Cho, H.-J. (2014). A VIF-based optimization model to alleviate collinearity problems in multiple linear regression. Computational Statistics, 29(6), 1515–1541.

- Klapper, L. (2017). How digital payments can benefit entrepreneurs. IZA World of Labor.

- Lai, V. S., & Li, H. (2005). “Technology acceptance model†for internet banking: An invariance analysis. Information & Management, 42(2), 373–386.

- Liu, Y., Wang, M., Huang, D., Huang, Q., Yang, H., & Li, Z. (2019). The impact of mobility, risk, and cost on the users’ intention to adopt mobile payments. Information Systems and e-Business Management, 17(2-4), 319–342.

- Loewenstein, G. F., Weber, E. U., Hsee, C. K., & Welch, N. (2001). Risk as feelings. Psychological Bulletin, 127(2), 267–286.

- Madan, K., & Yadav, R. (2016). Behavioural intention to adopt Mobile Wallet: A developing country perspective. Journal of Indian Business Research, 8(3), 227– 244.

- Megadewandanu, S., Suyoto, & Pranowo. (2016). Exploring mobile wallet adoption in Indonesia using UTAUT2: An approach from consumer perspective. 2016 2nd International Conference on Science and Technology-Computer (ICST).

- Milly, N., Xun, S., Meena, M. E., & Cobbinah, B. B. (2021). Measuring Mobile Banking Adoption in Uganda using the “technology acceptance model†(TAM2) and perceived risk. Open Journal of Business and Management, 09(01), 397– 418.

- Neuburger, H. L. I. (1971). Perceived costs. Sage journals.

- Oliveira, T., Thomas, M., Baptista, G., & Campos, F. (2016). Mobile payment: Understanding the determinants of customer adoption and intention to recommend the technology. Computers in Human Behavior, 61, 404–414.

- Phuong, N. N., luan, l. T., Dong, V. V., & Khan, N. L. (2020). Examining customers’ continuance intentions towards E-wallet usage: The emergence of mobile. Journal of Asian Finance, Economics and Business, 7(9), 505–516.

- Pripp, A. H. (2015). Hvorfor p-Verdien Er Signifikant. Tidsskrift for Den Norske Legeforening, 135(16), 1462–1464.

- Rodrigues, C., Menon, A., Francis, J. G., & Haresh, R. (2021, October). Digital payments: India vs. China – an empirical study with the help of Tam. International Journal of Research in Engineering, Science and Management.

- Saeedi, T. A. (2019, October 7). World Bank sees Pakistan's digital finance potential at $36 Billion. The news.

- Sharma, G., & Kulshreshtha, K. (2019). Mobile Wallet Adoption in India: An Analysis. IUP Journal of Bank Management, 18(1),

- Sharma, S. K., Mangla, S. K., Luthra, S., & Al- Salti, Z. (2018, August 22). Mobile Wallet inhibitors: Developing a comprehensive theory using an integrated model. Journal of Retailing and Consumer Services.

- Shin, D. H. (2009). Towards an understanding of the consumer acceptance of Mobile Wallet. Computers in Human Behavior, 25(6), 1343–1354.

- Silva, P. (n.d.). Davis' “technology acceptance model†(TAM) (1989). IGI Global.

- Surendran, P. (2012). “Technology acceptance modelâ€: A survey of literature. International Journal of Business and Social Research.

- Taggart, T. (2022, February 18). Why mobile payments are important: Advantages of mobile payments. Citcon.

- The World Bank. (2017). The Global Findex Database. Home | Global Findex.

Cite this article

-

APA : Mahboob, F., Talpur, A. B., & Khaskhely, M. K. (2022). Investigating Factors Towards Adoption of Mobile Wallet Payment Services. Global Economics Review, VII(IV), 1-7. https://doi.org/10.31703/ger.2022(VII-IV).01

-

CHICAGO : Mahboob, Faraz, Arifa Bano Talpur, and Mahvish Kanwal Khaskhely. 2022. "Investigating Factors Towards Adoption of Mobile Wallet Payment Services." Global Economics Review, VII (IV): 1-7 doi: 10.31703/ger.2022(VII-IV).01

-

HARVARD : MAHBOOB, F., TALPUR, A. B. & KHASKHELY, M. K. 2022. Investigating Factors Towards Adoption of Mobile Wallet Payment Services. Global Economics Review, VII, 1-7.

-

MHRA : Mahboob, Faraz, Arifa Bano Talpur, and Mahvish Kanwal Khaskhely. 2022. "Investigating Factors Towards Adoption of Mobile Wallet Payment Services." Global Economics Review, VII: 1-7

-

MLA : Mahboob, Faraz, Arifa Bano Talpur, and Mahvish Kanwal Khaskhely. "Investigating Factors Towards Adoption of Mobile Wallet Payment Services." Global Economics Review, VII.IV (2022): 1-7 Print.

-

OXFORD : Mahboob, Faraz, Talpur, Arifa Bano, and Khaskhely, Mahvish Kanwal (2022), "Investigating Factors Towards Adoption of Mobile Wallet Payment Services", Global Economics Review, VII (IV), 1-7

-

TURABIAN : Mahboob, Faraz, Arifa Bano Talpur, and Mahvish Kanwal Khaskhely. "Investigating Factors Towards Adoption of Mobile Wallet Payment Services." Global Economics Review VII, no. IV (2022): 1-7. https://doi.org/10.31703/ger.2022(VII-IV).01