Abstract:

The present research examined those factors that affect gross savings in the developing economy of Pakistan. Data from the period of 11 years from 2010 to 2020 was gathered from secondary sources. The study found that the inflation rate has a negative and significant relation with gross savings. It is also found that the interest rate has a negative and significant relation with gross savings. We also found that openness to the economy has a positive and significant relation with gross savings. Implications, discussion and future directions are also highlighted.

Key Words:

Gross Savings, Inflation, Interest, Openness to Economy, Pakistan

Introduction

Pakistan's saving rate has remained very poor over the last two decades relative to other countries at comparable stages of growth. For the poor output of savings at the individual and government level in Pakistan, different variables such as cultural, economic and insecurity should be taken into account. A high preference for well-known consumption, the emergence of new consumption, is the primary explanation. Pakistan has a profound need to improve its manufacturing sector in general and economic development in particular. Unfortunately, in the recent past, this goal has not been able to step in the right direction, especially towards the development of industries and reliable capital markets that generate job opportunities and increase savings.

Pakistan is currently heavily dependent on foreign assistance because of a higher risk, which is why savings are challenging for individuals and organizations in Pakistan relative to other developed countries. As Uremadu (2007) pointed out, GDP growth per capita, the large-scale money supply has a positive effect on private savings, although the negative ratio of savings to real interest rates and inflation in Turkey is unfavourable. It is necessary for investors to research how gross savings in developed countries have an effect on micro, macro, overall economic growth and increase their savings either publicly or privately. The goal of this analysis is to examine the effect on gross savings of real interest rates, inflation, economic transparency. In the background of the Pakistani economy, this analysis is very important, since many factors are responsible for economic growth.

In Pakistan's jurisdiction, inflation and credit risk are increasing day by day, while savings will minimize this type of risk, as well as savings, encourage investment in physical assets that add stability to the economy in the form of an increase in the quality of living or economic development, as well as savings in defence spending.

Related Literature

Fatima (2010) compared savings and investment in Pakistan with other developing countries such as Bangladesh, China, India, Indonesia, South Korea and Malaysia. Her studies have shown that Pakistan has lower savings and consumption rates than other nations. Sawani and Patterson (2010) concluded that, in developed countries, low wages and lack of structured fiduciary might negatively affect the saving of households. Kibet, et al. (2009) conducted a survey in rural areas of the Nakuru district of Kenya to chart the determinants of the family saving. They found out that the income level, the profession of businessmen; the gender and schooling of individuals are positively linked to the saving behaviour of rural households, while credit availability, age and dependence ratio negatively affect the saving behaviour of households.

Howard, (1978) counted inflation, disposable per capita income, unemployment and interest rates among the determinants of the main saving in different countries. Alfaro, et al., (2006) Demonstrated that, in the case of developed countries, FDI has a little beneficial effect on the host country, both at micro and macro levels. Furthermore, they observed that FDI produces expert labor opportunities that minimize saving opportunities in developing countries, while local farmers involve the local population, which enhances the country's saving opportunities.

Khan et al. (1992) counted savings rates among the lowest in third world countries in Pakistan, indicating that the key determinants of Pakistan's national savings rate are real interest rate PCI, dependence ratio, and foreign capital inflows. Hallaq, (2003) established the effect on private savings as negative of reliance ratio, government savings and the ratio of public social security spending in Jordon and found an inverse relationship. Besides this, this study also mentioned that the rate of GDP expansion, the amount of GDP per capita, and the creation of the consumer credit sector to lift consumer credit bars are positively related to private savings. However, the actual interest rate, the inflation rate and terms of trade have had little effects on Jordan's private savings. Ahmed et al. (2015) conducted a study by using an annual data of 30 years from 1980 to 2010 on household savings and found that factors like inflation, GDP growth, interest rate and government expenditure are the main causes of household saving in Pakistan. Khan et al. (2017) explored the factors that affect domestic savings by using data from Pakistan, China, Russia, Singapore, Japan and Turkey. They selected annual data from the period from 1995 to 2016. Their findings suggest that factors like money supply (M2), per capita income, age dependency ratio, and GDP have positive and significant relation with household savings while factors like inflation, interest rate, and foreign direct investments have a negative association with domestic savings.

Babatund et al. (2007) examined the socio-economic and saving practices of cooperative farmers in South-West Nigeria in their study. They concluded that socio-economic characteristics might have an effect on farmers' saving habits. Interest paid as a determinant for preserving the actions of cooperative farmers was counted among other determinants. Wakita et al. (2000) concluded that the rise in income has a favourable relationship with the saving trends, whereas the number of dependents is likely to adversely impact the saving rate.

Shahbaz et al. (2008) agreed that trade openness negatively impacts economic growth while financial openness encourages economic growth, and also observed that inflation and economic growth are inversely associated with gloomy effects on savings in a nation. Sinning (2007) conducted an analysis in Germany to examine the importance of migrant returns to their home country. Jappelli and Pagano (1997) published a report on savings determinants in Italy, indicating a clear positive association between income growth and savings. "Productivity stagnation, timid reform of the loan and insurance markets, and improvements in the social security sector" were the main determinants of Italian private saving and development rates.

Shaikh, Chema and Shaikh, (2013) explored the determinants or causes of national saving by taking Pakistan as a sample. To check this scenario, data from 1973 to 2011 was collected from secondary sources like SBP, economic survey of Pakistan, yahoo finance and world bank. ECM and Jhonsen Co-integration tests were applied to check desire objectives. They found that factors like inflation, fiscal deficit and GDP play a vital role in determining country saving. Furthermore, they concluded that instead of only inflation, the remaining variables have positive and significant relation with national saving in the short run. Asghar and Nadeem (2016) examined saving behaviour in the Pakistani context. They checked the long and short-run causal relationship between saving factors and national approach by choosing data from 1984 to 2014. The results of both VECM and Jhonsen Cointegration models shows that factors like population, foreign remittance and economic stability positively determine national savings while factors like inequity in income and unstable government negatively determine savings in the Pakistani context. In certain variables, there exists bidirectional causality like inequality in income and population size, and inequality in income and government savings, while in certain variables there is a unidirectional relationship like savings and population size, and foreign remittance and savings.

In the same vein, Chudary et al. (2014) explored the monetary and fiscal factors that affect the national savings by applying Jhonsen Co-Integration and ARDL approach. To test the stated hypotheses, data were collected from secondary sources from 1972 to 2010. Monetary factors were measure through certain determinants like inflation rate, M2, deposit rate, budget deficit and government expenditures. Based on the results they have drawn from ARDL and ECM, they found that in a short run factors like government expenditures, inflation rate, and deposit rates have a positive impact on country savings. Moreover, M2 has a significant but negative relationship with country savings. Based on their study results, they concluded that financial institutions need to take struck actions to regularize the operation smoothly and increase national savings. Earlier in 2010, Choudary et al., also study the same phenomenon by exploring the short and long-run determinants of national savings in the context of Pakistan. To check the desire objectives, they collect the data from 1972 to 2008. Though Jhonsen Cointegration and VECM they found that factors foreign remittance, interest rate, consumer price index, and public loans have positive long-run relation whit national savings, while factors like interest rate and foreign remittance have a positive influence on savings in the short run.

Edwards (1995) distinguished between private and public savings determinants. He listed demographic variables, social security spending and the depth of the financial sector as determinants of private savings, while government savings are influenced by other determinants that do not affect private savings. Countries with political stability would see more public savings relative to those with an uncertain political climate, a decrease in spending and a rise in the savings of retirement households with a life-cycle model, with the systemic introduction of unanticipated negative knowledge decreasing demand and rising savings. The household sector has a larger role to play in supplying liquidity to the country economy. Thus, based on the cited literature, we proposed that:

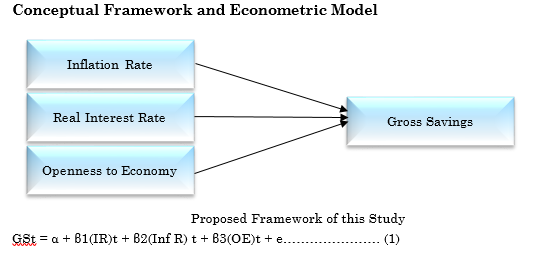

H1: Inflation has a significant relationship with gross savings

H2: Openness of the economy has a significant relation with gross savings

H3: Real interest rate has a significant relationship with gross savings

Methodology

Sampling and Data Collection

The used in the current study was collected from different sources, e.g., State Bank, World Bank, Yahoo Finance and Economic Survey of Pakistan for a period of ten years from 2010 to 2020. We selected this period as the data of the selected variables are available on these websites.

Statistical Tools

Different econometric tests like descriptive statistics, regression and correlation were applied in Eviews 7 for testing the study hypotheses. Inflation was measured through the consumer price index (CPI).

Results Table 1. Descriptive Statistics

|

|

GS |

Infan |

RIR |

OOE |

|

Mean |

24.6 |

9.4 |

4 |

36.4 |

|

Mode |

22 |

13 |

1 |

34 |

|

SD |

3.4 |

4.2 |

4.8 |

3.3 |

|

Min |

16 |

03 |

-03 |

26 |

|

Max |

26 |

18 |

19 |

37 |

Table 1 reports the descriptive statistics of the study variables. As depicted, GS has a minimum value of 16 and a maximum value of 26 per cent to GDP between 2010-2020. Similarly, the minimum value of the inflation rate is 03 per cent, and the maximum value is 18 per cent from 2010-2020. The higher value of the inflation rate was found during the crises period. Further, the minimum value of the interest rate was found -3 per cent, and the maximum was observed at 19 per cent during the study period. Similarly, the minimum value of openness to the economy was found 26 per cent, and the maximum was observed 37 per cent during the study period. The mean value of gross savings is 24.5, CPI is 9.4, the interest rate is 4, and openness to the economy is 36.4 per cent, respectively. Similarly, the standard deviation value of gross savings is 3.4, CPI is 4.2, the interest rate is four and openness to the economy is 3.3, respectively.

Table 2. Model Summary

|

R |

R2 |

Adj.R2 |

Std. Error |

|

.542 |

.267 |

.226 |

3.41 |

The model summary of the study variables, i.e.,

gross savings, inflation rate, interest rate and openness to the economy is

highlighted in Table 2. The value of R2 is .267, indicating that all three

variables, i.e., inflation, interest and openness to economy explain 26.7%

variance in the dependent variable gross savings.

Table 3. ANOVA

|

|

Df |

SS |

MS |

F |

Sig. F |

|

Regression |

3 |

.305 |

.034 |

5.62 |

.005 |

|

Residual |

8 |

.051 |

.006 |

|

|

|

Total |

5 |

.351 |

|

|

|

Table 3 depicted the ANOVA statistics of the study

variables. The most important values in this table are F and Sig. F. To

confirmed whether the existing model is fit or not, we may decide on these two

values. Here the value of F is 5.62, which is good and also significant,

indicating that the model we used in this study is fit.

Table 4. T-Statistics and P-Value

|

variables |

t-stat |

p-value |

|

Constant |

3.265 |

0.421 |

|

CPI |

-4.194 |

.004 |

|

Inf. R |

-3.621 |

.005 |

|

Op. Econ. |

4.236 |

.000 |

The regression coefficients are reported in Table 4. It is evident that CPI has a negative and significant relation to gross savings. It means that when the inflation rate in the country is high, the savings of the household will be a minimum point. Similarly, the interest rate has a negative but significant relationship with gross savings. Thus, increase in interest rate may also bring negative changes in the gross household savings. However, it is also found that openness to the economy has a positive and significant relation with gross savings. Thus, when the country broader their economy through different techniques like attracting FDI, expansion in the existing economy etc. has affected the overall savings on people of the country.

Discussion

The regression study has shown that inflation and gross savings have no or insignificant relationship. Interest rate also has a negative relationship with gross savings in Pakistan. On the other hand, openness to the economy has a positive and significant relation with gross savings. Pakistan is dependent on foreign assistance and debt, and the country's interest payments raise rates by introducing tariffs, reducing subsidies etc. The results of the current research are consistent with Khan et al. (2017) as they also find a negative association among interest rate, inflation rate and domestic savings. Our results are also consistent Ahmad et al. (2015) as they studied the Pakistani economy and found the same findings. The results of the current study are also consistent with Babatund et al. (2007) as they found that both inflation and interest rates have a negative association with gross savings in Nigeria. Similarly, Shahzad et al. (2008) have the same conclusion as the current research have. This is confirmed from the results of the current study and past findings that domestic savings are decreases with the increase in inflation rate and interest rate.

Conclusion and Recommendations

The current was an attempt to investigate factors that affect gross savings in the context of Pakistan. An annual data from 2010-2020 was collected for this purpose from different sources like State Bank of Pakistan, World Bank and Yahoo finance. After confirming all the assumptions of regression model, we apply regression analysis and found that inflation and interest rates have a negative and significant association with gross savings while openness to the economy has a positive and significant relation with gross savings. It is concluded that government should redesign their policies and make it possible to provide a stable interest rate and inflation rate to the economy. It will help the local community to boost their savings. Abrupt and insignificant variation in the interest rate or inflation rate may cause losses in the savings of the people of the country. We also concluded that openness to the economy has a positive and significant relationship with domestic savings. Thus, the government should revisit its economic policy and try to expand its economy through different sources that make able local communities save more.

Limitations and Future Directions

Besides this effort, there are many limitations of the study as well. First, we only choose three factors that affect gross savings; however, there are other factors that may also affect gross savings. Future researchers are welcome to check the effect of all possible indicators of gross savings. Second, our sample size is very small, i.e., ten years. In future, the same study will be replicated with huge sample period will give a clearer picture. Lastly, we choose the sample from developing economy, i.e., Pakistan, where the economic condition of country and household is not well, and minor interruption in the micro and macro-economic variables resulted in a huge effect. Thus, researchers are encouraged to check these variables in a developed economy and compared it with the existing study.

References

- AbuAl-Foul, B. (2010). The Causal Relation between Savings and Economic Growth: Some Evidence from MENA Countries, E6, E2, O2, 10(1),1-12.

- Ajmi, A. N., El Montasser, G., & Nguyen, D. K. (2013). Testing the relationships between energy consumption and income in G7 countries with nonlinear causality tests. Economic Modelling, 35, 126-133.

- Ayalew, A. (2013). Determinants of domestic saving in Ethiopia: An autoregressive distributed lag (ARDL) bounds testing approach. Journal of Economics and International Finance, 5(6), 248-257.

- Chaudhry, I. S., Faridi, M.Z., Abbas, M., and Bashir, F. (2010). Short Run and Long Run Saving Behavior in Pakistan: An Empirical Investigation. Journal of Money, Investment and Banking, 16, 57-66.

- Chinn, M. D., and Prasad, E.S. (2003). Medium-term determinants of the current account in industrial and developing countries: an empirical exploration. Journal of International Economics, 59(1), 47-76.

- Chowdhury, R. A. (2005). Private Savings in Transition Economies: are these terms of trade shocks. Institute for Economics in Transition.

- Dickey, D. and W. A. Fuller, (1981.)

- Davidson, R. and Mackinnon, J. G. (1983). Inflation and the Savings rate. Applied Economics, 15(6), 731-743.

- Dirschmid, W. and Glatzer, E. (2004). Determinants of the household saving rate in Austria. Monetary Policy & The Economy, 4(4):25-38.

- Dollar, D. and A. Kraay (2002). Growth is Good for the Poor. Journal of economic growth 7(3): 195-225.

- Domar, E.D. (1946), Capital Expansion, Rate of Growth, and Employment, Econometrica 14: 137- 147.

- Easterly, W. (1999). Life during growth. Journal of economic growth, 4(3): 239-276.

- Edwards, S. (1996). Why are Latin America's savings rates so low? An international comparative analysis. Journal of Development Economics, 51(1), 5-44.

- Enders, W. (1995). Applied Econometric Time Series. New York: John Wiley & Sons Inc.

- Fajnzylber, P., D. Lederman, et al. (2002). What causes violent crime? European Economic Review, 46(7): 1323-1357.

- Farhan, M. and Akram, M. (2011). Does income level affect saving behavior in Pakistan? An ARDL approach to Co-integration for empirical assessment. Far East Journals, 3(3):62-71.

- Friedman, M. (1957). A Theory of the Consumption Function. Princeton University Press. Govt. of Pakistan, (2010-2011), Pakistan Economic Survey, Ministry of Finance, Islamabad. Govt. of Pakistan, Hand book of statistics (2010-11), State Bank of Pakistan.

- Gedela, S. P. R. (2012). Determinants of saving behaviour in rural and tribal households: An empirical analysis of Visakhapatnam District). International 53 Journal of Research in Social Sciences,2(3):108-128.

- Ghatak, S., & Siddiki, J. (2001). The use of ARDL approach in estimating virtual exchange rates in India. Journal of Applied Statistics, 11, 573- 583.

- Gujarati, D. N. (1995). Basic Econometrics. New York: Mc. Graw Hill, Inc. 3rd Edition.

- Pesaran, M. H., Shin, Y., & Smith, R. J. (2001). Bound testing approaches to the analysis of level relationships. Journal of Applied Econometrics, 16, 289- 326.

- Harrod, R.F. (1939). An Essay in Dynamic Theory. Economic Journal, 49: 14-33.

- Hasnain, (2006). The impact of demography, growth and public policy on household savings: A case study of Pakistan. Asia Pacific Development Journal, 13(2), 57- 71.

- Horioka, C. Y. and Wan, J. (2007). The determinants of household saving in China: A dynamic panel analysis of provincial data. Journal of Money, Credit and Banking, 39(8):2077-2096.

- Household, E., Rates, S., Publishing, O., Hufner, F., & Koske, I. (2010). Explaining Household Saving Rates in G7 Countries. OECD Economics Department Working Papers, (754).

- Hüfner, F. and I. Koske (2010). Explaining Household Saving Rates in G7 Countries.

- Jangili, R. (2011). Causal relationship between saving, investment and economic growth for India- what does the relation imply? Reserve Bank of India Occasional Papers, 32(1):25-39.

- Jappelli, T. and Pagano, M. (1994). Saving, growth, and liquidity constraints. The Quarterly Journal of Economics, 109(1):83-109.

- Johansen, S., Juselius, K., (1990). Maximum likelihood estimation and inference on cointegration - with application to the demand for money. Oxford Bulletin of Economics and Statistics 52,169-210.

- Kazmi, A. (1993). National Saving Rates of India and Pakistan: The Macro econometric Analysis. The Pakistan Development Review, 34: 1313-1324.

- Khan, A. H., Hasan, L., Malik, A. and Knerr, B. (1992). Dependency ratio, foreign capital inflows and the rate of savings in Pakistan. The Pakistan Development Review, 31(4):843-856.

- Khan, Z., A. Ullah, et al. (2009). Intra Rural Regional Difference In Household Savings: Empirical Evidence From Three Rural Areas of District Karak (Pakistan). Abasyn University Journal of Social Sciences 3(2): 74-78.

- Kibet, L. K., Mutai, B. K., Ouma, D. E., Ouma, S. A. and Owuor, G. (2009). Determinants of household saving: A case study of smallholder farmers, entrepreneurs and teachers in rural areas of Kenya. Journal of Development and Agricultural Economics, 1(7):137-143.

- Leibenstein, H. (1957). Economic backwardness and economic growth.

- Levine, R. and D. Renelt (1992). A sensitivity analysis of cross-country growth regressions. The American Economic Review: 942-963

- Lewis, W.A. (1955). The theory of economic growth. Homewood, NJ: Richard D. Irvin. Mahlo, N. (2012). Determinants of household savings in South Africa. University of Johannesburg: 1-73.

- Malik, M.A., and Baharumshah , A.Z., (2007).Savings and Development, 31(4), 399-417 Malthus, T. (1820) Principles of Political Economy (London: J. Murray).

- Marashdeh, H., & Saleh, A. S. (2006). Revisiting budget and trade deficits in Lebanon: A critique. Economics working Paper Series 2006 (WP 06-07), April, University of Wollongong Australia. l Accessed 05.09.06.

- Masson, P. R., Bayoumi, T. and Samiei, H. (1998). International evidence on the determinants of private saving. The World Bank Economic Review, 12(3):483- 501.

- Misztal, P. (2011). The relationship between savings and economic growth in countries with different level of economic development. Financial Internet Quarterly, 7(2), 17-29.

- Modigliani, F. (1966). The Life Cycle Hypothesis of Saving, the Demand for Wealth and the Supply of Capital. Social Research, 3, 160-217; and Collected Papers of Franco Modigliani. Vol. 2. Andrew Abel, ed. Cambridge Mass., MIT Press. 1980. pp. 323-81.

- Nasir, S., Khalid, M. and Mahmood, A. (2004). Saving-investment behaviour in Pakistan: An empirical investigation. The Pakistan Development Review, 43(4):665-682.

- Orbeta, A. C. (2006). Children and household savings in the Philippines: Philippine Institute for Development Studies. Discussion Paper Series No. 14:1-22.

- Ozturk, I., (2010). A literature survey on energy-growth nexus. Energy Policy 38 (1), 340-349.

- Ozturk, I., Aslan, A., & Kalyoncu, H. (2010). Energy consumption and economic growth relationship: Evidence from panel data for low- and middle-income countries. Energy Policy, 38(8), 4422-4428.

- Pahlavani, M., Wilson, E., & Worthington, A. C. (2005). Trade-GDP nexus in Iran: An application of the autoregressive distributed lag (ARDL) model. Faculty of Commerce Papers, University of Wollongong, Australia. Accessed 05.09.06

- Payne, J.E., (2010). Survey of the international evidence on the causal relationship between energy consumption and growth. J. Econ. Stud. 37 (1), 53-95.

- Pedroni P. (2004),

- Pesaran, M. H., & Shin, Y. (1997, January). An autoregressive distributed lag modelling approach to cointegration analysis. England: University of Cambridge.

- Pesaran, M. H., Shin, Y., & Smith, R. J. (2001). Bound testing approaches to the analysis of level relationships. Journal of Applied Econometrics, 16, 289-326.

- Pesaran, M. Pesaran, M. H., & Smith, (1998). Structural analysis of cointegration VARS. Journal of Economic Surveys, 12(5), 471-505.

- Phillips, P.C.B., Perron, P., (1988). Testing for a unit root in time series regression. Biometrika 75, 335-346.

- Samantaraya, A., & Patra, S. K. (2014). Determinants of Household Savings in India: An Empirical Analysis Using ARDL Approach, Economics Research International 1-(8), 2014.

- Shahbaz, M., Ahmad, K. and Chaudhary, A. (2008). Economic growth and its determinants in Pakistan. The Pakistan Development Review, 47(4):471-486.

- Shahbaz, M., Ahmad, N. and Wahid, A. N. (2010). Savings-investment correlation and capital outflow: The case of Pakistan. Transition Studies Review, 17(1):80-97.

- Shaheen, S., M. M. Ali, et al. (2013). Impact of Foreign Capital Inflows on Domestic Saving of Pakistan. Interdisciplinary Journal of Contemporary Research in Business 4(10): 443.

- Shaikh, S. (2012). Consumption & Savings behavior in Pakistan. Munich Personal RePEc Archive, MPRA Paper No. 42496.

- Sheng, L. (2015). Theorizing global imbalances: a perspective on savings and inequality. Cambridge Review of International Affairs, 28(2), 191- 204.

- Shrestha, M. B., & Chowdhury, K. (2005). ARDL modelling approach to testing the financial liberalization hypothesis. Economics Working Paper Series 2005 (WP 05-15). Australia: University of Wollongong, June. Accessed 20.11.06.

- Siddiqui, R., R. Siddiqui, et al. (1993). Household Saving Behaviour in Pakistan [with Comments]. The Pakistan Development Review: 1281-1292.

- Sinha, D. (1998-99), The role of saving in Pakistan's economic growth. Journal of Applied Business Research, 15, 79-85.

- Sirisankanan, A. (2015). Risk, Uncertainty and Consumption - Smoothing Mechanisms Evidence from Thai Household Socio-Economic Panel Data, 32(1), 163-180.

- Solow, R. M. (1956). A contribution to the theory of economic growth. The quarterly journal of economics: 65-94.

- Soytas, U., & Sari, R. (2006). Energy consumption and income in G-7 countries. Journal of Policy Modeling, 28(7), 739-750.

- Tang, T. C. (2003). Japanese aggregate import demand function: Reassessment from ‘bound' testing approach. Japan and the World Economy, 15(4), 419-436.

- Teshome, G., Kassa, B., Emana, B. and Haji, J. (2013). Determinants of rural household savings in Ethiopia: The case of east hararghe zone, Oromia regional state. Journal of Economics and Sustainable Development, 4(3):66-75.

- Unny, C. J. (2012). Determinants of savings of rural households in Kerala. Money and Finance Conference, 5th:1-29.

- World Bank, (2015). World Development Indicators.

- Xu, Y. (2012). Demographic changes, household savings and economic growth in all China: A timeseries approach. School of Economics and Management, Lund University:1-44

Cite this article

-

APA : Pervez, H., & Khan, R. (2020). Determinants of Gross Saving: Evidence from Pakistan. Global Economics Review, V(I), 276-285. https://doi.org/10.31703/ger.2020(V-I).23

-

CHICAGO : Pervez, Hira, and Rashid Khan. 2020. "Determinants of Gross Saving: Evidence from Pakistan." Global Economics Review, V (I): 276-285 doi: 10.31703/ger.2020(V-I).23

-

HARVARD : PERVEZ, H. & KHAN, R. 2020. Determinants of Gross Saving: Evidence from Pakistan. Global Economics Review, V, 276-285.

-

MHRA : Pervez, Hira, and Rashid Khan. 2020. "Determinants of Gross Saving: Evidence from Pakistan." Global Economics Review, V: 276-285

-

MLA : Pervez, Hira, and Rashid Khan. "Determinants of Gross Saving: Evidence from Pakistan." Global Economics Review, V.I (2020): 276-285 Print.

-

OXFORD : Pervez, Hira and Khan, Rashid (2020), "Determinants of Gross Saving: Evidence from Pakistan", Global Economics Review, V (I), 276-285

-

TURABIAN : Pervez, Hira, and Rashid Khan. "Determinants of Gross Saving: Evidence from Pakistan." Global Economics Review V, no. I (2020): 276-285. https://doi.org/10.31703/ger.2020(V-I).23