Abstract:

This study determines the effect of parameters used for cash holding in hospitality sector (HS) of target countries i-e France, Spain and United State of America for the period of 14 years (2005-2018). The parameters consist of firm size, leverage, capital expenditure, growth opportunity, liquidity, cash flow, cash flow volatility, asset intangibility, dividend payments and stock exchange. Dynamic panel data is employed for empirical estimation i-e Generalized Method of Moments (GMM). System GMM model estimation reveals that leverage, cash flow volatility and asset intangibility influence cash holdings positively while size, capital expenditure, growth opportunities and cash flow affect cash holdings negatively

Key Words:

Cash Holdings, Hospitality, Unique Attributes

Introduction

Global Economy Watch (PWC, 2019) shows the uncertainties in Economics and Political issues, which impact the decision maker policy in US, Spain and France. When there is high fluctuation in a countries then these uncertainties also affect the share holder as well as investors investment policy which cut back the employees, its reduce level of productions and investment decision in advance projects, The important issue related to measure uncertainty which exist in countries, prior literature used various methodologies to measure the level of uncertainty such as Stock market fluctuation risk, geographical risk, political risk and economic growth risk. Garcia-Gomez et al (2020). Due to resurgence of all over the world raised capital market competition and uncertainty especially in developed countries, the holding of cash is at that moments were become least crucial because organizations may easily raise capital to invest in any advance projects at a very less cost of interest. But after laps of few years, financial market raises their obstacle which was very severe to gain the funds from the capital markets for investors especially for small and medium entrepreneurships. So, in this condemning situation holding of cash is very mandatory because cash provides the opportunity to invest in advance projects. Moreover, cash helps to meets its day to day transactions and also to overcome the menace arising of unpredictable events. For example, kalcheva et al., (2007) describe that firms might retain 16% of cash reserve out of total assets. Ozkan and Ozkan (2004) found that an ordinary cash reserve is 14% in UK companies. While studying a sample of 15 developed countries, Ferreira & Vilela (2004) found that the cash ratio is 15% respectively. Moreover, Ditmar et al., (2003) determined that level of cash reserves is 13% in 45 sample countries, while Al-Najjar & Belghtar (2011) accomplished that firm should maintain 9% in liquid cash. The holding of cash protects the companies from financial distress (Opler et al, 1999). Cash is retained by companies for different issues such as enhancement of existing infrastructure, distribution of company income to investors, repurchase of other companies share and other valuable instruments, and also to deal with unpredictable events (Mohsin 2016).

The hospitality sector (HS) holds the unique attributes which help to investigate corporate theories and practices (Ahmad and Adaoglue, 2018). The HS bears capital intensity, competitiveness, more risk, and leverage (Singal, 2015). Exploring the HS and its subsector, Ahmad and Adaoglu (2018) have explored cash management for the United Kingdom only. However this study investigates the factors affecting cash holdings of HS firms for the top three tourism destinations in the world i-e France, Spain and then United States of America (USA).

Underlying Theories

The underlying theories are as follows:

Trade-off Theory

Trade off theory postulate that the main priority of Top Management is to maximize the wealth of investor through acquiring funds by measuring cost and benefits (afza and adnan 2007). Ferriera and vielela (2004) derived three advantages from holding cash. Firstly, its minimize financial distress, secondly, gain the opportunity for investment in advance projects, and the last advantage is reduce the transaction cost which raising funds from external financial market. Holding of transaction and precautionary cash results in minimizing the chances of bankruptcy and also helps to avail high growth opportunities, while external financing companies may not easily avail such opportunities due to financial barriers (Guizani, 2017). Two motives are imperative i.e., Transactions motive and precautionary motive, which actually explains the trade off theory. According to transaction motive, the companies need to keep cash to curtail the cost of getting expensive external finances (Dittmar and Smith, 2003). Transaction motive are less beneficial when firm is suffered with the shortage of internal source funds instead they utilize the external source of fund to paid both variable and fixed cost (opler et al (1999).

Moreover, according to precautionary motive, keeping cash helps to make payments in time and helps to avoid financial crisis if any (Opler et al. 1999).

Pecking Order Theory

Under this theory which is express by Myer and Majluf(1984) stated that a SME (Small and Medium enterprises) even Large cap organization is also provide an option for raising a funds in a optimal level for investment in advance technological projects. The most important aspect of this expression is that the top Management has deeper knowledge about its value and potential investors Magerankis (2015). So, in this regard a firms reduce the asymmetric information when use a specific hierarchical model. Hierarchical model obviously prefer internal source of funds to mitigate external source of funds. Hierarchical model ranking is firstly from their retain earning, afterward safe banks debts, then riskier bank debts and the last option is equities. External funds are very expansive for the firms as compare to financing from internal source of fund (Ferreira and Vilela, 2004). To minimize high interest payment cost, firms will prefer to operate in internal resource to finance any advance projects (Ferreira and Vilela, 2004). In panel data analysis various scholars result oriented which shows negative relationship between growth opportunity and leverage, except in Malaysia and China. Companies with high investment opportunity i-e Airlines, Restaurants and Recreational activities required high capital intensive will obviously access to financial market. Mostly profitable companies use house in funds as compare external funds which increase sales of a company Vatavu (2012)

Free Cash Flow Theory

According to this theory retained of reserve funds will reduce the under pressure management team to improve its productivity and create high fluctuation in utilization of funds for various advance projects but some time with high reserve funds, top managements increase the number of asset under their control and also be in command of investment decisions of a firm, thus using it for the personal motives (Jenson in 1986). In this regard the Top management undertakes advance projects without reporting to Shareholder and investors (Abbas ali, 2013).

Literature Review and Development of Hypotheses

Firm size is an imperative variable of firm that effect cash holding. Under the traditional point of view settle cash on the optimal level (Baumol, 1952, Millar et al., 1966). The proxy is used for asset is natural log of total assets. Prior literature studies that either economies of scale is exist or not in cash transaction (Frazer 1964, Vogel et al., 1967, and opler et al., 2007). Further added that larger firms suffer less of external financing and hold low level of liquidity kim et al. (1998). Large firms obtain cash in easier and cheaper way (Bigolli & Sanchoz vidal, 2012). Firms larger in size of Hospitality sector such as Airlines and Restaurants raise high capital easily from market than smaller ones (Peterson and Rajan, 2002). Firms bigger in size (large cap firms) are more diversified than SME (small and medium enterprises) and hence face less financial distress (Al-Najjar and Belghitar, 2011). It is further added that such big firms gain financial support or access to financial market easily and hence need to hold less cash, which may not be the option for smaller ones firms (ferri and Jones 1979). The hypothesis generated is given here:

H1: A negative relationship between firm size and cash holdings is expected.

According to the trade off theory argued that high debts firms have a chance of financial distress whereas, companies retain precautionary motives cash can divert bankruptcy (Al-Najjar & Balghitar). Those firms hold less cash who posses the ability to access the debt markets with ease (D’Mello et al., 2008). Companies having leverage are closely monitored by lending entities and therefore hold less cash (Ferreira and Vilela, 2004). Leveraged firms facing more risk of default hold more cash (Islam, 2012) and supports the trade off theory. The hypothesis proposed is given here:

H2: A negative relationship between leverage and cash holdings is deemed.

Capital intensiveness is one of the key characteristics of hospitality sector (Singal, 2015). Those profitable firms having easy and cheap access to debt markets need to hold less cash (Maheshwari and Rao, 2017). On the other hand, supporting the trade off theory, excess capital expenditure will confront the company to financial insolvency, therefore firms should retain excess cash reserve (Riddick and Whited, 2009). As a result, those companies which may easily obtain the capital from financial market will retain very less cash. Then the following hypothesis is developed:

H3: A negative association between capital expenditure and cash holdings is deemed.

Trade-off theory shows that corporations amass cash to take on new project ventures, thereby saving the related opportunity costs (Uyar and Kuzey, 2014). The pecking-order theory shows that firms hold cash to overcome the adverse selection costs arising from getting finances from other sources and therefore suggests a positive relation between growth opportunities and cash holdings. The hypothesis developed is as follows:

H4: A positive association between growth opportunities and cash holdings is deemed.

According to tradeoff theory, liquidity affects cash holdings negatively. The liquidity refers to the assets which are more liquid in nature and act as an alternate to cash (Al-Najjar and Belghitar, 2011), thereby reducing the cost of capital (Al-Najjar, 2013). Bates et al. (2009) recommended that liquidity consists of assets which act as an alternate source of cash for emergency and hence such companies amass less cash. The hypothesis generated is as given:

H5: A negative association between liquidity and cash holdings is deemed.

Cash flow is a liquid source which minimizes need for holding cash (Ferreira & Vilela 2004). Trade-off theory shows that cash flows affect holdings of cash in a negative way, while pecking-order theory predicts a positive relationship between the two. On the other hand, following the influx of cash flows, firms have a tendency to amass cash (Drobetz and Grüninger, 2007) to save more (Lian et al., 2011). The developed hypothesis is as under:

H6: A positive relationship between cash flows and cash holdings is deemed.

In cash holding’s studies, intangible assets are of considerable importance (Antonio et al., 2013). Trade off theory shows that intangibility of assets affects holding of cash positively (Antonio et al., 2013). The features of intangible assets i.e., less collateral, elevated information asymmetry and unpredictable liquidation value mitigate the borrowing potential of firms (Williamson, 1988), thereby keeping high cash. The hypothesis proposed is as follows:

H7: A positive relationship between asset intangibility and cash holdings is deemed.

According to trade-off theory, firms with high variation in cash may face the menace of cash shortage (Ozkan and Ozkan, 2004). Therefore, such firms need to compile to overcome the deficiency. Firms tend to lose profitable investment avenues due to fluctuation in their cash flows (Minton and Shrand, 1990). Contrary to the above discussion, cash flow volatility also affects cash holdings negatively (Paskelian, Bell and Nguyen, 2010). The following hypothesis is given:

H8: A positive relationship between cash flow volatility and cash holdings is deemed.

Companies with stable dividend payment policy obtain finances easily and hold less cash (Al-Najjar and Belghitar, 2011). Companies keep more cash in pursuit of stable dividend policy (Maheshwari and Rao, 2017). A dividend dummy variable (DD) is used to capture this relationship. The hypothesis developed is as given:

H9: A positive relationship between cash holdings and dividend payment dummy is deemed.

Stock exchange Dummy (SX) analysis includes those HS firms registered in stock exchange of France, Spain and US. Those firms which are registered on stock exchange of France and Spain keep less cash as compare to New York stock exchange of US, because these companies are bigger in size may easily access to financial market at a low cost of transaction (Ahmad & Adaoglue, 2018). The hypothesis generated is as given:

H10: A positive relationship between cash holdings and the stock exchange dummy is deemed.

Regressend

Cash and its equivalent (Regressend variable) is just like blood in organization and ready available source for utilization of obligation to sustain its day to day operations activities within a hospitality sector such as small, medium and large caps companies in USA, France and Spain. Hence if a company does not meets its obligation which leads to bankruptcy sooner or later. In this regard it is very important tools to retain some portion of liquid asset in any source i-e commercial paper, Treasury bills, Cash ration is cash and its equivalent divided by Total asset. According to rules ratio of cash increases grasp more on holding cash and vice versa.

Methodology Data, Sample and Descriptive Statistics

Data has been accumulated from the target regions i.e, France, Spain and USA for the period of 2005 to 2018 from the Thomson Reuters Data stream. 2005 was preferred as a base year due to Industrial Classification Benchmark (ICB) which is globally adopted as a symbols of standards for segregation of industrial sectors;. Total 146 companies are obtained from Hospitality sectors. Further covering the time specified effect i-e 2008-09 integrated the global financial crises which are serving the purpose of capturing the time effect of target countries. In Table 2 descriptive statistics indicate that leverage and liquidity are debt intensive and liquidity constraints in HS of target countries. I-e USA, France and Spain.(Singal, 2015) , Ahmad and Adaoglu (2018) .

Table 1. Descriptive Statistics

|

Variable |

Mean |

Median |

SD |

Min |

Max |

|

CS |

0.889 |

0.639 |

1.951 |

0.000 |

7.486 |

|

SZ |

5.575 |

5.725 |

1.355 |

0.477 |

8.060 |

|

LR |

0.919 |

0.619 |

2.561 |

-0.688 |

67.96 |

|

CX |

0.067 |

0.049 |

0.0691 |

0.000 |

00.79 |

|

GO |

7.067 |

1.890 |

36.982 |

-103.0 |

830.7 |

|

LQ |

-3.640 |

-0.071 |

34.248 |

-572.09 |

0.910 |

|

CF |

0.174 |

0.961 |

0.531 |

-537.00 |

10.41 |

|

CFV |

0.180 |

0.074 |

00.822 |

-0.525 |

13.40 |

|

NT |

2.269 |

0.121 |

19.860 |

0.000 |

475.3 |

|

DD |

0.547 |

1.000 |

0.497 |

0.000 |

1.000 |

|

SX |

0.277 |

0.000 |

0.448 |

0.000 |

1.000 |

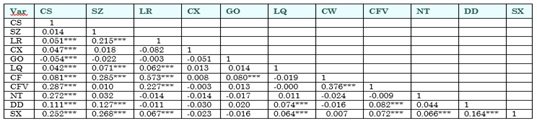

In Table 2 show the descriptive statistics which consist of regressend and regressor. The proxy for regressand i.e., cash holdings is Cash & Cash equivalent/Total assets (TA) while regressors i.e., prozy of SZ is natural Log of Total Assets, proxy of LV is Total liabilities to TA, proxy of CX is Capital Expenditure to TA, proxy of GO is Market to Book Value (MTBV), proxy of LQ is Net working Capital minus Cash to TA, proxy of CF is Operating cash flow to TA, proxy of CFV is Standard deviation of cash flow to TA. NT is measured as Intangibles asset to TA, DD is used as dummy variable if a company’s regularly pay dividend will be equal to 1 otherwise 0, similarly if a company’s registered in New York stock exchange will be 1 otherwise 0. Table 3 portrays the Pearson Correlation matrix among the variables. The value less than 0.8 (rule of thumb) confirms absence of multicollinearity among the variables.

Econometric Model

The Dynamic unbalance panel data estimator i-e generalized method of moments (GMM) is employed by (Arellano & Bond,1995) and further augmented by (Roodman 2009) In this study (Roodman 2009) has been adopted the xtabond2 commands in Stata for consistent estimation result. The main aim of GMM estimation is to counter the endogeneity problem which is deducted during diagnostic test from Durbin-Wu-Housman test where p-value is (0.000. The imperative cause of endogeneity happened due to following grounds. 1). Omitted variable, simultaneity and measurement error. The GMM methodology beaten the endogeneity problem by fitting is an instruments. During estimation process lagged of cash and its equivalent was used “dependent variable” as a instruments. Further positve lagged cash shows that prior-year cash holding is having a significant positive impact on current years. Other main features of GMM includes encounter the problem of autocorrelation by gaining well-organized result (Wooldridge, 2001), It’s also deal with the heteroscedasticity problem by allowing orthogonal condition for efficient estimation Bawm, Schaffer & stillman (2002)

Given below is the estimated model:

CSi,t= ? + ?0CSi,t-1+ ?1SZi,t+ ?2LRi,t+ ?3CXi,t+ ?4GOi,t+ ?5LQi,t+ ?6CWi,t+ ?7NTi,t + ?8CFV+ ?9DDi,t + ?10SXi,t +?i +?t+ ?i,t (Equation 1)

Whereas ?i and ?t shows both the industry and time dummy regressor and ?i,t is showing the error term. arise due to observe shocks.

Empirical Results

Two model within GMM estimation is used i-e Model 1 estimated without dummy variable while Model 2 were being estimated for including both the dummy variables such as sub-sector dummy variables and time dummy variables. Time dummy is used to reveal the financial crises era i-e 2008-09 while sub-sector dummy variables are used to show the subsector’s cash holdings effect. Table 3 shows the estimated results.

Firm size indicates a negative relationship with holding of cash which describes that as firm size increases, the holding of cash decreases due to larger ownership structure. Raja & Zingale (1995) argued that larger firms have advance growth opportunity for installation of sophisticated technology to reduce the cost of capital. Further (Ferriera & Vilela 2004) determine that rising of fund is more complicated for

smaller ones and as they cannot access the capital market easily. This estimation is

consistent with Chauhan et al (2018), Hu et al (2018), Nyborg & Wang (2014), Bashir (2014) and Opler (1999).

Leverage (LV) shows a positive relationship with cash holding which indicates that high leverage companies in HS retain maximum cash to avoid bankruptcy and financial distress. This result is consistent with Gill & Shah (2012), Islam (2012), and Bashir (2014).

Capital expenditure portrays a negative relationship with cash holding. Those profitable firms having easy and cheap access to debt markets need to hold less cash (Maheshwari and Rao, 2017). Supporting the trade-off theory, excess capital expenditure will confront the company to financial insolvency, therefore firms should retain excess cash reserve (Riddick and Whited, 2009). The same result is also found by Kim et al. (2011).

The growth opportunity negatively affects the cash holdings and supports the free cash flow theory. Ferriera & vilela (2004) investigated that management tends to stock pile funds and invest in useless projects which reduce the value of firms as well as investors.

This result also found positive association between cash flow volatility and cash holding, which supports the trade off theory, being consistent with Bates et al. (2014) and Wasiuzzaman (2014). They argued that high fluncation in cash flows, which is risky, firms retain more cash as a precautionary motive in order to cope with the uncertainty.

Asset intangibility is vital part of cash holding, which affects positively each other and supports the trade off theory. Trade off theory shows that intangibility of assets affects holding of cash positively (Antonio et al., 2013). The features of intangible assets i.e., less collateral, elevated information asymmetry and unpredictable liquidation value mitigate the borrowing potential of firms (Williamson, 1988) and hence such firms need to hold more cash. The finding is consistent with Nakamura (2001).

Similarly, the study (model 2) portrays a positive nexus between dividend payments and holding of cash, which augments the argument that corporations amass more cash in pursuit of stable dividend policy (Maheshwari and Rao, 2017; Ozkan and Ozkan, 2004).

Stock exchange also positively affects the cash holding, HS firms retain more liquid cash listed in New York stock exchange as compare to companies listed in main stock exchanges of France and Spain. Unlikely, the link between liquidity and cash holdings has been found to insignificant.

In Table 3, subsector i.e., restaurant and bars is omitted as a reference subsector. The results portrays that hotels hold less cash as compare to the restaurants and bars.

Table 3. GMM Estimation Result

|

Regressor |

Estimated Sign |

Model (1) |

P.value |

Model (2) |

p-value |

|

CSt-1 |

Positive |

0.9044*** |

0.000 |

0.9032*** |

0.000 |

|

SZ |

Negative |

-0.0480*** |

0.000 |

-0.0634*** |

0.004 |

|

LR |

Positive |

0.0290*** |

0.000 |

0.0355*** |

0.000 |

|

CX |

Negative |

-0.5084*** |

0.000 |

-0.6288*** |

0.000 |

|

GO |

Negative |

-0.0084*** |

0.000 |

-0.0006*** |

0.000 |

|

LQ |

Positive |

0.0005 |

0.195 |

0.0003 |

0.727 |

|

CF |

Negative |

-0.2898*** |

0.000 |

-0.4740*** |

0.000 |

|

CFV |

Positive |

0.2026*** |

0.001 |

0.4358*** |

0.001 |

|

NT |

Positive |

0.0026** |

0.022 |

0.0026 |

0.363 |

|

DD |

Positive |

0.0844 |

0.372 |

0.0816*** |

0.000 |

|

SX |

Positive |

0.3156*** |

0.000 |

0.0445 |

0.755 |

|

2006 |

- |

- |

- |

-0.3951 |

0.677 |

|

2007 |

- |

- |

- |

0.0296 |

0.213 |

|

2008 |

- |

|

|

-0.0212 |

0.296 |

|

2009 |

|

|

|

0.0035 |

0.787 |

|

2010 |

|

|

|

0.0182 |

0.147 |

|

2011 |

|

|

|

0.0242** |

0.010 |

|

2012 |

|

|

|

-

0.0083 |

0.486 |

|

2013 |

|

|

|

0.0308*** |

0.008 |

|

2014 |

|

|

|

-0.0017 |

0,815 |

|

2015 |

|

|

|

0.0294*** |

0.000 |

|

2016 |

|

|

|

0.0037 |

0.478 |

|

2017 |

|

|

|

-0.0127 |

0.095 |

|

2018 |

|

|

|

-0.0294*** |

0.000 |

|

Air

Lines |

|

|

|

0.0421 |

0.870 |

|

Gambling |

|

|

|

-0.2929 |

0.132 |

|

Hotels |

|

|

|

-0.2053* |

0.081 |

|

Recreational

Services |

|

|

|

-0.1172 |

0.261 |

|

Travel

& Tourism |

|

|

|

-0.0153 |

0.899 |

|

Constant |

|

0.3156*** |

0.000 |

0.0468*** |

0.000 |

|

Observation |

|

1573 |

|

1573 |

|

|

AR(1) |

|

0.029 |

|

0.032 |

|

|

AR(2) |

|

0.889 |

|

0.100 |

|

|

Hensen |

|

0.472 |

|

0.487 |

|

10%, 5% and 1% statistical significance

is shown by ***, ** and *respectively.

Furthermore, in table 4 AR (1) specify the nonavailability of first-order serial correlation, whereas AR (2) indicate the absence of second order serial correlation. While Hensen test result confirms that there is no link between instrument and error term means instruments are used in this result are valid

Conclusion

This study determines the effect of parameters used for cash holding in hospitality sector (HS) of target countries i-e France, Spain and United State of America for the period of 14 years (2005-2018). The parameters consist of firm size, leverage, capital expenditure, growth opportunity, liquidity, cash flow, cash flow volatility, asset intangibility, dividend payments and stock exchange. Dynamic panel data is employed for empirical estimation i-e Generalized Method of Moments (GMM). System GMM model estimation reveal that leverage, cash flow volatility and asset intangibility influence cash holdings positively while size, capital expenditure, growth opportunities and cash flow affect cash holdings negatively. Moreover, subsectors such as airlines, gambling, hotels, recreational services, travel & tourism and restaurants and bars have also been investigated. The study shows that hotels hold less cash as compare to the referecne sub sector of restaurants and bars. Lagged of cash is used as a instrumental variable and its positive implication (coefficient) reveal that prior year reserve of cash have significant impact on current year and, suggesting these companies have target level of cash. The academic implication indicates that larger companies in HS retain more cash and easily access to diversify and advance sophisticated technology projects. The existing estimation result consistent with prediction of trade off theory, pecking order theory and free cash flow theory. Furthermore in table 4 AR (1) specify the nonavailability of first-order serial correlation, whereas AR (2) indicate the absence of second order serial correlation. While Hensen test result confirms that there is no link between instrument and error term means instruments are used in this result are valid.

Limitation and Future Research

Our present study is focused only on hospitality sector of target countries i.e., USA, France and Spain, using the unique attributes (competitiveness, capital-intensity, risk and debt intensiveness). The study can be extended to some other regions in order to have more comprehensive insight of the determinants of cash holdings. Moveover, some other determinants i.e., interest rates, macro economic factors, market capitalization etc can be taken as regressors to show its effects on holding of cash.

References

- Abbas Ali & Samran Yousaf 2, Determinants of Cash holding in German Market, IOSR Journal of Business and Management (IOSR-JBM) e-ISSN: 2278-487X, p-ISSN: 2319-7668. Volume 12, Issue 6 (Sep. - Oct. 2013), PP 28-34.

- Afza, T., & Adnan, S.M. (2007). Determinants of corporate cash holdings: A case study of Pakistan. Proceedings of Singapore Economic Review Conference (SERC) 2007, Singapore 164-165.

- Ahmad, W., & Adaoglu, C. (2018). Cash management in the travel and leisure sector: evidence from the United Kingdom. Applied Economics Letter, 26(7), 618-621.

- Akron, S., Demir, E., DÃÂez-Esteban, J. M., & GarcÃÂa-Gómez, C. D. (2020). Economic policy uncertainty and corporate investment: Evidence from the U.S. hospitality industry. Tourism Management, 77, 104019. doi:10.1016/j.tourman.2019.104019

- Al-Najjar, B., and Belghitar, Y. (2011). Corporate cash holdings and dividend payments: Evidence from simultaneous analysis. Managerial and Decision Economics, 32(4), 231-241. doi:10.1002/mde.1529

- Antonio, F., Kadyrzhanova, D., Jae W., and Sim, J. W. (2013). Rising intangible capital, shrinking debt capacity, and the US corporate savings glut. Federal Reserve Board working paper. doi:10.2139/ssrn.235086

- Arellano, M., and Bond, S. (1995). Some Tests of Specification for Panel Data: Monte Carlo Evidence and an Application to Employment Equations. Review of Economics Studies, 58, 277-97. doi:10.2307/2297968

- Baker, M. (2016). Statisticians issue warning over misuse of P values. Nature, 531(7593), 151-151. doi:10.1038/nature.2016.19503

- Baltagi, B. H. (2005). Econometric analysis of panel data (3rd ed.). England: Wiley.

- Bashir, M. M. S. (2014). Determinants Of Corporate Cash Holdings: Panal Data Analysis: Pakistan. International Journal of Current Research, 6(2), 5316-5318

- Bates, T., Kahle, K. and Stulz R., (2009).

- Baum, C. F, Schaffer, M. E, & Stillman, S. (2002). Instrumental variables and GMM: Estimation and testing (Boston College Working Papers in Economics No. 545). Retrieved from Boston College Department of Economics website:

- Baum, C., M. Caglayan, N. Ozhan and O. Talavera,

- Bigelli, M., and Sanchez-Vidal, J. (2012). Cash holdings in private firms. Journal of Banking & Finance, 36, 26-35. doi:10.1016/j.jbankfin.2011.06.004

- By William J. Boumol (1952), the transaction demand for cash: An Inventory theoretic approach.

- Chauhan, Y., Pathak, R., & Kumar, S. (2018). Do bank-appointed directors affect corporate cash holding? International Review of Economics & Finance, 53, 39-56

- D'Mello. R., Krishnaswami. S., & Larkin. P. J., (2008). Determinants of corporate cash holding: Evidence from spin-offs journal of Banking & Finance. Pp. 1209-1220.

- Dittmar. A. & Mahrt-Smith. J. (2003). International corporate governance and corporate cash holding. Journal of Financial and Quantitative Analysis. 38(01), 111-133

- Drobetz, W., and Grüninger, M. C. (2007). Corporate cash holdings: Evidence from Switzerland. Financial Markets Portfolio Management, 21, 293-324. doi:10.1007/s11408-007-0052-8

- Efstathios Magerakis

- Ferreira, M. A., and Vilela, A. S. (2004). Why do firms hold cash: Evidence from EMU countries. European Financial Management, 10 (2), 295-319. doi:10.1111/j.1354- 7798.2004.00251.x

- Gill, A., & Shah, C. (2012). Determinants of corporate cash holdings: Evidence from Canada. International Journal of Economics and Finance, 4(1), 70-79.

- Hansen, E., & Wagner, R. (2017). Stockpiling cash when it takes time to build: Exploring price differentials in a commodity boom. Journal of Banking & Finance, 77, 197- 212.

- Hu, Y., Li, Y., & Zeng, J. (2018). Stock liquidity and corporate cash holdings, Finance Research Letters.

- Islam, S. (2012). Manufacturing firms' cash holding determinants: Evidence from Bangladesh. International Journal of Business and Management, 7 (6), 172- 184. doi:10.5539/ijbm.v7n6p172

- Jensen, M. C. (1986). Agency costs of free cash flow, corporate finance and takeovers. American Economic Review, 76, 323-339

- Jensen, M. C., and Meckling, W. (1976). Theory of the firm: managerial behaviour agency costs and ownership structure. Journal of Financial Economics, 30 (4), 474-493. doi:10.1016/0304-405x(76)90026-x

- Kalcheva, I., and Lins, K.V. (2007). International evidence on cash holdings and expected managerial agency problems. Review of Financial Studies, 20: 1087- 112.

- Kim, J., Kim, H., and Woods, D. (2011). Determinants of corporate cash-holding levels: An empirical examination of the restaurant industry. International Journal of Hospitality Management, 30, 568-574. doi:10.1016/j.ijhm.2010.10.004

- Lian, Y., Sepehri, M., & Foley, M. (2011). Corporate cash holdings and financial crisis: An empirical study of Chinese companies. Eurasian Business Reviews, 1(2), 112-124.

- Maheswari, Y., and Rao, K. T. V. (2017). Determinants of corporate cash holdings. Global Business Review, 18 (2), 416-427. doi:10.1177/0972150916668610

- MartÃÂnez-Sola, C., Garcia-Teruel, P. J & MartÃÂnez-Solano, P. (2011). Corporate cash holding and firm value. Applied Economics, 45(2), 161-170

- Millar. M., H & Orr. D. (1966). A model of the demand for money by firms. Quarterly Journal of Economics, 80, 413-435

- Minton, B. A., and Schrand, C. (1999). The impact of cash flow volatility on discretionary investment and the costs of debt and equity financing. Journal of Financial Economics, 54 (3), 423-460. doi:10.1016/s0304-405x(99)00042-2

- Mohsin. S. Shujahat H., H. & Ghulam. M., C. Determinants of corporate cash holding in Pakistan. International Journal of Organization Leadership 5(2016) 50-62.

- Muncef Guizani, The Financial Determinants of Corporate Cash Holdings in an Oil Rich Country: Evidence from Kingdom of Saudi Arabia, Borsa Istanbul Review, Volume 17, Issue 3, September 2017, Pages 133-143

- Myers, S. C., and Majluf, N. S. (1984). Corporate financing and investment decisions when firms have information that investors do not have. Journal of Financial Economics, 13, 187-221. doi:10.1016/0304-405x(84)90023-0

- Nyborg, K. G., & Wang, Z. (2014). Stock liquidity and corporate cash holdings: Feedback and the Cash as Ammunition Hypothesis, Swiss Finance Institute Research Paper No. 13-36

- Opler, T., Pinkowitz, L., Stulz, R., and Williamson, R. (1999). The determinants and implications of corporate cash holdings. Journal of Financial Economics, 52 (1), 3-46. doi:10.1016/s0304-405x(99)00003-3

- Ozkan, A., and Ozkan, N. (2004). Corporate cash holdings: An empirical investigation of UK companies. Journal of Banking and Finance, 28 (9), 2103-2134. doi:10.1016/j.jbankfin.2003.08.003

- Paskelian, O. G., Bell, S., and Nguyen, C. V. (2010). Corporate governance and cash holdings: a comparative analysis of Chinese and Indian firms. The International Journal of Business and Finance Research, 4, 59-73.

- Peterson, M., and Rajan, R. (2002). Does distance still matter: The information revolution in small business lending? The Journal of Finance, 57 (6), 2533-2570. doi:10.1111/1540-6261.00505

- PWC. (2019). March 2019 global economy Watch [online] Available at: . (Accessed 10 June 2019).

- Rajan, R.G., Zingales, R., 1995. What do we know about capital structure? Some evidence from international data. The Journal of Finance 50 (5), 1421-1460.

- Riddick, L. A., and Whited, T. M. (2009). The corporate propensity to save. The Journal of Finance, 64 (4), 1729-1766. doi:10.1111/j.1540-6261.2009.01478.x

- Riddick, L. A., and Whited, T. M. (2009). The corporate propensity to save. The Journal of Finance, 64 (4), 1729-1766. doi:10.1111/j.1540-6261.2009.01478.x

- Roodman, D. (2008). XTABOND2: Stata module to extend xtabond dynamic panel data estimator. In Statistical software components S435901. Boston College Department of Economics.

- Singal, M. (2015). How is the hospitality and tourism industry different? An empirical test of some structural characteristics. International Journal of Hospitality Management, 47, 116-119. doi:10.1016/j.ijhm.2015.03.006

- Uyar, A., & Kuzey, C. (2014). Determinants of corporate cash holdings: Evidence from emerging market of Turkey. Applied Economics, 46(9), 1035-1048.

- Vatavu, S. (2012). Determinants of Capital structure: Evidence from Romanian manufacturing companies. Journal of Advanced Research in Scientific areas.

- Wasiuzzaman, S. (2014). Analysis of corporate cash holdings of firms in Malaysia. Journal of Asia Business Studies, 8(2), 118-135.

- William J. Frazer, TR. The financial structure of manufacturing corporation and the demand for money some empirical funding, Journal of Political Economy Volume 72, Number 2Apr., 1964

- World Tourism Organization, Tourism Market Trends UNWTO. 2018. UNWTO Tourism Highlights (Ed, 2018). Available at:

Cite this article

-

APA : Mumtaz, M., Ahmad, W., & Shah, S. A. A. (2020). Determinants of Corporate Cash Holdings in Hospitality Sector of France, Spain and United States of America. Global Economics Review, V(III), 55-66. https://doi.org/10.31703/ger.2020(V-III).06

-

CHICAGO : Mumtaz, Majid, Wisal Ahmad, and Syed Arshad Ali Shah. 2020. "Determinants of Corporate Cash Holdings in Hospitality Sector of France, Spain and United States of America." Global Economics Review, V (III): 55-66 doi: 10.31703/ger.2020(V-III).06

-

HARVARD : MUMTAZ, M., AHMAD, W. & SHAH, S. A. A. 2020. Determinants of Corporate Cash Holdings in Hospitality Sector of France, Spain and United States of America. Global Economics Review, V, 55-66.

-

MHRA : Mumtaz, Majid, Wisal Ahmad, and Syed Arshad Ali Shah. 2020. "Determinants of Corporate Cash Holdings in Hospitality Sector of France, Spain and United States of America." Global Economics Review, V: 55-66

-

MLA : Mumtaz, Majid, Wisal Ahmad, and Syed Arshad Ali Shah. "Determinants of Corporate Cash Holdings in Hospitality Sector of France, Spain and United States of America." Global Economics Review, V.III (2020): 55-66 Print.

-

OXFORD : Mumtaz, Majid, Ahmad, Wisal, and Shah, Syed Arshad Ali (2020), "Determinants of Corporate Cash Holdings in Hospitality Sector of France, Spain and United States of America", Global Economics Review, V (III), 55-66

-

TURABIAN : Mumtaz, Majid, Wisal Ahmad, and Syed Arshad Ali Shah. "Determinants of Corporate Cash Holdings in Hospitality Sector of France, Spain and United States of America." Global Economics Review V, no. III (2020): 55-66. https://doi.org/10.31703/ger.2020(V-III).06