Abstract:

The research has been conducted to apply the most fundamental concept of fraud triangle theory, introduced by Donald Cressey’s in 1950-53, to private and public commercial banks of Sindh, Pakistan. According to this theory, Donald Cressey identified that when three-component/factor i-e pressure, opportunity, and rationalization, comes into an individual’s life, he is very likely to commit fraud. Eight different hypotheses are drawn for this study to test the elements of the fraud triangle in public and private sector banks. The study adopted a primary source of data collection, with a sample size of 600 distributed to respondents of the two largest bank of Pakistan, i-e, the National Bank of Pakistan and Habib Bank Limited. The statistical Mann-Whitney U-Test applied to test the hypotheses. The results of the study disclosed that the employees in public sector banks in Sindh, facing more financial pressure, the internal control of public banks is also week; hence fraudsters find more opportunities to commit fraud and the employees working in public banks also behave rationalization for their illicit activities.

Key Words:

Fraud Triangle Theory, Public and Private Commercial Banks, Sindh, Pakistan

Introduction

The instances of banking fraud have been growing worldwide from trifling levels to very high levels in the 19th century to the twenty-first century. All over these years bank’s supervisory body and other concerned parties have struggled to find some procedures/policies to make stronger internal controls of the bank and to prevent banking fraud by categorizing it as a foremost operational risk incident loss. Nevertheless, these procedures/policies found unsuccessful as banking fraud has continued a thorn in the flesh within the worldwide banking sector. (Tembo et al., 2013; Janothan, 2013).

Over the decades, numbers of theories on fraud have been proposed to organizations, to explain the fraudulent behaviour and factors that causes incident of fraud such as Ajzen (1988-1991) proposed theory of planned behaviour Burke (2016), Edwin Sutherland in 1930 on White Collor Crimes and elite deviance Helfgott (2008) and Donald Cressey’s Fraud Triangle in 1950-53 Padgett (2014) and many others studied and published research papers to identify causes, characteristics, methods on detection and prevention of fraud in organizations to control this major issue of the business world. Among all this literature, the Fraud Triangle Theory is considered as one of the most fundamental concepts to clarify why people commit fraud and is also a great way to help prevent fraud.

A range of scholars has studied Cressey’s fraud triangle model with the element of religiosity, arrogance, attitude and capability to stressed upon the motives and protect against the chances of fraud. Jamaliah (2018) analyzed religiosity with the fraud triangle model, Nindito (2018) applied arrogance and capability with the fraud triangle model and so on. However, none of them has applied organizations reward system, debt burden ratio requirement on staff loans, fear of disciplinary action, unauthorized access of outsourcing staff, lack of technology adoption, unethical moral illness and workplace frustration as sources of pressure, opportunity and rationalization in organizations, especially in isolation of banking sector.

This research would apply the above factors with the objectives to measure and test their level of significance in the context of the public and private banking sector in Sindh, Pakistan and based on analysis; the study may suggest tools and techniques that can be applied to control the sources of fundamental factors of fraud. The research will add new knowledge to the existing literature of Pakistan, which helps the regulators to solve this major issue of the banking sector.

Research Hypotheses

|

Hypotheses

No. |

Hypotheses

Description |

|

|

H1 |

H1a |

Reward system is highly ineffective in

public sector banks as compared to private sector banks. |

|

H1b |

The

leniency of debt burden ratio on staff loans and advances is more in public

sector banks as compared to private sector banks. |

|

|

H1c |

Fear of disciplinary action on illegal acts

is high in employees of private sector banks as compared to public sector

banks. |

|

|

H1d |

Employees of private sectors banks are more

dedicated to giving long banking hours to complete tasks as compared to

public sector bank employees. |

|

|

H2 |

H2a |

Unauthorized

Access of Staffs on banks database and liquid assets is more in public sector

banks than in private sector banks. |

|

H2b |

The senior staffs in public sector banks

are less technology adaptive in comparison to private sector banks. |

|

|

H3 |

H3a |

Unethical and moral illness prevails more

in public sector banks as compared to private sector banks. |

|

H3b |

Workplace

frustration reign more in private sector banks as compared to public sector

banks. |

|

Literature Review

(Roden, 2016) Tested whether mediators for components of the fraud triangle are identified with fraudulent corporate conduct. He used accounting and auditing enforcement releases from 2003 through 2010 to frame an example of 103 firms with infringement and contrast their qualities with a coordinated example of control firms. The result revealed significant explanatory factors speaking to each of the three sides of the fraud triangle, including pressure, rationalization and opportunity. SEC infringements are almost certain when the board of directors has fewer women, longer duration, more insiders, and the CEO is additionally the chairperson. Fraud is additionally almost certain when directors and managers are remunerated with investment opportunities, and when there has been an on-going examiner change.

(Jamaliah Said, 2018) Built-up another model of fraud risk by coordinating new components into a fraud triangle theory. The research analyzed religiosity and the three components of fraud triangle factors of employee fraud executed by middle and low-level public officials. The result obtained from data so collected from 120 enforcement officials disclosed that religiosity is adversely related to employees’ fraud. Conversely, all the three factors of fraud triangle theory were found positively related to employees’ fraud i-e opportunity, pressure and rationalization. The outcomes suggested that strong religiosity is vital to eliminate employees’ fraud. To reduce employee fraud, the chances of such fraud ought to be minimized through the decrease of negative rationalization, strong internal control and employees’ financial pressure.

(Lokanan, 2018) Adopted Cressey’s (1953) fraud triangle framework, employing a trial of non-fraud banks with a counterpart sample of fraud banks, assumed that opportunity, pressure and rationalization are optimistically related to fraud in banks. The data for this research were collected from a financial database operated by Standard & Poor. The study utilizes a quantitative research design to test the fundamental relationship between fraud and fraud risk factors. Logistic regression is used to study the association among the dependent variable fraud and predictors’ variables (rationalization, pressure and opportunity). The study concluded that the variables that have pressure and opportunity contribute significantly to identifying fraud. While two variables (Audit Change and Unqualified Opinion) that belong to rationalization are not positively related to contributing and identifying fraud in banks.

(Nindito, 2018) Applied a new approach of Fraud Pentagon Model based on five factors: pressures, opportunity, rationalization, capability, and arrogance to determine financial statement fraud. The quantitative research method applied using a logistic regression model to test the hypothesis. The study included 14 non-fraud and 14 fraud companies listed on the Indonesia Stock Exchange as a research sample. The control sample from the same industry with a range of 30% had a similar level of assets selected as non-fraud companies. The results indicated that four out of five-factor significantly affects the incidents of financial statement fraud, except for one factor, arrogance.

(Abdullahi, 2015) Conducted research on two classical theories, fraud triangle theory and fraud diamond theory. The data collected through secondary sources, and then a comparison between two theories based on their point of agreement and disagreement made. The results concluded that the level and cost of fraud is growing over time. In order to control this issue, anti-graft bodies and fraud risk factors have to be aware of the essential elements which put into fraudulent acts. Cressey’s (1950) fraud triangle and his extended version addressed by Wolf and Hermsanson’s (2004) fraud diamond theory found a fundamental factor that needs to be thoroughly understood by the auditors, accountants, fraud examiners and anti-fraud bodies for understanding the fraud. This will help them in investigating and identifying the root causes of fraud and appraisal of fraud risk.

To sum up, the above literature revealed that the concept of fraud triangle factors had been endorsed by every researcher. Besides it, no study has applied this theory in the context of a similar industry by comparing the level of fraud motives in public and private sector organization, as well as in isolation of banks. Surprising to note that the banking sector in Pakistan has been experiencing major scams; billions of rupees have been identified defrauded with the connivance of internal staff. Besides this, very limited work literature found. Therefore, there is a great need to add literature on banking fraud in Pakistan.

Methodology

The research adopted purposive-non probability sampling because the data concerning this research are more purposeful, as the respondent is more familiar with fraud, internal control techniques, risk management and other terms. The sample size for this research was 600. 20 branches of each public and private sector banks from five (05) regions of Sindh was selected. The data on banking fraud in the existing literature of Pakistan is very limited; therefore, the primary source of data collection is applied by delivery of questionnaire to the employees of public and private sector banks in Sindh. Total 436 responses received; 191 from Habib Bank Limited and 245 from National Bank of Pakistan.

Before applying a statistical test, the normality of data was checked through Kolmogorov-Smirnov (K-S) and Shapiro-Wilk tests. In the K-S and Shapiro-Wilk test, a significant value (sig < 0.05) indicates a deviation from normality (Jamaliah Said, 2018). The result shows all the variables are highly significant, indicating that the distribution is not normal.

Table I. Kolmogorov-Smirnov & Shapiro-Wilk Tests

|

Bank |

Kolmogorov-Smirnova |

Shapiro-Wilk |

|||||

|

Statistic |

df |

Sig. |

Statistic |

df |

Sig. |

||

|

HBL |

Fair

Reward |

0.368 |

191 |

0.00 |

0.675 |

191 |

0 |

|

Work

Appreciation |

0.434 |

191 |

0 |

0.593 |

191 |

0 |

|

|

Performance

or Grade Based |

0.317 |

191 |

0 |

0.804 |

191 |

0 |

|

|

Promotions |

0.198 |

191 |

0 |

0.869 |

191 |

0 |

|

|

Satisfaction |

0.227 |

191 |

0 |

0.837 |

191 |

0 |

|

|

Reward

Match with Work |

0.337 |

191 |

0 |

0.78 |

191 |

0 |

|

|

Employee

Turnover |

0.283 |

191 |

0 |

0.732 |

191 |

0 |

|

|

NBP |

Fair

Reward |

0.302 |

245 |

0 |

0.808 |

245 |

0 |

|

Work

Appreciation |

0.277 |

245 |

0 |

0.784 |

245 |

0 |

|

|

Performance

or Grade Based |

0.304 |

245 |

0 |

0.749 |

245 |

0 |

|

|

Promotions |

0.333 |

245 |

0 |

0.777 |

245 |

0 |

|

|

Satisfaction |

0.327 |

245 |

0 |

0.831 |

245 |

0 |

|

|

Reward

Match with Work |

0.287 |

245 |

0 |

0.818 |

245 |

0 |

|

|

Employee

Turnover |

0.324 |

245 |

0 |

0.805 |

245 |

0 |

|

Source: Researchers own calculation

Reliability Statistics

Reliability may be defined as “the extent to which a measure yields consistent results; the extent to which scores are free of random error” (Aryetal., 2002, p. 566). The best common core reliability measure is Cronbach's alpha (wikipedia.org). The needed reliability is 0.70 or upper. Cronbach’s alpha of 41 measures is 0.883, which is satisfactory and acceptable. The reliability data is presented in table III – 6, which is calculated with the use of SPSS 22.0.

Table 2. Reliability statistics

|

Cronbach’s alpha |

Number of items |

|

.883 |

41 |

Mann-Whitney U-Test

Effectiveness of the Reward System

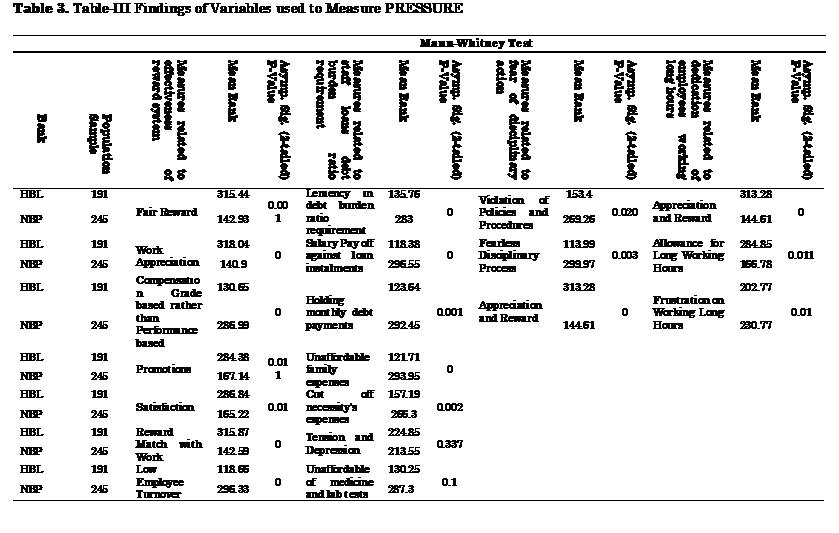

Table-III shows that the mean rank of the fair reward system, work appreciation, promotions, satisfaction and reward match with work is higher in HBL than in NBP, which illustrate that the reward system in HBL is more effective than in NBP. Out of 07 measures, 05 measures witnessed a higher rank in HBL than in NBP. Significance test statistics also indicate that the p-value quoted next to Asymp. Sig. (2-tailed), is 0.000, which is less than 0.05 in almost all measures. We, therefore, have significant evidence to reject null hypotheses and accept alternate hypotheses.

Debt Burden Ratio Requirement

The mean rank of measures related to debt burden ratio requirement illustrated in table-III explains that the variables; holding monthly debt payments, unaffordable monthly expenses, cut off necessities expenses, and unaffordable for medicine and lab tests have a higher mean rank in NBP as compare to HBL. Out of 07 measures, 06 measures witnessed a higher mean rank in NBP, which illustrate that leniency on debt burden ratio requirement is higher in NBP as compare to HBL. Further p-value, quoted in Asymp. Sig. (2-tailed), is 0.000 is less than 0.05. Therefore based on output, we can accept the alternate hypothesis and reject the null hypothesis.

Fear of Disciplinary Action

The data illustrated in table-III demonstrates that violation of policies and procedures, and the fearless disciplinary process has a higher mean rank in NBP as compare to HBL. The measures of higher ranks in NBP illustrate that the policy of disciplinary action is not rigid in public banks; therefore, bank employees, in case of financial need, can violate policies and procedure to satiate their illegal motives. The statistical significance test also indicates the p-value 0.020, 0.003 and 0.000, which is less than 0.05, hence based on data results, we accept alternate hypothesis and reject the null hypothesis.

Dedication of Employees Working Long Hours

The mean rank of appreciation and reward, allowances for working long hours, shows a higher value in HBL as compare to NBP. This indicates that the staff of HBL is appreciated with reward and allowances for working long hours; therefore, they bear less financial pressure as compared to the employees working in NBP. Moreover, the mean rank of frustration on working long hours shows higher value in NBP witnesses’ higher frustration in employees of NBP as compare to HBL. The value of p shows 0.000,0.011 and .01, which is less than 0.05. This reflects that there is significance in the difference between the mean rank value of NBP and HBL. Therefore the null hypothesis is rejected, and the alternate hypothesis is accepted.

Findings of Variables used to Measure Second Component of Fraud Triangle Theory: Opportunity

The second component of fraud triangle theory was measured by variables that cause opportunities for fraud in public and private sector banks is summarized in Table IV

Table 4. Findings of Variables used to Measure opportunity

|

|

|

Mann-Whitney Test |

|||||

|

|

Measures

related to unauthorized access of outsource staff6 |

Mean Rank |

Asymp. Sig. (2-tailed) |

Measures

related to level of technology adoption in employees |

Mean Rank |

Asymp. Sig. (2-tailed) |

|

|

Bank |

Population Sample |

||||||

|

HBL |

191 |

Documentation

and Approval |

259.13 |

0 |

Comfortable

on Manual Ledgers |

145.41 |

0.002 |

|

NBP |

245 |

186.82 |

275.48 |

||||

|

HBL |

191 |

Unauthorized

Access of Staff |

118.46 |

0.001 |

Help to

Power on PC |

142.76 |

0.01 |

|

NBP |

245 |

296.49 |

277.55 |

||||

|

HBL |

191 |

Proper

Supervision and Monitoring |

311.03 |

0.011 |

Difficult

to Operate Banking Software |

138.17 |

0 |

|

NBP |

245 |

146.37 |

281.12 |

||||

|

HBL |

191 |

CCTV

Monitoring |

232.26 |

0.031 |

Separation

of Role and Responsibilities |

297.26 |

0 |

|

NBP |

245 |

207.78 |

157.1 |

||||

Unauthorized Access of Outsource Staff

The mean rank tests of unauthorized access of staff in Table IV indicate that HBL has a high mean rank in documentation and approval, proper supervision and CCTV monitoring as compare to NBP. Moreover, the measure of unauthorized access of staff is high in NBP as compare to HBL. This specifies that unauthorized staff has frequent access in NBP and weak CCTV monitoring and supervision causes ample opportunities for fraud. The test statistic result also indicates that the p-value is 0.000 and .031, which is less than 0.05. Therefore we can say that the difference observed in mean rank values is significant. Hence we reject the null hypothesis and accept the alternate hypothesis.

Level of Technology Adoption in Employees

The data relevant to the level of technology adoption in the table-IV describes that the mean rank of measures on comfortable to work on manual ledgers, help to power on the computer and difficult to operate banking software is higher in NBP as compare to HBL. Out of 04 measures, 03 measures witnessed a higher mean rank in NBP except for 01 measure i-e separation of role and responsibilities whereby the mean rank of HBL is higher than NBP. This illustrates that the employees of public banks are less technology adoptive as compare to private banks. The value of P is 0.002, 0.010 and 0.000, which is less than 0.05, which specifies that there is a significant difference in the level of technology adoption in employees of HBL and NBP. Therefore we reject the null hypothesis and accept the alternate hypothesis.

Findings of Variables used to Measure Third Component of Fraud Triangle Theory: Rationalization

The third component of fraud triangle theory i-e, rationalization in public and private sector banks, was measured by the variables summarized in Table V

Table 5. Findings of Variables used to Measure rationalization

|

|

|

Mann-Whitney

Test –Ranks |

||||||

|

|

Measures related to unethical

and moral illness in employees |

Mean Rank |

Asymp. Sig. (2-tailed) |

Measures related to workplace

frustrations in employees |

Population Sample |

Mean Rank |

Asymp. Sig. (2-tailed) |

|

|

Bank |

Population Sample |

|

|

|

|

|

|

|

|

HBL |

191 |

Office

Facilities for Personal Use |

175.89 |

0 |

Discretion

in Performing Job |

191 |

206.34 |

0.050 |

|

NBP |

245 |

251.72 |

245 |

227.98 |

||||

|

HBL |

191 |

Gift

from Customer |

138 |

0 |

Discretion

on Policies and Procedure |

191 |

155.96 |

0 |

|

NBP |

245 |

281.26 |

245 |

267.26 |

||||

|

HBL |

191 |

Personal

Belief |

264.16 |

0 |

Trouble

Financial Situation |

191 |

196.25 |

0 |

|

NBP |

245 |

182.91 |

245 |

235.85 |

||||

|

HBL |

191 |

Compromise

on Self-Ethics and Principles |

225.52 |

0.226 |

|

|||

|

NBP |

245 |

213.03 |

||||||

|

HBL |

191 |

Encourage

in Reporting Suspicious Activity |

252.94 |

0 |

||||

|

NBP |

245 |

191.65 |

||||||

|

HBL |

191 |

Unethical

Practices |

219.51 |

0.878 |

||||

|

NBP |

245 |

217.72 |

||||||

|

HBL |

191 |

Access

to the Organization's Code of Ethics and Conduct |

207.97 |

0.097 |

||||

|

NBP |

245 |

226.71 |

||||||

|

HBL |

191 |

Updating

and Review of Code of Conduct and Ethics |

239.57 |

0.001 |

||||

|

NBP |

245 |

202.08 |

||||||

|

HBL |

191 |

Behavioral

Training |

229.53 |

0.082 |

||||

|

NBP |

245 |

209.9 |

||||||

|

HBL |

191 |

Banking

Trust, Confidence and Transparency |

223.31 |

0.414 |

||||

|

NBP |

245 |

214.75 |

|

|

|

|

||

Unethical and Moral Illness in Employees

The mean rank test in Table V indicates that private sector bank i-e HBL has a high mean rank in personal belief, compromise on self-ethics and principles encourage in reporting suspicious activity, updating and review of code of conduct and ethics, behavioral training, banking trust, confidence and transparency as compare to public sector bank i-e NBP. Whereas the measures, office facilities for personal use, a gift from customer shows high mean rank in NBP. The further p-value in 05 measures is less than .05, which means there is significance in difference observed between measures, and in remaining 05 measures, the p-value is higher than .05; this indicates that there is no significance in difference observed between measures.

Workplace Frustrations in Employees

The data relevant to workplace frustration in employees in table-V describes that the mean rank of measures on discretion in performing Job, discretion on policies and procedure, trouble financial situation are higher in HBL as compare to NBP. The value of P is 0.050, 0.000 and 0.000, which is less than 0.05, specifies that there is a significant difference in workplace frustration in employees of HBL and NBP is observed. Therefore based on significance value, we reject the null hypothesis and accept the alternate hypothesis.

Discussion and Conclusions

The analysis initiated with the basic issue that the financial pressure, opportunity and rationalization in public banks is high as compare to private banks. To test the financial pressure, the variables i-e reward system, debt burden ratio on staff loans, fear of disciplinary action and dedication in employees to spend long working hours, were used. To measure the element of opportunity in private and public sector banks, the variables i-e unauthorized access of outsourcing staff, and level of technology adoption in senior staff were applied. Thirdly the rationalization was tested with the variables unethical and moral illness and workplace frustration in employees of public and private banks.

The results disclose that the employees in public banks suffer from more financial pressure, the element of opportunities to fraud persists more in public banks, as well as the employees in public banks are more frustrated, and their behavior is unethical and morally ill; therefore, they behave rationalization for their illegal act. Hence the chances of bank frauds are more in public banks as compare to private banks.

From the perusal of statistical examination and discussions, this research comes to the following conclusions:

The study set three (03) objectives; the first (1st) objective was to measure the sources of behavioural factors in the context of private and public banks, proposed in Fraud Triangle Theory. After measuring sources of behavioral factors i-e reward system, debt burden ratio, fear of disciplinary action and dedication to work long hours, unauthorized access of staff, technology adoption, ethical and moral illness and workplace frustration. It is concluded that the employees of public banks are suffering more financial pressure, leaving more opportunities for fraud and acting negative rationalization for personal gain. Therefore after measuring variables, the first objective has been successfully achieved.

The second (2nd) objective was to test the significance level in fundamental elements that prevailed in public and private sector banks. To achieve the second objective of the study, the Mann-Whiteny U static and Critical value obtained. The conclusion of the second objective says that the difference observed in mean rank between variables so tested of public and private banks found statistically significant. This accomplished that there is noteworthy dissimilarity in elements of the fraud triangle in the public and private banking sector in Sindh, Pakistan.

The third objective was to suggest tools and techniques that can be applied to control the fundamental factors of fraud in private and public sector banks. Subsequent to review the existing stages of NBP and HBL, it is suggested that public sector banks need to review their reward system, ensure debt burden ratio requirement before sanctioning staff loans, adopt a strict disciplinary procedure to reduce the financial pressure on employees. The public banks also suggested stopping the entries of unauthorized staff on bank’s MIS/Software, Cash Vaults and training the staff to easily operate the bank’s system/software to reduce the opportunities for fraudsters. Finally, there is a need to build a culture of positive rationalization in employees by giving them an environment to strictly follow the bank's code of conduct and ethics to uplift the services and gain the trust and confidence of customers.

References

- Abdullahi, M. (2015). Fraud Triangle Theory and Fraud Diamond Theory:Understanding the Convergent and Divergent for Future Research. International Journal of Academic Research in Accounting, Finance and Management Sciences, 5, 30-37

- Akindele, (2011). The fraud as a Negative Catalyst in the Nigerian banking Industry. Journal of Emerging Trends in Economics and Management Sciences, 2(5), 357- 363.

- Akinyomi. (2012). Examination of Fraud in Nigerian Banking Sector and Its Prevention. Asian Journal of Management Research, 3(1), 184-192.

- Aloyce, L. (2013). An Assessment of Fraud and Its Management In Tanzania Commercial Banks. 79.

- Baz, R., Samsudin, R. S., & Che-Ahmad, B. (2017, March). The Impact of External Factors on Bank Fraud Prevention And The Role Of Capability Element As Moderator In Saudi Arabia Banking Sector. Asian Academic Research Journal Of Social Science And Humanities, 4(3), p. 148

- Bhasin, L. (2016). Frauds in the Banking Sector: Experience of a Developing Country. Asian Journal of Social Sciences and Management Studies, 3(1), 1-9.

- Dagogo, W. (2017). Bank Fraud and Financial Intermediation: A Supply-side Causality Analysis. Athens Journal of Business & Economics, 4(01), 83-96.

- Enofe, A. (2017). Bank Fraud and Preventive Measures in Nigeria: An Empirical Review. International Journal of Academic Research in Business and Social Sciences, 07, 51.

- Fathi, N. (2017). Potential Employee Fraud Scape in Islamic Banks:The Fraud Triangle Perspective. Global Journal Al-Thaqafah, 7(2), 79-93.

- Idolor, J. (2010). Bank Frauds In Nigeria: Underlying Causes, Effects And Possible Remedies. African Journal of Accounting, Economics, Finance and Banking Research Vol. 6. No. 6. 2010, 80.

- Ismail, B. (2019). How Can Psychology and Religious Beliefs Affects on Fraud Triangle? Jurnal Media Riset Akuntansi, Auditing & Informasi, 19(1), 53-68.

- Jamaliah Said, A. (2018). Integrating Religiosity into Fraud Triangle Theory: Empirical Findings from Enforcement Officers. Global Journal Al-Thaqafah, 131-143.

- Jamaliah, M. (2017). Integrating Ethical Vallues Into Fraud Triangle Theory In Assessing Employee Fraud: Evidence From The Malaysian Banking Industry. Journal of International Studies, 10(2), 170-184.

- Kothari, C. (1990). Research Methodolog Method and Techniques (2 ed.). New Age International (P) Limited.

- Lokanan, S. (2018). A Fraud Triangle Analysis of the Libor Fraud. Journal of Forensic & Investigative Accounting, 10(2), 187-212.

- Matti Kurvinen, T. (2016). Warranty Fraud Management: Reducing Fraud and Other Excess Costs in Warranty and Service Operations. John Wiley & Sons.

- Mawanza, W. (2014). An Analysis of the Main Forces of Workplace Fraud in Zimbabwean Organisations: The Fraud Triangle Perspective. International Journal of Management Sciences and Business Research, 3(2), 86-94.

- MUHAMMAD Shahir Nuhu, A. (2015). Fraud Triangle Theory and Fraud Diamond Theory:Understanding the Convergent and Divergent for Future. European Journal of Business and Management, 7, 37.

- MUHAMMAD Umar, M. (2017). Pressure, Dysfunctional Behavior, Fraud Detection and Role of Information Technology in the Audit Proces. Australasian Accounting, Business and Finance, 11(4), 102-115.

- Nindito, M. (2018). Financial Statement Fraud: Perspective of the Pentagon Fraud Model in Indonesia. Academy of Accounting and Financial Studies Journal, 22(3), 1528-2635-22-2-199.

- Nwankwo, O. (2013). Implications of Fraud on Commercial Banks Performance in Nigeria. International Journal of Business and Management, 8(15), 144-150.

- Olaoye, O. (2014). Analysis OF Frauds in Banks: Nigeria's Experience. European Journal of Business and Management, 6(31), 90-99.

- Roden, M. (2016). The Fraud Triangle as a Predictor of Corporate Fraud. Academy of Accounting and Financial Studies Journal, 20(1), 80-92.

- Schuchter, A. (2015). Beyond the fraud triangle: Swiss and Austrian elite fraudsters. A. Schuchter, M.Levi/Accounting Forum, 39, 176-187.

- Soheil Kazemian, S. (2019). Examining Fraud Risk Factors on Asset Misappropriation: Evidence from the Iranian Banking Industry. Journal of Financial Crime, 26(2), 372-381.

- Zuraidah, N. (2015). Effects of Internal Controls, Fraud Motives and Experience in Assessing Likelihood of Fraud Risk. Journal of Economics, Business and Management, 3(2), 194-200.

Cite this article

-

APA : Anand, V., Nizamani, M. Q., & Nizamani, F. Q. (2020). Deliberation of Fraud Triangle Theory: A Comparison among Public and Private Commercial Banks of Sindh, Pakistan. Global Economics Review, V(I), 336-348. https://doi.org/10.31703/ger.2020(V-I).28

-

CHICAGO : Anand, Vivek, Muhammad Qasim Nizamani, and Farheen Qasim Nizamani. 2020. "Deliberation of Fraud Triangle Theory: A Comparison among Public and Private Commercial Banks of Sindh, Pakistan." Global Economics Review, V (I): 336-348 doi: 10.31703/ger.2020(V-I).28

-

HARVARD : ANAND, V., NIZAMANI, M. Q. & NIZAMANI, F. Q. 2020. Deliberation of Fraud Triangle Theory: A Comparison among Public and Private Commercial Banks of Sindh, Pakistan. Global Economics Review, V, 336-348.

-

MHRA : Anand, Vivek, Muhammad Qasim Nizamani, and Farheen Qasim Nizamani. 2020. "Deliberation of Fraud Triangle Theory: A Comparison among Public and Private Commercial Banks of Sindh, Pakistan." Global Economics Review, V: 336-348

-

MLA : Anand, Vivek, Muhammad Qasim Nizamani, and Farheen Qasim Nizamani. "Deliberation of Fraud Triangle Theory: A Comparison among Public and Private Commercial Banks of Sindh, Pakistan." Global Economics Review, V.I (2020): 336-348 Print.

-

OXFORD : Anand, Vivek, Nizamani, Muhammad Qasim, and Nizamani, Farheen Qasim (2020), "Deliberation of Fraud Triangle Theory: A Comparison among Public and Private Commercial Banks of Sindh, Pakistan", Global Economics Review, V (I), 336-348

-

TURABIAN : Anand, Vivek, Muhammad Qasim Nizamani, and Farheen Qasim Nizamani. "Deliberation of Fraud Triangle Theory: A Comparison among Public and Private Commercial Banks of Sindh, Pakistan." Global Economics Review V, no. I (2020): 336-348. https://doi.org/10.31703/ger.2020(V-I).28