Abstract:

The aim of the research is twofold: first, to measure the corporate sustainability disclosure determination rate (CSDR) and examine its relationship with sustainability performance indicators (SPI). Second, to analyze the value relevance of sustainability investment (SI) with corporate financial performance (FP) from a sample of the top 85 companies listed on the Pakistan Stock Exchange (PSX). Using content analysis, we developed a sustainability reporting index based on 20 indicators, and robust statistical methods were also applied to analyze the linkage between CSDR - SPI and SI- FP using a regression analysis for panel data. The content analysis of data shows that to some extent, companies disclose non-financial information on community development, social, and environmental progression. The findings of the study indicate the absence of a significant relationship between CSDR - SPI and SI - FP, and Pakistani companies do not enjoy the financial benefits of sustainability investments.

Key Words:

CSR, Sustainability reporting, Corporate disclosure, Performance indicators

Introduction

Financial disclosure has a comparatively narrow scope because it pertains to limited financial information, but because of the diverse nature of environmental, economic, and social elements, sustainability reporting appeals to a larger number of external users and is still voluntary (Oncioiu et al., 2020). The idea of sustainability is growing (Dresner, 2008), and its reporting has grown largely as a result of the Brundtland Report on sustainable development. Corporate sustainability reporting (CSR) aims to measure the company's maturity level on sustainability performance.

During the previous two decades, sustainability reporting has become an essential concern for researchers. Companies also have realized its importance because of devastating climate change. This non-financial disclosure (sustainability reporting), such as ethics, etc., is not completely new (Gnanaweera & Kunori, 2018). And with the aging process, awareness of sustainability performance is increasing because it provides valuable information about global resources. It is also a helpful tool in providing environmental information initiated by companies. The value of proper sustainability reporting is increasing, and it is important for the success of firms (Ching et al., 2017).

According to Brouwers et al. (2014), nearly half of the world's carbon emissions are expected to originate in Asia. They also pointed out that the issue has barely been studied compared to developed markets like the United States and Europe. They reported the significance of the nexus between sustainability disclosure and performance to assess CSR determination.

Accounting information, including sustainability reporting, should have value relevance in the decision-making process because the information that has no value relevance in decision-making is of no use (Setyahuni & Handayani, 2020). Stakeholder pressure, regulatory enforcement, competitive advantages, and public image are the key drivers of sustainability development (Cooper & Owen, 2007). Top management and stakeholders of the company also consider CSR as an integral part of their financial reporting because it represents the direction in which resources are deployed (Oncioiu et al., 2020). Many countries have started emphasizing the disclosure of sustainability reporting (Setyahuni & Handayani, 2020) because the success of a company in a sustainable economy is influenced by how its CSR is manifested.

The reasons for undertaking this research are manifold. Firstly, the most important reason is to have a better knowledge of the phenomena and to eliminate inconsistencies in the literature on the linkage of CSR-FP. While, it has been suggested that companies with better financial performance are more concerned with CSR disclosure (Ali et al., 2018; Attamimi & Ameer, 2010). Even today, there is a substantial gap between sustainability reporting talk and practice (Cho et al., 2015). Therefore, to strengthen the sustainability reporting concept, a critical analysis of published non-financial discourse is required.

Secondly, as Ali et al. (2018) argued that because of differences in environmental regulation, culture, and other corporate characteristics, a different consensus had been recorded in different circumstances, making sustainability reporting a country-specific phenomenon (Ali et al., 2017; Azizul Islam & Deegan, 2008; Dhaliwal et al., 2012; Jennifer Ho & Taylor, 2007). In this regard, most studies investigating the drivers of sustainability disclosure have been conducted in developed countries (Ali et al., 2017; Fifka, 2013; Gallardo-Vázquez et al., 2019).

Thirdly, due to lack of consensus on a theoretical framework for understanding sustainability reporting. Owing to this issue, research on sustainability reporting shows inconsistent findings (Hahn & Kühnen, 2013; Hooghiemstra, 2000). And several theoretical viewpoints have been used to explain the differences in sustainability reporting. (Ali et al., 2018). However, most of the literature does not reference the theory (Hahn & Kühnen, 2013). In light of differences in results found in the literature, we contribute to the debate both conceptually and experimentally by finding the variables that explain and modify this link.

This work has many practical and social implications, such as raising awareness that a sustainable model is more than just reporting, although corporate sustainability development (CSD) and corporate financial performance indicator (FPI) does not directly relate. We add to the long-lasting discussion over the ambiguous CSD – FPI relationship and determine which variables explain this relationship.

Literature Review

Markets are shifting toward environment-friendly goods or sustainability models to cater to climate challenges. Organizations usually rely on the environment for the funds they need to manage the operation of businesses, as well as to obtain these resources; they must maintain a constant state of harmony with the environment (Welbeck et al., 2017). The literature on this phenomenon illuminates this association in different ways. Some researchers examine financial statements and compare financial performance indicators (FPI) of companies, while others analyze the performance of stock indices. Each analysis of the said phenomenon produces different outcomes. The CSD and FPI can have three types of relationships: positive, negative, and neutral.

On the positive relationship between disclosure on sustainability and social visibility, Ali et al. (2018) undertook a study in Pakistan. The data from publicly traded firms were analyzed using a multiple linear pooled regression analysis. The data demonstrated a positive link between CSR disclosure and company size, profitability, and environmental sensitivity. Akisik and Gal (2014) used a similar methodology to investigate the relationship between CPI and sustainability report review (SR). The results of multivariate regression are as follows: (i) SR has a significant impact on some performance indicators, such as ROE, ROA, and ROS, as well as revenues; (ii) the value of a firm has a negative relationship with the sustainability report review.

Ameer and Othman (2012) used four indices to assess 100 sustainable global companies to highlight their contributions to sustainable activities and identified the companies with sustainability commitments that had more robust economic results measured by PBT, ROA, and cash flow when compared to firms that do not have such commitments. And to determine the influence of sustainability reporting on financial performance, Kapoor and Sandhu (2010) conducted a content study of financial statements and websites of Indian companies. Sustainability has a considerable impact on ROS, ROE, and ROA but has minor impacts on development.

Gallardo-Vázquez et al. (2019) conducted a study in Spain on the unbiassed link between social responsibility disclosure and performance. They used a Meta-Analytic approach and concluded that the relationship is not that significant in terms of practical applications. Similarly, Ching et al. (2017), the relationship between sustainability reports and the financial success of Brazilian listed companies was explained using accounting and market-based measures. According to the researchers, there is no linkage between sustainability reporting and accounting metrics.

Theoretical Perspective of CSD

According to Lucian Belascu & Alexandra Horobet (2013), there are four types of theoretical foundations for the linkage between social and financial performance: (i) unilateral causality; corporate social performance causes corporate financial performance, (ii) unilateral causality; corporate financial performance causes corporate social performance, (iii) bilateral causality; corporate social performance influences corporate financial performance, which influences corporate social performance, and (iv) no correlation exists among CSR and FP. Except for the last, positive and negative relationship between a company's social and financial performance is depicted in each category. According to unilateral causality, stockholders reward socially conscious companies because they see social performance as an indication of efficient management. The negative association in this category is a trade-off between corporate social and financial performance; due to financial constraints, corporations invest in one but not the other simultaneously. In the second category, a positive relationship of unilateral causality indicates that when a company's financial performance is strong, it has funds to take direct social initiatives.

In contrast, a negative association shows that when the firm's financial performance is poor, managers may take advantage of stakeholders to invest strategically in the company's social performance. In the third category, the positive bilateral causality relationship refers to a two-way effect, which means that when social performance investment produces higher corporate financial performance, as a result, more social investment is made. The negative aspect of this category's attempts to improve corporate social performance led to poor corporate financial performance, leading to poor corporate social performance. The fourth perspective states that there is no link between financial performance and corporate social responsibility, either because the link is too complex to discern or because it is in equilibrium. Corporate social performance investments increase demand for the firm's products, resulting in higher financial performance and higher costs, resulting in worse FP. The above casualties are used in some theories, such as legitimacy and signalling theories (Ching et al., 2017).

The Legitimacy theory describes how a company behaves when adopting, creating, and addressing its social responsibility strategies. The critical hypothesis of this theory is to fulfil the company's social contracts, which involve the implementation of a CSR policy that affects a variety of activities, particularly management accounting (Deegan & Gordon, 1996; O'Donovan, 2002; Patten, 1991). Legitimacy can be achieved by aligning a firm's practices with societal standards, such as compliance with regulations, environmental audits, community work, and conservation (Mousa et al., 2015). Furthermore, because corporate environmental behaviour is controversial, firms are under pressure to focus on societal criteria (Christmann, 2004). Therefore, Organizations can try to gain legitimacy by communicating their social initiatives to strengthen their status and reputation. Additionally, a firm can benefit from corporate sustainability disclosure (Milne & Patten, 2002; O'Donovan, 2002).

Signalling theory is very supportive in explaining the behaviour of companies and individuals when both parties have access to and exposure to different types of information. Insiders or senders must determine whether and how to transmit (or signal) information, while outsiders and receivers must decide whether and how to receive or interpret the signal (Connelly et al., 2011). According to these researchers, it mainly focuses on insiders' deliberate positive communication. Insiders can bombard outsiders or receivers with measurable behaviours. Because it is difficult for stakeholders to understand whether a company is devoted to sustainability, in order to tackle the information gap, businesses can invest in costly sustainability programmes (Connelly et al., 2011). That is why the sustainability reporting framework is critical. Firms will attempt to depict their sustainability initiatives positively, and the framework will facilitate determining the true intent of those efforts.

Research Methodology

This part provides a brief overview of date and estimation techniques, the definition of variables.

Data and Estimation Techniques

Based on the availability of annual and sustainability reports, data for the study was gathered from 85 public limited companies listed on the PSX. The data was collected for the five years from 2015-to 2019. We used a content analysis technique to construct a sustainability reporting index using 20 non-financial indicators of essential information and quality assessment.

We used panel data models to obtain the results because they help deal with heterogeneity issues. As Himmelberg et al. (1999) and Yasser (2011) pointed out, panel data models are more reliable because it combines cross-section and time-series observations and helps to reduce collinearity. Three-panel data strategies (fixed-effect model, random effect model, and simple pooling of ordinary least squares) are used to account for unobserved corporation level heterogeneities, according to previous research (Collins G. Ntim & Kofi A. Osei, 2011) and Soobaroyen, (2013). But we applied a simple fixed effect panel data technique because it was more appreciated than the other two (refer to Table 10).

Definitions of Variables

Definitions of Independent and dependent variables are given below.

CSDR

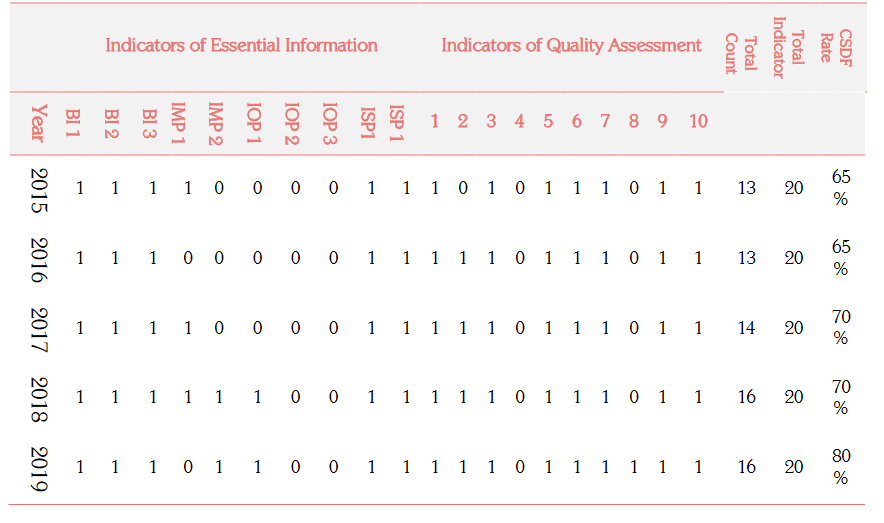

The CSDR serves as the dependent variable (refer to Table 1a), and the data for the CSDR is derived from the content analysis of financial statements. To perform the content review, a CSD Framework was developed after reviewing the studies (Bowen, 2009; Cho & Patten, 2007; Cochran & Wood, 1984; H?bek & Wolniak, 2015; Patten, 2002; Zhongfu et al., 2011). Twenty non-financial indicators encompassing economic performance, social integrity, environmental concern, and quality parameters are incorporated in the Corporate Sustainability Disclosure Framework as a guiding concept for good reporting. And data for CSDR is divided into ten indicators of Essential Information (IEI) and 10 Indicators of Quality Assessment - IQA (refer to Table 2). Furthermore, Indicators of Essential Information - IEI are divided into four categories by the Japanese Ministry of Environment (MoE): (1) Basic Information - BI, (2) indicators of management performance - IMP, (3) indicators of operational performance – IOP, and (4) indicators of social performance – ISP. Then, IQA was recognized to assess the quality of reporting structure according to the MoE's and GRI's guidelines (Gnanaweera & Kunori, 2018). These indicators (IEI and IQA) are rated on a scale with a score of one (1) or zero (0), indicating whether the attribute is present or not in the financial report for that year (see Table 3). For each year, the scores are assigned to the firms. Each company's score is expressed as a percentage; see Table 3. for an example of the CSDR percentage calculation.

Table 1

|

Variable –

Dependent |

Description |

|

CSDR |

Corporate Sustainability disclosure

determination percentage |

|

Variables –

Independent |

Description |

|

CO2 Emissions (GHG) |

Greenhouse gas emissions, both direct

and indirect (CO2) |

|

Water Usage (WU) |

Total water consumption (M3) |

|

The logarithm of total assets (LTA) |

To determine the size of a company |

|

Return on equity (ROE) |

To assess a company's profitability |

The major environmental indicators are water consumption (m3/ton) and GHG emission (tons CO2e/ton), and values are obtained from sustainability reports.

Indicators of Sustainability performance

This research uses four sustainability performance indicators as explanatory variables, which can affect the CSDR (see Table 1). These four variables are CO2 emissions (GHG), water usage (WU), the logarithm of the total asset (LTA), and ROE. And figures for independent variables are collected for sustainability and financial reports.

Corporate Financial Performance (FP)

FP is a quantitative indicator of a firm's capability to produce profits from its assets. It is a term frequently used to describe how a company's overall financial health has changed over time. There are various empirical researches on the association between profitability and sustainable disclosure/investment (Abramson & Chung, 2000; Aras et al., 2010; Clarkson et al., 2008; Derwall & Bauer, n.d.; Wagner, 2005). Previous research on the linkage between these two variables has yielded varied results (Clarkson et al., 2008; Fairfield & Yohn, 2001). Even yet, there is limited but growing literature on the analysis of profitability measures (Fairfield & Yohn, 2001). Therefore, in this study, return on equity (ROE) is used as a profitability variable.

Table 2

|

|

Indicators of Essential Information |

Indicators of Quality Assessment |

Total

Count |

Total

Indicator |

CSDF Rate |

|||||||||||||||||||||||

|

Year |

BI 1 |

BI 2 |

BI 3 |

IMP 1 |

IMP 2 |

IOP 1 |

IOP 2 |

IOP 3 |

ISP1 |

ISP 1 |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

|

|||||||

|

2015 |

1 |

1 |

1 |

1 |

0 |

0 |

0 |

0 |

1 |

1 |

1 |

0 |

1 |

0 |

1 |

1 |

1 |

0 |

1 |

1 |

13 |

20 |

65% |

|

||||

|

2016 |

1 |

1 |

1 |

0 |

0 |

0 |

0 |

0 |

1 |

1 |

1 |

1 |

1 |

0 |

1 |

1 |

1 |

0 |

1 |

1 |

13 |

20 |

65% |

|

||||

|

2017 |

1 |

1 |

1 |

1 |

0 |

0 |

0 |

0 |

1 |

1 |

1 |

1 |

1 |

0 |

1 |

1 |

1 |

0 |

1 |

1 |

14 |

20 |

70% |

|

||||

|

2018 |

1 |

1 |

1 |

1 |

1 |

1 |

0 |

0 |

1 |

1 |

1 |

1 |

1 |

0 |

1 |

1 |

1 |

0 |

1 |

1 |

16 |

20 |

70% |

|

||||

|

2019 |

1 |

1 |

1 |

0 |

1 |

1 |

0 |

0 |

1 |

1 |

1 |

1 |

1 |

0 |

1 |

1 |

1 |

1 |

1 |

1 |

16 |

20 |

80% |

|

||||

Assessment Model a

A mixed approach was employed for both the qualitative and quantitative components of the study. The first component of the approach is qualitative, measured through the content analysis technique, which is used to arrange the qualitative data. For the quantitative data, this study employs the multiple regression model:

?YCSDR?_it= ?_°+?_1 ?GHG?_it+?_2 ?WU?_it +??_3 ?LTA?_it+?_4 ROEit +??_it

Where, YCSRD=CSDR rate, ?0=Constant, GHG= Co2 Contribution, WU=water usage, LTA=Logarithm of Total Asset, ROE=Return on Equity, i= Cross Sectional, t=time period µ= Error terms

Assessment Model b

Model-b analyses the value relevance of sustainability investment (SI) concerning corporate financial performance (FP). It is believed that investing in environmentally friendly technologies and processes in the business can help develop a distinctive value for their products and services, resulting in increased sales. Furthermore, green initiatives assist businesses in reducing operational costs by conserving energy (Abdi et al., 2020). According to studies, larger companies are more exposed and visible due to their size and image, and they aim to improve their reputation through sustainable measures (Barth et al., 1997; Cho et al., 2015; Clarkson et al., 2008; Li, n.d.; López et al., 2007; Orlitzky, 2001; Welbeck et al., 2017). Therefore, the study has adopted water consumption, GHG emission, and the log of total assets as explanatory variables for model-b. The data for these variables were obtained from sustainability reports and consolidated financial statements.

Y_FP =?_0 + ?_1 ?IEP?_1it + ?_2 ?IEP?_2it + ?_3 ?IFS?_it + µit

Where, Y_FP = Corporate Financial Performance, ?_0 = Constant,?IEP?_1= Water Usage, ?IEP?_2=

?CO?_(2 ) Contribution,IFS = Logarithm of Total Assets 3

, µ = Error term, i= Cross Sectional, t=time period

Table 4

|

Indicator

No. |

Description |

|

|

Indicators

of Essential Information and category |

Category |

|

|

1 |

Statement

from the CEO |

BI |

|

2 |

Fundamental

requirements of reporting |

BI |

|

3 |

Summary

of the organization’s business |

BI |

|

4 |

Status

of environmental management and policies in activities |

IMP |

|

5 |

Environmental

accounting information |

IMP |

|

6 |

Material

balance of organizational activities (input/output) |

TOP |

|

7 |

The

total amount of greenhouse gas emissions |

TOP |

|

8 |

The

total amount of water consumed |

TOP |

|

9 |

Information

for employment |

ISP |

|

10 |

Information

for occupational health and safety |

ISP |

|

Indicators

of Quality Assessment |

||

|

11 |

Mission

and value statement |

|

|

12 |

Data

in a comparable format |

|

|

13 |

Future

goals as well as past practices |

|

|

14 |

Include

BAD news as well as GOOD news |

|

|

15 |

Integrate

CSR reporting with financial reporting |

|

|

16 |

Third-party

assurance statement |

|

|

17 |

Summaries

of key facts and figures |

|

|

18 |

Interviews

and surveys |

|

|

19 |

Stakeholder

engagement |

|

|

20 |

Index

and grades |

|

Empirical Findings

The findings based on the selected variables and details are presented in the following section to highlight the assessment of sustainability reporting determination of Pakistani companies. This study section has two parts: Testing of Hypothesis" and "Analysis of Sustainability Disclosure".

Content Analysis/Analysis of Sustainability Disclosure

The key objective of this part was to examine

the sustainability reports to assess the level and trend of sustainability reporting yearly. This content analysis could help determine a company's CSR commitment by establishing sustainability guidelines and reporting patterns. As already stated in the preceding section, the indicators of non-financial information have been divided into two groups: 10 indicators of essential information - IEI and ten indicators of Quality assessment - IQA.

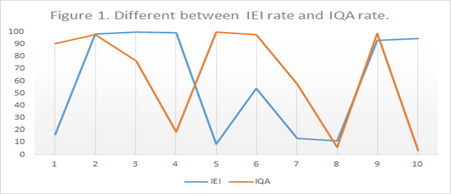

The difference between the IEI and IQA is depicted in Figure 1. And it shows that six indicators of IQA have more than 60% of the information disclosed by the firms, and indicator 9 of IQA has 100% of the information. According to MoE guidelines, IEI has been divided into four sub-categories: BI, IMP, IOP, and ISP. Among these groups, only BI and ISP have 90% information, but indicators of IMP and IOP have 50% or less, except for indicator 4. Furthermore, information regarding the level of CSDR for 20 indicators is shown in the table below (refer to Table 5).

Table 5

|

CSDR Rate |

2015 |

2016 |

2017 |

2018 |

2019 |

Total |

% |

|

1% to 25% |

0 |

0 |

0 |

0 |

0 |

0 |

0% |

|

26%

to 50% |

14 |

13 |

5 |

3 |

3 |

83 |

9% |

|

51%

to 75 % |

69 |

71 |

78 |

76 |

76 |

370 |

87% |

|

75%

to 100% |

2 |

1 |

2 |

6 |

6 |

17 |

4% |

|

Total |

85 |

85 |

85 |

85 |

85 |

425 |

100% |

The result of Table 5 shows the level of sustainability disclosure among companies listed on the PSX. From above Table, the level of disclosure of non-financial information can be classified into four categories: (i) no or poor disclosure (1% - 25%), (ii) average disclosure (26% - 50%), (iii) good disclosure (56%-75%) and (iv) strong disclosure (76% - 100%). most of the companies (87%) in the study fall into the third group, indicating that their degree of disclosure is adequate or moderate, but only 4% fall in the fourth group and have a strong level of disclosure. The findings also reveal a positive trend in disclosing non-financial or sustainable development information in Pakistan because none of the companies has "no or poor disclosure", and only a few companies (9%) have an average level of sustainability disclosure. Furthermore, firms are attempting to enhance their degree of disclosure every year, as the disclosure rate has been gradually increasing over the last five years (refer to Table 5).

Descriptive and Diagnostic Tests

Table 5 shows descriptive statistics, which indicate that ROE has a mean of 24.9 and a standard deviation of 194.4. CSDR has the lowest mean and standard deviation at 0.85 and 0.1, respectively. The rest, environmental indicators GHG and WU, have the same mean of 1.0 and almost the same standard deviation of 0.1 and 0.3, respectively.

The correlation matrix (refer to Table 7) shows that quality assessment indicators have a positive but weak correlation with ROE. On the other hand, essential information indicators have a weak and adverse relationship with ROE. The sustainability index (CSDR) has a moderate correlation with ROE.

Table 6. Descriptive Statistics

|

Variables |

N |

Minimum |

Maximum |

Mean |

Std. Deviation |

|

CSDR |

425 |

0.40 |

0.85 |

0.6 |

0.1 |

|

GHG |

425 |

0 |

1 |

0.00 |

0.069 |

|

WU |

425 |

0 |

1 |

0.11 |

0.317 |

|

LTE |

425 |

-1.9 |

7.5 |

3.4 |

1.9 |

|

ROE |

425 |

-2.6 |

2889.1 |

24.9 |

194.4 |

Note: CSDR = corporate sustainability disclosure determination rate; GHG = CO2 contribution; WU = water used; LTA = logarithms of total assets; ROE = return on equity,

The figures of the value inflation factor test (VIF) show that none of the variables has a value of VIF greater than five, not even close to it. It means there is no issue of multicollinearity in the panel data. Similarly, Table 9 demonstrates whether the data has an issue of heteroscedasticity. The results confirm that the data is free of heteroscedasticity because p > 5% indicates that the data is homoscedastic. As a result of the assumed equal variance, it can be analyzed further accordingly.

Table 7. Correlations Analysis

|

Variables |

LTE |

ROE |

IEI |

IQ |

CSDR |

|

|

ROE

|

Pearson Correlation |

-0.01 |

1 |

|

|

|

|

Sig. (2-tailed) |

0.79 |

|

|

|

|

|

|

IEI

|

Pearson Correlation |

-0.07 |

-0.2** |

1 |

|

|

|

Sig. (2-tailed) |

0.15 |

0.0 |

|

|

|

|

|

IQ

|

Pearson Correlation |

-0.01 |

0.14** |

0.20** |

1 |

|

|

Sig. (2-tailed) |

0.79 |

0.01 |

0.00 |

|

|

|

|

CSDR

|

Pearson Correlation |

-0.04 |

-0.04 |

0.80** |

.725** |

1 |

|

Sig. (2-tailed) |

0.36 |

0.42 |

0.0 |

.000 |

|

|

|

N |

425 |

425 |

425 |

425 |

425 |

|

Table 7

**. Correlation is significant at the 0.01 level (2-tailed).

Note: ROE = Return on Equity; IEI = Indicators

of essential Information; IQA = Indicators of Quality Assessment; CSDR = Corporate Sustainability Disclosure Determinization rate

Table 8

|

Variables |

VIF |

1/VIF |

|

LTE |

1.01 |

0.99 |

|

WU |

1.01 |

0.99 |

|

GHG |

1.01 |

0.99 |

|

ROE |

1.00 |

0.99 |

|

Mean VIF |

1.01 |

|

Note: LTA = logarithm of total assets; WU = water used; GHG = CO2 contribution; ROE = return on equity

Table 9. Breusch-Pagan / Cook-Weisberg test for Heteroskedasticity

|

Ho: Constant

variance |

|

chi2(1) |

|

Prob > chi2 = 0.4468 |

The generalized white test for homoscedasticity (refer to Table 10) suggests that there is no issue of heteroskedasticity because the p-value of homoscedasticity is greater than five per cent. It means we cannot reject the null hypothesis of the white test (Ho: homoscedasticity).

Table 10

|

Ho: homoscedasticity |

|||

|

chi2(1) |

|||

|

Prob > chi2 = 0.1627 |

|||

|

Cameron & Trivedi's decomposition

of IM-test |

|||

|

Source |

chi2 |

Df |

p |

|

Heteroskedasticity |

14.23 |

10 |

0.1627 |

|

Skewness |

8.23 |

4 |

0.0835 |

|

Kurtosis |

4.58 |

1 |

0.0323 |

|

Total |

27.05 |

15 |

0.0284 |

Results of Table 11 show that individual sustainability index determinants have a positive effect on CSDR except for firm sizes and ROE. The two of four indicators for the sustainability index are insignificant: LTA and ROE. The Breusch–Pagan Lagrange test validates that the fixed-effect (FE) model is the most appropriate evaluation model for data analysis, and the explanatory power (R2) of the random effect model is 3.72. It means that approximately four percent change in the dependent variable (CSDR) is because of sustainability performance indicators which are greenhouse gas contribution (GHG), total water consumed (WU), firm size (LTA), and return on equity (ROE).

Table 11. Regression Results for model-a

|

Variables |

Pooled OLS |

Fixed Effect |

Random Effect |

|

GHG |

3.63

(0.000) |

1.24

(0.217) |

2.14

(0.036) |

|

WU |

8.99

(0.000) |

1.49

(0.137) |

4.70

(0.000) |

|

LTA |

-1.35

(0.177) |

2.19

(0.030) |

0.46 (0.646) |

|

ROE |

-0.48

(0.628) |

1.24

(0.216) |

0.98

(0.326) |

|

R2 |

18.48 |

03.72 |

21.20 |

|

F or chi2 statistics |

23.64

(0.000) |

2.29

(0.05) |

25.45

(0.000) |

|

LM test (Pooled vs FE

or RE) |

327.04

(0.000) |

||

|

Fixed or random-effect model is

more appreciated than pooled OLS model |

|||

|

Hausman test (RE vs.

FE) |

14.71

(0.0053) |

||

|

The fixed effect model is more

appreciated than the random effect model |

|||

|

Note: Dependent

variable = CSDR; OLS = ordinary least square; GHG = CO2

contribution; WU = water used; LTA = logarithm of total assets; ROE = return

on equity; LM = Lagrange multiplier; FE = fixed effect; RE = random effect |

|||

Table 12. Regression Results for model-b

|

Variables |

Pooled OLS |

Fixed Effect |

Random Effect |

|

GHG |

3.63

(0.000) |

1.24

(0.217) |

2.14

(0.036) |

|

WU |

8.99

(0.000) |

1.49

(0.137) |

4.70

(0.000) |

|

Variables |

Pooled OLS |

Fixed Effect |

Random Effect |

|

GHG |

-0.22

(0.828) |

0.02

(0.986) |

-0.11

(0.912) |

|

WU |

-0.90

(0.370) |

0.02

(0.981) |

-0.53

(0.594) |

|

LTA |

-0.22

(0.828) |

0.57 (0.567) |

0.04

(0.972) |

|

R2 |

2.2 |

0.8 |

4.0 |

|

F or chi2 statistics |

0.31

(0.8217) |

0.11

(0.9545) |

0.29

(0.9622) |

|

LM test (Pooled vs FE

or RE) |

123.94

(0.000) |

||

|

A random effect or fixed effect

model is more appreciated than pooled OLS model |

|||

|

Hausman test (RE vs.

FE) |

0.44

(0.9324) |

||

|

The random effect model is more

appreciated than the fixed effect model |

|||

|

Note: Dependent

variable = ROE; OLS = ordinary least square; GHG = CO2

contribution; WU = water used; LTA = logarithm of total assets; LM = Lagrange

multiplier |

|||

Table 12 shows regression analysis for model-b of the study, which illustrates the effect of corporate sustainability reporting on firms' financial performance. The results of the LM test and Hausman test also appreciate the Random effect model to be the best fit than other panel techniques for analysis of model-b. The coefficient of random effect model R2 = 4.0 indicates that only four per cent variation in financial performance is measured by explanatory variables, which are greenhouse gas contribution (CO2 contribution), water consumed (WU), and firm size (LTA). The results of Table 12 also show that all coefficients in the models are negative and insignificant except for firm size, meaning that Pakistani companies do not enjoy the financial benefits of sustainability investments and perform likewise.

Conclusion & Discussion

The study aims to examine the relationship between corporate suitability disclosure determination rate (CSDR) with corporate sustainability performance indicators and assess the value relevance of sustainability investment in Pakistan. The data was collected from consolidated financial statements (Abdi, Li, & Càmara-Turull, 2020) and sustainability reports of 85 companies listed on PSX for five years from 2015-to 2019. A content analysis technique was used to create the corporate sustainability reporting framework based on 20 indicators (refer to Table 3). The study's findings were mixed, demonstrating that the degree of non-financial information disclosure varied among the companies, but most of the companies revealed and released significant information about sustainable development. As shown in Table 5, most of the companies in the sample (87 per cent) had a sufficient degree of disclosure, and only 4% had a strong level of disclosure. According to earlier research, corporate performance and sustainability disclosure are still new concepts, but momentum is building (Gnanaweera & Kunori, 2018). Nonetheless, findings show that Pakistani companies perform likewise in financial performance regardless of sustainability investment.

The findings also reveal a positive trend of disclosing Pakistan's non-financial or sustainable development information. Moreover, companies are trying to improve their level of disclosure every year; the rate of disclosure for all five years had some gradual upward trend. The correlation matrix (refer to Table 7) shows that quality assessment indicators have a positive but weak correlation with ROE. On the contrary, indicators of essential information have weak and negative relations with ROE, and CSDR has a moderate correlation with ROE.

Two regression models were applied: First, to measure the CSDR of the companies and analyze its relationship with SPI. Second, to analyze the value relevance of SI of the firms. Model-a shows that individual determinants of sustainability disclosure have a positive effect on CSDR except for firm sizes and ROE. The empirical evidence also indicates an absence of a significant relationship between CSDR and SPI, which means there is no strong link between the degree of sustainability disclosure and sustainability performance.

The results of regression model-b illustrate the effect of sustainability investment (SI) on firms' financial performance (refer to Table 11). The findings of model-b are also insignificant for the linkage between SI and FP, which means that firms with higher or lower CSDR would perform similarly in terms of FP, and Pakistani companies do not enjoy the financial benefits of sustainability investments. Because empirical evidence indicates that only a 4% change in FP is measured by explanatory variables, which are greenhouse gas contribution (CO2 contribution), water consumed (WU), and firm size (LTA). The results also show that all coefficients in the models are negative and insignificant except firm size (refer to Table 11). This study's results are inconsistent with several kinds of research that support the positive relationship between SI and FP, but they are consistent with research that supports the negative or neutral relationship between SI – FP (Ching et al., 2017; Setyahuni & Handayani, 2020).

A possible explanation for the lack of association between SI and FP is that profit from sustainability investment would offset for the expense in market equilibrium. In other words, the answer to sustainability development conduct is to legitimize the firm's environmental and social practices in the eyes of the stakeholders, or companies can also use expensive sustainability development initiatives to minimize information asymmetry. Based on the results, one may think about why companies pursue a sustainable development path if these initiatives are voluntary or beyond their legal obligations and could entail a compromise in short-term income and/or contradict with its value maximization strategy.

According to the literature, evaluating a financial performance of a company based on accounting figures is not considered adequate, and it should be evaluated considering social and environmental factors as well. Shareholders may be unwilling to invest their money into a company that isn't socially responsible. They are also interested in whether a company operates in an environmentally sustainable manner (Abdi et al.,2020)

Limitations & Recommendations

There are certain limitations to this study, which opens the avenues for future studies. Firstly, the study used data of single developing country, so the results cannot be generalized specially to developed countries where sustainability development and their disclosure is good enough or mandatory by legal perspective. These findings should be compared to those listed in other stock indices for further study. Secondly, other aspects of sustainable disclosure, such as quality of sustainability, may have been included, and more recent data would have given us up to date picture of the phenomenon. This would help to compare our findings to new circumstances of sustainability development and disclosures.

The outcomes of this study add information to the understanding of voluntary CSR and reveal a positive trend of sustainability disclosure in Pakistan which is significant for creating globally accepted reporting standards for sustainable development.

References

- Abdi, Y., Li, X., & CÃ mara-Turull, X. (2020). Impact of Sustainability on Firm Value and Financial Performance in the Air Transport Industry. Sustainability, 12(23), 9957.

- Abramson, L., & Chung, D. (2000). Socially Responsible Investing: Viable for Value Investors? The Journal of Investing, 9(3), 73–80.

- Akisik, O., & Gal, G. (2014). Financial performance and reviews of corporate social responsibility reports. Journal of Management Control, 25(3–4), 259–288.

- Ali, W., Faisal Alsayegh, M., Ahmad, Z., Mahmood, Z., & Iqbal, J. (2018). The Relationship between Social Visibility and CSR Disclosure. Sustainability, 10(3), 866.

- Ali, W., Frynas, J. G., & Mahmood, Z. (2017). Determinants of Corporate Social Responsibility (CSR) Disclosure in Developed and Developing Countries: A Literature Review: Determinants of CSR Disclosure. Corporate Social Responsibility and Environmental Management, 24(4), 273–294.

- Al-Tuwaijri, S. A., Christensen, T. E., & Hughes, K. E. (2004). The relations among environmental disclosure, environmental performance, and economic performance: A simultaneous equations approach. Accounting, Organizations and Society, 29(5–6), 447–471.

- Ameer, R., & Othman, R. (2012). Sustainability Practices and Corporate Financial Performance: A Study Based on the Top Global Corporations. Journal of Business Ethics, 108(1), 61–79.

- Aras, G., Aybars, A., & Kutlu, O. (2010). Managing corporate performance: Investigating the relationship betweencorporate social responsibility and financial performance in emerging markets. International Journal of Productivity and Performance Management, 59(3), 229–254.

- Attamimi, A. A. B., & Ameer, R. (2010). Readability of Corporate Social Responsibility Communication in Malaysia. SSRN Electronic Journal.

- Azizul Islam, M., & Deegan, C. (2008). Motivations for an organization within a developing country to report social responsibility information: Evidence from Bangladesh. Accounting, Auditing & Accountability Journal, 21(6), 850–874.

- Bowen, G. A. (2009). Document Analysis as a Qualitative Research Method. Qualitative Research Journal, 9(2), 27–40.

- Brouwers, R., Schoubben, F., Hulle, C. V., & Uytbergen, S. V. (2014). The link between corporate environmental performance and corporate value: A literature review. Review of Business and Economic Literature, 4(58), 343–374.

- Ching, H. Y., Gerab, F., & Toste, T. H. (2017). The Quality of Sustainability Reports and Corporate Financial Performance: Evidence From Brazilian Listed Companies. SAGE Open, 7(2), 215824401771202.

- Cho, C. H., & Patten, D. M. (2007). The role of environmental disclosures as tools of legitimacy: A research note. Accounting, Organizations and Society, 32(7–8), 639– 647.

- Cho, C. H., Laine, M., Roberts, R. W., & Rodrigue, M. (2015). Organized hypocrisy, organizational façades, and sustainability reporting. Accounting, Organizations and Society, 40, 78–94.

- Christmann, P. (2004). Multinational Companies and the Natural Environment: Determinants of Global Environmental Policy Standardization. Academy of Management Journal, 47(5), 747–760.

- Clarkson, P. M., Li, Y., Richardson, G. D., & Vasvari, F. P. (2008). Revisiting the relation between environmental performance and environmental disclosure: An empirical analysis. Accounting, Organizations and Society, 33(4–5), 303–327.

- Cochran, P. L., & Wood, R. A. (1984). Corporate Social Responsibility and Financial Performance. Academy of Management Journal, 27(1), 42–56.

- Collins G. Ntim & Kofi A. Osei. (2011). The Impact of Board Meetings on Corporate Performance in South Africa. African Review of Economics and Finance, 2(2), 83–103.

- Connelly, B. L., Certo, S. T., Ireland, R. D., & Reutzel, C. R. (2011). Signaling Theory: A Review and Assessment. Journal of Management, 37(1), 39–67.

- Cooper, S. M., & Owen, D. L. (2007). Corporate social reporting and stakeholder accountability: The missing link. Accounting, Organizations and Society, 32(7–8), 649–667.

- Coupland, C. (2005). Corporate Social Responsibility as Argument on the Web. Journal of Business Ethics, 62(4), 355– 366.

- Deegan, C., & Gordon, B. (1996). A Study of the Environmental Disclosure Practices of Australian Corporations. Accounting and Business Research, 26(3), 187–199.

- Derwall, G., & Bauer, K. (2004). (n.d.). The Eco-Efficiency Premium Puzzle. 36.

- Dhaliwal, D. S., Radhakrishnan, S., Tsang, A., & Yang, Y. G. (2012). NonfinancialDisclosure and Analyst Forecast Accuracy: International Evidence on Corporate Social Responsibility Disclosure. The Accounting Review, 87(3), 723–759.

- Dowling, J., & Pfeffer, J. (1975). Organizational Legitimacy: Social Values and Organizational Behavior. The Pacific Sociological Review, 18(1), 122–136.

- Dresner, S. (2008). The principles of sustainability (2nd ed). Earthscan.Dresner, S. (2008). The principles of sustainability (2nd ed). Earthscan.

- Fifka, M. S. (2013). Corporate Responsibility Reporting and its Determinants in Comparative Perspective - a Review of the Empirical Literature and a Meta- analysis: Corporate Responsibility Reporting and its Determinants. Business Strategy and the Environment, 22(1), 1– 35.

- Gallardo-Vázquez, D., Barroso-Méndez, M., Pajuelo-Moreno, M., & Sánchez-Meca, J. (2019). Corporate Social Responsibility Disclosure and Performance: A Meta- Analytic Approach. Sustainability, 11(4), 1115.

- Gnanaweera, K. A. K., & Kunori, N. (2018). Corporate sustainability reporting: Linkage of corporate disclosure information and performance indicators. Cogent Business & Management, 5(1), 1423872.

- Hąbek, P., & Wolniak, R. (2015). Factors Influencing the Development of CSR Reporting Practices: Experts' versus Preparers' Points of View. Engineering Economics, 26(5), 560–570.

- Hahn, R., & Kühnen, M. (2013). Determinants of sustainability reporting: A review of results, trends, theory, and opportunities in an expanding field of research. Journal of Cleaner Production, 59, 5–21.

- Himmelberg, C. P., Hubbard, R. G., & Palia, D. (1999). Understanding the determinants of managerial ownership and the linkbetween ownership and performance. Journal of Financial Economics, 53(3), 353–384.

- Hooghiemstra, R. (2000). Corporate Communication and Impression Management – New Perspectives Why Companies Engage in Corporate Social Reporting. Journal of Business Ethics, 27(1/2), 55–68.

- Jennifer Ho, L.-C., & Taylor, M. E. (2007). An Empirical Analysis of Triple Bottom-Line Reporting and its Determinants: Evidence from the United States and Japan. Journal of International Financial Management & Accounting, 18(2), 123–150.

- Jha, M. K., & Rangarajan, K. (2020). Analysis of corporate sustainability performance and corporate financial performance causal linkage in the Indian context. Asian Journal of Sustainability and Social Responsibility, 5(1), 10.

- Kapoor, S., & Sandhu, H. S. (2010). Does it Pay to be Socially Responsible? An Empirical Examination of Impact of Corporate Social Responsibility on Financial Performance. Global Business Review, 11(2), 185–208.

- López, M. V., Garcia, A., & Rodriguez, L. (2007). Sustainable Development and Corporate Performance: A Study Based on the Dow Jones Sustainability Index. Journal of Business Ethics, 75(3), 285– 300.

- Lucian, B., & Alexandra Horobet. (2013). On the Relationship between Social Responsibility and Financial Performance – The Need for Theoretical Convergence. International Proceedings of Economics Development and Research, 65(7), 32– 36.

- Milne, M. J., & Patten, D. M. (2002). Securing organizational legitimacy: Anexperimental decision case examining the impact of environmental disclosures. Accounting, Auditing & Accountability Journal, 15(3), 372–405.

- Mousa, et. al., Gehan. A. (2015). Legitimacy Theory and Environmental Practices: Short Notes. International Journal of Business and Statistical Analysis, 2(1), 41–53.

- Ntim, C. G., & Soobaroyen, T. (2013). Corporate Governance and Performance in Socially Responsible Corporations: New Empirical Insights from a Neo- Institutional Framework: Corporate Governance and Social Responsibility. Corporate Governance: An International Review, 21(5), 468–494.

- O'Donovan, G. (2002). Environmental disclosures in the annual report: Extending the applicability and predictive power of legitimacy theory. Accounting, Auditing & Accountability Journal, 15(3), 344–371.

- Oncioiu, I., Petrescu, A.-G., Bîlcan, F.-R., Petrescu, M., Popescu, D.-M., & Anghel, E. (2020). Corporate Sustainability Reporting and Financial Performance. Sustainability, 12(10), 4297.

- Orlitzky, M. (2001). [No title found]. Journal of Business Ethics, 33(2), 167–180.

- Patten, D. M. (1991). Exposure, legitimacy, and social disclosure. Journal of Accounting and Public Policy, 10(4), 297–308.

- Patten, D. M. (2002). The relation between environmental performance and environmental disclosure: A research note. Accounting, Organizations and Society, 27(8), 763–773.

- Setyahuni & Handayani. (2020). On the Value Relevance of Information on Environmental, Social, and Governance (EsgESG): An Evidence from Indonesia. Journal of Critical Reviews, 7(12).

- Wagner, M. (2005). How to reconcile environmental and economic performance to improve corporate sustainability: Corporate environmental strategies in the European paper industry. Journal of Environmental Management, 76(2), 105–118.

- Welbeck, E. E., Owusu, G. M. Y., Bekoe, R. A., & Kusi, J. A. (2017). Determinants of environmental disclosures of listed firms in Ghana. International Journal of Corporate Social Responsibility, 2(1), 11.

- Welbeck, E. E., Owusu, G. M. Y., Bekoe, R. A., & Kusi, J. A. (2017). Determinants of environmental disclosures of listed firms in Ghana. International Journal of Corporate Social Responsibility, 2(1), 11.

- Yasser, Q. R. (2011). Corporate Governance and Performance: An Analysis of Pakistani Listed Firms. 13.

- Zhongfu, Y., Jianhui, J., & Pinglin, H. (2011). The study on the Correlation between Environmental Information Disclosure and Economic Performance-With empirical data from the manufacturing industries at Shanghai Stock Exchange in China. Energy Procedia, 5, 1218–1224.

Cite this article

-

APA : Rasool, N., Sohail, M., & Hussain, M. M. (2022). Analysis of Sustainability Disclosure and Performance Indicators in Pakistan to Determine the Value Relevance of Sustainability Reporting. Global Economics Review, VII(I), 41- 56 . https://doi.org/10.31703/ger.2022(VII-I).05

-

CHICAGO : Rasool, Nosheen, Muhammad Sohail, and Muhammad Mubashir Hussain. 2022. "Analysis of Sustainability Disclosure and Performance Indicators in Pakistan to Determine the Value Relevance of Sustainability Reporting." Global Economics Review, VII (I): 41- 56 doi: 10.31703/ger.2022(VII-I).05

-

HARVARD : RASOOL, N., SOHAIL, M. & HUSSAIN, M. M. 2022. Analysis of Sustainability Disclosure and Performance Indicators in Pakistan to Determine the Value Relevance of Sustainability Reporting. Global Economics Review, VII, 41- 56 .

-

MHRA : Rasool, Nosheen, Muhammad Sohail, and Muhammad Mubashir Hussain. 2022. "Analysis of Sustainability Disclosure and Performance Indicators in Pakistan to Determine the Value Relevance of Sustainability Reporting." Global Economics Review, VII: 41- 56

-

MLA : Rasool, Nosheen, Muhammad Sohail, and Muhammad Mubashir Hussain. "Analysis of Sustainability Disclosure and Performance Indicators in Pakistan to Determine the Value Relevance of Sustainability Reporting." Global Economics Review, VII.I (2022): 41- 56 Print.

-

OXFORD : Rasool, Nosheen, Sohail, Muhammad, and Hussain, Muhammad Mubashir (2022), "Analysis of Sustainability Disclosure and Performance Indicators in Pakistan to Determine the Value Relevance of Sustainability Reporting", Global Economics Review, VII (I), 41- 56

-

TURABIAN : Rasool, Nosheen, Muhammad Sohail, and Muhammad Mubashir Hussain. "Analysis of Sustainability Disclosure and Performance Indicators in Pakistan to Determine the Value Relevance of Sustainability Reporting." Global Economics Review VII, no. I (2022): 41- 56 . https://doi.org/10.31703/ger.2022(VII-I).05