Abstract:

This study aims to draw a policy decision between public investment and public consumption by designing a Dynamic Stochastic General Equilibrium (DSGE) model for the economy of Pakistan which is experiencing persistent shocks that have stressed the growth pattern. The DSGE model has a microeconomic foundation and justifies locus critics by envisioning an artificial economy. The model is evaluated and set to best fit for data through an exercise of moment matching. Government consumption shocks and Government Investment shocks are used to trace out the behaviour of the economy. The analysis confirms that Pakistan economy could go for capital formation through public investment but it results in compromised public consumption and structural unemployment. It is further concluded that the export base and long-run public investment programs are needed to achieve sustainable development in the economy

Key Words:

Fiscal Policy, Analysis, Public Investment, Consumption, DSGE model

Introduction

The economy of Pakistan is characterized as unstable and vulnerable to economic shocks due to its poor fiscal space, weak financial soundness, low productive capacity and poor export base. The central bank has also a poor autonomy. Though optimal fiscal policy plays an instrumental role to enhance economic output in short-run for Pakistan still we are not certain about the role of fiscal policy to achieve long-run sustained economic equilibrium. (Ali & Ahmad, 2010).

It is acknowledged that fiscal impetus pays a significant role to increase economic growth, job creation and income generation in short-run (Foster, 2009). But, it is subject of analysis to trace out the role of an increase in government spending on macroeconomic soundness in long-run. (Javid & Arif, 2009).

Attiya and Arif (2009) point out that there is a need to trace out the role of fiscal policy to quantify the effects of government spending on macroeconomic activities. Though fiscal transmission mechanism guides policy experts about the effect of a fiscal intervention in the economy, it is extremely important to know about the composition of government expenditures. We segregate government spending on government consumption and government investment. These two categories have different effects on the aggregate economic situation (Ramey, 2011). Turnovsky & Fisher (1995) show that government investment expenditures have a strong role to increase the productive capacity of the economy for a long period through job creation and capital formation. Contrary to this, government consumption doesn’t make way for long-run productivity.

There have been quite a few studies to investigate the fiscal policy transmission mechanism in Pakistan. All studies have used time-series data and Ordinary Least Square (OLS) technique to estimate fiscal policy transmission mechanism. Many studies have used Vector Autoregressive (VAR) models for this purpose. However, time series-based models have certain limitations. First, consistent and long time-series are not available in many cases. Second, time-series data of national income accounts is not available on quarterly frequency in Pakistan. Coefficients estimated through OLS regression are subject to Lucas Critique and, cannot be used for robust policy analysis.

Dynamic Stochastic General Equilibrium (DSGE) models are now generally used for macroeconomic policy analysis in central banks and other economic policy analysis institutions. These models incorporate microeconomic foundations and rational expectations. DSGE models are capable of overcoming issues of Lucas critique and inconsistent time series as well. Based on these merits, it is highly desirable to construct a DSGE model to analyze fiscal policy transmission mechanism in Pakistan.

We observe that generally, Pakistan specific studies on fiscal transmission have two things in common: annual data and use of VAR models. Annual data is used as national income accounts are maintained only on an annual basis in Pakistan whereas VAR models are used to avoid the econometric issues related to simultaneity. Khalid et. al. (2007) admit that their parsimonious model might have missed some important dynamics. Apart from degrees of freedom problem, other issues related to VAR models are the atheoretic nature and subjectivity to Lucas critique. It is recommended that using a restricted VAR model based upon DSGE model restrictions could present better analysis (Javid and Arif, 2009).

Keeping in view above noted issues, we propose a small open economy DSGE model using quarterly data for policy analysis. DSGE models are widely used for monetary policy (Christiano et. al. 2005; Smets and Wouter (2003 & 2007) and fiscal policy analysis (Botman, Laxton, & Romanov, 2006); Ratto et. al. (2009). It is believed, an estimated quarterly DSGE model can overcome the problems of degrees of freedom and atheoretic nature of VAR models.

The objective of this study to recommend an optimal fiscal policy for Pakistan economy by knowing how fiscal policy variables e.g. government spending i.e. government expenditures and government investments affect important macroeconomic variables like GDP, consumption, private investment, inflation and interest rate using a DSGE model.

Literature Review

Mencinger (2016) tried to analyze the role of fiscal policy to achieve economic

sustainability. He assessed fiscal policy in a time of economic recession and economic expansion. He relates his work with the theoretical framework of classical general equilibrium. He used a structural autoregressive methodology for fiscal analysis. He concludes that fiscal multiplier from government investment is much higher than government spending. He also concludes that fiscal multiplier appears larger in the presence of large output gaps (negative) as compare to economic expansion at the full employment level.

It is believed (Corsetti, Kuester, & Müller, 2011) that fiscal policy has more significant effects in time when a Central Bank is following a fixed exchange rate regime. However, market liberalization and openness do not let the big impact to realize in the economy. Ravn and Spange (2012) worked on the Danish economy and made use of the SVAR model in their analysis. The findings confirm that fiscal policy has profound effects on economic output in the presence of fixed exchange rate but the effects of a fiscal intervention on the consumption are unclear and inconclusive. However, they witnessed that an increased level of public spending cause private investment to decrease in the economy.

A famous macroeconomist (Castro, 2003) analyzed fiscal shocks using a VAR model for the Spanish economy. He concludes that fiscal policy positively contributes to GDP, private investment, interest rate and inflation in the economy. It has been further confirmed that fiscal injections in the economy open up ways for multiple investment opportunities in the private sector.

Leading macroeconomist (Woodford, 2009) worked on a Real Business Cycle model. He concludes that there is uncertainty in the quantitative effect of fiscal policy. Mainly, uncertainty arrives because of estimation and evaluation methodology adopted for policy analysis. Smets and Wouters's model is considered as a baseline model that captures the current theoretical framework of new-Keynesian models whose foundations model is (Christiano, Eichenbaum, & Evan, 2005).

A Dynamic Stochastic General Equilibrium (DSGE) model is used for the Eurozone and incorporates real and nominal frictions. This model is used to gauge the behaviour of monetary policy and fiscal rule for macroeconomic indicators and talks about the effectiveness of policies. The model uses quarterly data and takes into account optimization behaviour of economic agents. Authors also term that the DSGE model is best suited for monetary and fiscal policy analysis. But, the analysis requires a proper representation of data to achieve forecast results at a satisfactory level. The model is non-Ricardian in nature so does not respond to interest rate movements (Ratto, Roeger, & Veld, 2009).

Policy analysis is a key concern of various studies in macroeconomics through empirical analysis. (Eric & Wolff, 2018) made a comprehensive attempt to quantify the role of government spending on economic output and welfare of the economy. The study points out that government spending is not a desirable policy tool. The study documents the effect of fiscal policy intervention through a New Keynesian DSGE model. The model is designed along the lines of (Christiano, Eichenbaum, & Evans, 2005) and (Smets & Wouters, 2007). The model includes price & wage rigidity, capital formation and economic shocks. The model includes two types of government spending; government consumption and government investment. Government consumption is an aggregate consumption from which households draw utility, assuming private and government consumption are substitutable. Government investment is incorporated into the model by (Baxter & King, 1993). It is confirmed that government spending and investment is financed by taxation and debt. It is also assumed in this model that monetary policy follows a Taylor rule. The model was applied to data set of United State of America (USA) and Bayesian estimation techniques were adopted for analysis purposes.

Choudhri and Malik (2012) designed a DSGE model for the economy of Pakistan. They tried to trace out the impact of fiscal dominance on monetary policy behaviour in Pakistan. Authors confirm that the presence of fiscal dominance is a reason for the inflationary behaviour of the economy.

A group of researchers (Rehman, Khan, & Hayat, 2017) from State Bank of Pakistan designed a DSGE model to analyze the impact of workers’ remittances on macroeconomic indicators for Pakistan economy. They conclude that workers’ remittances contribute to economic growth as they indirectly help to increase consumption and investment.

A very useful work on fiscal policy was conducted by (Shahid, Ahmad, & Rahman, 2018) through the use of a DSGE model for the economy of Pakistan. The findings reveal that fiscal policy has a significant impact on the price level and interest rate and demands increased coordination between fiscal and monetary authorities.

It is admitted fact that seminal work was done by a stream of researchers on theoretical models after it was confirmed that DSGE models prove equally good in policy analysis which can help to improve the policy development process for the Pakistan economy. But, it is a reality that research conducted so far remained restricted to use a DSGE model for monetary policy analysis. Most studies conducted so far were aimed to analyze specific research areas like consolidation, fiscal dominance, the role of foreign direct investment and fluctuation in key macroeconomic variables. Such studies mainly focus on monetary policy analysis. Hardly any study was aimed to decide optimal fiscal policy move by understanding how government spending i.e. government expenditures and government investments affect important macroeconomic variables.

Section 03: Description of The Model

A small open economy Dynamic Stochastic General Equilibrium (henceforth DSGE) model is designed with various nominal and real frictions to trace fiscal and monetary policy shocks.

Structure of the Model

DSG model has a fairly simple structure. It builds upon four simple blocks. Demand block, supply block and monetary policy equation and fiscal rule. The model is confirmed as best fit through calibration (Adolfson et. al., 2005). Despite the simplicity, the model is in position to account for inflation, output, and interest rate for the economy of Pakistan.

Model Economy

Our open economy model consists of four classes of agents; representative households, representative final good producing firms (f-firm), intermediate firms that are involved in the processing of raw material (i-firms), monetary authority and fiscal authorities. The model economy accounts for external sector i/e export and import of the economy. Further, an assumption of the microeconomic foundation also prevails in the economy (Sbordone, Tambalotti, Rao, & Wals, 2010).

Data Sources

To calculate empirical moments, data have been taken from Economic Survey of Pakistan (all volumes), Pakistan Bureau of Statistics, State Bank of Pakistan and International Financial Statistics and multiple microeconomic studies for model calibration.

Table 1. Data Sources

|

S. No. |

Data Series |

Source |

|

1 |

GDP |

Hanif et. al. (2013) |

|

2 |

Private Consumption |

Hanif et. al. (2013) |

|

3 |

Private Investment |

Hanif et. al. (2013) |

|

4 |

Government Spending |

Hanif et. al. (2013) |

|

5 |

Consumer price index |

State Bank of Pakistan |

|

6 |

Call money rate |

State Bank of Pakistan |

|

7 |

Population |

World Bank |

Time Series

The study makes use of data series of

different macroeconomic variables ranging from 1980 to 2016. The period

captures all major macroeconomic fluctuations that Pakistan economy

experienced.

Types of Variables

The variables are selected according to the requirement of the DSGE model. This model incorporates three types of variables.

i. Structural parameters

ii. Shocks variables

iii. Policy variables

Structural Parameters

Structural variables are in control of the economic agents, so also called control variables. There is a total of ten structural parameters in this model.

Table 2. Structural Parameters

|

S.

No. |

Parameter |

Interpretation |

|

1 |

? |

Share

of leisure in a utility function |

|

2 |

|

Risk

aversion parameter |

|

3 |

|

Subjective

discount factor |

|

4 |

|

Share

of labour in output |

|

5 |

|

The

depreciation rate of capital |

|

6 |

|

Calvo

probability of fixed price in next period |

|

7 |

|

The

curvature of investment adjustment cost function |

|

8 |

|

Interest

rate smoothing coefficient |

|

9 |

|

Interest

rate response to inflation |

|

10 |

|

Interest

rate response to the output gap |

Shocks variables directly capture economic fluctuation that appears in the economy due to internal or external factors. There is only one shock variable i/e technology shock.

Table 3. Shock Variables

|

S. No. |

Parameter |

Interpretation |

|

1 |

|

Technology Shock

Variable |

Policy Variables

Policy

variables taken in this model are government consumption, government investment

and monetary policy shocks. these are also called shock variables of the

economy.

Table 4. Policy Variables

|

S.

No. |

Symbol |

Parameter

Name |

|

1 |

|

Persistence

of total factor productivity shock |

|

2 |

|

Persistence

of fiscal spending shock |

|

3 |

|

Persistence

of monetary policy shock |

|

4 |

|

Standard

deviation of the total factor productivity shock |

|

5 |

|

Standard

deviation of fiscal spending shock |

|

6 |

|

Standard

deviation of the monetary policy shock |

Calibration for DSGE Model

Calibration

refers to assign a numeric value to the model parameter/s. To fully overcome

Lucas critique, structural parameters of the model are calibrated in a way that

implied steady-state ratios of investment to GDP and consumption to GDP match

averages of these ratios in real macroeconomic data. Another strategy of

calibration is to use parameter values from related studies.

Choice

of the frequency of data i.e. annual vs. quarterly is important for

calibration. Many parameters are time-invariant e.g. share of labour in output

and share of consumption in GDP. However, many parameters are sensitive to data

frequency e.g. discount factor

First,

we discuss parameters related to households’ preferences. Subjective discount

factor “?” measures the degree of impatience of representative agents. Lower

the value of “?”, higher the interest rate is required to make households to

save. Value of ?=0.99 has been taken from (Haider,

Din, & Ghani, 2012). A group of researchers (Ahmad,

Ahmed, Choudhri, Pasha, & Tahir, 2018) have also used the

same value in their study. Value of risk aversion “?” has been taken from

Bayesian estimation results of (Ahmad, Ahmed, Choudhri, Pasha,

& Tahir, 2018). We have used a

posterior mean of “?” which is equal to 0.848. Share of leisure in the utility

function, ?=0.40 is calibrated

using Bayesian estimation results of Gabriel et. al. (2010).

Share

of capital in production

Choudhry

et. al. (2016) provide Calvo price

rigidity coefficient based on a survey of structured interviews of Pakistani

firms. Since the survey was conducted in an environment when firms were forced

to change prices too often, therefore this number might have been overstated by

Chief Executive Officers (CEO’s) during interviews. To overcome this bias, we

use price stickiness coefficient to be 0.50 instead of 0.25.

Investment

adjustment cost parameter, ?=2 has been calibrated based upon (Gabriel,

Levine, Pearlman, & Yang, 2010). Monetary policy

Taylor type interest rate rule coefficients (

We have four

exogenous shocks namely total factor productivity, fiscal spending, foreign

output and monetary policy in our model. These shocks are represented by

first-order autoregressive equations. Persistence of these exogenous shocks is

measured through the first-order autoregressive coefficient of these exogenous

shocks’ equations. Standard deviations of these shocks are measured through

standard deviation of residuals of these first-order autoregressive equations.

Table 5. Values of Structural Parameters

|

S. No. |

Parameter |

Interpretation |

Value |

|

1 |

|

Share of leisure in a utility function |

0.40 |

|

2 |

|

Risk aversion parameter |

0.848 |

|

3 |

|

Subjective discount factor |

0.99 |

|

4 |

|

Share of labour in output |

0.40 |

|

5 |

|

Depreciation rate of capital |

0.0164 |

|

6 |

|

Calvo probability of fixed price in next period |

0.50 |

|

7 |

|

Curvature of investment adjustment cost function |

2 |

|

8 |

|

Interest rate smoothing coefficient |

0.93 |

|

9 |

|

Interest rate response to inflation |

0.25 |

|

10 |

|

Interest rate response to the output gap |

1.05 |

|

11 |

? |

Elasticity of substitution between foreign and domestic goods |

1 |

|

12 |

? |

Share of foreign goods in total consumption |

0.3 |

Persistence of TFP

shock,

Table 6. Values of Shock Parameters

|

S. No. |

Parameter |

Interpretation |

Value |

|

|

1 |

|

Persistence of total factor productivity shock |

0.99 |

|

|

2 |

|

Persistence of fiscal spending shock |

0.66 |

|

|

3 |

|

Persistence of monetary policy shock |

0.30 |

|

|

4 |

|

Standard deviation of the total factor productivity shock |

0.017 |

|

|

5 |

|

Standard deviation of fiscal spending shock |

0.028 |

|

|

6 |

|

Standard deviation of the monetary policy shock |

0.008 |

|

|

7 |

|

Persistence of foreign output shock |

0.80 |

|

|

8 |

|

Standard deviation of foreign output shock |

0.01 |

|

A solution of Log-Linearized DSGE Models

Uhlig

(1999) provides a 5-step procedure to solve and analyze DSGE models.

1. Get first-order conditions (through

optimization), constraints and equilibrium conditions.

2. Calibrate the model parameters.

3. Log-linearize the model equations

around the non-stochastic steady state.

4. Obtain solution of the model as

‘policy functions’ where endogenous variables of the model depend upon previous

state and current socks.

5. Analyze the solution obtained in step

4 using Impulse Response Functions (IRF’s) and second-order moments.

6. Interpret the shocks and transmission

effects

To

obtain these policy functions, IRF’s and second-order moments, we have used

Dynare; a set of Matlab routines provided by (Juillard, 1996).

To

evaluate data matching capabilities of DSGE model, it is a standard practice to

match or compare second-order moments obtained from DSGE model (theoretical

modes) with the same moments i/e empirical moments drawn from actual

macroeconomic data. We undertake the following data transformations:

1.

Make data real (if nominal)

2.

Apply seasonal adjustment

3.

Divide by population to get per capita series

4.

Take natural logarithm

5.

Apply a Hodrick-Prescott (HP) filter to obtain deviation from trend

Second-order

moments include standard deviations, autocorrelations, cross-correlations of

all model variables with key macroeconomic variables like GDP, employment

level, interest rate etc.

Moment

Matching Exercise

Moments

for different versions of our DSGE models and actual quarterly data have been

summarized. The relative standard deviation for GDP is simply 1 owing as it has

been calculated by taking ratio with itself. Model 4 shows that relative SD for

consumption is 0.97 which is slightly lower than the number observed in

empirical data i.e. 1.36. However, the model 4 can capture the well know

stylized fact that investment is more volatile than consumption. Relative SD of

investment in model 4 is 2.97 which is lower than the empirical value of 5.73. The

relative standard deviation of inflation is greater than that of empirical

values of 2.58. Model 4 overestimates the relative standard deviation of

inflation: 6.00 in model vs. 2.58 in data. In case of interest rate, model 4

also overestimates relative volatility of interest rate: 3.95 in model vs. 1.15

in data.

One major justification about overestimation of inflation volatility by our model is that the real economy has much more amount of frictions that delay pricing decisions by firms and effectively reduce inflation volatility. We have modelled only a few of them such as monopolistic competition and output price rigidity. However, many are not in our model. However, it is interesting to note that even our simplified model is doing a reasonable job in terms of capturing the relative standard deviations.

Table 7. Second Order Moments from DSGE and Data

|

Models |

Empirical |

||||

|

|

M1 |

M2 |

M3 |

M4 |

|

|

Relative

SD |

|||||

|

GDP |

1.000 |

1.00 |

1.000 |

1.000 |

1.000 |

|

Private

Consumption |

0.27 |

0.44 |

2.305 |

0.97 |

2.359 |

|

Private

Investment |

2.279 |

7.50 |

2.780 |

2.97 |

5.725 |

|

Inflation |

6.00 |

2.579 |

|||

|

Nominal

Interest Rate |

3.95 |

1.148 |

|||

|

Cross-Correlation |

|||||

|

GDP |

1.00 |

1.00 |

1.000 |

1.000 |

1.000 |

|

Private

Consumption |

0.932 |

0.559 |

-0.425 |

0.65 |

0.437 |

|

Private

Investment |

0.997 |

0.191 |

0.063 |

0.49 |

0.044 |

|

Inflation |

-0.35 |

-0.031 |

|||

|

Nominal

Interest Rate |

-0.75 |

0.007 |

|||

|

Autocorrelation |

|||||

|

GDP |

0.724 |

0.727 |

0.640 |

0.76 |

0.137 |

|

Private

Consumption |

0.778 |

0.738 |

0.384 |

0.67 |

-0.161 |

|

Private

Investment |

0.721 |

0.534 |

0.856 |

0.91 |

0.307 |

|

Inflation |

0.62 |

0.534 |

|||

|

Nominal

Interest Rate |

0.93 |

0.775 |

|||

Section 04: Results And Analysis

Fiscal Transmission Mechanism DSGE Impulse Response

Functions Analysis

Table 8. Variables and symbols

|

Variable

Name |

Sign |

Variable

Name |

Sign |

|

Output |

Y |

Inflation

CPI |

Pi_c |

|

Inflation

Households |

Pi_h |

Private

Investment |

i |

|

Consumption |

C |

Rented

capital |

R_k |

|

Interest

rate |

R |

Employment |

h |

|

Wage

rate |

W |

Depreciation

|

dep |

|

Capital |

K |

Real

exchange rate |

rer |

|

Nominal

interest rate |

R |

|

|

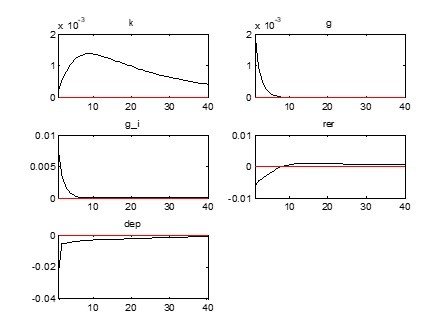

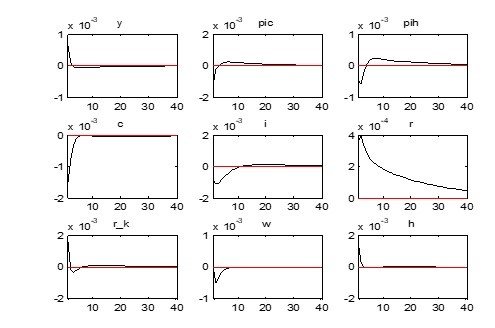

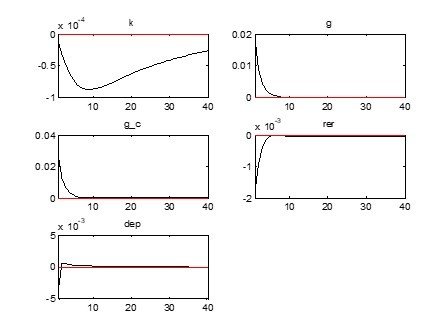

Figure 3

Response of model variables to government consumption shock

Table 9. Comparisons between government investment shock and government consumption shock

Table 9

|

Variable Name |

Sign |

Aftershock,

Level of Variable from

Steady State |

|

|

|

|

Investment Shock |

Consumption Shock |

|

Output |

Y |

Increased |

Below

steady state |

|

Consumption |

C |

Increased |

Below

steady state |

|

Inflation

CPI |

Pic |

Below

steady state |

Above

steady state |

|

Household

inflation |

Pih |

Below

steady state |

Above

steady state |

|

Interest

rate |

R |

Below

steady state |

Above

steady state |

|

Wage

rate |

W |

At

steady state |

Below

steady state |

|

Capital |

K |

Much

higher |

Much

below steady-state |

|

Private

investment |

I |

Above

steady state |

Below

steady state |

|

Rented

capital |

R_k |

At

steady state |

Below

steady state |

|

Employment

|

H |

Below

steady state |

At

steady state |

|

Depreciation |

Dec |

Below

steady state |

Above

steady state |

Conclusions and Policy Analysis

The study explains the fiscal policy analysis through the Dynamic Stochastic General Equilibrium Model for the economy of Pakistan amid fiscal policy dominance and poor accommodating behaviour of State Bank of Pakistan.

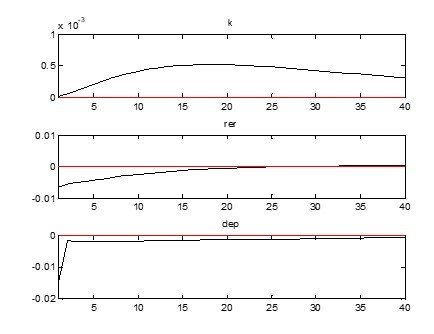

The government expenditures are segregated into government consumption and government investment to identify which is responsible for sustainable economic growth in the economy. Policy analysis is drawn through Impulse Response Functions for both government consumption and government investment. Monetary policy is also introduced to achieve literature coherence.

The impulse response function analysis shows that government investment shock in the economy helps to increase the long-run level of economic output in the economy. The effect of government investment shock on different macroeconomic variables i.e. structural variables for 40 periods i.e. 10 years shows that government investment shock leads to an increase in output level by boosting employment and capital stock in the economy. As a result of public sector investment, level of private investment in the economy also increases while inflation remains below its steady-state level.

Generally, the level of economic activity increases due to the presence of low-interest rates in the economy. The central bank also plays an important role in time the government is making a considerable investment in the form of public sector development projects. Due to continuous government investment, monetary authorities constantly watch the monetary level in the economy. In time, when a low level of interest rate persists in the economy, private investors start investing in the small and medium type of enterprises to achieve profit margin. It increases the economic output in the economy. But, a continuous private investment causes to increase in interest rate but its level remains below the steady-state.

The demand in the labour market also increases. Initially, the economy is assumed to be in equilibrium but as small investors need more labour, the wage rate also starts to increase in the economy and in long-run approaches to its level of steady-state.

Thus, an increase in government investment (positive government investment shock) opens the ways for private investors as public investment becomes the function of private investment. Resultantly, capital stock in the economy increases and finally output level reaches much higher than its steady-state level. Public sector development programs of the government of Pakistan is an example that helps to increase economic output in the economy.

Results also guide us that one-time shock in public investment could not get its desired objectives. However, persistent public sector investment leaves the economy at an increased output, capital, employment and consumption level in long- run. The variance decomposition analysis confirms that technology and government investment shocks mainly contribute to GDP fluctuation.

But on the other hand, government consumption shocks in the economy also cause increase in the economic output through an increased level of private consumption. The level of inflation in the economy increases. The increased level of inflation gives rise to an increased level of interest rate in the economy. The increase in interest rate increases the cost of borrowing which leads to a decrease in private investment. The increased inflation also decreases the amount of profit. The private investors become discouraged. This leads to a decrease in the employment level in the economy. Increase in cost of investment crowds out private investment and stock of capital in the economy over time.

Resultantly, the economy reaches a lower level of economic output. As the overall level of inflation has gone beyond its steady-state level, so investors’ profit margin has decreased. The level of capital stock also decreases in the long run. The economy achieves equilibrium at a level where economic output is lower to its steady-state level and higher inflation prevails in the economy.

The role of monetary policy is quite accommodating as results are quite consistent with macroeconomic literature, which states money supply causes inflation in the long run though it lowers the interest rate and boost investment in the short run.

Analysis confirms that due to different structural adjustment programs initiated by the government, the profile of Pakistan’s economy has changed. Now, it can absorb technologically driven economic shock. The results also ascertain that in time of government investment shock, the level of economic output increases as private investment in the economy started to increase. Post government investment, the increase in private investment shows that private investment is a function of public investment. It means that government investment is required to boost up private investment in the economy. It indicates as government keeps on investing in infrastructure programs, state of infrastructure in the country improves that paves the way for private investment. For example, if the government builds roads there will be an option for the private investors to make small production units on the roadside where one can easily access the city market.

Government investment shock in the economy leads to an increased level of employment in the economy as well. It will come up with increased output, increased employment, increased capital formation and increased level of private investment. The technological investment by the government sector will also change the internal fabric of the economy. The behaviour of the economy is quite similar to other developing economies where the government is initiating public sector development programs to achieve economic growth in the economy. On the other hand, the fiscal stimulus that increases government consumption would not be a desirable option for the economy of Pakistan as it is not only an inflationary phenomenon. It can only help to increase economic activity that fails to achieve its long-run steady-state level. An increase in government consumption appears an economic inefficiency that leads to crowd out private investment which is the backbone of any economy.

Pakistan’s economy can only come out of its fragile structure if government keeps on giving opportunities to boost small and medium enterprises through on hand business training, provision of credit lines and business-friendly environment and lower cost of doing business. The government also needs to remove existing externalities in the economy in the form of market dominance. The public sector investment will also be helpful to increase real economic output that helps to achieve sustainable economic growth. The economy could achieve financial stability and growth if the government could increase export base but exports must be competitive.

Government Consumption shocks and Government Investment shocks are used to trace out the behaviour of the economy. The analysis confirms that Pakistan’s economy is resilient as it doesn’t have an investment base. The economy could go for capital formation through public investment but it results in compromised public consumption and structural unemployment. It is further concluded that long-run public investment programs and increased export base are also need of time to achieve sustainable growth in the economy.

Recommendations of Study

Based on policy analysis, we proposed the following recommendation for the policy managers to be adopted for the economy of Pakistan:

1. Public consumption-based interventions should be avoided as it could only be an inflation phenomenon. It would hardly lead to an increase in economic output in the economy.

2. Long-run investment projects are needed to achieve economic sustainability. These projects will help to develop the productive potential of the economy.

3. Small and medium enterprises should be promoted with the support of the private sector to enhance private investment.

4. Technology-based interventions should be planned as it would help to increase economic output in the country. There is a need to initiate the e-monitoring system so that public level performance could be improved.

5. Digitalization of the public sector can help to increase economic activity as a change in economic structure has allowed adopting technology change as variance decomposition analysis shows that technological shock has a significant contribution to economic output.

6. There would be an urgent need for an autonomous central bank that can cooperate with the fiscal interventions implemented by the fiscal authorities and come up to manage the level of interest rate in the economy.

7. The government should plan long-run development policies to improve the economic profile of the country.

8. The government should increase its export base and promote high tech human resources.

Limitation of the Study

The study has the following limitation.

1. The DSGE model is an open economy model that is purely theoretical whose parameters i.e. model variables are calibrated through microeconomic studies.

2. The assumption of a balanced budget is prevailing during the process of development of the whole DSGE model.

3. The segregated tax function is completely missing in the study

References

- Ahmad, S., Ahmed, W., Choudhri, E., Pasha, F., & Tahir, A. (2018). A Model for Forecasting and Policy Analysis in Pakistan: The Role of Government and external sectors. State Bank of Pakistan, Working Paper Series.

- Ali , S., & Ahmad, N. (2010). The Effect of fiscal policy on economic growth: Empirical evidence based on time series data from Pakistan. The Pakistan Development Review, 497-512.

- Baxter, M., & King, R. G. (1993). Fiscal Policy in General Equilibrium. American Economic Review, 83, 315-34.

- Botman, D., Laxton, D., & Romanov, A. (2006). A New Open Economy Macroeconomic Model for Fiscal Policy Evaluation. International Monitory Fund, Working Paper 46.

- Castro, F. (2003). Macroeconomic effects of fiscal policy in Spain. Banco de Espana, Working Paper, No. 0311.

- Christiano, L. J., Eichenbaum, M., & Evan, C. L. (2005). Nominal rigidities and dynamics effects of a shock to monitory policy. Journal of Political economy, 113, 1-45.

- Christiano, L. K., Eichenbaum, M., & Evans, C. L. (2005). Nominal Rigidities and the Dynamic Effects of a stock of monetary policy. Journal of Political Economy, 113, 1-45.

- Corsetti, G., Kuester, K., & Müller, G. J. (2011). Floats, pegs and the transmission of fiscal policy. Federal Reserve Bank of Philadelphia, Working Paper, No. 11-9

- Eric, S., & Wolff, J. (2018). The output and welfare effect of Government Spending shocks over the business cycle. International Economic Review. doi:0.1111/iere.12308

- Foster, J. D. (2009). Keynesian Fiscal Stimulus Policies Stimulus. Retrieved from

- Gabriel, V., Levine, P., Pearlman, J., & Yang, B. (2010). An Estimated DSGE Model of the Indian Economy. Oxford Handbook of the Indian Economy

- Haider, A., Din, M., & Ghani, E. (2012). Monetary policy, informality and business cycle fluctuations in a developing economy vulnerable to external shocks. The Pakistan Development Review, 609-681.

- Javid, A. Y., & Arif, U. (2009). Dynamic Effects of Changes in Government Spending in Pakistan's economy. The Pakistan Development Review, 48(4), 973-988.

- Juillard, M. (1996). Dynare : a program for the resolution and simulation

- Ramey. (2011). Identifying Government Spending shocks: It is all in the timing. The Quarterly Journal of Economics, 126(1), 1-50., 126(1), 1-50.

- Ratto, M., Roeger, w., & t Veld, J. i. (2009). An estimated open economy DSGE model of the euro area with fiscal and monetary policy. Economic modelling, 222-233.

- Rehman, M., Khan, S., & Hayat, Z. (2017). A Small Open Economy DSGE Model withWorkers' Remittance.s. Working Paper No. 84. State Bank of Pakistan Working paper series.

- Sbordone, A. M., Tambalotti, A., Rao, K., & Wals, K. (2010). Policy Analysis Using DSGE Models: An Introduction. FRBNY Economic Policy Review, 23-43.

- Shahid, M., Ahmad, M., & Rahman, A. u. (2018). Assessing the Neutrality and NonNeutrality of Fiscal Policy in Pakistan. The Journal of Humanities & Social Sciences, 26(1), 1-15.

- Smets, F., & Wouters, R. (2007). Shocks and Frictions in US Business Cycles: A Bayesian DSGE Approach. American Economic Review, 97, 586-606.

- Woodford, M. (2009). Convergence in macroeconomics: element of a new synthesis. Americal Economic Journal: Macroeconomics 1, 267-279.

Cite this article

-

APA : Raashid, M., Saboor, A., & Afzal, A. (2020). Decision between Public Investment and Public Consumption: A Policy Analysis. Global Economics Review, V(I), 131-152. https://doi.org/10.31703/ger.2020(V-I).11

-

CHICAGO : Raashid, Muhammad, Abdul Saboor, and Aneela Afzal. 2020. "Decision between Public Investment and Public Consumption: A Policy Analysis." Global Economics Review, V (I): 131-152 doi: 10.31703/ger.2020(V-I).11

-

HARVARD : RAASHID, M., SABOOR, A. & AFZAL, A. 2020. Decision between Public Investment and Public Consumption: A Policy Analysis. Global Economics Review, V, 131-152.

-

MHRA : Raashid, Muhammad, Abdul Saboor, and Aneela Afzal. 2020. "Decision between Public Investment and Public Consumption: A Policy Analysis." Global Economics Review, V: 131-152

-

MLA : Raashid, Muhammad, Abdul Saboor, and Aneela Afzal. "Decision between Public Investment and Public Consumption: A Policy Analysis." Global Economics Review, V.I (2020): 131-152 Print.

-

OXFORD : Raashid, Muhammad, Saboor, Abdul, and Afzal, Aneela (2020), "Decision between Public Investment and Public Consumption: A Policy Analysis", Global Economics Review, V (I), 131-152

-

TURABIAN : Raashid, Muhammad, Abdul Saboor, and Aneela Afzal. "Decision between Public Investment and Public Consumption: A Policy Analysis." Global Economics Review V, no. I (2020): 131-152. https://doi.org/10.31703/ger.2020(V-I).11