01 Pages : 1-10

Abstract:

There is a plethora of international organizations that has been formed to maintain peace in the world. FATF is such an organization that has been formed in order to scrutinize and control the menace of money laundering and that of the terror financing. In a third world state like Pakistan where there is dearth of transparent mechanisms of money transfers and where there is no rule of law, it has become easy for the individuals to carry out the illicit activities like money laundering (Dube and Vargas, 2013). Pakistan has been in the grey list from the last few years and it has dramatically affected the economy of Pakistan. Pakistan has established a number of centralized mechanisms that are, without a doubt, on the correct track for monitoring the financial transaction system, which is currently very near to meet the certain much needed criteria for finding and freezing the founded and highlighted money laundering cases and that of the terrorist financing

Key Words:

FATF, Terror Financing, Al Qaida, Money Laundering, Illicit Transfer, Hawala and Hundi

Introduction

The September 11 attacks, which were followed by strikes in Madrid and that of Bali, Pakistan and Casablanca, Saudi Arabia to London, then Turkey and the state of Chechnya has been entered into a new phase of terrorism, manifested particularly in the well-known terrorist Al-Qaida group. Scholars have underlined the expanding character of terrorism in the 1990s, emphasizing the new era in terms of global perspective. The present terrorist threat has three distinct characteristics. The maximum number of the attacks being carried out are having prominent common characteristics linking them with those happened in the Middle East, Caucasus, Asia, and the African region, indicating a more global nature. Second, since September 11, terrorist attacks have escalated, and the increase in the pace of terrorism has been because of al-Qaida’s new maxim of changing it into a movement from organization.” This paper explains with certain evidences that how the mighty Al-Qaida group along with the other terrorist organizations have made certain structural changes in their whole functioning mechanisms. The ability of any terrorist group, particularly Al-Qaida, to follow as well as maintain a supportive network for maneuvering the financial and logistical realms of resources is critical to its existence (Dube and Vargas, 2013). Terrorism's strategic nature and adaptability indicate to the need for a multinational counter-terrorist organization with a similar operating model. Successful policies to counter terrorists’ groups must always be proactive rather reactive, analyzing related risks and also comprehending the structure in which terrorists function and the way to deal with the resources and flexibility in order to prevent the forthcoming attack. In order to handle the uncertain and predictive danger, a counter-terrorist strategy that is similarly dynamic is essential. This has been evident in the UN's attempt to get states to raise their vigor and cooperation. The Security Council has stated in the Security Council Resolution of 1617 in late July 2005 that the FATF’s coordination, and capacity-building initiatives represent a paradigm for crippling terrorist groups' finances. Since 2001, the FATF has served as the principal institution for the world community's anti–money laundering regime also known as AML regime, legislation, and certain enforcement mechanisms in the wake of fight against terrorist financing. The FATF's performance makes it an excellent case study for successful responses to the menace of global terrorism financing.

The Loop of Terrorism Financing Background

Shortly after the 9/11 attacks, federal authorities in the United States obtained information via authentic and confidential source that a sheikh from Yemen was actually raising money for leading al-Qaeda in the region of Brooklyn. It was on record discussion that concluded that the sheikh was able to boast and has raised a giant amount of around $20 million for world known terrorist leader Osama bin Laden. As a result, the sheikh arranged for the bulk cash to be sent as cargo. Agents discovered $140,000 in cash and honey jars stashed in cardboard boxes when they apprehended two guys at Kennedy Airport in October 2001. Since eons honey trade has been utilized for manipulating or under covering the money transfers. The same Yemeni honey trade enterprises imported over-invoiced honey in the months preceding up to 9/11 to hide money owed to the US. The major events of terrorism and that of terrorism financing were seen with the 9/11 episode and it has totally altered the landscape of the global politics (Khwaja and Mian, 2008).

The Process of Financing

The details of the process of transferring and moving money has often been neglected and while denying the facts that how this might be able to disrupt. On the flip side, researchers and mostly policymakers highlight the sources of terrorist funding or simply at a next level they put focus on the items that terrorists spend money on for instance weapons and attacks. Nonetheless, movement of Money is done in a very formal way and it has become a crucial element in the entire process. Terrorist organizations raise funds in locations other than where they are based and where attacks may occur. All prominent terrorist organizations ought to be capable enough to transmit money from its main source to that of the certain operational localities where it has been required in order to make it all more effective. These money transfers are possible weak places that the government might exploit to more effectively disrupt terrorist organizations.

Volume of Money they Might Move

Terrorist groups can fund their operations more easily since they can shift more money with each transaction. However, not all ways can transport the same amount of money. Many a number of formal banks, certain money transfer companies and that of hawalas are able to do giant transmission of money and that in a single transaction. In typical scenarios the movement of bulk cash has been constrained by the size and weight of the currency being transferred which put a lot of limitations. For instance, with one million dollar of US in 100 dollars’ bills weighing more than twenty pounds and more than hundred pounds in US 20 dollar bills. A shipment of this size would likewise take up a lot of room. The reality is totally opposite to what has been manifested in movies, a standard size of briefcase has the capacity of over 250,000 dollars (US) in used bills of amount 100 dollars (US), or a small amount of just 50,000 dollars(US) in used bills of around twenty dollars (US).

The contemporary financial and that of the political networks are critical to certain terrorist operations, necessitating well defined counter-terrorism policy that could put a halt to terrorism's "enabling environment”. Following the series of events happened in the post 9/11 scenario, the international community has become more vigilant about the critical role of money used in terrorist operations in all parts of the world. The aim of preventing future terrorist attacks has been totally relied on the ways of blocking finances at grass root level used by the terrorist organizations. Multiple state and that of the international actors can target the terrorist networks by "merely following their sources of the money." Ironically, to keep an eye on these financial resources has been tiresome task and all the stakeholders till date couldn’t get hold on all the financial resources of terrorist groups. It has been analyzed that .05 to .1 percent of the more than 2 trillion dollars has been shifted via wire in total sum of 700,000 transactions done on daily basis, the sum amount becomes 300 million dollars. The money required by the terrorists to carry out their activities is easily laundered every day to somehow support around 600 to 750 and surprisingly this ratio of attacks is equal to those happened on 9/11.

Involved Risks on the way of Terrorists

There are certain risks on the way of terrorist groups as well, and the probability of the risks entirely depend on the process the terrorist group is adapting for the transfer of financial resources. One such highlighted risk lies in the transfer of money itself as there are chances that it could be detected by the concerned authorities. Certain transfer of money happened among two banks is considerably having more chances to get scrutinized, then documented, and detected as compared to a cash transfers happened among two regions for instance in Afghanistan and Pakistan. The different degrees of anonymity connected with each means of transmitting funds adds another layer of risk. Some obvious formal methods, for instance banking, require formal institutions to follow. "know your customer" or KYC procedures are one such set of rules that each bank must have to follow, on the flip side other methods like hawalas or may be cash provide greater chances of anonymity. All terrorist organizations to avoid any hurdle always consider the reliability of methods before applying them. There has been immense confidence built that transfers between hawalas and that of Banks will be always accurate, complete and free of any expected fuss. Transfer of money according to the terrorists and money launderers are not in any way reliable, due to the chances of associated fraud linked with it. They may also be more subject to law enforcement seizure due to their size.

Terrorist’s convenient Method

Some techniques for transporting finances for a terrorist clan may sometimes depend on their geographic location. To transport money into a certain tribal region or out of that particular tribal area for instance in Iraq or in the state of Afghanistan using cash or hawalas is more adaptable and easy than that of those conventional banking system. Similarly, The Al Qaeda's active trading in region of West African consists of diamonds which was itself a more convenient way to move any amount of money than using typical cash or that of gold. As the area of west Africa is among far flung area as per its geography and also because it is totally separated from region of south Asia, diamonds are too much easy to hide as well as to transfer than that of typical currency. Huge shipments of elements like gold as in jewelry form are not focus of attraction because of its size. As gold has its own worth when it comes to dowries in both south Asia and in some regions of Middle East, large shipments filled with gold in the form of refined jewelry will not be in limelight of concerned authorities. Geographic or the topographic realms for instance unregulated border as well as the ethnic, linguistic and most importantly cultural characteristics deeply impact the selection of a particular strategy to be adapted by the terrorist organization.

Terrorists seek to get money to their destination as early as possible to fuel their operations. Hawalas, for example, enable for rapid transfers, but the bank system has a requisite of deposits to wait for a day in order to get the clearance. Smuggling in form of cash can take numerous forms, depending highly on the distance and the number of many borders it must pass through. An illicit trade invoicing plan is probably going to take the most time to accomplish.

Cash Courier’s as the very basic method to Transfer Money

The “simplest and oldest manner of transporting value” is to use couriers to transport physical currency. Individuals who are involved in the business when transport the particular amount across borders, they usually hide the amount in trucks, containers, sometimes in luggage, or any other container large enough to store huge amounts of cash. Criminals do not always conceal the cash when the state borders were unregulated or the financial resources of different states were worn out. In the 1990s and prior to 9/11, AQ relied on couriers to transport money. Al-Qaeda has made the best out of the opportunity and assisted money changers to transfer a good amount of one million dollars (US) from UAE to that of Pakistan, and also took full advantage of couriers in order to transport it as cash across the borders of Afghanistan, as per the report of 9/11 Commission.

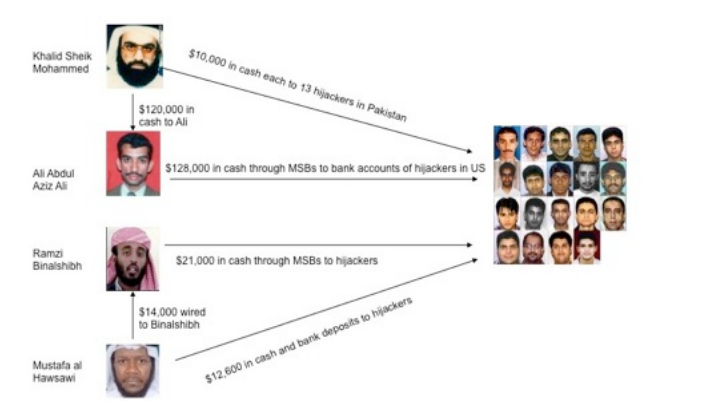

During the incident of 9/11 well-known figure Khalid Sheik Mohammad has delivered 120,000 dollars (US) to counterpart Abdul Aziz Ali in the region of Dubai. He has further take the best use of this cash and right away send this amount to concerned hijackers based in United States. In addition, as the hijackers fled to Pakistan, Khalid Sheik Mohammed gave each of them a big amount of $10,000. As they entered the United States, the hijackers then along with the cash and traveler's checks which they bought with them and then submitted the funds at famous bank chains such as Bank of America, another one known as SunTrust and other such institutions.

Other prominent figures Ramzi Binalshibh and the famous Mustafa al Hawsawi also paid for the attack with the use of cash. Zacarious has been another prominent fictional character by Zacarious Moussaoui who was able to bring the most money into the country that is 35,000 dollars which he in front of Customs has formally announced when he came back to the country. Following figure manifests cash flow in the pre-9/11 scenario. Other organizations use cash couriers as well. Foreign fighters, for example, who travelled to the territory of Iraq in order to join the mighty AQI carried a good amount with them as well. According to recovered papers from the area of Sinjar (northwestern Iraq, near the border of Syria), 149 of the 590 foreign percent fighters smuggled cash to Iraq. In general, practically all nationalities had rates that were nearly identical. Although there were a lot of fighters who makes sure to supply enough money from 20 percent to 30 percent. Moreover, they also have about 22 to 23 percent of such fighters who are actually earning more than 1,000 dollars. As a whole, cash transfers are projected to account for way more than 70 percent of the entire budget of mighty AQI. This depicts the worth of this technique for not only generating funds but also moving certain funds inside the particular organization.

The Case Study of Pakistan

In Pakistan there has been immense number of cases where money laundering has been done and this money ultimately was seen used by terrorist organizations. Basically Money Laundering is a white collar type of crime that is difficult to completely understand. It has far-reaching negative consequences for any country's economy. It is defined as per the formal organization of FATF as the mechanism of funding by the criminals in order to highlight their illicit sources of money.

Hundi has been a very prominent laundering money from illicit source in Pakistan. Mostly the overseas citizens use Hundi to transfer amounts of money to their family and that of friends. This system acts like a transfer of credit or that of the IOU, transferring certain amount of money from one region to another without really moving it. Some foreign exchange corporations are said to utilize this method to disguise their taxable earnings from the authorities.

The transfer of certain amount of cash to some other jurisdiction and then depositing that amount in a particular financial institution for instance in some offshore bank which has proper bank secrecy and also has less stringent laundering regulations is known as physical bulk cash smuggling. Using a third part in the realm of real estate, certain manipulation of values of worthy property, defining the structure of cash deposits for buying land property, income coming from various rental property to legalized the illicit funds, purchase different property in order to facilitate and support different criminal activities, renovations done on the property are all a few instances of purchases in the domain of real estate.

Money launderers and other criminals provide sponsorship to terrorists under the pretense of supporting them. Because the money has been hidden and the sources of this amount of money as well as the destination is not been divulged to the government, all such amount of money that terrorists gain control on is purely called as ‘laundered' money. The vast area cultivation of Opium and certain origins of trade have been in practice in Pakistan and neighboring Iran and that of India as well as in Afghanistan. Those stakeholders who trafficked drugs then transfer these amounts of drugs all across the various border and in return receives their share of money from the concerned drug lords since the borders of states are not strictly maneuvered and scrutinized (Khawaja and Mian, 2008). Laundering through trade entails undervaluing or overvaluing invoices in order to conceal money movement. There are multiple aspects of art for instance the subjective value of creative art works and that of the covert nature of auction houses regarding the unique identity of the related buyer and the specific seller, because of all aforementioned reasons the market of art has been significantly accused of being a perfect tool for carrying out the task of money laundering.

Certain accounts are specified in order to deposit cash by the criminals and they portray it as earnings came from a very legal source in cash-oriented business, which typically expected to receive a large portion of their revenue in cash. Service businesses are the ideal candidates for this strategy because they have few or zero variable of the cost amount and a high amount of this variable to cost ratio while making it hard to highlight the related anomalies among cost and that of the revenues. Many parking garages, large clubs, various pubs, certain tanning salons, car washers, multiple arcades and different restaurants are all such instances.

The real and actual owner of the specific amount of money are always hidden. They frequently refer to the corporate entity as ‘rathole’, while the word actually means a person characterized as a false owner of a certain amount of money. In the whole round process, amount of money has been deposited via controlled mechanism to some offshore foreign firm and then reversed or sent back very smartly manifesting it as a foreign direct investment which is totally tax free. Another variant of this process is to send amount of money to a legal law firm or any such formal organization depicting it as retainer fees, while canceling the retainer and if it managed to cancel the retainer the money is then remitted, manifesting perfectly that the amount or the sum acquired from the official lawyers has been a legacy under a real will. Most of the people often claim prominent sums of certain amount money as their profits gained via planned operations because Pakistan has nearly no agricultural tax on agri produce. Criminals display their illegal funds as proceeds from the selling of antiques that they have either discovered or inherited. Pakistanis pay their respects to holy saints' shrines by offering alms and other forms of philanthropy. Except for a few government-controlled shrines, the income and source of all such places are unknown.

Prize bond draws are a great opportunity for corrupt politicians, government officials, and other criminals to display their ill-gotten gains. Another creative approach to launder money is to convert bribe money in Pakistani rupees into higher-value foreign currencies, such as US Dollars or Euros. Criminals nowadays use TV channels or other platforms to stage fraudulent game shows or prize schemes in order to demonstrate their wealth as a result of the same. Criminals register phony NGOs to claim that they raised funds by community participation, donations, or simple fundraising.

Because of the government's favorable policies, foreign remittances and wire transfers are highly safe instruments for laundering money. Tax amnesty plans are frequently used by criminals to legalized their undisclosed assets. Similarly, criminals declare their illicit money as proceeds of profits from enterprises conducted in tax-free zones such as the former FATA and PATA. As a result of Pakistan's undocumented economy, criminals are disclosing their illicit wealth as a result of unregistered private business, such as service businesses.

Criminals are accusing the Afghan Transit trade of being a source of money laundering. In one case, expensive high-seas boating equipment was booked through this transit commerce, despite the fact that Afghanistan is a landlocked country with no sea.

By controlling Money laundering will certainly results in a significant reduction in other illicit activities such as drug trafficking and terrorist financing. Strong legislation, the development of the rule of law, close coordination of AML agencies at the national and international levels, effective border monitoring, and strict accountability of politicians and the elites are all needed to combat this threat.

The Contemporary Scenario of Pakistan

Pakistan's position will be revisited at an extraordinary plenary session in June 2021, after the Financial Action Task Force (FATF) agreed in February to keep the country on its 'grey list.' FATF President Dr Marcus Pleyer made the statement during a news conference from Paris on the results of the FATF's four-day virtual plenary assembly. The following tables manifests that in the last 2021 session of FATF which was held in the month of February, there were in total three out of the 27 points which were needed to be fully addressed as per the action plan discussed with Pakistan. This table also highlights the background of the number of points which are needed to be largely addressed, and then partially addressed.

Table 1

|

Plenary Session |

Status |

|||

|

|

Largely Addressed |

Partially Addressed |

Incomplete |

No consensus |

|

Jan

2019 |

1 |

1 |

25 |

- |

|

Jun

2019 |

2 |

12 |

12 |

1 |

|

Oct

2019 |

5 |

17 |

5 |

- |

|

Feb

2020 |

14 |

11 |

2 |

- |

|

Oct

2020 |

21 |

6 |

- |

- |

|

Feb

2021 |

24 |

3 |

- |

- |

The three points that are yet to be addressed by Pakistan have been explained by FATF on its website. These points are as follows.

1. “Demonstrating the fact that TF (terrorism funding) investigations and prosecutions are directed at or on behalf of the identified persons or entities”.

2. “Demonstrating that TF prosecutions produce in effective, appropriate, and deterrent penalties or the sanctions”.

3. “Demonstrating the point that the efficient application of targeted financial sanctions against all 1267 and 1373 designated terrorists, as well as those who act on or on their behalf”.

Counter Actions taken by Pakistan

Pakistan has developed and reevaluated its laws and regulations in conformity with the International Standards introduced to prevent terrorist funding and money laundering, realizing that enforcement of law and regulation can help substantially in combatting terrorism financing. Pakistan has also improved its monitoring and enforcement capabilities, as well as its interagency and stakeholder coordination. There are certain measures Pakistan has already taken in order to cope up with the challenges. The introduction of CFT (Combating Terror Financing) regime encompasses many such measures that has prominently reduced the concerns of Global World regarding Money Laundering. The Anti-Counter Pakistan's Terrorist-Financing Measures includes Challenges and Prospects money laundering Act, 2010, the Investigation for Fair Trial Act, 2013, the Anti-Terrorism Amendment Act, 2013, National Counter Terrorism Authority (NACTA) Act, 2013 and Anti Money Laundering Regulations, 2015, Prevention of Electronic Crimes Act, 2016; AML/ CFT Regulations for Banks and DFIs 2017 was another effective measure. NACTA Act (Amendment), 2017 and Security and Exchange Commission of Pakistan (AML/ CFT) Regulations, 2018, then the Anti-Terrorism (2nd Amendment) Act, 2013 are certain legal initiatives in order to enhance capacity building in the hope of fighting terrorism at the grass root level.

The State Bank of Pakistan (SBP) also published many suggestions for financial institutions to follow in order to align CFT Regulations with the FATF Action Plan by making required adjustments to funds transfer regulations. Various aspects of the regulations were revised in accordance with these guidelines to provide more clarity on requirements relating to customer due diligence (CDD), correspondent banking, wire transfers/fund transfers, and the minimum documentation required for consumers to create accounts.

The Associations with Charitable and Not-for-Profit Objects Regulations, 2018 set out the procedures for granting licenses to charitable and not-for-profit organizations, including incorporation as a public limited company, fit and proper criteria for promoters, members, directors, and chief executive officer, and provisions for license revocation and winding up. The AML/CFT Regulations, 2018 were also released to establish a consolidated set of regulations for financial institutions under SECP's authority, harmonizing the regime of AML or CFT.

Several legislative amendments were introduced in an attempt to comply with the FATF's requirement that Pakistan demonstrate the effectiveness of sanctions, including remedial actions to curb terrorist financing in the country,80 in reference to corrective actions taken by any authority ranging from law enforcement agencies to financial institutions.

Conclusion

Pakistan is currently facing economic issues that necessitate enormous foreign trade and investment, necessitating the immediate presence of credible stakeholders in order to stabilize the economy. While Pakistan must continue to work to make that the FATF's broader membership is aware of India's smear campaign aimed at blacklisting Pakistan, India's repeated attempts to politicize the monitoring group's procedures have seriously harmed the monitoring group's general credibility. Despite criticism of the FATF's operation, the organization's standards provide Pakistan with a chance for persistent, focused institutional change and capacity building in order to strengthen its capability and improve anti-terrorism and anti-money laundering systems. Pakistan's inclusion on the grey list may have prompted it to step up its efforts to combat terrorism financing and money laundering, yet the politicization of the FATF remains a problem for the country. While Pakistan's initiatives have aided the country's progress on the Action Plan, Pakistan must devote equal attention to the successful implementation of the measures approved.

References

- Amin, M., Khan, M., & Naseer, R. (2020). Pakistan in the FATF Grey-list: Challenges, Remedies and International Response. Margalla Papers, (1).

- Amoore, L., & de Goede, M. (2011). Risky geographies: aid and enmity in Pakistan. Environment and Planning D: Society and Space, 29(2), 193-202

- Butt, I., Rashid, A., & Khan, S. (2020). Pakistan Initiatives and Endeavours Tocounter Money Laundering and Terrorist Financing Within FATF Perspective. Pakistan Vision, 21(1), 151.

- Chohan, U. W. (2019). The FATF in the Global Financial Architecture: Challenges and Implications

- Chohan, U. W. (2020). The FATF & Pakistan: A Timeline. Available at SSRN 3542772.

- Chohan, U. W. (2020). The Political Economy of the FATF & IMF in Pakistan During 2019 (Part 2). Essays in Political Economy (CASS).

- Chohan, U. W. (2021). Pakistan's Legislative Progress on FATF Stipulations in 2020. Available at SSRN 3763041

- De Koker, L. (2013). South African money laundering and terror financing law. Lexis Nexis

- Dehlvi, G. R. (2017).

- D'Souza, J. (2011). Terrorist financing, money laundering, and tax evasion: Examining the performance of financial intelligence units. CRC Press.

- Hashmi, A. S., & Saqib, M. Terror Financing and Growth of Terrorist Groups: A Case Study of Tehrik-eTaliban Pakistan.

- Hassan, S., & Bukhari, S. H. (2020). Pakistan-United States Relations in Trump Era and FATF. Review of Economics and Development Studies, 6(1), 117-124.

- Hassan, S., & Bukhari, S. H. (2020). Pakistan-United States Relations in Trump Era and FATF. Review of Economics and Development Studies, 6(1), 117-124

- Hussain, A. (2019). Pakistan on FATF's Grey List: Terrorist Financing Perspective. Global Regional Review, 4(4), 281-290.

- Iqbal, K. (2018). Stigma of Terror Financing. Defence Journal, 21(9), 74-76.

- Jaffery, I. H., & Mughal, R. A. L. (2020). Money-laundering risk and preventive measures in Pakistan. Journal of Money Laundering Control.

- Khalid, O. (2018). Pakistan and the FATF: Evolving from 'Grey'to 'White'listing

- Khalid, O. Pakistan and the FATF: Getting to the

- Limodio, N. (2018). Terrorism financing, recruitment and attacks: Evidence from a natural experiment in pakistan. Working Paper.

- Mukhtar, A. (2018). Money laundering, terror financing and FATF: Implications for Pakistan. Journal of Current Affairs, 3(1), 27-56.

- Rana, S. A. (2014). The economic causes of terror: evidence from rainfall variation and terrorist attacks in pakistan. Working paper.

- Shah, A. R. (2020). India and Pakistan at the Financial Action Task Force: finding the middle ground between two competing perspectives. Australian Journal of International Affairs, 1-6.

Cite this article

-

APA : Gul, S., Asghar, M. F., & Ali, S. (2021). FATF and Terror Financing: The Perspective of Pakistan. Global Economics Review, VI(II), 1-10. https://doi.org/10.31703/ger.2021(VI-II).01

-

CHICAGO : Gul, Shabnam, Muhammad Faizan Asghar, and Shujat Ali. 2021. "FATF and Terror Financing: The Perspective of Pakistan." Global Economics Review, VI (II): 1-10 doi: 10.31703/ger.2021(VI-II).01

-

HARVARD : GUL, S., ASGHAR, M. F. & ALI, S. 2021. FATF and Terror Financing: The Perspective of Pakistan. Global Economics Review, VI, 1-10.

-

MHRA : Gul, Shabnam, Muhammad Faizan Asghar, and Shujat Ali. 2021. "FATF and Terror Financing: The Perspective of Pakistan." Global Economics Review, VI: 1-10

-

MLA : Gul, Shabnam, Muhammad Faizan Asghar, and Shujat Ali. "FATF and Terror Financing: The Perspective of Pakistan." Global Economics Review, VI.II (2021): 1-10 Print.

-

OXFORD : Gul, Shabnam, Asghar, Muhammad Faizan, and Ali, Shujat (2021), "FATF and Terror Financing: The Perspective of Pakistan", Global Economics Review, VI (II), 1-10

-

TURABIAN : Gul, Shabnam, Muhammad Faizan Asghar, and Shujat Ali. "FATF and Terror Financing: The Perspective of Pakistan." Global Economics Review VI, no. II (2021): 1-10. https://doi.org/10.31703/ger.2021(VI-II).01