Abstract:

The present study is conducted to see how an IPO event affects the existing firm's performance within the same industry. For this purpose, 88 IPO firms were examined from Pakistan Stock Exchange (PSX) from 1998-2016. IPO is examined from three major perspectives IPO proceeds, initial returns and time Lag between IPO listing date and IPO subscription. The study uses Buy and Hold Abnormal Returns (BHAR) and Cumulative Abnormal Returns (CAR) to calculate competitor’s abnormal returns. To calculate the operating performance of competitors’, the Wilcoxon significance test was applied. IPO intra-industry effects are significant in the long run, whereas insignificant results are shown in the short run. In addition, IPO proceeds and abnormal returns are significant but negatively related to competitors’ stock returns (long term). Moreover, Herfindahl Hirschman Index (HHI) finds IPO improves competitiveness in the industry environment. This present study is an important one from an emerging economy perspective.

Key Words:

IPO Event, CAR, Time Lag, BHAR, HHI

Introduction

Initial Public Offerings (IPO) is considered an important perspective for any firm as it helps the firm to raise its capital, and it receives much attention from investors, which includes existing and potential investors. There are many research studies that explore the effect of Initial Public Offerings (IPO) on firm operating performance, but there are very few studies that show the effect of IPO on competing firms from the same industry and financial market.

In this study, we gauge the effect of IPO on its competitor’s share prices in the long run and short run. To explain this effect, this study develops hypotheses that IPO have a significant effect on rivals’ stock returns. Why does an IPO affect the stock returns of other firms in the same industry? Rival firms can take the idea from it that the industry has changed its outlook now, and therefore it will create changes in the valuation of competitors. In addition, competitors are compelled to evaluate their competitive position in the industry.

Research Objectives

1. To find the effect of IPO events on existing firms, share prices belong to the same industry.

2. To analyze the effect of IPO on existing operating performance

within the industry.

3. To analyze the effect of IPO on industry concentration.

Research Questions’

1. How does IPO affects the share price of existing firms that belong to the same industry?

2. How do firms already exist in the industry get affected through IPO events?

3. How IPO impacts the industry concentration where it’s occurred?

The remaining paper is structured as follows: Chapter 2 includes a literature review, whereas Chapter 3 includes methodology. Chapter 4 discusses the result and interpretation and Chapter 5 concludes the study followed by the recommendations.

Literature Review

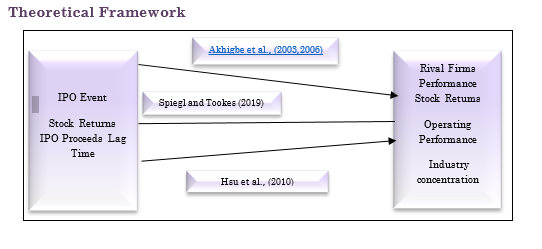

The objective of this study is to explore the effects of IPO events on the operating performance of competitor firms belong to the same industry. According to Akhigbe et al. (2006) and Hsu, Reed and Rocholl (2010), IPO event has a negative effect on rival firms. On the basis of these findings, the first hypothesis of this study is:

Hypothesis 1: IPO stock returns exerts a negative impact on its rival firms stock returns belong to the same industry.

According to Akhigbe et al. (2003), the IPO proceeds collected from the IPO event is to generate a signal for other firms. If a firm considered proceeds from IPO as reimbursement of previous debts and loans, then it will be taken as a competitive advantage from its rivals. Therefore on the basis of this concept, the second hypothesis of this study is:

Hypothesis 2: IPO proceeds negatively impact the performance of prevailing firms belong to similar industries.

The effect of time lag among the date of subscription and trading day of Chinese IPOs have been studied by (Chan, Wang and Wei, 2004) and shown a positive relationship underpricing of IPOs. So we hypothesize that lag time between the subscription date of IPO and its first day of trading of IPO trading creates underpricing and underpricing move towards high abnormal returns which affect rival’s performance.

Hypothesis 3: Time lag between subscription and listing date of IPO significantly affect the operating performance of existing firms’.

Akhigibe et al. (2006) and Hsu et al.,. (2010) both applied Herfindahl Hirschman Index (HHI) to measure industry concentration. The present study also measures how IPO event impacts the industry concentration:

Hypothesis 4: An IPO event significantly impacts its industry concentration.

Operational Definitions

|

Variable |

Definitions |

|

IPO |

Initial

Public Offering |

|

Rivals

Firm |

IPO competing firms belong to the same

industry |

|

IPO

proceeds |

The amount against subscription

received from IPO investors |

|

Time

Lag |

A time period between the dates of

IPO subscription and listing. |

|

BHAR |

Buy and hold abnormal return |

|

HHI |

Herfindahl

Hirschman Index to measure industry concentration |

Research Methodology

In this study, data is taken from 1998-2016; both years are included. The population of the study consists of 120 IPOs, while 94 IPOs are taken as a sample for this study. This present research uses secondary data collected from Yahoo finance, the Pakistan Stock market etc.

Rival Portfolios Returns in Short-Run

To estimate the effect of IPO on its rival firms, this study used the Cumulative Abnormal Returns (CAR) methodology by Akhigbe et al. (2006).

AR it

Rival Portfolios Returns in Long-Run

To calculate the performance of IPOs on

their rivals, in the long run, this study uses the Buy and Hold Abnormal Returns (BAHR) model.

{(1+Rit) -1}-{(1+Rmt) -1}

Time Lag and Rival Firms Performance

The effect of the time period between the announcement date and first day of trading is studied by (Chan, Wang and Wei,2004) in china and observed a positive relationship underpricing of IPOs. Therefore, on the basis of this concept, this study developed a hypothesis that time lag (lead time) between announcement dates and listing dates results in underpricing of IPO, which is responsible for high abnormal returns.

Results and Interpretation Table 1. Cumulative Abnormal Return- CAR

|

Days |

IPO |

CAR (percentage) |

Z-Stats |

|

0 |

88 |

- 0.043 |

- 1.591 |

|

(0, +2) |

88 |

- 0.012 |

- 0.772 |

|

(0, +6) |

88 |

0.067 |

0.194 |

|

(0, +10) |

88 |

0.11 |

0.255 |

|

(0, +14) |

88 |

0.123 |

0.272 |

Table 1

shows the Cumulative abnormal return (CAR) of IPO competitors is calculated by

subtracting actual stock returns from the expected ones. The market model is

applied to calculate expected return and calculating returns on a daily basis

from pre 220 days to post 20 days of IPO event. The null hypothesis of

z-statistics shows a CAR is equal to zero.

Table 1 indicates CAR of competitors portfolios on the 2nd, 6th,10th and 14th trading days of IPOs. Results of this study are aligned with the findings of Akhigbe et al. (2003), who observed the in-significant effect of IPO on rivals in the short run, but study findings are dissimilar from Sushka and Feraro (1995), who indicated a decline in the performance of competitors in short-run

Table 2. Buy & Hold Abnormal Return (BHAR)

|

Year |

n-IPO |

BHAR (%) |

Tstat |

||

|

IPO |

Rival firms |

IPO |

Rival’s firm |

||

|

1 |

88 |

-22.34 |

-6.67 |

-11.68*** |

-13.03*** |

|

2 |

88 |

-16.21 |

-12.57 |

-5.88*** |

-4.73*** |

|

3 |

88 |

-8.08 |

-7.14 |

-4.72*** |

-6.77*** |

|

(1- 3) |

88 |

-58.01 |

54.88 |

-3.68*** |

-3.02*** |

Buy

& Hold Abnormal Return (BHAR) of IPO industry’s competing firms calculated by

taking diff. Of mean holding period return of benchmark with competing firms by

computed everyday returns during. 3-years

Post-IPO. 1-3 indicates a combined three year’s period starting from 20

days post- IPO. *** shows Sig. @. 1.%

In

table 4.2, BHAR is calculating for competing firm’s after 3 year of IPO. The

results of the study are similar with Akhigbe et al.,

(2006)

and Hsu

et al., (2010)

who demonstrates considerable drop in competing firms share prices in Post- IPO

event.

Table 3. Rival Firms Performance before and after IPO

|

Time |

ROA |

ROE |

?Sales |

?Assets |

Leverage |

|

|

% |

% |

% |

% |

% |

|

3 years Pre_IPO |

4.2 |

8.69 |

11.55 |

15.57 |

12.47 |

|

3 years Post_IPO |

1.17 |

5.34 |

7.57 |

8.87 |

14.57 |

|

Wilcoxon Sig. |

*** |

*** |

*** |

*** |

*** |

Table 3

demonstrates the operating performance of a competing firm’s portfolio’s 3

years before and after IPO. ROA denotes returns on assets and percentage of net

income to total asset, whereas ROE indicates the return of equity, and it is

ratio of profit to equity. ? Sales indicate

change in the sale while ? Assets shows the change in assets. Leverage is a

ratio of debts to assets. *** indicates sig at 1%.

Table 3 indicates a significant drop in financial outcomes of competing firms’ for three years pre and post IPO event. A decline in performance is shown by all ratios except the leverage ratio, which increased in that period.

Table 4. Multivariate Analysis of IPO Intra-Industry Performance

|

|

1 |

2 |

3 |

4 |

6 |

7 |

8 |

|

AR-1 |

AR-5 |

AR-10 |

AR-20 |

AR-365 |

AR-730 |

AR-1080 |

|

|

IR |

0.006* |

-0.500 |

-0.118 |

-0.484* |

-0.069** |

-1.870*** |

-0.061** |

|

(1.80) |

(0.61) |

(0.14) |

(1.47) |

(2.80) |

(5.98) |

(1.46) |

|

|

IP |

0.007* |

-3.806* |

-0.839 |

-2.815* |

-0.070*** |

-3.830*** |

0.08*** |

|

(1.40) |

(1.12) |

(1.51) |

(1.34) |

(5.19) |

(5.51) |

(4.54) |

|

|

LT |

0.003 |

-2.831 |

-5.424 |

-3.102 |

-6.200* |

-2.414** |

-2.50* |

|

(0.33) |

(0.68) |

(0.19) |

(0.89) |

(1.26) |

(1.12) |

(2.57) |

|

|

Adj R2 |

0.08 |

0.12 |

0.04 |

0.07 |

0.19 |

0.41 |

0.24 |

|

N. |

88 |

88 |

88 |

88 |

88 |

88 |

88 |

*** Sig. level of 1%. ** Sig. level of 5% ,.* Sig. level of 10%

The table indicates

short-term intra-industry impact of IPO

(2nd 6th , 10th, 14th day) and long

run (1 to 3 years). The independent variables include; IR; Initial Returns, IP;

Proceed from IPO and LT; time lag. T-stat. shown in parenthesis under

coefficient values.

Table 4 shows short-term and long-term

regression results of IPO events against its competing firms portfolios. The

results clearly indicate an insignificant IPO intra-industry effect in the short-term.

However, in the long-term time frame, significant results are observed.

Furthermore, IPO proceed (IP) and IPO Initial returns (IR) shows significance

in long run for rival firms whereas time lag (LT) indicate an in-significant

results in short run and long-run.

IPO and Industry Concentration

To find the industry’s concentration, we apply the Herfindahl Hrsihman index (HHI), which serves as a proxy to measure the degree of industry concentration proposed by (Lang and Stulz 1992). In recent years it is also used by (Akhigebi et al., 2006 and Hsu et al., 2010).

Table 5. Industry Concentration of Rival Industries

|

Mean difference |

Std. Err. |

Z-Stat |

P-Value |

|

-102.176*** |

0.2085 |

490.052 |

0.0000 |

Table

5 shows a significant negative impact of IPO on industry concentration of rival

portfolios. It means overall IPOs in PSX decreasing industry concentration. In

PSX, mostly the IPO firms are a new entrant in the industry and having no

previous history in the market. Therefore IPO means they come to share the

existing market share of the industry, which ultimately decreases the industry

concentration. This can be gone other way round if a big IPO conducted in an

industry than it will increase the industry concentration.

Conclusion

This study inspects the connection between initial public offerings IPO and its industry competing firms on the basis of their operating performance and stock return. IPO event is calculated through three variables which include IPO proceeds, initial returns and lag time. According to the results of this study, IPO has insignificant effect on its rival firm in short run. The study findings are in line with Akhigbe, Borde & Whyte (2003) who also reported an in-significant impact of IPO but different as compared to Sushka and Ferraro (1995) demonstrated a negative impact of IPO event on its industry competing firms. When observing long-term IPO intra-indusrty impacts the study found a significant but negative effect. Theses finding are in line with (Akhigbe, Johnston & Madura 2006 and Brian & Lauran 2009). The study applied 3 proxies to measure IPO event, 2 proxies, i.e. IPO proceeds and Initial returns show a significant effect on rivals stock returns whereas lag time which is calculated as a time difference among filing of IPO and 1st day of trading which displays an insignificant impact on competing firm’s stock returns. Similarly, long-term intra-industry impacts of IPO in terms of operating performance also demonstrate a considerable decline in competing firms stock returns which is also proved through Wilcoxon sign rank test. Therefore it is concluded that successful IPO bring a negative signal for already existing firm’s in the industry in the context of their market share and their share prices that is obvious through considerable decline in their share prices and their operating performance. While measuring industry concentration in terms of Pre and post IPO event, the study clearly observed a significant decline in industry concentration. This means IPO event helps in reduction in monopoly and thus helps economy to reduce unfair practices and bring perforce competition in the market.

The study has certain limitations. Future studies can be done by considering some important factors for example what type of counter measures can be taken by rival firms to protect themselves from deterioration in their performance? Additionally, how rival firms should respond once IPO failed and dropout from the industry? Future studies can also be done by exploring some exterior elements from the industry which is important in determining the success/failure of IPO.

References

- Akhigbe, A., Borde, S. F., & Whyte, A. M. (2003). Does an industry effect exist for initial public offerings? Financial Review, 38(4), 531-551.

- Akhigbe, A., Johnston, J., & Madura, J. (2006). Long-term industry performance following IPOs. The Quarterly Review of Economics and Finance,46(4), 638-651.

- Baker, M., & Wurgler, J. (2000). The equity share in new issues and aggregate stock returns. The Journal of Finance, 55(5), 2219-2257.

- Braun, M., & Larrain, B. (2009). Do IPOs affect the prices of other stocks? Evidence from emerging markets. Review of Financial Studies, 22(4), 1505-1544.

- Brav, A. (2000). Inference in Long†Horizon Event Studies: A Bayesian Approach with Application to Initial Public Offerings. The Journal of Finance,55(5), 1979-2016.

- Busaba, W. Y., Benveniste, L. M., & Guo, R. J. (2001). The option to withdraw IPOs during the premarket: empirical analysis. Journal of Financial Economics,60(1), 73-102.

- Carr, D. L., Markusen, J. R., & Maskus, K. E. (1998). Estimating the knowledge-capital model of the multinational enterprise (No. w6773). National bureau of economic research. 91(3), 693-708.

- Chan, K., Wang, J., & Wei, K. C. (2004). Underpricing and long-term performance of IPOs in China. Journal of Corporate Finance, 10(3), 409-430.

- Cotei, C., Farhat, J., & Abugri, B. A. (2011). Testing trade-off and pecking order models of capital structure: does legal system matter? Managerial Finance,37(8), 715-735.

- Do more reputable financial institutions reduce earnings management by IPO issuers? (2009, September 1). ScienceDirect.

- Dunbar, C. G., & Foerster, S. R. (2008). Second time lucky? Withdrawn IPOs that return to the market. Journal of Financial Economics, 87(3), 610-635.

- Fama, E. F., & French, K. R. (1993). Common risk factors in the returns on stocks and bonds. Journal of financial economics, 33(1), 3-56.

- Hsu, H. C., Reed, A. V., & Rocholl, J. (2010). The new game in town: Competitive effects of IPOs. The Journal of Finance, 65(2), 495-528.

- Jain, B. A., & Kini, O. (1994). The post†issue operating performance of IPO firms. The journal of finance, 49(5), 1699-1726.

- Jovanovic, B. (2004, February 16). Interest Rates and Initial Public Offerings. NBER.

- Kim, M., & Ritter, J. R. (1999). Valuing IPOs. Journal of financial economics,53(3), 409-437.

- Krishnamurti, C., & Kumar, P. (2002). The initial listing performance of Indian IPOs. Managerial Finance, 28(2), 39-51.

- Lang, L. H., & Stulz, R. (1992). Contagion and competitive intra-industry effects of bankruptcy announcements: An empirical analysis. Journal of Financial Economics, 32(1), 45-60.

- Loughran, T., & Ritter, J. R. (1997). The operating performance of firms conducting seasoned equity offerings. The Journal of Finance, 52(5), 1823-1850.

- Loughran, T., & Ritter, J. R. (2004). Why has IPO underpricing changed over time?. Financial management, 33(3).

- Mikkelson, W. H., Megan Partch, M., & Shah, K. (1997). Ownership and operating performance of companies that go public. Journal of financial economics, 44(3), 281-307.

- Pagano, M., & Panetta, F. (1998). Why do companies go public? An empirical analysis. The Journal of Finance, 53(1), 27-64.

- Pástor, Ľ., Taylor, L. A., & Veronesi, P. (2009). Entrepreneurial learning, the IPO decision, and the post-IPO drop in firm profitability. Review of Financial Studies, 22(8), 3005-3046.

- Ritter, J. R. (1991). The longâ€Ârun performance of initial public offerings. The journal of finance, 46(1), 3-27.

- Sohail, M. K., & Nasr, M. (2007). Performance of initial public offerings in Pakistan. International Review of Business Research Papers, 3(2), 420- 441.

- Sohrabi, M., Biglar, R., & Jamshidian, M. (2013). The relationship between IPOs and long-term industry performance: Evidence from Tehran Stock Exchange. Management Science Letters, 3(11), 2759-2766.

- Spiegel, M., & Tookes, H. (2020). Why does an IPO affect rival firms?. The Review of Financial Studies, 33(7), 3205-3249.

- Stoughton, N. M., Wong, K. P., & Zechner, J. (2001). IPOs and Product Quality. The Journal of Business, 74(3), 375-408.

Cite this article

-

APA : Khadim, M. I., & Babar, S. F. (2021). IPO Intra Industry Effects on Peer Firm's Earnings, Composition and Stock Returns. Global Economics Review, VI(II), 41-48. https://doi.org/10.31703/ger.2021(VI-II).04

-

CHICAGO : Khadim, Muhammad Irfan, and Samreen Fahim Babar. 2021. "IPO Intra Industry Effects on Peer Firm's Earnings, Composition and Stock Returns." Global Economics Review, VI (II): 41-48 doi: 10.31703/ger.2021(VI-II).04

-

HARVARD : KHADIM, M. I. & BABAR, S. F. 2021. IPO Intra Industry Effects on Peer Firm's Earnings, Composition and Stock Returns. Global Economics Review, VI, 41-48.

-

MHRA : Khadim, Muhammad Irfan, and Samreen Fahim Babar. 2021. "IPO Intra Industry Effects on Peer Firm's Earnings, Composition and Stock Returns." Global Economics Review, VI: 41-48

-

MLA : Khadim, Muhammad Irfan, and Samreen Fahim Babar. "IPO Intra Industry Effects on Peer Firm's Earnings, Composition and Stock Returns." Global Economics Review, VI.II (2021): 41-48 Print.

-

OXFORD : Khadim, Muhammad Irfan and Babar, Samreen Fahim (2021), "IPO Intra Industry Effects on Peer Firm's Earnings, Composition and Stock Returns", Global Economics Review, VI (II), 41-48

-

TURABIAN : Khadim, Muhammad Irfan, and Samreen Fahim Babar. "IPO Intra Industry Effects on Peer Firm's Earnings, Composition and Stock Returns." Global Economics Review VI, no. II (2021): 41-48. https://doi.org/10.31703/ger.2021(VI-II).04