Abstract:

Wealth sustainability has always remained a policy concern for policymakers in developing economies like Pakistan. This study has filled the gap by investigating weak sustainability and determinants of wealth accumulation for 46 years, from 1972 to 2017, in Pakistan. Wealth sustainability has been analyzed through the Genuine Savings (GS) Index. Moreover, the auto-regressive distributive lag (ARDL) model has been applied to find out the effects of wealth determining factors ? which include Government expenditure, real gross domestic product (GDP), real money market rate, life expectancy, and real money supply ? over wealth accumulation. Results of the GS estimate imply that during the reporting period, the economy is sustainable, and ARDL results show that the effects of government expenditure, real gross domestic product (GDP), and life expectancy on wealth accumulation are significant and positive in the long run, the effect of interest rate is positive but insignificant.

Key Words:

Wealth Accumulation, Genuine Savings, Natural Resource Depletion, Hartwick Rule

Introduction

This paper is aimed at evaluating the sustainability of the economy of Pakistan through the Genuine Savings (GS) approach and examining the effects of various wealth determining factors on wealth accumulation in the economy of Pakistan in the post-Dhaka fall scenario from 1972 till 2017. In terms of population, Pakistan is the fifth largest country, eleventh among the merging and leading economies of the world, with a growing middle class. As of 2018, there are approximately 17 million middle-class households and 102 million middle-class individuals. Wealth sustainability in an economy over a period of time signals sustainable economic development as it implies persistent investment in human capital, physical capital and preserved natural environment. Therefore, the relationship between wealth determining factors and wealth sustainability in the Hamiltonian Genuine Savings framework in the case of Pakistan has been investigated in this paper. For the sake of present development, the welfare of the coming generations should not be compromised. The traditional growth theories ignore the cost of development, such as the depletion of natural resources and environmental degradation. But wealth sustainability is deeply dependent on the intensity of the cost of development, which requires a tool or a model that can gauge it. (Hamilton 1995) and (Hamilton and Hartwick 2005) addressed the issue and formulated a model generally known as genuine savings under the definition of weak wealth sustainability, which assumes natural capital can be substituted with other components of wealth such as human capital and produced capital to maintain wealth for coming generations.

Hartwick’s rule states that savings and investment in human capital is a case of weak sustainability and are associated with socioeconomic development, as referred by (Pearce, Atkinson et al. 1994) and (Pearce, Hamilton et al. 1996). The lack of adequate research in this genre is hindering efficiency in the overall policymaking system in Pakistan. The motivation behind this study is to assess the direction of wealth determining factors and the effects of these factors on wealth accumulation in the case of Pakistan while envisaging a sound knowledge of the relationship with wealth sustainability, assist the policymakers in devising and implementing suitable policies which may strive to attain sustainable economic development. In the case of Pakistan, this is a first-ever study wherein Hamilton's Genuine Saving index is used to ascertain wealth sustainability coupled up with an evaluation of the effects of the wealth determining factors over wealth accumulation through applications of econometric techniques in the Hamiltonian Genuine Savings framework.

As per empirical literature, economic growth has been considered the main indicator for assessing the economic prosperity of a present generation, while GS assesses weak wealth sustainability, that is, whether or not an economy is accumulating wealth for the present generation and sustaining wealth for coming generations. As (Hamilton 2000) narrates, "Growth theory provides the intellectual underpinning for expanded national accounting and, through the measure of genuine savings, an indicator of when economies are on an unsustainable development path”. Positive GS is an indication that an economy sustains more resources for future generations and is said to be on a sustainable development path, while negative GS is an indication of an unsustainable economy. When an economy exhibits high economic growth while not considering the cost of development, it may not be said to be on a sustainable development path.

This study focuses on a sustainability analysis of the performance of the economy of Pakistan. Therefore, the wealth sustainability analysis is based on a weak sustainability approach as the WS concept depends on the substitutability of wealth components at the margin, which has implications for aggregate measures of green national accounting and genuine savings. Additionally, all the available literature on the Genuine Savings approach is based on Weak Sustainability. The data for PM10 is only available from 1990. However, the study calls for data beginning in 1971 and going forward. So that they could account for the gaps in data, the researchers predicted that the series would go in the opposite direction of its exponential trend. Moreover, because of data limitations in the case of Pakistan, the cost of water pollution, land degradation, livestock and fisheries depletion have not been incorporated in Genuine Savings estimates. Furthermore, because of data limitations, investment in human capital has been proxied by education expenditure only under the present study, as in theory, education expenditure coupled with health expenditure constitutes a proxy for Investment in Human Capital. In addition, the present econometric model includes only five variables, which has the potential for more variables to be incorporated to ascertain the effects of additional variables on wealth accumulation. Moreover, wealth sustainability and wealth accumulation have interesting aspects of picking, such as comparative cross-country analysis.

Review of Literature

Thomas (Piketty 2015) put together a detailed discussion over wealth and capital in his book wherein the concept of wealth has interchangeably been used with capital. Controversies may exist in real life; however, conceptually, the two terms are the same. Capital has been defined by Piketty as it is the market value of every tangible and intangible asset possessed by the masses and regime in a given period of time, subject to the condition that it has commercial value (Estrada 2014). Nevertheless, wealth is a broader term, while capital can be its component in one form or another. Hence, wealth refers to the stock of assets that can yield financial gain and welfare. Hamilton-based his analysis on World Bank's estimates and asserted that the best form of wealth is human capital and the performance of conventional and unconventional organizations. There are costs associated with the progress that present and future generations will have to bear, but Rogers (2012) considers sustainable development to be a socioeconomic system that assures that real income, educational standards, and health and well-being are all improving. According to (Hamilton 2006), sustainability can be gauged through an investigation of changes in the wealth of a nation over a period of time. (Pearce and Atkinson 1993) explicated that an economy may be said to be sustainable if its savings ratio is more than the devaluation caused by consumption of manmade as well as natural capital. (Hamilton and Atkinson 2006) associated wealth with well-being and sustainability and asserted that in accounting for national per capita wealth, the transformation of real wealth should also be articulated. The paper proposed the ideal rate of wealth accumulation is that which is proportionately greater than the rate of population growth and sustained with the upward move in the rate of the real change in assets worth, that is, genuine savings.

Dasgupta (2001) believes that “a development path is sustainable if social welfare does not decline at any point along the path”. If a certain level of national consumption for future generations is ensured, the well-being or communal welfare in an economy will be sustained. Sustainable development, as conceived by (Pezzey 1997), is a parallel line that is a benchmark which is not violated by the maximum welfare of the present generation that can be maintained constantly by an economy. Contrary if the benchmark is violated, that is a case of over-efficiency where the economy operates above the optimum level for which the cost of current development will be paid by future generations. It entails that the wealth of nations should be conserved.

However, (Pearce, Atkinson et al. 1994) referred to Hartwick’s rule, according to which a constant level of consumption can be maintained if the revenue from the use of exhaustible resources is reinvested in produced capital. It is therefore, weak sustainability is a state of an economy in which the overall production capacity is sustained instead of a particular asset. (Pearce, Hamilton et al. 1996) referred to sustainability as a persistently positive per capita well-being which can be achieved either through weak sustainability (WS) or strong sustainability (SS). SS is based on the assumption of non-substitutability of natural capital with other assets that should be preserved, which entails that the overall stock of assets is not depleting. At the same time, the concept of WS has implications for aggregate measures of green national accounting and genuine savings.

Investment in human capital is one of the key wealth determining factors around the globe (Gylfason and Zoega 2003). The theoretical discussion over the concept of investment in human capital was pioneered by (Becker 1962), who referred to investing in human capital as the fixing of resources in raw labour that has implications for future real income. The various forms of investing productive resources in human beings to make it capital can be education expenditure, job capacity building, healthcare activities and nutrition and so on. The differences in the level of income are associated with the level of investment because income is the net of investment incurred and receipt on returns. The author urged that investing in human capital does not affect income because government or industries receives returns while utilizing this capital in productive activities. (Hamilton and Michael 1999) more simplified the concept by affirming that education expenditure transforms into human capital as a bodiless knowledge that does not depreciate.

Khan et al. (2005) assessed the causation

the link between human capital and economic growth in Pakistan by using a variety of econometric approaches on a set of time series data for a span of thirty-five years. Their findings indicated that there was a correlation between the two variables. The education index and the health index that were produced were used in the study as proxies for human capital. The Johansen Cointegration test was used to validate the hypothesis that these proxies had a stable long-run association with economic growth. The results of the Vector Error Correction Model (VECM) showed that neither of the proxies for human capital had a significant association with economic growth in the short run but did have a significant association with economic growth in the long run. The Granger Causality test found that there was no short-term causality correlation between the health index and economic growth. However, the test found that there was a two-way relationship in the long run. In addition, the same analysis found a one-way causal link moving from economic growth to education, although the association is a two-way process in the long run. In aggregate, the findings show that there is no active short-run causality relationship between the variables; but, in the long run, it is considered two ways. In addition to VECM, the Toda-Yamamoto Causality test demonstrated that the causality association moves from economic growth to health and education indices, respectively, and from education to health index. The diagnostic tests were used to validate the coefficients, and the CUSUMSQ and CUSUM tests were used to confirm that the model was stable.

(Abbas and Foreman-Peck 2008) examined the association between human capital and economic growth in Pakistan by applying the Johansen approach on time series data collected over a period of 43 years. The study used secondary education expenditure and health expenditure as a proxy for human capital. Results revealed a significant role of human capital formation in the convergence of economic growth. The investment in the education sector in Pakistan is negligible to GDP. Nevertheless, the minor investment yields better results as compared to other development indicators. However, the contribution of human capital to Pakistan's GDP per head is only one-fifth. Literature established the fact that economic growth in Pakistan is endogenously determined by national policies. The study signalled a rapid decline in human capital growth in past decades, ultimately depressing Pakistan's economic growth. The study proposed the promulgation of long-term policies for significant production of quality human capital to compete in the regional and global technological revolution.

Shafuda and Kumar (2020) found that there is a direct association between government educational expenditure and human capital development. Saad and Kalakech (2009) found that in the long-run, government expenditure in the education sector has a positive effect on economic growth. Thus government spending causes wealth accumulation. An increase in government expenditure increases the income through the multiplier effect; this would affect savings through the saving function of the economy, but this also causes crowding out, which implies a negative effect on income and thus on savings and wealth accumulation. The effect of government expenditure on wealth accumulation depends on crowding out; in the case of complete crowding out, government spending does not affect wealth accumulation through the Keynesian saving function, but a decrease in interest would affect wealth accumulation through the classical saving function.

(Khan, Teng et al., 2017) applied fixed effect model over cross-country time series data to examine the factors which are responsible for determining GDS in six countries, including Pakistan. The results revealed that GDP, money supply and per capita income have significantly positive effects on GDS. Whereas FDI and inflation have an insignificantly negative effect on GDS. Moreover, age dependency has significantly negative effects on GDS. (Nasir, Khalid et al. 2004) conducted an empirical analysis of saving and investment behaviour in the case of Pakistan by applying simple OLS techniques over time series data obtained for the post-Dhaka fall period. The results indicated the non-presence of the Ricardian Esquiline theorem in Pakistan as deficit financing and public investment expenditure has no significant effect on saving. Public current financing has a significant effect on the increased wage rate. Moreover, saving is significantly and positively affected by growth in economic activities. However, the effects of interest rates are positive and insignificant. In fact, in Pakistan, people save money to meet precautionary expenditures such as education expenses, weddings, housebuilding etc. Saving is significantly and positively affected by remittances. Moreover, the Harberger-Lawrson-Meltzer effect for savings has not been detected in Pakistan.

By applying regression analysis (Ihsan and Anjum 2013) analyzed the effects of the money supply on GDP in Pakistan. The results indicate that the rapid increase in money supply (M2) by the Central Bank has significant negative implications for Pakistan's economy as it induces a general price level but adversely affects GDP. (Tobin 1965) revealed that an increase in general price level is induced by the rising growth rate of money supply that causes stimulation of opportunity cost of holding cash money which results in capital accumulation. (Ahmed 1990) evaluated the monetary policy of Pakistan for a period of twenty-five years by applying OLS techniques over a set of panel data. The study concluded that the Monetary Policy of Pakistan is effective in control over inflation. However, it has not a controlled devaluation of domestic currency and deficit balance of payments and has not taken measures to increase domestic savings through banks. Moreover, a number of major sectors do not have easy access to finance. In short, Pakistan's Monetary Policy is limited to only controlling the budget deficit and increasing the general price level.

Literature Gap

Wealth sustainability has remained a policy issue in Pakistan. As per imperial literature, it is proved that wealth sustainability is the major factor in explaining long-term economic growth (Hamilton and Hartwick 2014). The lack of adequate research in this genre is hindering efficiency in the overall policymaking system in Pakistan. Such as according to (Hamilton 2006), an investigation of changes in the wealth of a nation over a period of time leads to the results of sustainability. Moreover, (Pearce and Atkinson 1993) proved that if in an economy savings ratio is greater than the depreciation of produce as well as natural resources, then the economy may be said to be sustainable. In addition, (Hamilton and Atkinson 2006)

asserted that the ideal rate of wealth accumulation is that which is proportionately greater than the rate of growth in population and is sustained with an upward move in the rate of the real transformation in assets value that is genuine savings. These are the major gaps which are essential to be investigated in the case of Pakistan.

Foregoing in views, this study will conduct a proportionate comparison between wealth accumulation and population growth and will evaluate the effects of various determinants of wealth over wealth accumulation in the Hamiltonian Genuine Savings framework. Moreover, this study will envisage sound knowledge of the relationship between wealth sustainability, wealth accumulation and the wealth determining factors which will enable the policymakers to devise and implement suitable policies that may help in the sustainable development of the economy.

Methodology

The study analyzes weak wealth sustainability with the GS model and the determinants of wealth accumulation with the time series model.

Data and Model Specification for Wealth Sustainability

To check the weak wealth sustainability of Pakistan's economy, the study uses GS, which is the difference between wealth accumulation (V) and cost of development. The cost of development is the sum of depreciation of produced capital, deforestation, cost of CO2 emission, cost of PM10 emissions, and natural resources depletion other than deforestation. The formal model of genuine savings was developed by (Hamilton 1996), later slightly modified by (Hamilton and Michael 1999), (Hamilton 1999) and (Hamilton 2000), where total wealth ‘V’ is the present value of utility on the parallel line in time period ‘t’. A social planner then wishes to maximize wealth as follows:

max?V=?_t^???U(C,B)e?^(-r(s-t)) ds

Subject to

K ?="F - C - a - " EE, X ? = e - d, S ? = g – R and H ?= q (EE)

The current value of total wealth at time period ‘t’ is a function of the consumption of manmade commodities and environmental services 'B' at time period 't' and the pure rate of time preference 'r'. The simplified version is;

GS = wealth accumulation – the cost of development, or

GS = GDS – D + EE – a – O – W – EN.

Where Genuine Saving (GS) is the sum of Gross Domestic Savings (GDS) and expenditure on education (EE) minus depreciation cost of manmade capital (D), air pollution cost (a) other than CO2, CO2 damage cost (O), water pollution cost (W) and depletion of exhaustible natural capital (EN). The analysis is based on WDI data over a period of 46 years post-Dacca fall from 1972 to 2017.

Investment in human capital is proxied by education expenditure (adjusted savings), as suggested by (Hamilton 2006). As per The World Bank's definition, Education Expenditure (EE) is the operational expenses over education that includes wages and salaries and does not include that physical infrastructure development. An effective educational system is a product of steady educational expenditure. As asserted by (Mercan and Sezer 2014), the sustainability of an economy depends on its educational system. Hence, it enhances competitiveness and produces quality human capital. According to Keynes's MPC concept, saving and consumption are positively related to the level of current disposable income (Johnson, Ley et al. 2004). It is, therefore, at the macro level, the most appropriate indicator for saving is Gross Domestic Savings (GDS) which is calculated as per the saving-consumption connection that is GDP (income) minus final consumption expenditure.

The study analyzes the effects of the following macroeconomic variables as wealth determining factors over the wealth accumulation in the GS framework;

Wealth Accumulation = V = f (GDP, G, LE, M, i) or

log_V=?_0+ ?_1 (log_G ) +?_2 (log_GDP)+?_3 (i)+?_4 (log_LE)+?_5 (log_M)+?

Where

V shows wealth accumulation in the GS framework, which is a composite variable which comprises saving and education expenditure. At the same time, wealth accumulation is the function of gross domestic product (GDP), government expenditure (G), inflation, life expectancy (LE), real money supply (M), and real interest rate (i). Selection of the specific variables is based on given empirical literature as these variables are determinants of wealth accumulation in the case of Pakistan. This study uses the ARDL framework.

Results and Discussions Status of Wealth Sustainability in Pakistan

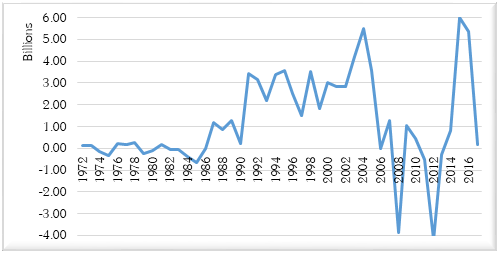

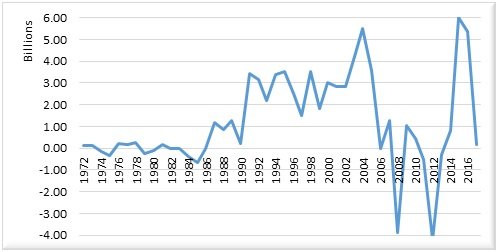

Fig 1 shows fluctuations in sustainability indicators over the reporting period in Pakistan. Such as, during 1972-1986 and 2007-2017, the economy of Pakistan moved up and down around the benchmark (GS=0). It also shows that during these years, the economy did not operate on a sustainable path; the cost of development was greater than wealth accumulation. However, the direction of policies showed improvement onward 1986 to 2007, during which recourses rent invested in wealth accumulation. This period also shows a situation of weak wealth sustainability.

Thus, the sustainability in socioeconomic indicators sustains wealth for coming generations and the evolution of positive change in wealth over time, which is the major factor that shows sustainability in an economy. According to Valente (2008), having more positive current real savings does not exclude the possibility of having "actual dissaving in the future." It is possible that negative signs will dominate positive signs, which would imply that even though an economy is currently moving in the direction of sustainable growth, this may not continue to be the case in the foreseeable future. Because of this, a sustainable economy with low levels of wealth may one day no longer be viable. The key to long-term wealth and financial security is a healthy savings account. According to Nasir (2004), the savings rate in Pakistan is incredibly low both in absolute and relative terms when compared to the other nations of the region. In fact, it is actually lower than the economies of South Asia that have a lower per capita income.

Figure1: Estimated Genuine Savings for the Economy of Pakistan

Growth Comparison of Wealth Accumulation and Population

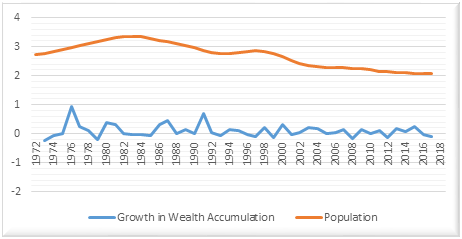

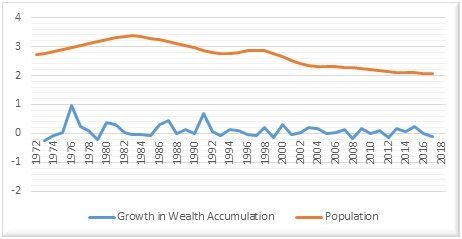

Growth in wealth accumulation has been compared with growth in population in Pakistan over the last forty-six years. (Fig 2) below shows fluctuations in the level of wealth accumulation, and it is constantly below the growth rate of the population and in the majority of the reporting period, the economy has operated inefficiently as compared to the persistently positive population growth, which proportionately grown with decreasing rate.

A decrease has been observed in the rate of population growth onward year 1997, the rate of wealth accumulation could not cross-population growth rate and is negative for a few years. It shows the rent earned from natural resources was consumed rather than invested.

During the period 1986-2006, wealth accumulation is good, during which the population has grown at a decreasing rate. But, on average, the economy of Pakistan is unsustainable as it shows negative average GS growth (-390.49) which is far less than the average population growth (2.71). The effects of positive growth in wealth accumulation over the years, such as from mid-1975-77, 1980-82, 1986-88, 1990-92, and 2014-16 have been offset by economic shocks.

Growth Comparison of Gross Domestic Savings and Cost of Development

According to (Hamilton and Michael 1999), genuine saving is an advanced approach than the conventional savings approach as it encompasses the depletion of real assets. They further asserted that natural resource depletion negatively contributes to sustainability. So, it can be deduced that it is the level of wealth accumulation which determine sustainability. Considering environmental pollution and emissions is a diversion from income to well-being which originally enhanced the capital base for national accounting. Valuation of environmental degradation in market prices is a tough assignment. However, United Nations proposed a mechanism that can value environmental degradation as the cost of returning the quality of the environment to its state at the beginning of the accounting period. However, (Hamilton 1996) suggests that emissions and environmental degradation may be valued through marginal wear and tear costs and marginal social cost, but marginal social costs of pollution are preferably an accurate ground for valuing emissions into the environment because they can be measured through practical indicators and techniques.

The findings of the unit root test are presented in Table 1. Now, looking at table 1, it is possible to see that some of the variables are stationary at I(0), while others are stationary at I(1). Because the null hypothesis cannot be rejected and it is not possible to draw the conclusion that the variable is stationary at the level of significance used (0.05), the intercept values of the variables log rgdp and log rm are bigger than the probability value.

Table 1. Results of Unit Root Test

Results of Unit Root

Test

|

Variables |

Probability value at the level I(0) |

Probability value at the difference I(1) |

|

Log_V |

0.0024 |

0.0000 |

|

Log _G |

0.0297 |

0.0000 |

|

Log _rGDP |

0.7064 |

0.0000 |

|

rI |

0.0025 |

0.0000 |

|

Log _LE |

0.0187 |

0.0080 |

|

Log _rM |

0.6455 |

0.0000 |

The results of ARDL are presented in Tables 2-4 since all the required

properties for the ARDL model have been satisfied. Such as, the Unit Root ADF

test indicated a mixed level of integration at the level and at first difference. ARDL bound

test confirmed the long-run association between the study variables. The long-run coefficients of

the relationship are given below in Table 2

Table 2a. BG Serial Correlation LM Test

|

BG-LM test |

|||

|

F-statistic |

1.215413 |

Prob. F(2,28) |

0.3118 |

|

Obs*R-squared |

3.514738 |

Prob. Chi-Square(2) |

0.1725 |

Table 2b.

. The Long Run Coefficient of the Relationship

|

Dependent Variable: Log_V |

||||

|

Variable |

Coefficient |

Std. Error |

t-Statistic |

Prob. |

|

LOG_G |

0.350033 |

0.182782 |

1.915030 |

0.0651 |

|

LOG_rGDP |

1.431892 |

0.666183 |

2.149398 |

0.0398 |

|

LOG_LE |

18.838753 |

2.814549 |

6.693348 |

0.0000 |

|

rI |

0.006552 |

0.007019 |

0.933461 |

0.3580 |

|

LOG_rM |

-1.819971 |

0.636351 |

-2.860013 |

0.0076 |

|

C |

-23.792106 |

4.124668 |

-5.768248 |

0.0000 |

Table 3.

. Short Run Coefficients of the Relationship

|

Dependent Variable: Log_V |

||||

|

Variable |

Coefficient |

Std. Error |

t-Statistic |

Prob. |

|

D(LOG_G) |

0.446722 |

0.205576 |

2.173028 |

0.0378 |

|

D(LOG_rGDP) |

0.442501 |

0.308619 |

1.433813 |

0.1620 |

|

D(LOG_rGDP(-1)) |

-1.581155 |

0.321155 |

-4.923336 |

0.0000 |

|

D(LOG_LE) |

-139.719860 |

22.245205 |

-6.280898 |

0.0000 |

|

D(rI) |

0.003876 |

0.002972 |

1.304114 |

0.2021 |

|

D(LOG_rM) |

-0.666729 |

0.310240 |

-2.149072 |

0.0398 |

|

D(LOG_rM(-1)) |

1.533604 |

0.306929 |

4.996611 |

0.0000 |

|

CointEq(-1) |

-0.817901 |

0.116669 |

-7.010472 |

0.0000 |

The dependent variable is wealth accumulation (LOG_V). Whereas the independent variables are; (LOG_G), which is government expenditure, (LOG_rGDP) is real GDP, life expectancy is represented by (LOG_LE), (rl) is the real interest rate and (LOG_rM) represents real money supply. Lags selection plays a significant role in determining the results of the model. In the ARDL framework Schwarz Info Criterion (SIC) has been used as Akaike Info Criteria (AIC) usually leads to overestimating the lags, as suggested by (Larsson and Haq 2016). Numerous models were tried. The best model, which was consistent with economic theories, is that; the maximum lag order for the dependent variable was selected as five (05), whereas for independent variables, it was set as two (02). Hence, EViews automatically selected ARDL (1, 1, 2, 1, 1, 2) as the best model. The above model Indicates that when all other independent variables are equal to zero, the average value of a dependent variable (log_v) is equal to -23.79.

Further Results have been Interpreted below:

The effect of government expenditure (log_g) on wealth accumulation (log_v) is positive and significant at a 10 per cent level of significance in the long run. When we channel the effects of log_g on wealth accumulation, the literature shows a positive and significant effect of government expenditure on savings, as revealed by Feldstein (1995) and direct effects of government expenditure on human capital development Shafuda and Kumar (2020). The coefficient of the real GDP has significant and positive at a 5% level of significance. Table-V indicates that a one per cent change in GDP causes a 1.432 per cent positive change in dependent variable log_v in the long run. The real GDP has a significant and positive effect on wealth accumulation in the long run. Any shock in the short run causes the path to deviate from the long-run equilibrium; the error correction mechanism restores the long-run equilibrium. The coefficient of the real interest rate is positive and insignificant. The results reveal that a one per cent increase in real interest rate (I) brings insignificantly about 0.007 per cent increase in wealth accumulation (log_v) in the long run. In other words, the effect of real interest rate (I) on wealth accumulation (log_v) is positive but insignificant in the long run. The results of the present study justify classical views that saving is a positive function of the rate of interest, as shown by Tobin (1965) and Caminati (1981). The coefficient of Life Expectancy is positive and significant at a 1 per cent level of significance. The results reveal that a one per cent increase in Life Expectancy (Log_LE) brings about an 18.839 per cent increase in wealth accumulation (log_v) in the long run. This means that the effects of Life Expectancy on wealth accumulation (log_v) are significant in the long run in Pakistan. An increase in expected life has fairly large effects on the rate of savings in the long run, as indicated by (Bloom, Canning et al. 2003), which further asserted that an increase in expected lifespan has implications for postponement in retirement age, which alternatively helps up life savings. The coefficient of Real Money Supply is negative and significant at a 5 per cent level of significance and shows that the effect of real money supply on wealth accumulation (log_v) is negative in the long run in Pakistan. One reason is the high inflation and negative real interest rate for a few years. The empirical literature shows the mixed effect of the money supply over wealth accumulation. Ihsan and Anjum (2013) show that a rapid increase in money supply by the Central Bank has significant negative implications for Pakistan's economy as it induces a general price level.

Conclusions & Policy Recommendations

This study examines wealth sustainability and investigates the effects of the wealth determining factors on wealth accumulation

in the case of Pakistan. Data has been obtained from the database of the World Bank for a period of 46 years, from 1972-2017. Wealth sustainability has been investigated through the Genuine Saving (GS) approach over a period of 46 years in Pakistan, in which the cost of development (depletion of produce and natural capital) has been subtracted from wealth accumulation— a composite variable comprising savings (indicator for physical capital development) and investment in human capital (indicator for human capital development). While running the ADF test, it was ascertained that the level of integration is not the same. Therefore, the Autoregressive Distributive Lag (ARDL) model is used to ascertain the long and short-run effects of wealth determining factors (that are Government Expenditure, real Gross Domestic Product, real Money Market Rate, Life Expectancy and real Money Supply) over wealth accumulation. ARDL bound test confirmed the long-run relationship between the study variables. Residual diagnostic tests confirmed that the data is normally distributed, no problem of autocorrelation is found, and the model is stable and free from heteroscedasticity. In view of the foregoing analysis, the hypotheses have been tested, and the results have been summed up along with some policy recommendations, as follows:

1. An economy may be said to be sustainable if its sum of resource consumption is constantly less than its gross savings, which implies that Genuine Savings is greater than or equal to zero over a period of time (Hamilton 2006).

2. Since GS values are positive and negative over the period of analysis with no specific pattern, therefore, there should be a proper monitoring and evaluation framework at the policy level that may check and evaluate the fluctuations in sustainability indicators regularly and the level of wealth accumulation.

References

- Abbas, Q., & Foreman-Peck, J. S. (2008). "Human capital and economic growth: Pakistan 1960-2003." Lahore Journal of Economics 13(1), 1-27.

- Ahmed, Q. M. (1990). "Monetary Problems of Pakistan." Pakistan Economic and Social Review: 41-67.

- Akram, N., & Akram, M. I. (2016). "Macro and socioeconomic determinants of savings in Pakistan." Pakistan Business Review 18(2), 325-342.

- Atkinson, G., & Hamilton, K. (2007). Progress along the path: evolving issues in the measurement of genuine saving. Environmental and Resource Economics. 37 (1), 43-61.

- Becker, G. S. (1962). Investment in human capital: A theoretical analysis. Journal of Political Economy. 70(5, Part 2), 9- 49.

- Becker, G. S. (1962). "Investment in human capital: A theoretical analysis." Journal of political economy 70(5, Part 2), 9-49.

- Bloom, D. E., Canning, et al. (2004). Health, wealth, and welfare. Finance and development 41, 10-15.

- Bloom, D. E., Canning, et al. (2003). Longevity and life-cycle savings. Scandinavian Journal of Economics. 105 (3): 319-338.

- Boos, A., & Holm-Müller, K. (2012). A theoretical overview of the relationship between the resource curse and genuine savings as an indicator for “weak†sustainability. Natural Resources Forum, Wiley Online Library.

- Boos, A., & Holm-Müller, K. (2016). The Zambian Resource Curse and its influence on Genuine Savings as an indicator for “weak†sustainable development. Environment, Development and Sustainability. 18(3), 881-919.

- Caminati, M. (1981). The theory of interest in the classical economists. Metroeconomica, 33(1-2-3), 79-104.

- Chaudhry, I. S., & Riaz, et al. (2014). The monetary and fiscal determinants of national savings in Pakistan: An empirical evidence from ARDL approach to co-integration. Pakistan Journal of Commerce and Social Sciences (PJCSS). 8(2), 521-539.

- Corbo, V., & Schmidt-Hebbel, K. (1991). "Public policies and saving in developing countries." Journal of Development Economics 36(1), 89- 115.

- Dasgupta, P. (2001). Social capital and economic performance: Analytics, Citeseer.

- El-Seoud, M. S. A. (2014). "The Effect of Interest Rate, Inflation Rate and GDP on National Savings Rate." Global Journal of Commerce & Management Perspective 3(3), 1-7.

- Estrada, F. (2014). "Thomas Piketty’s Capital in the 21st century."

- Fatima, N., Sahibzada, S. A. (2012). Empirical evidence of Fisher effect in Pakistan. World Applied Sciences Journal. 18(6), 770-773.

- Feldstein, M. (1995). Fiscal policies, capital formation, and capitalism. European economic review. 39(3-4), 399-420.

- Ferreira, S., Vincent, J. R. (2005). Genuine savings: a leading indicator of sustainable development? Economic Development and Cultural Change. 53(3), 737-754.

- Giovannini, A. (1985). Saving and the real interest rate in LDCs. Journal of Development Economics. 18(2-3), 197-217.

- Giovannini, A. (1985). "Saving and the real interest rate in LDCs." Journal of Development Economics 18(2-3), 197-217.

- Gylfason, T., & Zoega, G. (2003). "Education, social equality and economic growth: a view of the landscape." CESifo Economic Studies 49(4), 557-579.

- Hamilton, K., & Hepburn, C. (2014). Wealth. Oxford Review of Economic Policy. 30(1), 1-20.

- Hamilton, K., & Michael, C. (1999). Genuine Savings Rates in Developing Countries. T he World Bank Economic Review. 13(2), 333-356.

- Hamilton, K., & Atkinson, G. (2006). Wealth, welfare and sustainability: Advances in measuring sustainable development. Edward Elgar Publishing.

- Hamilton, K., & Ruta, G. (2006). Measuring social welfare and sustainability. Statistical Journal of the United Nations Economic Commission for Europe. 23(4), 277- 288.

- Hamilton, K., Hartwick, J. M. (2005). Investing exhaustible resource rents and the path of consumption. Canadian Journal of Economics. 38(2), 615-621.

- Hamilton, K. (2002). Accounting for sustainability. Environmental Department, The World Bank.

- Hamilton, K. (1994). Green adjustments to GDP. Resources Policy. 20(3), 155- 168.

- Hamilton, K. (1996). Pollution and pollution abatement in the national accounts. Review of Income and Wealth. 42(1), 13-33.

- Hamilton, K. (1995). "Sustainable development, the Hartwick rule and optimal growth." Environmental and Resource Economics 5(4), 393-411.

- Hamilton, K. (2000). Genuine saving as a sustainability indicator.

- Hamilton, K. (2006). Where is the wealth of nations?: measuring capital for the21st century, World Bank Publications.

- Hamilton, K., & Michael, C. (1999). "Genuine Savings Rates in Developing Countries." The World Bank Economic Review 13(2), 333-356.

- Hamilton, K., & Atkinson, G. (2006). Wealth, welfare and sustainability: Advances in measuring sustainable development, Edward Elgar Publishing.

- Hartwick, J. M. (1977). Intergenerational equity and the investing of rents from exhaustible resources. The American economic review. 67(5), 972-974.

- Hartwick, J. M. (1977). Intergenerational equity and the investing of rents from exhaustible resources. The American economic review. 67(5), 972-974.

- Hasan, H. (1999). Fisher effect in Pakistan. The Pakistan Development Review. 153-166.

- Hassler, U., & Wolters, J. (2006). Autoregressive distributed lag models and cointegration. Modern Econometric Analysis. 57-72.

- Holdgate, M. (1993). Sustainability in the forest. The Commonwealth Forestry Review. 72(4), 217-225.

- Ihsan, I., & Anjum, S. (2013). "Impact of money supply (M2) on GDP of Pakistan." Global Journal of Management and Business Research.

- Iqbal, Z. (1993). Institutional Variations in Saving Behaviour in Pakistan. The Pakistan Development Review 32(4), 1293-1311.

- Kasri, R., & Kassim, S. H. (2009). "Empirical determinants of saving in the Islamic banks: Evidence from Indonesia." Journal of King Abdulaziz University: Islamic Economics 22(2),

- Khan, M., J.-Z. Teng, et al. (2017). "Factors Affecting the Rate of Gross Domestic Saving in Different Countries." European Academic Research 5, 4261-4291.

- Khan, T., A. R. Gill, et al. (2013). "Determinants of Private Saving: ACase of Pakistan." Asian Journal of Economic Modelling 1(1), 1-7.

- Lin, G. T., & Hope, C. (2004). Genuine savings measurement and its application to the United Kingdom and Taiwan. The Developing Economies. 42(1), 3-41.

- Mushtaq, S., Siddiqui, D. A. (2016). Effect of interest rate on economic performance: evidence from Islamic and non-Islamic economies. Financial Innovation 2(1), 9.

- Nasir, S., & Khalid, et al. (2004). Saving- investment behavior in Pakistan: An empirical investigation. The Pakistan Development Review, 665-682.

- Nkoro, E., Uko, A. K. (2016). Autoregressive Distributed Lag (ARDL) cointegration technique: application and interpretation. Journal of Statistical and Econometric Methods. 5(4), 63-91.

- Odhiambo Nicholas, M. (2008). Interest Rate reforms, Financial Depth and Savings in Tanzania: A Dynamic Linkage. Savings and Development. 32(2), 141-158.

- Pearce, D. W., Atkinson, G. D., & Dubourg, W. R. (1994). The economics of sustainable development. Annual Review of Energy and the Environment. 19(1), 457-474.

- Pearce, D. W., Atkinson, G. D. (1993). Capital theory and the measurement of sustainable development: an indicator of “weak†sustainability. Ecological Economics. 8(2), 103-108.

- Pearce, D., Atkinson, G. (1998). "Concept of sustainable development: An evaluation of its usefulness 10 years after Brundtland. Environmental Economics and Policy Studies. 1(2), 95-111.

- Pesaran, M. H., & Shin, et al. (2001). Bounds testing approaches to the analysis of level relationships. Journal of Applied Econometrics 16(3), 289- 326.

- Tobin, J. (1965). "Money and economic growth." Econometrica: Journal of the Econometric Society, 671-684.

- Valente, S. (2008). Optimal Growth, Genuine Savings and Long-Run Dynamics. Scottish Journal of Political Economy. 55(2), 210-226.

Cite this article

-

APA : Hussain, A., Ali, N., & Hassan, I. U. (2022). Determinants of Wealth Accumulation: Time Series Evidence from Pakistan. Global Economics Review, VII(I), 131-144. https://doi.org/10.31703/ger.2022(VII-I).11

-

CHICAGO : Hussain, Asghar, Naveed Ali, and Izhar Ul Hassan. 2022. "Determinants of Wealth Accumulation: Time Series Evidence from Pakistan." Global Economics Review, VII (I): 131-144 doi: 10.31703/ger.2022(VII-I).11

-

HARVARD : HUSSAIN, A., ALI, N. & HASSAN, I. U. 2022. Determinants of Wealth Accumulation: Time Series Evidence from Pakistan. Global Economics Review, VII, 131-144.

-

MHRA : Hussain, Asghar, Naveed Ali, and Izhar Ul Hassan. 2022. "Determinants of Wealth Accumulation: Time Series Evidence from Pakistan." Global Economics Review, VII: 131-144

-

MLA : Hussain, Asghar, Naveed Ali, and Izhar Ul Hassan. "Determinants of Wealth Accumulation: Time Series Evidence from Pakistan." Global Economics Review, VII.I (2022): 131-144 Print.

-

OXFORD : Hussain, Asghar, Ali, Naveed, and Hassan, Izhar Ul (2022), "Determinants of Wealth Accumulation: Time Series Evidence from Pakistan", Global Economics Review, VII (I), 131-144

-

TURABIAN : Hussain, Asghar, Naveed Ali, and Izhar Ul Hassan. "Determinants of Wealth Accumulation: Time Series Evidence from Pakistan." Global Economics Review VII, no. I (2022): 131-144. https://doi.org/10.31703/ger.2022(VII-I).11