Abstract:

This paper examines the relationship between the forex rate and the share price of the Pakistan Stock Exchange. The study provides additional understating of the complex nature of the relationship among bi-variate time series using the Copula model. Copula models are best suited to find the co-movement of time series data integrating the possible latent structure of the relationship through estimation of joint distribution with the help of marginal distribution of each time series variable. Alike from the traditional time series analysis, Copula models are best suited to estimate the complex relationship, specifically the tail dependence structure of joint distribution of the variables. Results of the study highlight a significant two-sided tail dependence structure between the Forex rate and share price of the Pakistan Stock Exchange.

Key Words:

Copula Model, Share Price, Forex rate, Joint Distribution.

Introduction

Stock exchange and Forex exchange are the two most traded financial markets in the world. Researchers, policymakers and traders often investigate the relationship between Forex and stock indices. Plenty of empirical research has been produced to investigate the relationship among these variable (Abdalla & Murinde, 1997; Faruqee, 1995; Kim, 2003; Kurihara, 2006; H. Zhao, 2010). Many such studies found a positive relationship between the two markets. However, the direction of causality is not well established, and opposite pieces of evidences have been presented in the literature. Theoretically, both hypotheses have been supported by the respective theories (IGAnalyst, 2018).

Theoretical economists who support the causality from the stock market to the forex market explain the mechanism in a way that the rise in the domestic stock market provides confidence to the investors that the local economy is rising. This results in increased interest in the domestic market viz a viz local currency by the foreign investors. Opposite to this, underperformed stock markets leads to falling the interest of foreign investors who subsequently take back their investments to other currencies (IGAnalyst, 2018); NIEHANS, 1976).

On the other hand, the “Portfolio Balanced Approach” supports the hypothesis that the forex market affects the stock market as the market value of any specific company listed in the stock market can be altered with the change in the value of the local currency. With a devalued currency, exports become cheaper internationally, resulting in an increase in the profits for export-oriented companies (Salvatore, 2016).

Many of the already conducted researches in this domain opted for one of the two possible hypotheses at the first stage and empirically estimated the significance of the relationship among two variables (Abdalla & Murinde, 1997; Faruqee, 1995; Kim, 2003; H. Zhao, 2010). On the other hand, several researches used statistical techniques, for example, the Granger Causality Test, to empirically investigate the direction of causality (Ibrahim, 2000; Olugbenga, 2012; Siami-Namini, 2017; Suriani, Kumar, Jamil, & Muneer, 2015). Albeit the fact that Granger Causality is not causality but provides a sequence of happening that can help in predictability (Maziarz, 2015). The majority of the above-mentioned researches started with stationarity testing, followed by time series regression, Cointegration, ARDL, Vector Error Correction models, GARCH family models and Granger Causality testing. Despite the fact that all such methods provide valuable information about temporal dependence in the conditional mean and variance of each component univariate time series. However, cross-sectional dependence across the standardized innovations of all the component univariate time series remain missing (Z. Zhao, Shi, & Zhang, 2020). Multivariate time series often presents complicated dependence structures, such as nonlinear dependence, tail dependence, as well as asymmetric dependence, which makes dependence modelling a challenging yet crucial task. A desirable feature of a multivariate time series model is able to accommodate the complex dependence in both temporal and cross-sectional dimension ( Z. Zhao, Shi, & Zhang, 2020). This becomes more important in the case of financial time series where tail dependence structure remains significant in most of the cases (Poulin, Huard, Favre, & Pugin, 2007).

Considering the shortcoming of traditional time series models, we opted for Copula based model to estimate the co-movement of Forex and Stock markets. The word Copula originates from a Latin word, which means link or tie. It is a widely used technique to find the relationship between two variables and facilitates establishing dependence in Bi-variate distributions. In financial data, Copula estimation can be used to see the relationship in tails to minimize the risk for investors. There are many types of Copula models, i.e. (i) Gaussian Copula; (ii) Gumbel Copula, as it can sense risk during stress period; (iii) Frank Copula, its strong dependence (negative or positive); (iv) T-Student Copula; (v) Clayton Copula; (vi)Archimedean Copula, as it has associativity and symmetric, so it has great importance; (vii) Tawn Copula, an extended form of Gumbel Copula; (viii) Bb7 Copula, very helpful in Archimedean Copula; (ix) Joe Copula; (x) Archimax Copula; and (xi) BB4 Copula. Further details of Copula models are explained in the next section.

Pakistan’s economy is one of the emerging economies in South East Asia. Economic growth remained volatile during previous decades, subsequently affecting people’s wellbeing, market functionality, stock positions and other macro-economic indicators (Yasir Riaz, 2020). Due to the strong dependence of the economic cycle on imports and exports, the exchange rate remained detrimental for economic activities in Pakistan. Due to this, the relationship between the exchange rate and the stock market remained in focus for policymakers, traders as well as academia. Most of the studies conducted in this regard in Pakistan followed the above-mentioned approaches (Abdalla & Murinde, 1997; Ahmad, Rehman, & Raoof, 2010; Ali, Rehman, Yilmaz, Khan, & Afzal, 2010; Jawaid & Ul Haq, 2012; Kamal, Ghani, & Khan, 2012; Suriani et al., 2015; Zia & Rahman, 2011). However, the rigorous and sophisticated approach of Copula modelling will certainly provide additional insight into the subject matter. The current study is conducted to fulfil this gap and to provide a detailed analysis of the tail dependence structure of two key variables, i.e. exchange rate of Pakistan and the Pakistan Stock Exchange Index. Section-2 of the paper provides theoretical background of the opted approach, whereas section-3 depict the key findings from the analysis. The paper is concluded with some key recommendations for policymakers.

Materials and Methods

Copula modelling is an emerging approach in high-dimension statistical application. As per the definition, Copula is a multivariate cumulative distribution function with Uniform marginal distributions. Copula models provide freedom and flexibility to the researcher to specify the models for the marginal distributions separately from the dependence structure that links these distributions to form a joint distribution. In the case of the bivariate copula model, two marginal distributions can make a joint distribution with the help of the Copula function. More precisely, when marginal distribution function of two variable w and z are plotted on to a joint copula function C (f(w), f(z) | ?), where ? is information gathered at the previously recorded time denoted by t ? 1.

In the case of risk management and financial market analysis, most of the variables are non-normal in nature and depict heavy tailness and skewed behaviour (Poulin, Huard, Favre, & Pugin, 2007).

Therefore, Copula models are often best suited for such data instead of Pearson correlation-based models. Copulas, in such cases, are very useful for understanding the correlation between variables.

Let w be the time series variable, and its marginal distribution function is F(w). Let us have another variable z, and its marginal distribution function is F(z). Then their joint distribution will be G(w,z) can be written in Copula Function as:

(i)

In financial time series data, the variation in one variable is restricted upon other(s). In order to include conditionalities in the above Copula (Equation i), we use a conditional parameter µ, and the marginal distribution of w and z are F1| µ and F2|µ, respectively. Then, the copula function is as follows:

(ii)

Especially in time series data (mostly which is not normally distributed), then we can make the bivariate distribution be used in financial research. By using a different form of Copula, for example, Clayton copula, Gumbel Copula, Gaussian copula, Frank copula and t-copula, we can get the bivariate distribution. However, the results considered only for Gumbel Copula (upper tail dependency) and Clayton (lower tail dependency) subject to their distinctive tail conditions.

The most basic Copula is Gaussian Copula will be as follows:

(iii)

Where -1 is used to represent the reverse of CDF of standard normal distribution, p is representing the CDF of a standard bivariate normal distribution with ? (Pearson correlation). The bivariate Gaussian copulas are symmetric distt. And have no tail dependence (left or right).

Embrechts (2005) suggest that the Gumbel copula is utilized for upper tail dependencies, and the Clayton copula can be used for lower tail dependencies to deal with tail dependencies. Our Clayton copula dependence parameter ? ? (0, ?) can be defined:

(iv)

Here copula parameter is , the marginal distribution of variable w and z are denoted by f(w) and f(z). Lower tail dependence and zero upper tail dependence can be shown as copula parameter. The dependence (?1) of the lower tail is normalized as 2?1/?. There is zero tail dependence when it is zero. The dependence parameter ? ? (0,?) of Gumbel copula is defined as:

(v)

The Gumbel parameter ? is normally distributed as (??) 2?21/?. For ? > 1, the Copula produces an upper tail dependency, and extreme dependences are achieved when ? ? ?.

To fit a Copula, we need the initial parameter calculated from the data given and then forecast the final parameter based on the initial parameter. The technique used for estimation of parameters is used in this process called pseudo-maximum likelihood by using expression as follows: -

(vi)

Where the arguments of the Copula density c are called pseudo observations:

And

After getting all the results, we use AIC (Akaike Information Criterion) and BIC (Bayesian Information Criterion) to find the best-fit Copula. For instance, which Copula function have the lowest AIC, will be the best fit.

Results and Discussions

Forex rate (Dollar to Pakistani rupee) and Pakistan Stock Exchange share price is taken

from June 2011 to July 2020, and to obtain the co-movement between then, the data is changed into returns. Both the variables are volatile, but the share price of the Pakistan Stock Exchange is more volatile. Forex Rate is somehow normally distributed, whereas the Pakistan Stock Exchange share price is not normally distributed, and kurtosis is high in this time series data.

In the current study, we estimated Gaussian Copula, T-Student Copula, Gumbel Copula, Clayton Copula and Frank Copula for the above-mention two variables. Choice of Copula functions is made considering the feasibility and applicability in the field of financial analysis. The basic theme behind tail dependence is to find a degree of dependence in the upper and lower tail. Gaussian Copula did not show upper and lower tail dependence, but t-student do so. Clayton Copula shows the lower tail dependence, whereas Gumbel Copula examines the Upper tail dependence. Estimation is done through the Pseudo-maximum likelihood technique, which follows a two-step procedure. Initial parameters are calculated first as Copula is fitted based upon one more specific parameter, and then final parameters are estimated. For the selection of Copula, two well-known statistical information criteria called Akaike Information Criteria (AIC), and Bayesian Information Criteria (BIC) are used for the selection of Copula. Results of estimated models are given in Table-1.

Table 1. Results of Copula estimation on Pakistan Forex rate and Pakistan Stock Exchange

|

|

Initial parameter |

Final Parameter |

AIC |

BIC |

Log-Likelihood |

Lower tail |

Upper tail |

|

Gaussian |

0.007651 |

-0.01338 |

1.6083 |

7.61025 |

0.195803 (df=1) |

0.0000 |

0.000 |

|

T-Student |

- |

-0.041556 (df = 4) |

-3.800 |

7.31365 |

3.900137 (df=2) |

0.1687 |

0.16873 |

|

Gumbel |

0.9924067 |

- |

- |

- |

- |

- |

- |

|

Clayton |

-0.015186 |

- |

- |

- |

- |

- |

- |

|

Frank |

- |

-0.06928 |

1.70791 |

7.413172 |

0.146045 (df=1) |

0.0000 |

0.0000 |

Table 1 reports the results of the dependence

structure for the pair of Forex Rate and Pakistan Stock Exchange share price.

We have found the significant dependence structure in studied variables through

Copula model estimation. As described in

Table 1, initial parameters are calculated for Gaussian, Gumbel and Clayton are

estimated. For Gumbel and Clayton Copulas, the values of initial parameters are

out of bounds, so their final parameter, AIC, BIC, Likelihood, and tail

dependence, cannot be calculated.

AIC values remained lowest for T-student Copula (-3.800274) as compared to Gaussian Copula (1.608393) and Frank Copula (1.70791). Likewise, BIC for T-student Copula remained lowest (7.313655), followed by Frank Copula (7.413172) and Gaussian Copula (7.610251). This reflects that T-Student Copula is the best fit for this data and lower tail dependence is 0.1687335, same as Upper tail dependence, confirming the significant two-tail dependence.

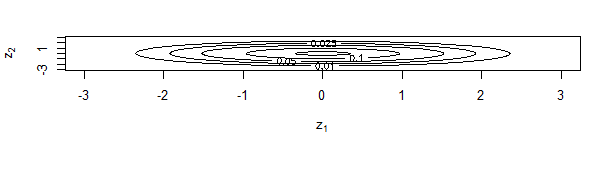

Diagram 1:

The contour plot of Gaussian Copula (Diagram 1) drawn by using Forex and Pakistan Stock Exchange share price is in oval shape, and it reflects that there is no tail dependence on the Lower tail as well as in the upper tail.

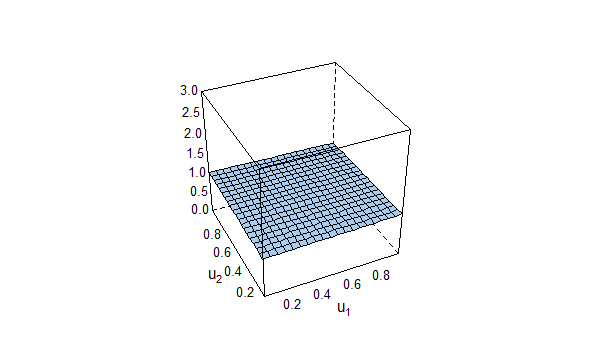

Diagram 2: Density Plot of Gaussian Copula of Table 1

The above-mentioned density plot of Gaussian Copula (Diagram 2) shows co-movement, but there is no tail dependence between the Forex rate (Dollar to Pakistani rupee) and Pakistan Stock Exchange stock share price. This confirms the findings of the contour plot shown in Diagram-1.

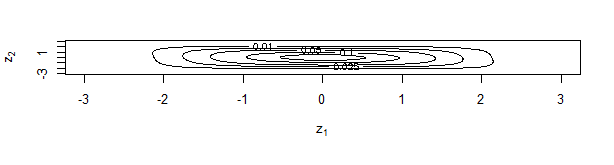

Diagram 3: Contour Plot of T-Student Copula of Table 1

The contour plot of T-Students Copula, shown in Diagram 3, reflects that there is heavily tail dependence on both sides in the same quantity (Upper tail and lower tail) between Forex rate (Dollar to Pakistani Rupee) and Pakistan Stock Exchange share price.

Diagram 4: Density Plot of T-Student Copula of Table 1

Diagram 4 shows the co-movement obtained by the T-student Copula model using the information of Forex rate (Dollar to Pakistani rupee) and Pakistan Stock Exchange stock share price. There is tail dependence as tails are moving upward, and this confirms the contour plot findings.

However, as highlighted in the initial analysis, both AIC and BIC show that T-student Copula shows a better fit as compared to other Copula functions; it can be concluded that there are enough evidences to support strong two-tail dependence.

Conclusion and Recommendations

In this study, the Copula approach is used to investigate the lower and upper tail dependence for the Forex Rate (Dollar to Pakistani Rupee) with the Pakistan Stock Exchange share Price. Considering the non-normal behaviour of concerned variables and complex relationship, specifically, expected tail dependence, Copula models are used to investigate the relationship instead of traditional time series models. Findings revealed a significant two-tail dependence structure. This can be interpreted as the two variables behave more closely in the corner of graphs than (or along with) the center of the graph. Such information is crucial for traders as well as policymakers who often interested in the co-movement of both variables in volatile circumstances. Traditional time series models are unable to differentiate between center vs tail dependence structure. The current study provides additional information about the relationship/co-movement of Forex and the Pakistan Stock Exchange in extreme cases. This study suggested for traders and policymakers to ensure a keen focus on tails dependence structure through Copula estimation to better understand the market behaviour.

References

- Abdalla, I. S., & Murinde, V. (1997). Exchange rate and stock price interactions in emerging financial markets: evidence on India, Korea, Pakistan and the Philippines. Applied financial economics, 7(1), 25-35.

- Ahmad, M. I., Rehman, R., & Raoof, A. (2010). Do interest rate, exchange rate effect stock returns? A Pakistani perspective. International Research Journal of Finance and Economics, 50, 146-150.

- Ali, I., Rehman, K. U., Yilmaz, A. K., Khan, M. A., & Afzal, H. (2010). Causal relationship between macro-economic indicators and stock exchange prices in Pakistan. African Journal of Business Management, 4(3), 312-319.

- Faruqee, H. (1995). Long-run determinants of the real exchange rate: A stock-flow perspective. Staff Papers, 42(1), 80-107.

- Ibrahim, M. H. (2000). Cointegration and Granger causality tests of stock price and exchange rate interactions in Malaysia. ASEAN Economic Bulletin, 36-47.

- IGAnalyst. (2018, 01 November 2018). What is the relationship between exchange rates and stock prices? , from

- Jawaid, S. T., & Ul Haq, A. (2012). Effects of interest rate, exchange rate and their volatilities on stock prices: evidence from banking industry of Pakistan. Theoretical & Applied Economics, 19(8).

- Kamal, Y., Ghani, U., & Khan, M. M. (2012). Modeling the exchange rate volatility, using generalized autoregressive conditionally heteroscedastic (GARCH) type models: Evidence from Pakistan. African Journal of Business Management, 6(8), 2830- 2838.

- Kim, K.-h. (2003). Dollar exchange rate and stock price: evidence from multivariate cointegration and error correction model. Review of Financial economics, 12(3), 301-313.

- Kurihara, Y. (2006). The relationship between exchange rate and stock prices during the quantitative easing policy in Japan. International Journal of Business, 11(4), 375.

- Maziarz, M. (2015). A review of the Granger-causality fallacy. The journal of philosophical economics: Reflections on economic and social issues, 8(2), 86-105.

- NIEHANS, J. (1976). EXCHANGE RATE DYNAMICS WITH STOCK-FLOW INTERACTION: JOHNS HOPKINS University Press.

- Olugbenga, A. A. (2012). Exchange rate volatility and stock market behaviour: The Nigerian experience. European Journal of Business and Management, 4(5).

- Poulin, A., Huard, D., Favre, A.-C., & Pugin, S. (2007). Importance of tail dependence in bivariate frequency analysis. Journal of Hydrologic Engineering, 12(4), 394-403.

- Salvatore, D. (2016). International Economics: Wiley

- Siami-Namini, S. (2017). Granger causality between exchange rate and stock price: A Toda Yamamoto approach. International Journal of Economics and Financial Issues, 7(4).

- Suriani, S., Kumar, M. D., Jamil, F., & Muneer, S. (2015). Impact of exchange rate on stock market. International Journal of Economics and Financial Issues, 5(1S).

- Yasir Riaz, W. M. K., Asad-ul-Islam Khan. (2020). The Index of Sustainable Economic Welfare for Pakistan. International Journal of Ecological Econoimcs and Statistics, 41(3), 81-96.

- Zhao, H. (2010). Dynamic relationship between exchange rate and stock price: Evidence from China. Research in International Business and Finance, 24(2), 103-112.

- Zhao, Z., Shi, P., & Zhang, Z. (2020). Modeling Multivariate Time Series with Copulalinked Univariate D-vines. Journal of Business & Economic Statistics, 1-39.

- Zia, Q. Z., & Rahman, Z. (2011). The causality between stock market and foreign exchange market of Pakistan. Interdisciplinary Journal of Contemporary Research in Business, 3(5), 906-919.

Cite this article

-

APA : Latif, M. N., Ali, N., & Shahzad, A. (2020). Co-Movement of Forex Rate and Share Price of Pakistan Stock Exchange - An Application of Copula Models. Global Economics Review, V(III), 78-87. https://doi.org/10.31703/ger.2020(V-III).08

-

CHICAGO : Latif, Muhammad Nouman, Nasir Ali, and Anjum Shahzad. 2020. "Co-Movement of Forex Rate and Share Price of Pakistan Stock Exchange - An Application of Copula Models." Global Economics Review, V (III): 78-87 doi: 10.31703/ger.2020(V-III).08

-

HARVARD : LATIF, M. N., ALI, N. & SHAHZAD, A. 2020. Co-Movement of Forex Rate and Share Price of Pakistan Stock Exchange - An Application of Copula Models. Global Economics Review, V, 78-87.

-

MHRA : Latif, Muhammad Nouman, Nasir Ali, and Anjum Shahzad. 2020. "Co-Movement of Forex Rate and Share Price of Pakistan Stock Exchange - An Application of Copula Models." Global Economics Review, V: 78-87

-

MLA : Latif, Muhammad Nouman, Nasir Ali, and Anjum Shahzad. "Co-Movement of Forex Rate and Share Price of Pakistan Stock Exchange - An Application of Copula Models." Global Economics Review, V.III (2020): 78-87 Print.

-

OXFORD : Latif, Muhammad Nouman, Ali, Nasir, and Shahzad, Anjum (2020), "Co-Movement of Forex Rate and Share Price of Pakistan Stock Exchange - An Application of Copula Models", Global Economics Review, V (III), 78-87

-

TURABIAN : Latif, Muhammad Nouman, Nasir Ali, and Anjum Shahzad. "Co-Movement of Forex Rate and Share Price of Pakistan Stock Exchange - An Application of Copula Models." Global Economics Review V, no. III (2020): 78-87. https://doi.org/10.31703/ger.2020(V-III).08