Abstract:

Emerging markets and volatility spillover effects remained a highly focused area in the field of financial economics. Therefore, we have empirically testified the volatility spillover effects between markets of emerging economies i.e Pakistan, China, Bangladesh, and India during the period from 1st January 2000 to 31st December 2015. We used Multivariate GARCH and causality models to identify the spillover effects. It is concluded that there exists significant evidence of spillover effect from the market of Pakistan to India, India to China and from China to Pakistan. However, the larger negative shift in the volatility occurs more frequently than positive shocks. Hence it is concluded that the impact of own spillovers of the markets is much higher than the impact of cross-market spillovers during this period

Key Words:

Emerging Markets. Volatility Spillover Effects, Multivariate GARCH Models

Introduction

Spillover effect in financial studies is elaborated concerning the context of financial events and exists due to the behavior of affected participants from one market to another market and moves the direction of demand and supply forces in a shocking parameter. When research finds out that financial events regarding the crises in any domain either financial crunch or economic depression then contagion effect may arise if markets are financially integrated and volatility passes on the effect of shocks or economic changes in a step to step paradox. The trading behavior of domestic and foreign investors with sudden changes put the matter in disequilibrium in response to the spillover effects presence then financially integrated blocks can be defined based upon the diagonal effect of these shocks and contagion effects. Practically it is can be seen that the economic benefits have been sharply increased due to an increase in the trade as a result of anticipated spillover effects on the formation of joint multilateral alliances of regional nations like ASEAN and SAARC.

Pakistan, India, China, and Bangladesh economies are co-joint from a geographical

perspective and it is seen that these Asian markets are facing unexpected volatility shifts from the last decade that have a drastic impact on these economies. Further, several international investors consider that these economies are volatile from an investment perspective. How investor behaves on change of different anomalies which can be seen through the market in a dramatic situation and such random behaviors may have caused these markets to be volatile. Market performance is strongly influenced by volatility trends. Volatility behaves in the opposite direction as markets go up the volatility decreases and vice versa Parasuraman, and Ramudu (2011). Crestmont (2011) concluded that higher volatility leads towards a decline in the market most probably and lower volatility a sharp rise in the market. It is a very critical element to understand the sources and behavior of volatility in the domestic pricing of assets. This study is important because there is an increasing collaboration of south Asian economies and especially China and Pakistan are very positive to increase the business and economic collaboration through CPEC and one belt one to make the region more prosperous and developed to reduce the poverty and unemployment. This study will contribute to designing the guidelines to global investors for future investment in this region, especially in Pakistan and China. For empirical analysis, we are examining traditional historical volatility and multivariate GARCH-BEKK, GARCH-CCC specifications to investigate conditional variances, and variance-covariance matrix, conditional correlation. This will assist to test the causality-in-mean as well as causality-in-variance to investigate the effects of shocks and volatility spillovers individually. We examine the extent of volatility effects in Pakistan, India, China, and Bangladesh not only their own but also across the markets In Pakistan, India, China, and Bangladesh equity markets behave strategically due to the political, economic and geographical point of view due to specific interests in the region and experience different unexpected volatility shifts due to financial turmoil. The market performance tends to decrease sharply as the volatility spectrum cause to increase. This phenomenon is a leading indicator that how investors behave more realistically in these economies as the information flows, the efficiency of the market becomes questionable due to spillover effects, and its time before forecasting perspective. This preview motivated us to address this issue in our study to make conclusive remarks about the emerging markets' interrelatedness.

Literature Review

Ng (2000) examined spillover from Japan and US markets to Malaysia, Hong Kong, Taiwan, Singapore, and Thailand. They concluded that there are significant spillovers from the US economy to several of the Pacific–Basin economies. Banerji and Dua (2010) studied emerging and developed economies during the financial crisis. Their results reveal that the Indian economy is not disturbed by this crisis and retaliated to this recession. Joshi (2011) used GARCH-BEKK to examine the return and volatility spillover among India, Korea, Japan, Hong Kong, China, and Jakarta for the period 2007-2010 and the results provide the evidence of volatility spillover effect bi-directionally among equity markets. However, results further revealed that its volatility spillover impact is greater than the cross-market spillover effect. Ehrmann et al. (2011) studied the spillover process across the equity markets of Europe and the United States. The results reveal that a cross-market spillover exists and financial markets of the US are explaining the variation of 30% to the movement of Euro Area markets.

Mohammadi and Tan (2015) examined the returns and volatility dynamics among the United States, China, and Hong Kong markets for the period 2001-13. They concluded that there exists a spillover effect from the United States to Asian equity markets. However, they found that no spillover effect exists between Hong Kong and China. Dua and Tuteja (2016) used vector autoregressive-multivariate GARCH-BEKK to study the transmission and inter-linkages between equity, money, and foreign exchange markets of India and USA. Their results reveal that causality-in-mean is significant between the returns of the Indian equity market and the exchange rate of (INR / US$) and vice versa. Jebran & Iqbal (2016) evaluated asymmetric volatility spillover effects between the foreign exchange market and stock market of Pakistan, Sri Lank, China, India, Japan, and Hong Kong for the period Jan 4, 1999, to Jan 1, 2014. Results reveal the asymmetric volatility spillover effect between the forex markets and the equity market of China, Hong Kong, Sri Lanka, and Pakistan.

Jebran & Iqbal (2016) evaluated the dynamics of equity markets using the GARCH model and justified that a significant spillover effect exists between China and Japan, Hong Kong, and Sri Lanka, China, and Sri-lanka. Such spillover effects are seen in various studies more dynamically.

Peng, Chung, Tsai, and Wang (2017) examined the spillover effect on Japanese and Taiwan equity markets. The outcomes indicate that a long-run stable relationship exists between these two stock markets. The result of the inner-market effect shows that returns are mainly prejudiced by the returns of the preceding periods. Further cross-market effect analysis indicates that past returns of the Japanese stock market affect the present returns of Taiwanese stock markets significantly, but previous returns of the Taiwanese stock market had no impact on the present returns of the Japanese stock market.

Habiba et al (2019) identified the bidirectional significant asymmetric impact of spillovers of volatility for some stock markets. However, found no evidence for volatility spillover effects from China to India, Indonesia, and Pakistan and from Pakistan to China, Indonesia, Korea, and Taiwan during this period. Further, they identified that volatility spillovers are unique phenomena in different periods for these economies.

Methodology and Data Sources

The daily data for the period Jan 2000 to Dec 2015 has been taken for the KSE-100 index (Pakistan), SSE (China), BSE SENSEX (India), and DSE (Bangladesh) to evaluate the spillover effects across these emerging economies.

?Stock Return?_t=?Ln (Stock Price?_t/?Stock Price?_(t-1))

Historical volatility is computed based on stock returns minus average stock returns for the above markets. Due to different holidays and breaks stock prices have been taken into consideration for those dates on which all markets have been traded.

Methodology

Multivariate Econometric Models

The spillover test over time and across the markets in returns is examined through vector autoregressive (VAR) model in GARCH (1,1) specification for the KSE, BSE, SS, DSE as follows

?Retun?_t=?_0+?_1 ?Return?_(t-1)+ ….+?_p ?Return?_(t-p)+?_t (1)

?_t |?_(t-1 )~ N(0,H_t)

where

Returnt = KSE, BSE, SS, DSE returns vector at time t.

p = lag length;

?_0 = vector of intercepts;

?_1 to ?_p = coefficient matrices,

?t = error terms.

It is mentioned that ?t have no serial correlation and a 4 × 4 matrix for the conditional variance and covariance matrix is presented. Ht for a constant variance for the information set ?_(t-1 )

For example, if the return of the KSE depends on k lags of the market and the k lags of the other three market returns, this vector autoregressive process in GARCH(1,1).

R_(a,t) ?=??_a+?_(j=1)^k???_aj R_(a,t-1) ?+?_(j=1)^k???_bj R_(b,t-1) ? +?_(j=1)^k???_cj R_(cj,t-1) ?+ ?_(j=1)^k???_dh R_(d,t-1) ? + ?_(a,t) (2)

Multivariate GARCH Models

In the exploration process of temporal dependence of the conditional variance, this study is using the BEKK model of Engle and Kroner (1995) and Bollerslev (1988) constant conditional correlation (CCC)

MGARCH-BEKK

The Engle and Kroner (1995) BEKK model is expressed in the blow manner,

H_t=(Cn) ?Cn+?_(j=1)^m??? (Ah) ??_j ?_(t-j) ? (?_(t-j) ) ?Ah+?_(j=1)^m??? (Gh) ??_j H_(t-j) ? ?Gh?_j (3)

H_t=(Cn) ?Cn+ (Ah) ??_(t-j) (?_(t-j) ) ?Ah+ (Gh) ?H_(t-j) ?Gh?_j (4)

Cn, Ahj, and Ghj are T × T matrix but Cn is triangular and Lag length is taken as 1.

BEKK model can decompose the conditional volatility for each efficiently into its autoregressive conditional heteroskedasticity and generalized autoregressive conditional heteroskedasticity ARCH parts. In this model ARCH part is related to the conditional volatility of KSE can be expressed in this way.

h_(11,t)= ?_1+?_11^2 ?_(1,t-1)^2+?_21^2 ?_(2,t-1)^2+?_31^2 ?_(3,t-1)^2 ?+ ??_41^2 ?_(4,t-1)^2+ ? 2??_11 ?_21 ?_(1,t-1) ?_(2,t-1)+? 2??_11 ?_21 ?_(1,t-1) ?_(2,t-1)+? 2??_11 ?_31 ?_(1,t-1) ?_(3,t-1)+? 2??_11 ?_41 ?_(1,t-1) ?_(4,t-1)+? 2??_21 ?_31 ?_(2,t-1) ?_(3,t-1)+? 2??_21 ?_41 ?_(2,t-1) ?_(4,t-1)+? 2??_31 ?_41 ?_(3,t-1) ?_(4,t-1) (5)

Here the autoregressive conditional hetrocedasity volatility in the KSE returns depends upon the square term and on the cross-products of the last period shocks related to the KSE, BSE, SS, and DSE. Here, ?11, ? 21, ? 31, ?41 captures the close effects of historical squared shocks on today’s volatility relevant to each market for KSE. In the same way, the GARCH component of KSE conditional variance can be expressed in this manner.

h_(11,t)= ?_1+?_11^2 h_(21,t-1)^2+?_21^2 h_(22t-1)^2+?_31^2 h_(33,t-1)^2 ?+ ??_41^2 h_(44,t-1)^2+ ? 2??_11 ?_21 ?_(1,t-1) ?_(2,t-1)+? 2??_11 ?_21 h_(12,t-1)+? 2??_11 ?_31 h_(13,t-1)+? 2??_11 ?_41 ?_(1,t-1) ?_(14,t-1)+? 2??_21 ?_31 h_(23,t-1)+? 2??_21 ?_41 h_(24,t-1)+? 2??_31 ?_41 h_(34,t-1) (6)

This particular equation is used to estimate the volatility of KSE based upon past conditional volatility and covariance related to each other markets. Here, ?11, ?21, ?31, ?4 will capture the effects of past volatility in today’s volatility perspective. BEKK model design is best for cross-market spillovers analysis for volatility and deals easily with large parameters set.

MGARCH-CCC

Time-varying and conditional variances and covariances are allowed by MGARCH-CCC model of Bollerslev (1990) but restrict the conditional correlations to be constant over the period. The conditional variance matrix can be defined in this manner.

H_t= ?Dx?_t R?Dx?_t=(?_mn ?(h_mmt h_nnt )) (7)

Dxt = 4 × 4 stochastic diagonal matrix with elements ?1t, ?2t, ?3t, ?4t,

R= Correlation matrix of 4 × 4 time-invariant

A GARCH (1,1) is rewritten as h_mmt=?_m+?_m ?_(t-1)^2+?_m ?_(t-1) (8)

? ?( @h)?_mmt=?_mn+?(h_mmt h_nnt );m,n=1,…4.

CCC model explains each conditional variance as a linear function for past squared shocks and its past conditional variance. This model also permits each pair of markets for constant conditional correlations. It is important because it reduces the number of unknown parameters in the equation.

Results and Discussion Table 1. Descriptive Statistics for Daily Historical Volatility

|

|

HVKSE |

HVBSE |

HVSS |

HVDSE |

|

A.M |

0.000911 |

0.000446 |

0.000265 |

0.000625 |

|

Med |

0.001097 |

0.00101 |

0.000241 |

0 |

|

Max |

0.110642 |

0.1599 |

0.090343 |

0.282336 |

|

Min |

-0.10097 |

-0.13794 |

-0.11304 |

-0.269066 |

|

SD |

0.015185 |

0.016795 |

0.017453 |

0.016507 |

|

Skew |

-0.0803 |

-0.28212 |

-0.277 |

0.503915 |

|

Kurt |

8.347765 |

10.65155 |

7.484906 |

68.11391 |

|

J. B |

4071.818 |

8373.476 |

2904.93 |

603259.1 |

|

Prob |

0.0000 |

0.0000 |

0.0000 |

0.0000 |

|

Sum |

3.109073 |

1.521403 |

0.903669 |

2.132618 |

|

S. Sq. Dev. |

0.786991 |

0.962659 |

1.039631 |

0.929961 |

|

Obs |

3414 |

3414 |

3414 |

3414 |

Table 1exhibit the summary of measures

of central tendency for the historical volatility series. It is clear from the

above results that average daily volatility is positive across the KSE, BSE,

SS, and DSE. The daily volatility of KSE and DSE are larger than the volatility

of returns for BSE and SS volatility series are negatively skewed except DSE.

The negative skewness in KSE, BSE, and SS indicates positive shocks and shifts

are less than that of the larger negative shifts in the volatility occurrence.

Excess Kurtosis indicates that large changes occur much time. JB value indicates the evidence of normality

in the dispersion of returns from mean series and the H0 is rejected

for all the series due to normal distribution.

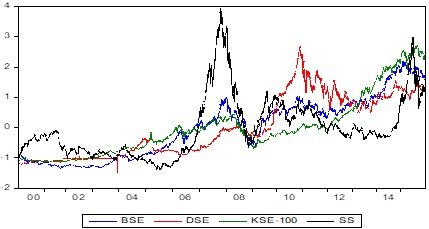

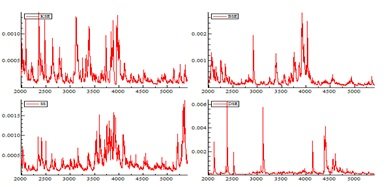

Figure 1 shows the log-normal trend of indices for the period of 2000-2015. It is clear evidence from the trend that financial turmoil exists immediately after 2008. Figure 2 indicates the return behavior and the graph shows that volatility remained high in the period of financial turmoil.

Table 2. Historical Volatility Correlation Matrix

|

Correlation |

|

|

|

|

|

Probability |

HVKSE |

HVBSE |

HVSS |

HVDSE |

|

HVKSE |

1.000000 |

|

|

|

|

HVBSE |

0.108540 |

1.000000 |

|

|

|

|

[0.0000]* |

|

|

|

|

HVSS |

0.063517 |

0.162519 |

1.000000 |

|

|

|

[0.0002]* |

[0.0000]* |

|

|

|

HVDSE |

0.014263 |

0.030381 |

0.012433 |

1.000000 |

|

|

[0.4048] |

[0.0759]** |

[0.4677] |

|

*Significant at p<0.05 **Significant at p<.010

The above results indicate that association among the historical volatilities of the market. KSE and BSE are positively correlated at p<0.05 level and indicates that both markets move in the same direction with a particular volatility shock. In the same manner historical volatility of KSE is also positively correlated with SS at p<0.05 level of significance. However, at p<0.05 the BSE and SS are also highly positively correlated with each other, but astonishingly BSE has also positive association with DSE at p<0.01.

Table 3. Granger Causality Test among Historical Volatility of Emerging Markets

|

Null Hypothesis |

Observations |

F-Statistic |

Prob. |

Hypothesis |

|

|

3412 |

9.1292 |

0.0001 |

CE |

|

|

|

0.52141 |

0.5937 |

NC |

|

|

3412 |

2.52038 |

0.0806 |

CE |

|

|

|

0.30332 |

0.7384 |

NC |

|

|

3412 |

0.57073 |

0.5652 |

NC |

|

|

|

1.50227 |

0.2228 |

NC |

|

|

3412 |

1.73703 |

0.1762 |

NC |

|

|

|

4.41785 |

0.0121 |

CE |

|

|

3412 |

0.77454 |

0.461 |

NC |

|

|

|

2.22352 |

0.1084 |

NC |

|

|

3412 |

1.3179 |

0.2678 |

NC |

|

|

|

0.31029 |

0.7333 |

NC |

*CE: Causality

Exist *NC: No Causality

Granger Causality test shows that the volatility of KSE is leading to the volatility of BSE and the volatility of SS is leading to KSE volatility and the volatility of BSE leads to Volatility in SS market. Results indicate that there strongly exist triangular effect among these equity markets. These bidirectional results indicate that Volatility shocks are transmitted from Pakistan to India and then from India to China and in last from China to Pakistan. This shock transmission impact is a unique phenomenon.

Table 4. URT: ADF-Test

|

Markets |

ADF- statistic |

Test critical values |

|||

|

|

T-Stat |

Prob |

1% level |

5% level |

10% level |

|

KSE |

-53.1207 |

0.0001 |

-3.43208 |

-2.86219 |

-2.56716 |

|

BSE |

-53.859 |

0.0001 |

-3.43208 |

-2.86219 |

-2.56716 |

|

DSE |

-60.8479 |

0.0001 |

-3.43208 |

-2.86219 |

-2.56716 |

|

SS |

-60.8479 |

0.0001 |

-3.43208 |

-2.86219 |

-2.56716 |

The following

equation is used to test the ADF process for testing the unit root

The prices are stationary for all the markets at the first

difference and nonstationary at level.

Table 5. Volatility Spillover Effects across the Markets

|

|

KSE |

BSE |

SS |

DSE |

|

KSE |

0.079441 |

0.013019 |

-0.001592 |

0.034637 |

|

p-value |

<0.00* |

0.3665 |

0.9177 |

<0.01* |

|

BSE |

0.040420 |

0.085045 |

0.018605 |

0.065264 |

|

p-value |

<0.01* |

<0.001* |

0.2548 |

<0.001* |

|

SS |

-0.002332 |

-0.027012 |

0.031673 |

0.08193 |

|

p-value |

0.8176 |

<0.0263** |

<0.0731*** |

0.4670 |

|

DSE |

0.000798 |

-0.005887 |

0.009045 |

0.055491 |

|

p-value |

0.9594 |

0.6381 |

0.6558 |

<0.001* |

*Significant at

p<0.01 **Significant at p<0.05 ***Significant at p<0.10

Table

5 presents the results to the response of KSE returns to its lags, along with

BSE, SS and BSE lagged returns. The past changes in KSE returns have a

significant effect on today’s return and past changes in DSE returns have an

impact on today’s return of KSE. BSE has no significant effect by past returns

of KSE and DSE but the BSE market is influenced by its past returns and SS but

interesting the matter is that it hurts BSE returns. It is evident from these

results that each market return is dependent upon its past returns showing the

presence of their own spillovers effect with past time. SS depends upon its

past returns at p<0.01 but exogenous to other markets. DSE is influenced by

past returns of KSE, BSE and its own lagged returns at p<0.01. It is evident

that spillover effects exist for KSE to BSE in a unidirectional and BSE has

spillover effects to SS markets in a unidirectional at lagged one and DSE has

spillover effects with KSE and BSE at lagged one.

Further Table 5 indicates that the spillover behavior indicates that all markets are affected by shocks either by its shocks or by the lagged behavior of other markets from 1 to 4 lag periods beyond this period lags. The spillover of each market return series varies across the market and has a significant impact on up to four lags maximum. In last, the spillover behavior suggests rapid diffusion across the information of price in the equity markets. Next, we examined the conditional volatility patterns across the KSE, BSE, SS, and DSE. MGARCH-BEKK model is used to estimate these elements in the market returns.

Table 5. Volatility Spillover Effects across the Markets

|

|

KSE |

BSE |

SS |

DSE |

|

KSE |

0.079441 |

0.013019 |

-0.001592 |

0.034637 |

|

p-value |

<0.00* |

0.3665 |

0.9177 |

<0.01* |

|

BSE |

0.040420 |

0.085045 |

0.018605 |

0.065264 |

|

p-value |

<0.01* |

<0.001* |

0.2548 |

<0.001* |

|

SS |

-0.002332 |

-0.027012 |

0.031673 |

0.08193 |

|

p-value |

0.8176 |

<0.0263** |

<0.0731*** |

0.4670 |

|

DSE |

0.000798 |

-0.005887 |

0.009045 |

0.055491 |

|

p-value |

0.9594 |

0.6381 |

0.6558 |

<0.001* |

*Significant at

p<0.01 **Significant at p<0.05 ***Significant at p<0.10

Table

5 presents the results to the response of KSE returns to its lags, along with

BSE, SS and BSE lagged returns. The past changes in KSE returns have a

significant effect on today’s return and past changes in DSE returns have an

impact on today’s return of KSE. BSE has no significant effect by past returns

of KSE and DSE but the BSE market is influenced by its past returns and SS but

interesting the matter is that it hurts BSE returns. It is evident from these

results that each market return is dependent upon its past returns showing the

presence of their own spillovers effect with past time. SS depends upon its

past returns at p<0.01 but exogenous to other markets. DSE is influenced by

past returns of KSE, BSE and its own lagged returns at p<0.01. It is evident

that spillover effects exist for KSE to BSE in a unidirectional and BSE has

spillover effects to SS markets in a unidirectional at lagged one and DSE has

spillover effects with KSE and BSE at lagged one.

Further Table 5 indicates that the spillover behavior indicates that all markets are affected by shocks either by its shocks or by the lagged behavior of other markets from 1 to 4 lag periods beyond this period lags. The spillover of each market return series varies across the market and has a significant impact on up to four lags maximum. In last, the spillover behavior suggests rapid diffusion across the information of price in the equity markets. Next, we examined the conditional volatility patterns across the KSE, BSE, SS, and DSE. MGARCH-BEKK model is used to estimate these elements in the market returns.

Table 6. Multivariate GARCH – Scalar BEKK Test

|

|

Co-efficient |

Std. Error |

T-value |

T-Prob |

|

|

0.001343 |

0.00022627 |

5.935 |

0.0000 |

|

|

0.000993 |

0.00022561 |

4.4 |

0.0000 |

|

|

0.000324 |

0.00026426 |

1.224 |

0.2209 |

|

|

0.000885 |

0.00037985 |

2.331 |

0.0198 |

|

?11 |

0.002176 |

0.00036333 |

5.988 |

0.0000 |

|

?12 |

0.000255 |

0.00014655 |

1.738 |

0.0823 |

|

?13 |

0.000132 |

0.00016857 |

0.7803 |

0.4352 |

|

?14 |

0.000073 |

0.000136 |

0.54 |

0.5892 |

|

?22 |

0.00218 |

0.00041306 |

5.277 |

0.0000 |

|

?23 |

0.000413 |

0.00016985 |

2.43 |

0.0151 |

|

?24 |

0.000245 |

0.00014632 |

1.676 |

0.0938 |

|

?33 |

0.002587 |

0.00046966 |

5.508 |

0.0000 |

|

?34 |

-0.00001 |

17990 |

-0.05369 |

0.9572 |

|

?44 |

0.002583 |

0.00063003 |

4.099 |

0.0000 |

|

b1 |

0.953958 |

0.0081387 |

117.2 |

0.0000 |

|

a1 |

0.275562 |

0.019352 |

14.24 |

0.0000 |

|

Diagnostic

Test |

Akaike |

-22.525862 |

Shibata |

-22.525906 |

|

|

Shwarts |

-22.497107 |

Hannan-Quin |

-22.515587 |

|

|

Li-Mcleoad |

1015.23 [0.000000] |

||

|

Std

Residuals TEST |

KSE |

BSE |

SS |

DSE |

|

Q

(50) |

122.774 |

59.86 |

70.0199 |

56.497 |

|

P-value |

[0.0000000] |

[0.0000000] |

[0.0000000] |

[0.0000000] |

Significant at

p<0.01

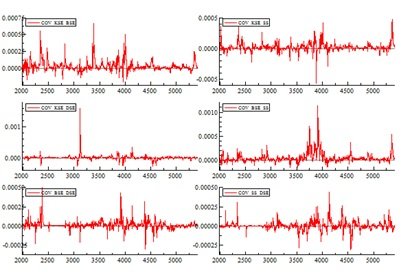

Table 6 reports the result of the GARCH-BEKK model. Here the Ljung Box Q-statistics rejects the null hypothesis for serial independence for KSE, BSE SS, and DSE at the 50th order. Similarly, the McLeod-Li test of serial independence hypothesis is rejected at p<0.05 for the squares of standardized residuals. Table 6 reports the corresponding GARCH parameters related to these equity markets. The squared ARCH parameters capture volatility responses in the concerned market to the standardized innovations with its square for each equity market and, the squared GARCH parameters ?11, ?22, ?33, ?44 apprehend response of volatilities in the Karachi Stock Exchange (Pakistan), Shanghai Stock Exchange (China), Bombay Stock Exchange (India), and Dhaka Stock Exchange (Bangladesh) respectively to the historical volatility among all the markets. Further, the results suggest that GARCH effects display three different patterns, Firstly all the four conditional variances are dependent upon their past and this element is evident from the estimates of ?11, ?22, ?33, ?44 GARCH parameters are significant at (p<0.05). The results reveal that a significant spillover effect at p<0.10 exist from KSE to BSE and BSE to SS has a significant spillover effect at p<0.05 and with DSE at p<0.10. The impact of cross-market spillovers is lesser than the market own spillovers as it is observed by these results. These results are in line with Worthington and Higgs (2004), Mohammadi, and Tan (2015). In short, this study provides strong evidence of volatility spillovers between these markets.

We studied the performance of the Bollerslev (1988) MGARCH-CCC model. This model indicates ARCH and GARCH effect and correlations between the KSE, BSE, SS and DSE markets. The results for MGARCH-CCC are reported in Table 7.

Table 7. Multivariate GARCH: CCC

|

|

Coefficient |

Std-Error |

T-stat |

P-value |

|

rho_21 |

0.109928 |

0.0211 |

5.21 |

0.0000 |

|

rho_31 |

0.050961 |

0.02071 |

2.461 |

0.0139 |

|

rho_41 |

0.006533 |

0.019798 |

0.33 |

0.7415 |

|

rho_32 |

0.146475 |

0.01956 |

7.488 |

0.0000 |

|

rho_42 |

0.035067 |

0.018329 |

1.913 |

0.0558 |

|

rho_43 |

0.015436 |

0.020004 |

0.7716 |

0.4404 |

|

Diagnostic Test |

|

|

|

|

|

|

Akaike |

-22.675660 |

Shibata |

-22.675743 |

|

|

Schwarz |

-22.636122 |

Hannan-Quinn |

-22.661532 |

|

|

Li-McLeod (50) |

1053.30[0.0000000] |

|

|

|

Std Residuals Test |

KSE |

BSE |

SS |

DSE |

|

Q (10) |

67.6305 |

26.7617 |

21.1748 |

31.9073 |

|

p-value |

[0.00000001] |

[0.0028401] |

[0.0199071] |

[0.0004149] |

|

Q (50) |

120.318 |

70.0133 |

71.6417 |

58.6154 |

|

p-value |

[0.00000001]* |

[0.0322973]** |

[0.0239952]** |

[0.1888012] |

*Significant at

p<0.01 **Significant at p<0.05

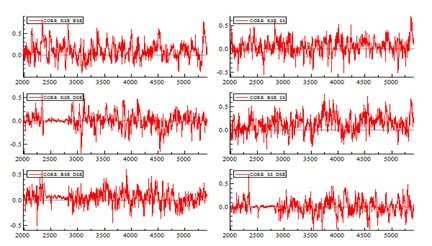

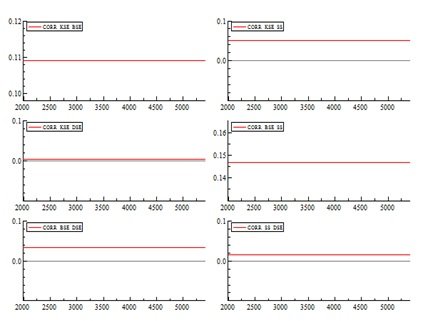

Figure 6: Conditional Correlations among Equity Markets: GARCH-CCC

The above results indicate the parameter estimates for GARCH-CCC as conditional variance models for KSE, BSE, SS, and DSE. Table 7 reports the conditional correlations between these markets. KSE has a significant conditional correlation with BSE and SS at p<0.05 and BSE has a significant correlation with SS at p<0.05 and with DSE at p<0.10. Conditional correlations are not too high as reflected in Figure 7 as well. The diagnostics for the CCC model indicate that the null hypothesis of serial independence at Q(10) but fail to reject the null hypothesis for DSE at the values of Ljung-Box Q(50) statistics. There exists no serial correlation among the standardized residual for all the four markets at Reported by McLeod-Li test statistics.

Conclusion

The primary purpose of this study was to explore the dynamics of spillovers of volatility across these economies. Volatility Spillover effects have been testified across the emerging economies of Pakistan, India, China, and Bangladesh during the period Jan 2005 to Dec 2015 by using daily return data of the concerned stock markets. The above results conclude that association among the historical volatilities of the market of KSE and BSE is positively correlated and indicates that both markets move in the same direction. We concluded that the association among the historical volatilities among KSE and BSE in a positive domain indicated that both markets have similar market demand and supply behavior. However, it may be further studied that either this is investor behavior in response to shocks or the trading magnitude among these economies or the same statement can be rationalized for KSE and BSE due to positive correlation. Here Granger Causality test shows that the volatility of KSE is leading to the volatility of BSE and the volatility of SS is leading to KSE volatility and the volatility of BSE leads to Volatility in the SS market. There exist significant triangular spillover effects from Pakistan to India and from India to China and from China to Pakistan and the volatility moves in unidirectional as well as bidirectional as well. Further volatility spillover effect model is run on return series instead of historical volatility and causal results have been examined through the VAR process. It is concluded that each market return is dependent upon its past returns showing the presence of their own spillovers effect with past time. It is evident that spillover effects exist for KSE to BSE in a unidirectional and BSE has spillover effects to SS markets in a unidirectional at lagged one and DSE has spillover effects with KSE and BSE at lagged one.

Further, we examined the conditional volatility patterns and the possibility of volatility spillovers across the markets through GARCH-BEKK. The results suggest that GARCH effects display three different patterns; firstly, all the four conditional variances are dependent upon their past and this element is evident from the estimates of GARCH parameters. The pieces of evidence have identified the spillover effects in a significant manner. Further GARCH-CCC model reports the corresponding conditional correlations between these markets. KSE has a significant conditional correlation with BSE and SS and BSE has a significant correlation with SS. Significant correlation means that these markets have strong interconnectivity. For policy implications, it is suggested that investors may follow the triangular spillover effect and can design efficient portfolios. As CPEC is now in its implementation stage and the behavior of the equity market is dramatically changing the investment dynamics in the Asian region and the policymakers are closely watching the rapid expected growth of business activities in this region and our study is one of the empirical evidence of this entire scenario. The practical implication of this study is to create a positive impact of spillovers on economic growth from one region to another region. The real example indicates china has attained marvelous economic growth with an increasingly positive economic indicator in the region and its collaborative attitude has put a positive impact on the economy of Pakistan. However, if the collaborative attitude is missing and then the psychology cannot put a positive moderating role then element produce a negative impression of the spillover as the bilateral trade relation of China and India. In China and Pakistan benefits of increased trade is the real example of spillover effect; however, the Indian economy interacts with Bangladesh in trade. Lastly, the failure of spillovers means that demand for spillover behavior may affect the other market participants due to a lack of information. However due to asymmetry of information investors behave noisily in these economies because as the information flows, due to time-varying volatility the spillover effects may see frequently, and abnormal returns can be gained. This phenomenon indicates that a study can be explored to identify this gap and its determinant and how to model the market to eliminate the asymmetry of information and spillovers can be generated through information. This study provides implications for the global markets’ investors that how a particular wave of information can last for the economies across the regions. The level of impact is greater for regional and integrated markets than the non-regional and non-integrated markets as evidence by some empirical studies. This study can be extended by modeling various macrocosmic forces to get have more inspiration for volatility spillover effects.

References

- Banerji, A., & Dua, P. (2010). Synchronization of recessions in major developed and emerging economies. Margin, The Journal of Applied Economic Research, 4: 197-223.

- Bekaert, G., & Harvey, C.R. (1997). Emerging equity market volatility. Journal of Financial Economics, 43, 29-77.

- Bollerslev, T. (1990). Modeling the coherence in short-run nominal exchange rates: A multivariate generalized ARCH model. Rev. Econ. Stat. 72, 498-505.

- Bollerslev, T., Engle, R. F., & Wooldridge, J. M. (1988). A capital asset pricing model with time varying covariances. Journal of Political Economy, 96,116-131.

- Crestmont (2011). Stock Market Returns & Volatility, Crestmont research.

- Dua, P., & Tuteja, D. (2016). Linkages between Indian and US financial markets: impact of global financial crisis and Eurozone debt crisis, Macroeconomics and Finance in Emerging Market Economies. DOI: 10.1080/17520843.2016.1166144

- Ehrmann, M., Fratzscher, M., & Rigobon, R. (2011). Stocks, bonds, money markets and exchange rates: Measuring international financial transmission. Journal of Applied Econometrics 26: 948-974.

- Engle, R. F., & Kroner, K. F. (1995). Multivariate Simultaneous Generalized ARCH. Econometric, Theory, 11: 122-150.

- Giannellis, N., & Papadopoulos, A. P. (2011). What causes exchange rate volatility? Evidence from selected EMU members and candidates for emu membership countries. Journal of International.

- Hsu, T. K. & Tsai, C. C. (2016). Using the EGARCH model to examine returns and volatility spillovers in the crude oil and gold markets. Empirical Economics Letters, 15(3): 239-244.

- Jebran, K., & Iqbal, A. (2016). Dynamics of volatility spillover between stock market and foreign exchange market: evidence from Asian Countries. Financial Innovation, 2(1), 1.

- Jebran, K., & Iqbal, A. (2016). Examining volatility spillover between Asian countries' stock markets. China Finance and Economic Review, 4(1), 1.

- Joshi, P. (2011). Return and volatility spillovers among Asian stock markets. Sage Open, DOI: 10.1177/2158244011413474.

- Kalyvas, L., & Dritsakis, N. (2012). The causal relationship between FT-SE 100 Stock Index Futures Volatility & FT-SE 100 Index Options Implied Volatility Working Paper

- Mohammadi. H., & Tan. Y. (2015). Return and Volatility Spillovers across Equity Markets in Mainland China, Hong Kong and the United States. Econometrics,3, 215-232.

- Ng, A. (2000). Volatility spillover effects from Japan and the US to the Pacific-Basin, Journal of International Money and Finance, 19, 207-233

- Parasuraman, N., & Ramudu, P. J. (2011). Historical and Implied Volatility: An Investigation into NSE Nifty Futures and Options. Australian Journal of Business and Management Research, 1(7), 112-120.

- Peng, C. L., Chung, C. F., Tsai, C. C. & Wang, C. T. (2017). Exploring the Returns and Volatility Spillover Effect in Taiwan and Japan Stock Markets. Asian Economic and Financial Review, 7(2): 175-187.

- Worthington, A., & Higgs, H. (2004). Transmission of equity returns and volatility in Asian developed and emerging markets: A multivariate GARCH analysis. Int. J. Finance Econ., 9, 71-80.

Cite this article

-

APA : Hamid, K., Ghafoor, M. M., & Saeed, M. Y. (2020). Emerging Markets and Volatility Spillover Effects: Empirical Evidence from Regional Emerging Economies of Pakistan, China, India, and Bangladesh. Global Economics Review, V(I), 102-116. https://doi.org/10.31703/ger.2020(V-I).09

-

CHICAGO : Hamid, Kashif, Muhammad Mudasar Ghafoor, and Muhammad Yasir Saeed. 2020. "Emerging Markets and Volatility Spillover Effects: Empirical Evidence from Regional Emerging Economies of Pakistan, China, India, and Bangladesh." Global Economics Review, V (I): 102-116 doi: 10.31703/ger.2020(V-I).09

-

HARVARD : HAMID, K., GHAFOOR, M. M. & SAEED, M. Y. 2020. Emerging Markets and Volatility Spillover Effects: Empirical Evidence from Regional Emerging Economies of Pakistan, China, India, and Bangladesh. Global Economics Review, V, 102-116.

-

MHRA : Hamid, Kashif, Muhammad Mudasar Ghafoor, and Muhammad Yasir Saeed. 2020. "Emerging Markets and Volatility Spillover Effects: Empirical Evidence from Regional Emerging Economies of Pakistan, China, India, and Bangladesh." Global Economics Review, V: 102-116

-

MLA : Hamid, Kashif, Muhammad Mudasar Ghafoor, and Muhammad Yasir Saeed. "Emerging Markets and Volatility Spillover Effects: Empirical Evidence from Regional Emerging Economies of Pakistan, China, India, and Bangladesh." Global Economics Review, V.I (2020): 102-116 Print.

-

OXFORD : Hamid, Kashif, Ghafoor, Muhammad Mudasar, and Saeed, Muhammad Yasir (2020), "Emerging Markets and Volatility Spillover Effects: Empirical Evidence from Regional Emerging Economies of Pakistan, China, India, and Bangladesh", Global Economics Review, V (I), 102-116

-

TURABIAN : Hamid, Kashif, Muhammad Mudasar Ghafoor, and Muhammad Yasir Saeed. "Emerging Markets and Volatility Spillover Effects: Empirical Evidence from Regional Emerging Economies of Pakistan, China, India, and Bangladesh." Global Economics Review V, no. I (2020): 102-116. https://doi.org/10.31703/ger.2020(V-I).09